In the modern era of financial advice, the advicer/client relationship is tightly centered on trust. And because of that foundation of trust, in an ideal advisor/client relationship, mistakes, disagreements, and concerns are surfaced quickly; action items are agreed and acted upon by everyone involved; and everyone feels aligned and accountable to their overall objectives.

The reality, however, can be a little more complicated – not only when it comes to getting clients to ask questions, give honest feedback, and raise (productive) disagreements; but also to get everyone truly aligned on (and excited about) action items and objectives. This can be frustrating for advisors: after all, clients are paying for advice, but if they never really seem ‘bought into’ that advice and don’t act on recommendations, it can be hard for the advisor to feel like they’ve provided much value to the relationship.

In his book “The Five Dysfunctions Of A Team”, Patrick Lencioni discusses similar issues that commonly occur among teams in the workplace. He posits that teams can suffer from a series of 5 “dysfunctions” which inhibits a team’s ability to align on objectives, act on them, and actually track and discuss the results. Dysfunction in teams can be insidious – the vast majority of people in the workplace are well-intentioned and don’t intentionally sow dysfunction. However, even well-meaning people can occasionally contribute to dysfunctional relationships, teams, and company cultures.

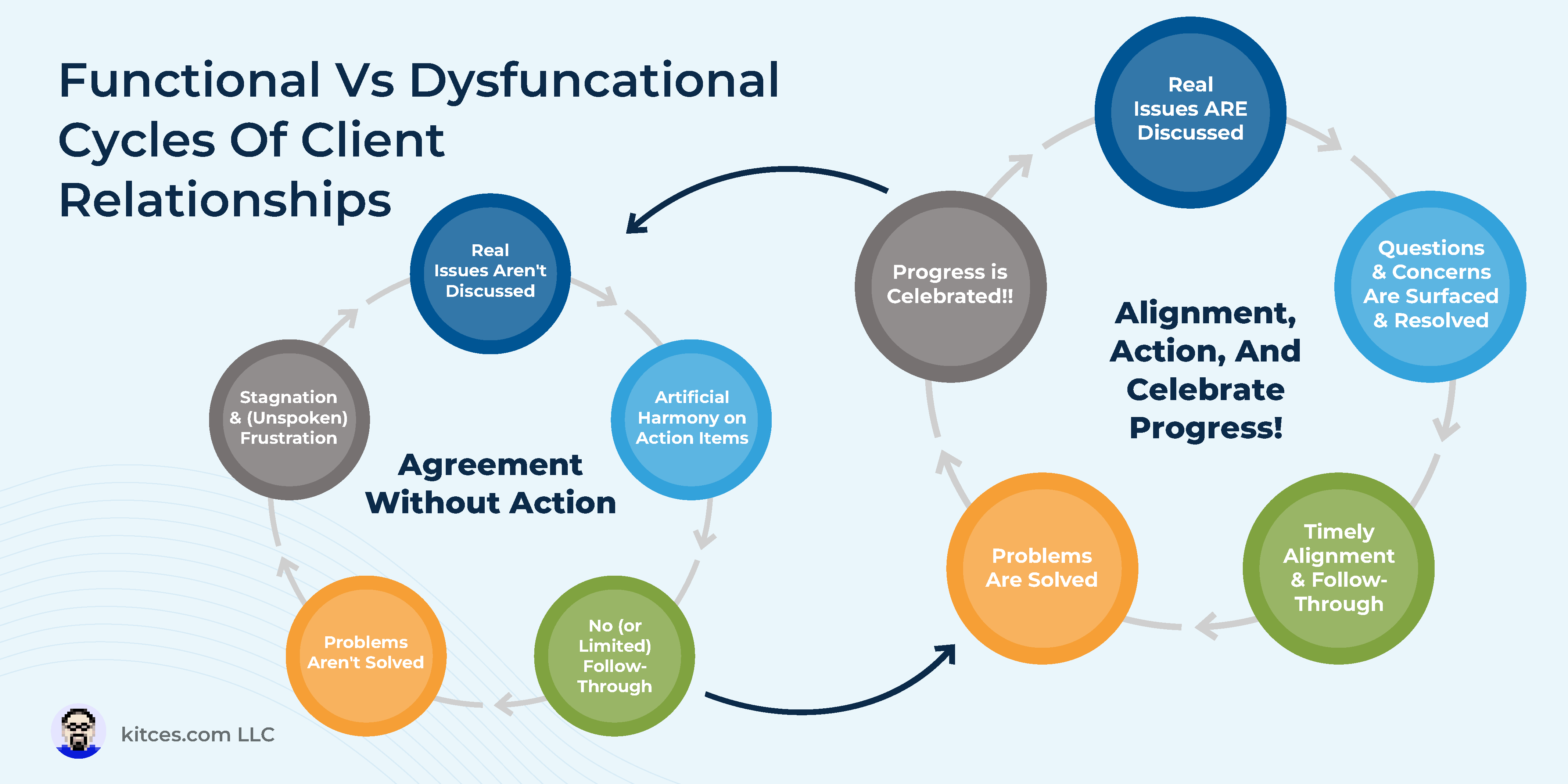

In the book, Lencioni gives insights into how dysfunction can be rooted out of a workplace – many of which can also be applied to the client/advisor relationship, where well-meaning clients and advisors can on occasion contribute to a dysfunctional relationship. As an example, a dysfunctional client/advisor relationship can look like one where the client doesn’t bring forward their “true” issues to a meeting, or where they have reservations about an advisor’s recommendations but feel hesitant to express them to the advisor. Then, because the client isn’t “bought in” to the recommendations, they simply don’t act on what the advisor recommends.

The good news is that dysfunction isn’t necessarily permanent – in fact, it can be improved upon or even resolved entirely. For advisors looking to resolve dysfunction, the first action item often comes with a candid conversation with a client centered on how the client feels the relationship is going, ranging from their comfort with bringing important issues to meetings to their alignment with the advisor on action items. Once an advisor understands not only where they see dysfunction themselves, but also where their client sees it, they can begin the work of uprooting and resolving it. Depending on the situation, this can involve exercises to rebuild trust or working with clients to name how they experience and work through conflict.

Once dysfunction in relationships is worked through and relationships become more functional, an advisor/client relationship can enter a positive feedback loop: clients bring what matters most to meetings, advisors present recommendations, reservations and questions are resolved in-meeting, everyone is aligned on what their actions are and why they matter, and implementation and results are tracked and celebrated. This then incentivizes clients to continue to bring issues forward, and reinforces an advisor’s value many times over.

Ultimately, the key point is that few people intend to add dysfunction to relationships – it’s something that runs the risk of creeping into client/advisor dynamics often because of good intentions. But the good news is that with proactive and mindful conversations, the advisor and client can not only resolve dysfunction, but in fact create a stronger dynamic than existed previously, where clients and advisors are constantly working through the issues that matter most!