It’s Wednesday, so a few topics. Tomorrow, I plan to address the issue that the US economy is heading into recession. The short assessment is that it doesn’t look like it to me despite the relatively poor labour market data that came out at the end of last week. But there is certainly a lot of fluctuating fortunes being recorded around the globe at present. Recent Japanese data is quite interesting and I discuss it in what follows. We should also remember that yesterday was the anniversary of the Hiroshima bombing – a very sad day in human history. Constantly reminding us of the damage that the US bombing caused should warn us off war altogether and nuclear weapons and technology specifically. Unfortunately, the trends are working against such a view. And we also have some music to listen to while cogitating over those issues.

Japanese exports

While mainstream economists try to make a case that the depreciation of the yen demonstrates that the conduct of macroeconomic policy in Japan has been disastrous – and some even claim that it somehow ‘proves’ Modern Monetary Theory (MMT) is dangerous – I have been, instead, watching the trade account quite closely.

We now have the – Trade Statistics (July 2024) – data from the Ministry of Finance, which show some interesting trends have developed over the last few years.

I saw some mainstream economic commentary the other day claiming, in a sort of ‘I told you so’ arrogance, that the decline in overall export value for agricultural, forestry and fishery products and other food items, in the first half of 2024 was evidence that the failure to push up interest rates significantly and the continued fiscal deficits has been destructive.

Sure enough, the exports of those key products for Japan fell by 1.8 per cent in the 6 months to June 2024 on an annual basis.

This was the first time since the beginning of the pandemic that these exports have declined.

But if we dig deeper we gain a better understanding of what is happening.

In fact, the decline has nothing to do with macroeconomic policy settings in Japan, but, rather reflects the decision by China to ban Japanese fishing products after the Japanese government started pumping the contaminated water from the Fukishima disaster into the ocean.

The data shows that even though Japanese exports to China rose by 12.3 per cent over the 12 months to June 2024, “food exports to China plunged 43.8%” (Source).

But outside of the Chinese bans, food exports to other countries have boomed on the back of the depreciation – rising by 14.3 per cent.

Exports of food to the US rose 19.9 per cent in the last year and 13.9 per cent for all products.

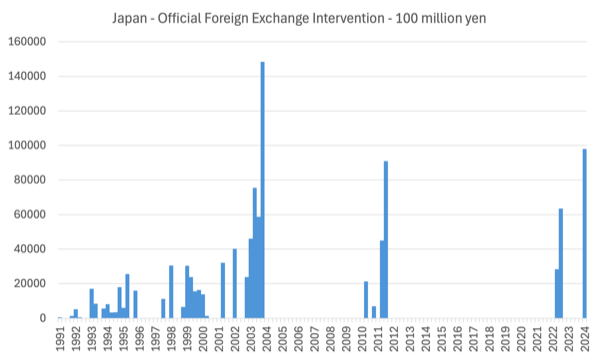

Another interesting data release came from the Japanese Ministry of Finance today (August 7, 2024) in the form of the – Foreign Exchange Intervention Operations – for the June-quarter 2024.

Some people think the Bank of Japan has only just intervened in foreign exchange markets.

But the data shows that it has regularly, since the major property crash in 1991 intervened at various times.

The following graph shows the scale of the interventions since the June-quarter 1991.

The most recent interventions since the global push for higher interest rates began and started shifting global capital out of Japan in search of higher returns were:

1. September 22, 2024 – 28,382 100 million yen (the total for the corresponding quarter).

2. October 21, 2024 – 56,202 100 million yen.

3. October 24, 2024 – 7,296 100 million yen.

4. April 29, 2024 – 59,185 100 million yen (¥5.92 trillion).

5. May 1, 2024 – 38,700 100 million yen (¥3.87 trillion)

So quite a significant intervention on two days earlier this year when the Bank of Japan sold US dollars in return for yen, to smooth out the fluctuations in the exchange rate.

Interestingly, the Bank sold US treasury stocks to get the US dollars which they then used to bolster the yen.

The data shows that these interventions generated around a 5 per cent appreciation in the yen again the dollar.

While the parity remains depreciated, the shift in recent days has been sharply in the direction of appreciation as a response to the slight upward movement in interest rates in Japan and talk of recession in the US (I will deal with that talk tomorrow).

Overall, none of this could be used to make a case against MMT.

It was obvious that the parity would slip when the Bank of Japan declined to follow the pavlovian interest-rate hikes of the other central banks.

And it was also obvious that its trade situation would improve.

While there has been a lot of talk about the ‘carry trade’ being responsible for swings in the yen parity – so investors borrowing cheap in yen and then investing it in higher yielding assets – which then generates an excess supply of yen in the foreign exchange market – most of the yen fluctuations are due to the trade weakness in recent years, which is now resolving.

Hiroshima

Yesterday (August 6, 2024), marksed the 79th anniversary of the nuclear attack by the US on the Japanese city of – Hiroshima – which allowed us all (unfortunately) to witness the consequences of using nuclear weapons against people.

Up to 166,000 (mostly) innocent people were slaughtered by this act either directly or subsequently from the illnesses that the bomb wrought.

At the – Nijō Castle – in Kyoto, there is a tree memorial which is made up of seedlings growth from a “Chinese parasol tree that survived the A-bombing of Hiroshima” – which was created in 2013.

You can read about that in this article from the Chuguko Shimbun (October 22, 2013) – Seedlings grown from A-bombed tree to be planted at World Heritage site in Kyoto.

It was sourced from the – Hiroshima Peace Memorial Park.

When I visit that Castle I always stop near that tree memorial and think about the need for nuclear disarmament.

The current – Hiroshima for Global Peace Plan – calls for a total abolition of nuclear weapons and recently held its annual meeting, where a new report – Hiroshima Watch 2024 was launched.

The Peace Plan is released by the Hiroshima Round Table which involves scientists from many different countries.

The Report considers that the world is sliding away from a firm position to ban nuclear weapons.

The “five nuclear-weapon states” have all stated that they will “use nuclear weapons if their sovereignty is threatened”.

The Report also documents (using data from the Stockholm International Peace Research Institute (SIPRI)) that the weapons race continues apace and considering resuming nuclear weapon testing.

Russia and the US account for 90 per cent of the global stock of nuclear warheads and are no longer willing to cooperate to renew the NewSTART (New Strategic Arms Reduction Treaty), which expires in early 2026.

The old enmities from the Cold War remain and are driving a fracturing of the progress that was made with the – Treaty on the Non-Proliferation of Nuclear Weapons.

The last two, five-yearly conferences have failed and the regulatory control that the NPT was intended to provide is really non-existent.

The Japan Times article (August 5, 2024) – What stands in the way of a nuclear weapon-free world? (paywalled) – notes that:

The inadequacy of the NPT as the dominant regulatory framework is captured by the reality that four of the nine states that possess nuclear weapons — Israel, India, Pakistan and North Korea (in the order in which they acquired them) — are outside of the treaty. The first three never signed and the latter is the only example thus far of an NPT defector state, although, if matters do not improve soon, it may be joined by others in the Middle East and Asia.

These states are not part of the NPT discussions and face no internal pressure to abide by anything the conferences decide.

The fact that the US still continues to provide weapons and funding to Israel is particularly scary in this context.

It is hard to see the current escalation in nuclear threats diminishing any time soon.

People should visit the Hiroshima Peace Park to learn why we should stop our politicians from engaging in this escalation.

Episode 3 of our Manga, the Smith Family and their Adventures with Money comes out this Friday

Yes, recession has struck and Ryan comes home with some bad news.

As time passes, his desperation mounts and he is struggling to reconcile what Professor Noitawl is saying on the TV each day about the need for growth friendly austerity and the reality that the depressed labour market has rendered for him and his family.

You can follow the – Smith Family and their Adventures with Money – throughout Season 2, with new episodes appearing fortnightly.

Book Event – Melbourne, September 12, 2024

Readings Bookshop has now updated the site for our event – Bill Mitchell with Alan Kohler – which will be held at the Hawthorn Shop (687 Glenferrie Rd, Hawthorn, Victoria, 3122) on Thursday, September 12, starting at 18:30.

I will be there with ABC Finance personality Alan Kohler to discuss my new book (co-authored by Warren Mosler) – Modern Monetary Theory: Bill and Warren’s Excellent Adventure.

Copies of the book will be available at discount prices and my pen might come out if you want it signed.

You need to book for the event which is free but limited (about 60 tickets are available).

You can find more details and booking information – HERE.

I hope to see all the MMT Melbourne crew there (well at least 50 of you).

My alternative Olympic Medal Tally

Since the 2000 Olympic Games I have been compiling – Bill Mitchell’s Alternative Olympic Games Medal Tally – which attempts to modify the official tally to take into account national wealth and population size as an antidote to the strutting nationalism deployed by the likes of China, the US and other big nations that have lots of investment in Olympic sports.

The alternative tally is updated each day until the Games are over and provides some interesting data for various conjectures.

Music – Shuggie Otis – one of my favourites

Johnny Otis – was one of the great blues, R&B musicians, vibrophone player, keyboard player, drummer, bandleader, composer – he did it all.

He was referred to as the “Godfather of Rhythm and Blues.”

He is credited with ‘discovering’ the marvellous Etta James as a 13-year phenomenon.

Shuggie Otis – was one of his sons and also does it all.

In the early 1970s he put out three wonderful albums, which most people will never have heard but are among my real favourites and are on my iPhone wherever I go.

As it goes, the music press called him the ‘heir’ to Jimi Hendrix. His guitar playing was phenomenal, which is where I became interested in his work in the early 1970s.

He was to be the gap between Stevie Wonder and Prince. The Rolling Stones invited him to join to replace Brian Jones.

In addition to putting out his own albums, upon which he played most of the instruments, he also played (as a teenager) on – Kooper Session – with Al Kooper and – Hot Rats – with Frank Zappa.

His most famous song – Strawberry Letter 23 – was on his second album – Freedom Flight (1971) – was a big hit for – The Brothers Johnson – and was produced by Quincy Jones.

Here is a – link – to remind you what was happening in 1977 as disco started taking over.

Obviously, I preferred the original.

Shuggie Otis’s third album is the best in my view – Inspiration Information – and it was released in 1974. A short album (31:38) but full of classics.

This is a great song from that album – Aht Uh Mi Hed.

Shuggie Otis hasn’t had an easy life – the usual issues. But I saw him a few years ago playing live again and he is still a masterful guitar player. Pity the drugs and drink got in the road when his star was really shining.

‘Heir to Hendrix’ Shuggie Otis: ‘I could have been a millionaire, but that wasn’t on my mind’ (April 16, 2016) is a contemporary discussion of Shuggie Otis.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.