In July 2024, Morningstar.com published a promising but ultimately disappointing article entitled “The Best Small-Cap Funds” (7/18/2024). “Content development editor” Tori Brovet has been publishing a series of “The Best” articles (Energy Stocks, Value Funds, Bond ETFs). The article promises there are

![]()

They aren’t.

You can do better if you’re interested in small cap options.

The essay has three problems. (1) It claims a short-term payoff (“for 2024”) for what should be a long-term investment. (2) It has no criteria for inclusion other than “our analysts say these are Gold.” There’s no analysis of the individual funds, no distinction between them, no discussion of what makes them Gold. In short, Morningstar has entered the Age of the Clickbait Listicle. Finally, (3) the listed funds aren’t particularly compelling.

A “Gold” rating means that Morningstar’s analysts (or algorithms) have concluded that the fund has a strong probability of outperforming its peers in the years ahead. That’s perfectly sane but it also raises the question, “How have they done so far?” Our answer is: not uniformly well. Sorry.

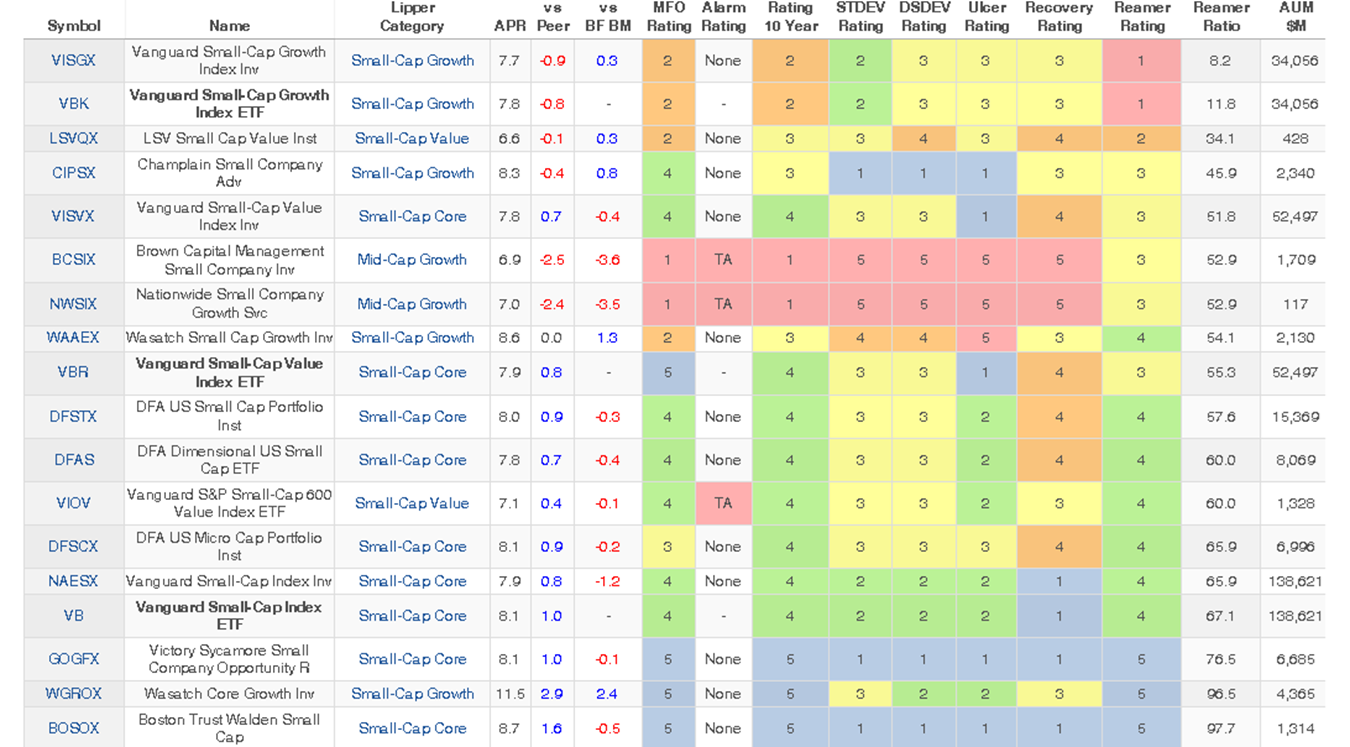

Here’s the data. We entered all 18 in the MFO Premium multiscreener and pulled up the fund’s 10-year record. We looked at three sets of results:

- Raw returns: how much did they make, how did it compare to their Lipper peer group and how did it compare to their best-fit benchmark?

- Risk and risk-adjusted returns: which include MFO and FundAlarm ratings, and volatility ratings (standard deviation, downside deviation)

- Consistency of performance: if an investor held each fund for three years, what are the chances they have would beat their peers’ raw returns? The consistency measures we’re using here (though the MFO Premium screener offers others) is the Reamer Ratio which looks at the performance of an investment in every rolling three-year period. January 2020 to December 2022 is one three-year period, then February 2020 to January 2023 is the next, and so on. Over 10 years you get 85 rolling three-year periods.

You can simplify your scan with this rule: you want to see lots of blue and green (much above average and above average score), you can live with some yellow (more or less mediocre) but really need to question any orange or red (below average and much below average).

Here’s the resulting picture.

10-year performance of Morningstar’s Gold, sorted by Reamer Ratio

Complete data or metric definitions are publicly available at MFO Premium.

How do you read the chart? Take the Vanguard Small-Cap Growth Index for an illustration. It had 85 opportunities to outperform its peers but managed above-average results only 8.2% of the time. It returned 7.7% annually which trailed its average peer (by 0.9% a year) but beat its Lipper benchmark index. It had average volatility (all those yellows) but ended up as a below-average performer.

By those measures, Morningstar identified three exceptional funds – Victory Sycamore Small Cap Opportunity, Wasatch Core Growth, and Boston Trust Walden Small Cap – plus three substantially disappointing funds and twelve that have been … mostly okay-ish?

You can do better.

We can help.

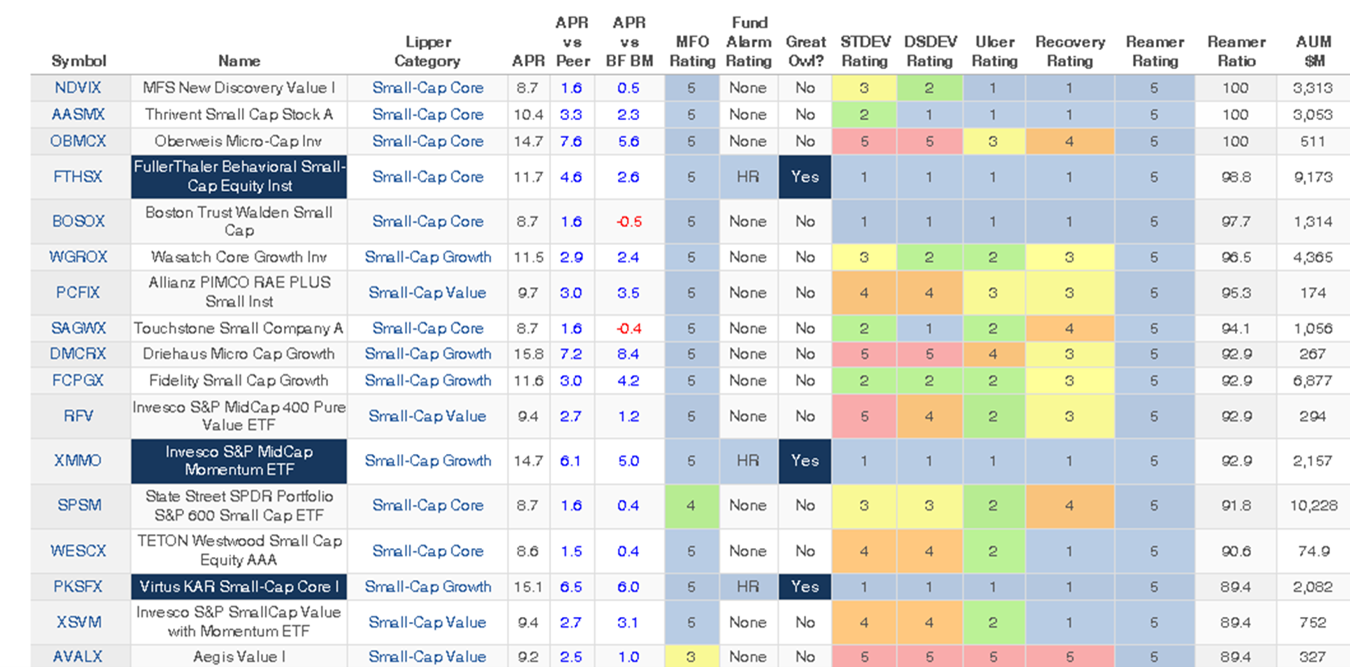

We asked the MFO Premium multiscreener to look at all small cap funds and ETFs and to identify those with the highest Reamer Ratio. That is, we looked for funds that would consistently win if you were willing to hold them for at least three years. All of the columns and color-coding rules are the same: happy investors have blue boxes!

10-year performance of the most consistently successful small cap funds, sorted by Reamer Ratio

What do you see?

First, only two Morningstar “Gold” funds make the cut:

Boston Trust Walden Small Cap (BOSOX): the managers are quality-at-a-reasonable-price investors, the fund holds 70 stocks, has an incredibly high active share (99), a slowly evolving management team with substantial insider investment, and an ESG-sensitivity. Good guys who are offered a covert endorsement of the Red Sox.

Wasatch Core Growth (WGROX): the managers are quality-at-a-reasonable-price investors (“defensible business models and great management teams” at “the most valuation sensitive Wasatch growth fund”) who shop for both small and midcap stocks with the latter representing 20% of its 56-stock portfolio, has a very high active share (93), a slowly evolving management team with huge insider investment.

Second, folks who wished Morningstar’s LSV Small Cap Value performed better have a great alternative, FullerThaler Behavioral Small Cap Equity. Both funds are run by behavioral finance PhDs, guys who are fairly sure that the best way to add value is to understand the predictable irrationality of other investors, and profit from it. Both groups are famous; Fuller Thuler, though, nearly doubles the returns of LSV.

FullerThaler Behavioral Small Cap Equity (FTHSX) “aims to capitalize on behavioral biases that may cause the market to overreact to historical, negative information or under-react to new, positive information. Looks for companies with one or both of:

-

-

- significant insider buying or stock repurchases (over-reaction)

- large earnings surprises (under-reaction)”

-

The fund owns 120 stocks, about 70% of which are classified as small caps. Turnover is 35%, the active share is very high (92) and the managers have each invested over $1 million in the fund.

Third, bloated small caps rarely make the list.

A third of Morningstar’s “Gold” funds weigh in at $10 billion-plus. All are index or smart-beta funds. None are great. And no bloated active fund made it. Among the consistent winners, only one – again, an index fund – made the top 17.

Fourth, two remarkable micro-cap funds make the cut.

Oberweis Micro-Cap (OBMCX): firmwide, Oberweis has committed to a variation of the behavioral finance strategy used by FullerThaler and LSV: they’re into “uncovering and capitalizing on the persistent and recurring stock pricing inefficiencies in global equities caused by a lag in investor response to new information.” The team has 80% of the 80-stock portfolio in microcaps. It has a moderately high active share (84) and is managed by a team led by James Oberweis and Keith Farsalas who are both heavily invested.

Aegis Value (AVALX) is, frankly one of our favorite small cap funds because it just keeps beating prejudices, peers, and expectations. It starts with the same fundamental insight: most small cap investors don’t know what the hell they’re getting into, and we can work with that. “Equity markets are inherently emotional and often overreact to events. This creates exploitable dislocations that offer excess return opportunity for contrarian, long-term-oriented investors. Small-cap stocks can experience larger dislocations. Lack of analyst attention, less transparency, and lower liquidity all magnify the impacts of emotional investor behavior.” The manager since inception is Scott Barbee, who Devesh designates “a legend,” who owns the firm and has over $1 million in the fund. He owns about 70 stocks with equal exposure to small- and mid-caps, a microscopic turnover ratio of 2%, and an astronomical active share (99.2). The high volatility scores reflect the exceptional commitment to incredibly small, out-of-favor stocks.

Finally, three funds earned Great Owl designations. “Great Owls” represent our attempt to identify those funds whose risk-adjusted returns, conservatively calculated, at always in the top tier over a variety of measurement periods: 3-, 5-, 10- and 20-year periods, based on the age of the fund.

FullerThaler Behavioral Small Cap Equity, profiled in point two, above.

Virtus KAR Small-Cap Core (PKSAX): they call it “core,” Morningstar and Lipper see “mid-cap growth” and “small-cap growth,” respectively. In any case, the fund closed to new investors in July 2018. Sorry.

Invesco S&P Mid Cap Momentum ETF (XMMO): the fund replicates the S&P Midcap 400 Momentum Index. Its investable universe is the S&P 400 mid-cap stocks, and it invests in the 80 stocks with the higher momentum scores, computed by measuring the upward price movements compared to the rest of the S&P Midcap 400. It’s rebalanced every six months and has a turnover ratio of 132%.

Bottom Line

There is no such thing as “a best fund.” There’s only “the best fund, given your particular needs and concerns, from what we can see just now.” That is, as it turns out, not click-baitable.

In assessing funds, MFO typically looks for two things first: (1) managers who have gotten it consistently right across time and markets and (2) funds that have exceptional downside controls. As Research Affiliates recently noted, “Investors seek only to avoid downside volatility while they are pleased to benefit from upside volatility.” This essay stresses one measure of consistent success: the Reamer ratio and its focus on performance over three-year periods. Using it, we identified three funds that have been their peers in 85 consecutive periods and 14 more that have won 90% of the time.

Our recommendations: (1) know yourself. Think about what you value in a partner, how patient you are, how anxious volatility has made you in the past, and so on. (2) Start with the numbers, but don’t end with them. Every investment, as with every relationship, is going to have periods of stress and disappointment. The key is whether you’re able to see past the short-term noise and focus on the long-term value.