In this edition of the reader story, Sahil shares his financial audit. A sequel to How Sahil Plans to Achieve Financial Independence by Efficient Tracking.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning and preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We have also started a new “mutual fund success stories” series. This is the first edition: How mutual funds helped me reach financial independence. Now, over to the reader.

This is an update to last year’s finance audit. Again, my focus is on how I track my personal finance-related metrics. This should be helpful for DIY investors and should help them to focus on what and how to measure. I am using the same format and adding a FY24 v/s FY23 section compared to last time.

How much do you earn, spend and invest?

- Firstly, every person should know what they are earning (post-tax) every month and what is the monthly salary growth rate. Secondly, how are you spending and/or investing the salary? Salary can either be 1) Spent in expenses, 2) Pay off an EMI and/or 3) Saved/Invested. Here’s how I track these.

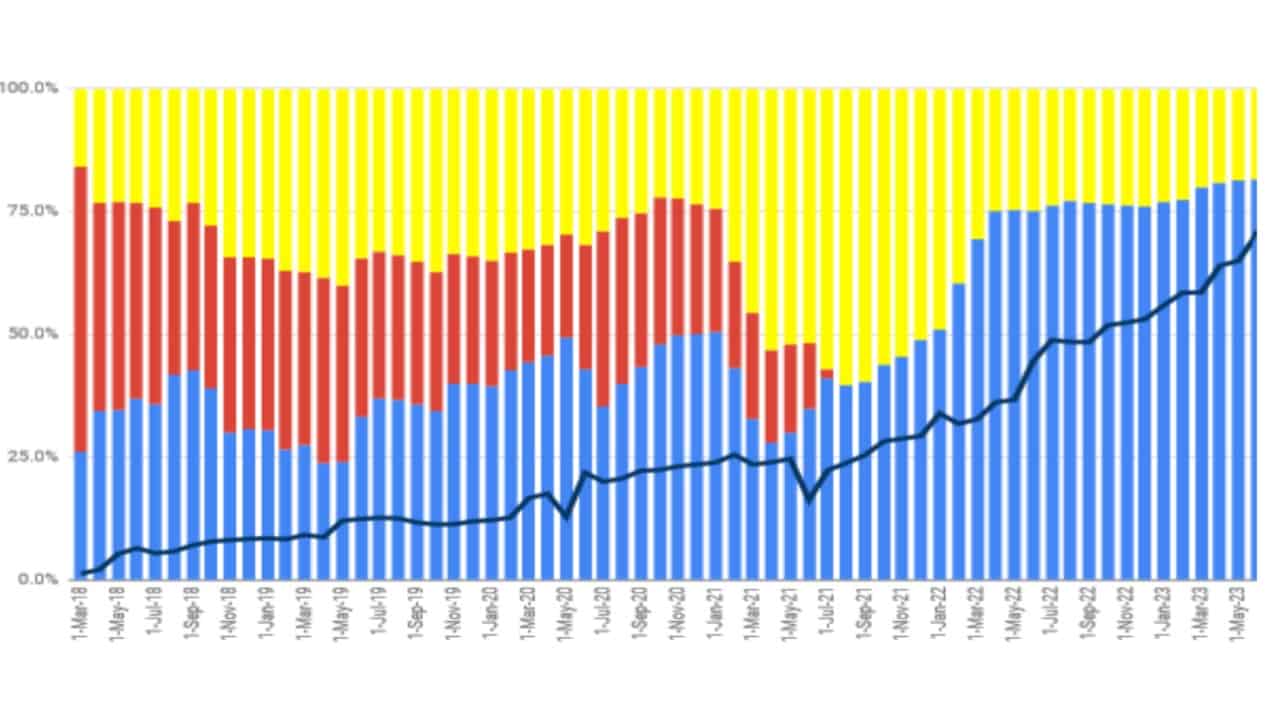

- I am using a dated graph as I don’t want to share the latest numbers.

- The black line shows my 12-month moving average post-tax earnings for any respective month (scale on the vertical right axis, redacted to ensure privacy). My salary has grown decently in the last 4-5 years and can be seen here in growth of the black line. I take 12 months rolling/moving average to smoothen any spikes.

- The blue portion is the % of earnings that go to investments, the red portion is % of earnings gone to EMI payments, and the yellow is % spent. Again, 12-month moving average. Over last 12-24 months I have been able to invest ~70%+ and the remaining <30% is expenses. In the last year, income has continued to increase, albeit at slower pace while, expenses % are in control.

- Ideally, one should expect continued growth in the black line, an increase in the blue bar height, meaning you are saving a bigger chunk of your salary, and thirdly, <35% spent on expenses.

- In extension to the above, I also track a 3-year CAGR for your moving/rolling average salary, expenses, and investments. It gives you further evidence of how you are doing both earning and spending-wise. An increase in the height of the yellow bar as above might indicate that you have a lifestyle creep and your expenses CAGR is higher than your salary CAGR. This happened with me in FY22 primarily due to one-time events while inverse happened in FY23/FY24. My expenses CAGR is back to being lower than my salary CAGR in FY24.

- 3-year rolling Salary CAGR (FY24): X% (redacted for privacy) (4% higher than FY23)

- 3-year rolling Savings CAGR (FY24): X%+16% (X%+13% in FY23)

- 3-year rolling Expenses CAGR (FY23): X%-25% (X%-15% in FY23)

Overall FY24 was way better than FY23 in terms of 3-year CAGR

- I also started tracking expenses in various buckets. But it is too tedious and doesn’t seem to give too many insights. I think whenever I’m closer to my FIRE, I’ll start tracking this again to better pin-point expenses during FIRE

Asset Allocation and Where to invest?

- Next part- Asset Allocation or where do I save or invest. I don’t maintain a separate emergency fund and have a unified portfolio. It is easier for me to calibrate and measure. I continued to add REIT and Gold (SGB) and target to reach 10% for both assets. Overall, my target is to reach 50-55% in equity, ~10% in REIT, ~10% in Gold and 25-35% in Debt. Once I’ll reach ~50% in equity, I’ll decide if I want to change my target asset allocation. I am happy to reduce Debt exposure and increase in equity exposure. One insight here is it becomes extremely difficult to increase the equity exposure as you literally have to pour all money in equity irrespective of valuation, where I have some reservations and hence increase in equity%

My avg. asset allocation as in FY24 vs avg. asset allocation in FY23 is as follows. I am happy with the increase in equity and reduction in Debt MFs and Liquid Debt

- Savings and FD: ~8% v/s 10%

- Debt MFs: ~15% v/s 17%

- Debt Illiquid (PPF + EPF + NPS-C/G): ~25% v/s 30%

- Equity (MFs+ Stocks+ NPS-E): ~41% v/s 36%

- Gold (SGB): ~4% v/s 3%

- REIT: ~6% v/s 6%

- Here is a bit more information on the instruments used:

- Debt MFs are a mix of short-term (liquid/arbitrage/UST/Savings) and some medium-term/TMF Debt/Gilt MFs. Short-term Debt MFs, incl. arbitrage, double up both as emergency funds and rebalancing/ switching to equity, while medium-term/TMF were for locking the yields. ~65% is arbitrage plus liquid funds, ~10% is short duration and ~25% are TMF+ Gilt funds.

- I ensure that the illiquid part of the portfolio, i.e. EPF, PPF, NPS, doesn’t become too large (>30-35%) because what use is the money if we can’t take it out during times of need? This used to be higher earlier and is going down now to ~25% v/s 40% or so in FY20.

- I have NPS Tier-1. Currently, NPS is at 75% equity, and I intend to maintain it until I hit my target equity allocation. I reduced equity to 68% in between the years but brought it back to 75% before end of FY24. It is a nice tool to move between equity and debt in NPS to change asset allocation without paying any taxes.

- Equity portfolio is majorly driven by MFs (80%+), NPS-E and some Indian direct equity

- Target amongst the equity portfolio is to have ~85% India and ~15% US weight. I’m at ~13% US weight currently. US weight is achieved by a mix of PPFAS flexi cap and Motilal S&P 500. Due to tax changes, didn’t add more to S&P 500 and hence, US exposure has not increased. Again with tax changes in FY25 budget, have started S&P 500 investment again

- Target in the India portfolio is to have ~10-15% small cap, ~20-25% mid cap and remaining large/giant cap. I track it through value research. Currently I have 5% small cap and 29% mid cap, in line with last year. I regret not adding more to small/mid cap in this bull run but hope this pays off in range-bound or down market

- MFs- PPFAS Flexi cap, Motilal S&P 500, SBI small cap, Invesco mid cap, Edelweiss Balanced advantage. Though, I also have some N50 and NN50, I will not go fully passive. These are same as last time. No new funds added since last 24 months

- Stocks: 10 stocks. Likes of ITC, HDFC Bank and a few new age companies. My stock portfolio has lagged Equity MF portfolio. Zomato has been one big winner

- Gold exposure via SGB and REIT exposure via four listed REITs. I have been buying fixed quantities every month. SGB (aka Gold) have been great returns this FY. REITs returns have been very bad. SGBs now are trading at premium to spot gold price. So post budget FY25, I have start buying gold ETF/MF for gold portion.

- I measure standard deviation and rolling returns of each equity MF and as a basket. I try to remove MFs which are not beating the indices in either return or risk.

I have been able to beat the indices both in return and volatility in FY24. This is the holid grail with lower volatility than Nifty, getting a higher return. I am super happy with this result. Mind you, this is tough and not attributed to me but to performance of chosen MFs

- XIRR as of 1st April 2024

- Equity MF: ~23.1% (This was ~13% on 1st April 2023, huge change)

- Debt MF: ~6.4% (Investing since 2017)

- NPS: ~19% (Investing since 2019)

- Gold: ~19% (Investing since 2020)

- REITs: ~6-7% (Investing since 2021)

- PF: ~8%

- PPF: ~7.3% (Investing since 2015)

- Money saved: No FnO, No trading, No LIC endowment/ULIP plan

Net-worth (NW) and its measurement

- All this saving, investment, asset allocation and fund selection is fine but how do you bring it all together.

- An example: NW on 1-Nov-21: 100; Nov-21 salary: 10 and expenses: 6; NW on 1-Dec-21: 105. Now, NW has increased by 5 units in 1 month; 4 units (80%) can be attributed to salary savings and the remaining 1 unit (20%) can be attributed to asset increase.

- In FY24, my NW has increased by ~65%+ and about ~60% growth came through salary savings and the remaining ~40% through asset returns (capital gain + interest etc.).

- Last year, 90% growth had come from salary increase and 10% from asset returns. As we become older, the majority of growth should come from asset returns which happened in FY24 compared to FY23. Do note, in a year of zero equity returns like FY23, asset returns could be negative as well, which has happened with me twice. But years like FY24 with amazing equity returns can give a huge jump to networth

- Overall, till date, ~89% of my net worth is from human capital (salary-expenses) and only ~11% if from financial/asset returns.

- I’ve crossed 10+ times (don’t want to share the exact number) of annual expenses in terms of FIRE goal. I want to reach 30-40x in the next 10 years.

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2022 edition: Portfolio Audit 2022: The Annual Review of My Goal-based Investments. We asked regular readers to share how they review their investments and track financial goals.

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

Do share this article with your friends using the buttons below.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

Podcast: Let’s Get RICH With PATTU! Every single Indian CAN grow their wealth!

You can watch podcast episodes on the OfSpin Media Friends YouTube Channel.

🔥Now Watch Let’s Get Rich With Pattu தமிழில் (in Tamil)! 🔥

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit ‘reply’ to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Most investor problems can be traced to a lack of informed decision-making. We made bad decisions and money mistakes when we started earning and spent years undoing these mistakes. Why should our children go through the same pain? What is this book about? As parents, what would it be if we had to groom one ability in our children that is key not only to money management and investing but to any aspect of life? My answer: Sound Decision Making. So, in this book, we meet Chinchu, who is about to turn 10. What he wants for his birthday and how his parents plan for it, as well as teaching him several key ideas of decision-making and money management, is the narrative. What readers say!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)