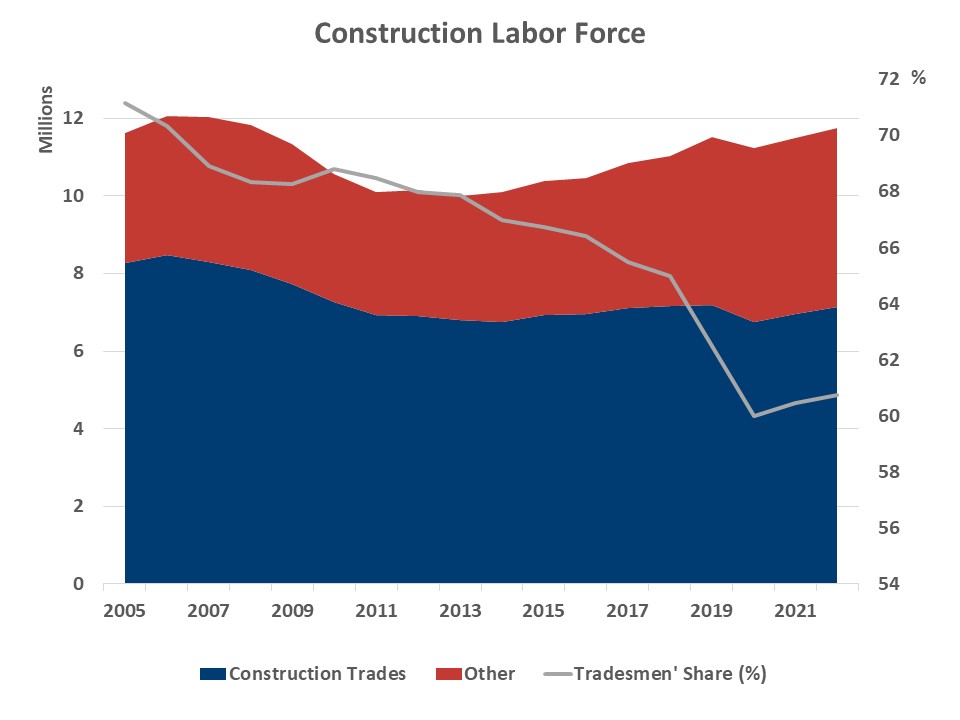

Analysis of the history of data from the American Community Survey (ACS) reveals dramatic shifts in the makeup of the construction labor force over the last two decades. While the overall count of workers in the industry now approaches the historic highs of the housing boom of 2005-2006, the share of tradesmen declined from 71% in 2005 to under 61% in 2022. At the same time, the share of computer, engineering, and science occupations doubled, and the share of management and business occupations increased 60%.

The results are noteworthy, particularly given a recent focus on relatively flat productivity growth in the construction sector. A growing count of engineering/tech workers would, on its face, suggest a boost to productivity. However, a decline for the share of workers associated with the trades could suggest declining productivity. Indeed, more workers in management and business occupations could be another impact of the rising regulatory burden associated with building. These findings and possible impacts deserve additional research attention given the need to supply more attainable housing to the market.

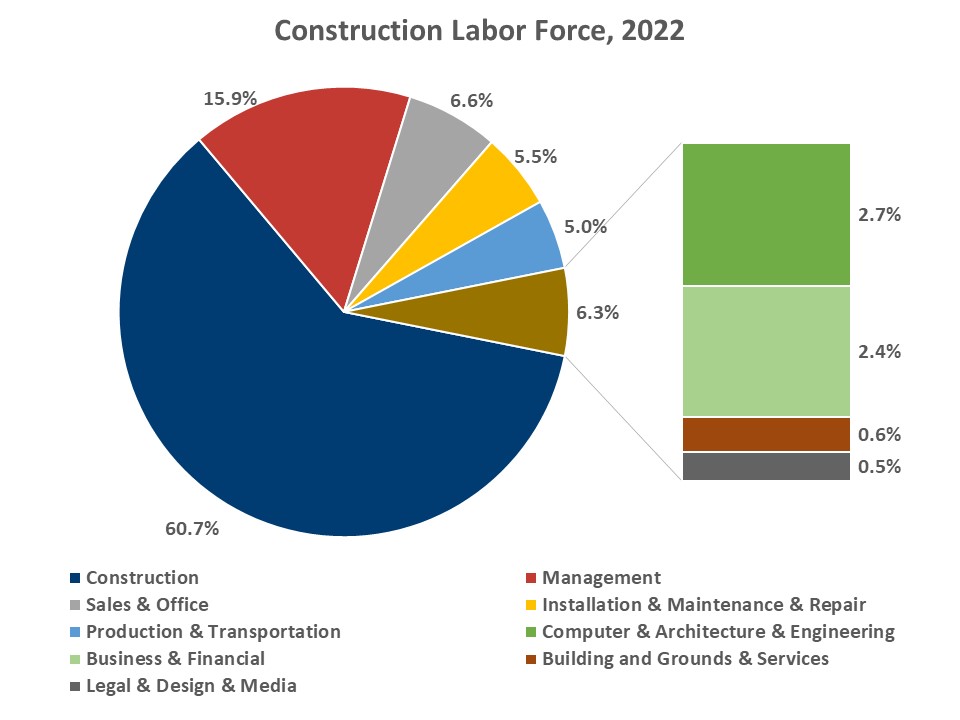

As of 2022, the construction labor force exceeds 11.7 million, just slightly below the housing boom peak of 12 million. Construction trades (such as carpenters, electricians, painters, plumbers, laborers, as well as first-line supervisors) account for 7.1 million workers in the industry, or 60.7%. In contrast, there were 8.5 million construction tradesmen during the peak employment of 2006. The disappearance of more than a million craftsmen helps explain the persistent labor shortages reported by the NAHB/Wells Fargo Housing Market Index Survey.

Over the same period, the construction industry absorbed a rising number of white-collar workers. The management ranks expanded from 1.2 million to 1.9 million workers, and their share increased from 10% to 16%. Business and financial occupations grew at similar rates. The number of engineers, architects and other science occupations doubled; they now account for close to 2.7% of the industry workforce. In contrast, the share of computer, engineering and science occupations was just 1.3% in 2005.

Even though the prevalence of white-collar jobs in construction remains less common than in the US economy overall, their numbers and shares have been rising faster in construction since 2005. For example, while the share of computer, engineering, and science occupations doubled in construction, it increased only 40% in the overall US workforce. Similarly, whereas the management ranks increased 60% in construction, they grew at a slower rate for the US labor force and registered gains of 45% since 2005.

The rising presence of white-collar workers in construction undoubtedly reflects evolving production technologies, an enhanced regulatory environment and more stringent building codes. The changing makeup of the construction workforce also coincides with the declining rates of self-employment in the industry and may reflect a shift towards larger construction firms. Larger building enterprises are better equipped to invest into new technologies and absorb higher overhead costs.

The labor force statistics reported in the post are tabulated using the historic ACS Public Use Microdata Sample (PUMS). The ACS statistics are most comprehensive as they include payroll workers, as well as self-employed. As the common practice dictates, the labor force estimates count employed and those unemployed workers who look for jobs.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.