Welcome to the September 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that Fidelity has announced a new bundled technology offering for advisors, including its own Wealthscape brokerage and eMoney financial planning software, alongside Advyzon’s portfolio management and performance reporting platform – which is rather surprising given that Wealthscape itself was once advertised as an “all-in-one” solution that could replace third party portfolio management software like Advyzon, and suggests that Fidelity’s aspirations for (and massive investment into) Wealthscape as a core software offering that would make its custodial platform ‘stickier’ for advisors and their assets may have been upended by advisors’ preferences to use independent standalone software instead?

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- GeoWealth has announced an $18 million investment from BlackRock to enhance GeoWealth’s capabilities for offering customized investment models (such as those provided by BlackRock itself) – which raises questions about whether BlackRock’s ownership stake in one of its own distribution channels will cause conflicts if BlackRock products are favored on the platform at the expense of other asset managers, or if BlackRock is content to invest passively in GeoWealth (since as long as BlackRock sees some share of the assets on GeoWealth’s platform, it will benefit as long as the TAMP continues to grow)?

- Estate planning software provider Vanilla has announced an estimated $20 million capital raise as it builds out its estate document preparation service on top of its existing estate analysis tools, reflecting investors’ enthusiasm for the growth potential for software tools that can also be packaged as a service (and priced accordingly higher) – although the question remains whether there will actually be enough demand for estate planning documents to sustain the service, given that clients only update their estate documents every 5–10 years (at most)?

- Hearsay, the social media marketing and compliance platform for financial professionals, has announced that it is being sold to Yext for $125 million, 11 years after being valued at $171 million – highlighting how even becoming a largely successful AdvisorTech provider (as Hearsay’s 260,000 users and $60 million in revenue attest) wasn’t necessarily enough to live up to the expectations of everyone who expected social media to be the dominant channel for advisor marketing.

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Wealthtender, a platform for gathering client reviews and testimonials, has partnered with the AI-powered compliance provider Hadrius to allow advisors to scan all testimonials collected through Wealthtender for compliance with the SEC’s Marketing Rule, and flag potential violations for human review – which represents a way to harness AI for a function that it truly does well in reading large amounts of text and flagging passages with specific meanings and implications, although given the relative infrequency that testimonials actually come in, there might not be that much time savings.

- Morgan Stanley has become one of the first financial services firms to launch its own internal AI meeting notes tool, which highlights the unique opportunity that mega-firms like Morgan Stanley have (with the reams of internal data at their disposal) to build their own in-house AI tools without the potential for exposing client data to a third-party vendor.

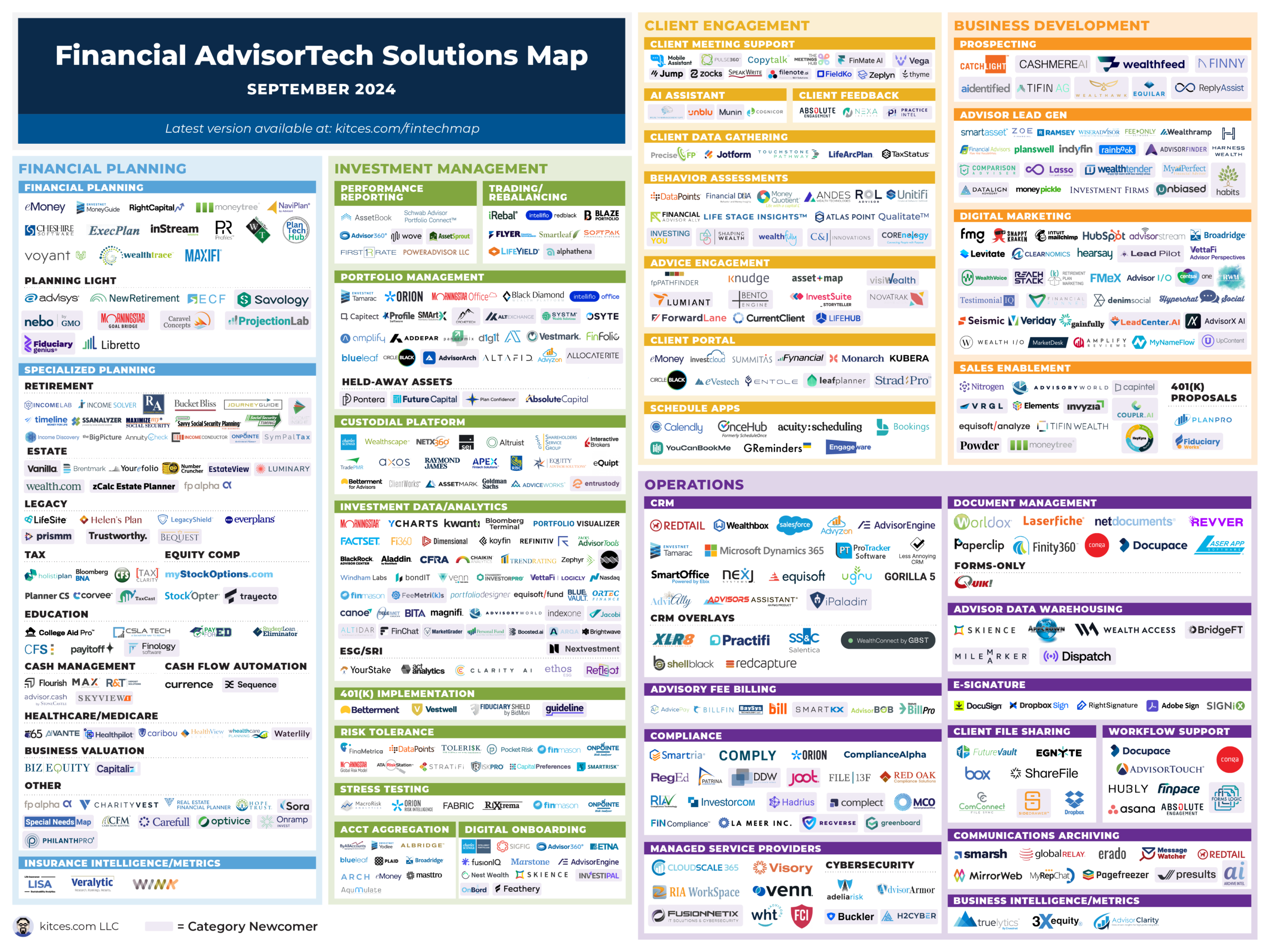

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!