Starting a new firm can be a nerve-wracking time for an entrepreneurially minded financial advisor, as making the jump involves a significant amount of professional and financial risk. Nonetheless, after a year or 2 in business, some firm owners will find that their plate is becoming full and their available time is shrinking as they balance servicing current clients with marketing for new ones and also possibly managing staff. Which presents an opportunity for the firm owner to step back and assess whether they want to change any of the practices that they’ve established in their first years in business to make the next several years both professionally and personally rewarding.

In this guest post, Jake Northrup, founder of Experience Your Wealth, LLC, discusses 7 lessons he learned in years 3–5 of building his RIA and the changes he subsequently made to his service model, client base, and daily schedule, offering guidance to firm owners who may need to navigate some of the same challenges that come with scaling their advisory business.

When an advisor opens a firm, they might have little to no revenue but a good deal of time to manage their practice. Which means that when their first clients come on board, they might be tempted to overservice them to demonstrate the value that they can provide. Nevertheless, as a client base grows, maintaining such a level of service can take up more time that the advisor may have available, particularly given the added responsibilities of running their growing business. In Jake’s case, after deciding that he was overservicing clients during the earlier years of his practice, he started scheduling fewer standard meetings and limited the number of after-meeting action items, freeing up his time and mental bandwidth for other activities to grow and run his firm.

In addition, he also found that he preferred working with certain types of planning clients over others, leading him to refine his niche and ideal client persona over time. While Jake had originally worked with equity compensation clients, current or aspiring business owners, and young professionals with student loans of $100,000 or more, he realized that he didn’t care as much for student loan planning, which led him to make the difficult decision to transition 20% of his client base who primarily needed student loan planning.

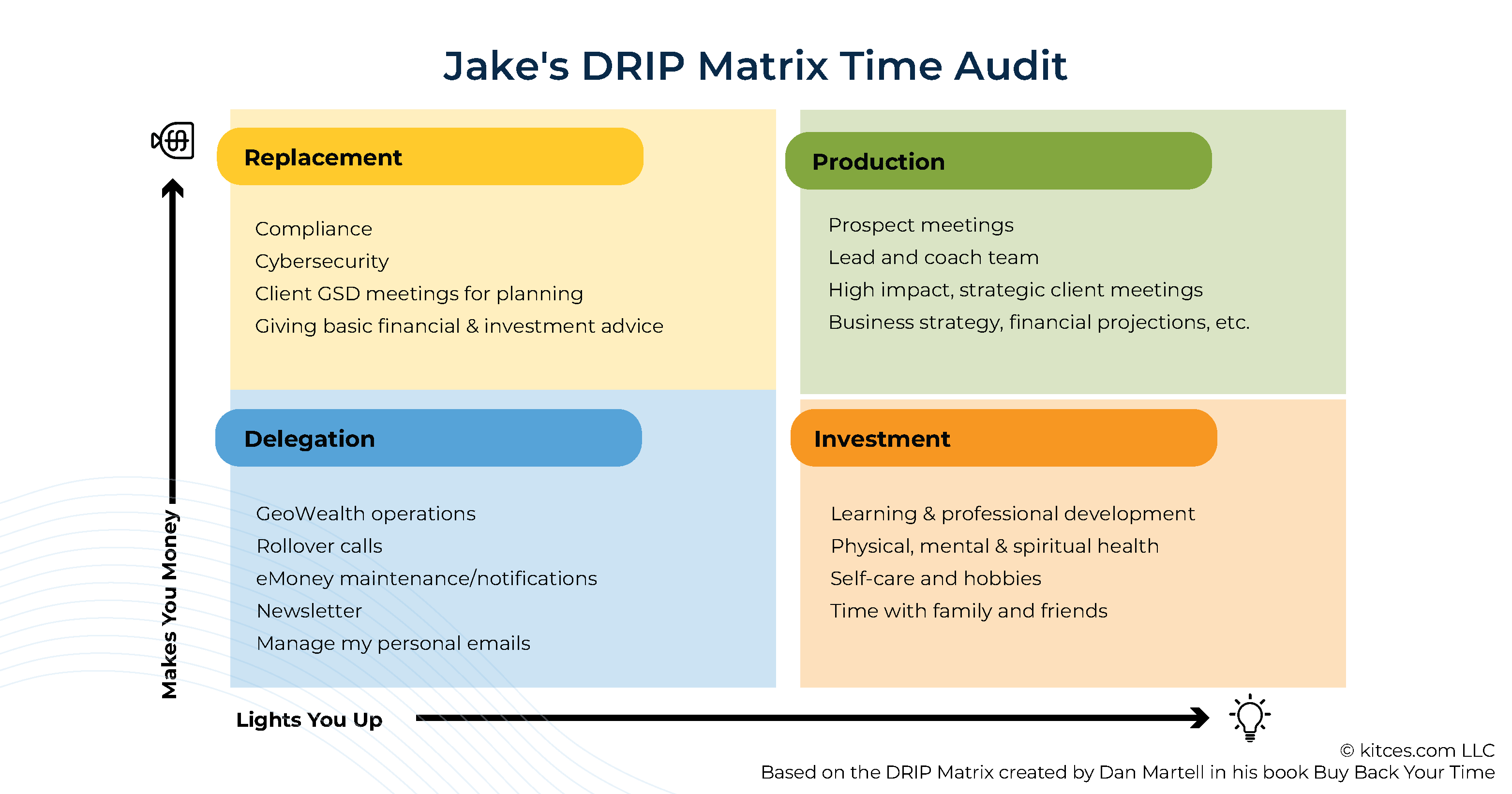

Jake also learned key lessons on managing daily schedules. For instance, because he disliked the traditional 9–5 work schedule, he offered his team significant flexibility in deciding when they worked. However, this lack of structure actually put more pressure on team members because it didn’t allow for sufficient collaboration time, leading him to implement a more standard work schedule that still offered some flexibility during the day and virtual coworking sessions for the team. For himself, Jake time blocked his schedule to ensure that he prioritized his personal life and wellbeing (e.g., taking vacations) and organized his workday to leverage the times of day when he has the most energy. He also conducted a “time audit” based on Dan Martell’s 2-dimensional DRIP Matrix system to help him identify tasks based not just on their revenue potential but also their ability to energize and light him up.

Ultimately, the key point is that a new financial advisory firm owner’s original vision for their practice is likely to change over time, which can create challenging decision points (e.g., when to hire new staff and whether to adjust the firm’s ideal client persona). Nevertheless, as Jake has found, there are strategies to help firm owners mold their business to meet personal and professional needs, which can help them support greater wellbeing for themselves and a more sustainable business in the long run!