Investment within the financial services technology sector is creeping back up after plummeting in August.

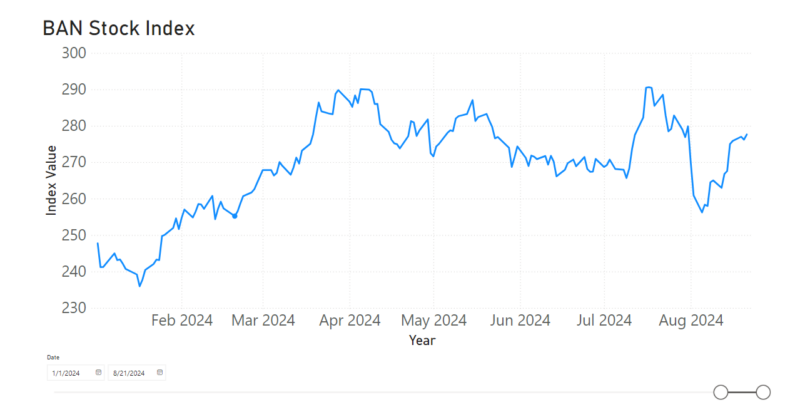

Following a July peak, Bank Automation News’ BAN Stock Index in August fell to 256.23, the lowest on the index since February, when it was 255.21. The BAN Stock Index tracks the average performance of financial technology providers.

The index tracks the daily stock performance of public technology providers and fintechs of various market capitalizations since 2014.

According to BAN’s BAN Stock Portfolio, which tracks the daily stock performance of financial service technology providers, these public companies have seen the highest percentage change in stock price since market close Sept. 6:

- DeFi Technologies’ shares are up 20.23% to $2.08. The company has a market capitalization of $673.72 million; and

- NEC shares are up 14.25% to $85.69. It has a market capitalization of $23.31 billion.

Behind the growth

DeFi Technologies’ stock growth follows a Sept. 5 announcement that it partnered with investment firm Professional Capital Management to expand into the exchange-traded fund (ETF) market, according to a DeFi Technologies release.

“ETFs represent a transformative opportunity to redefine how investors access and manage their portfolios,” Professional Capital Management founder and Chief Executive Anthony Pompliano said in the release.

Also last week, NEC launched its Gateless Biometric Authentication system that is aimed to authenticate large numbers of people at one time while they’re in motion, according to a Sept. 3 NEC release.

View the BAN Stock Portfolio here and BAN Stock Index here.

Register for the upcoming complimentary webinar presented by Bank Automation News: “The future of open banking: Payments meet data,” on Tuesday, Sept. 17, at 11 a.m. ET. Register for the webinar here.