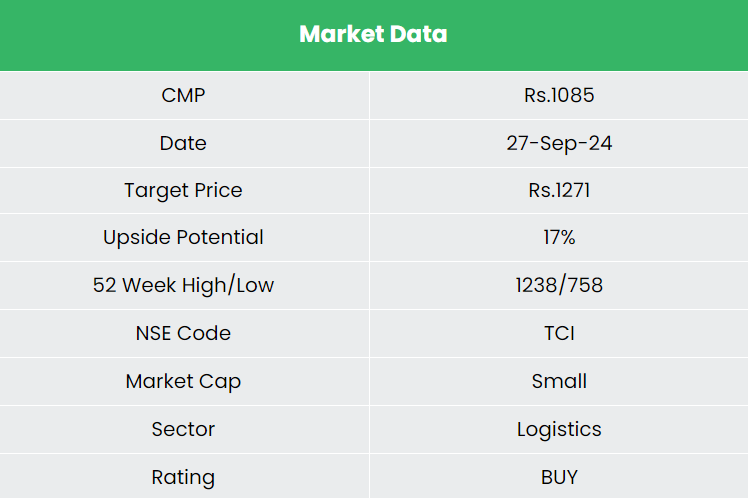

Transport Corporation of India Ltd – Leaders in Logistics

Founded in 1958, TCI delivers integrated multimodal logistics and supply chain solutions across road, rail, and sea. Catering to diverse industries, from automobiles to electronics and retail, TCI manages over 2,300+ train movements, 8,000+ containers, 10,000 trucks, 6 coastal ships, and 15+ warehouses with a workforce of 3,500+ as of Q1FY25.

Products and Services

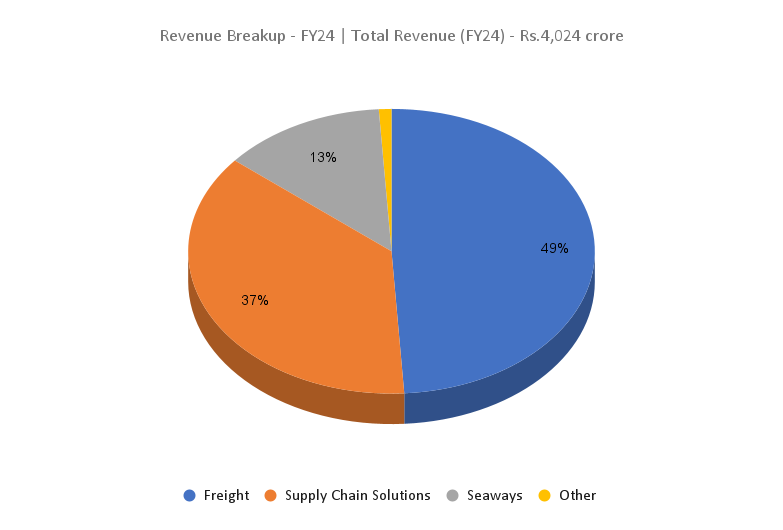

The company’s offerings can be classified into the following categories:

- TCI Freight – Provides total transport solutions for cargo of any dimension or product segment.

- TCI Supply Chain Solutions – Services offered are Supply Chain Consultancy, Inbound Logistics, Warehousing / Distribution Centre Management & Outbound Logistics.

- TCI Seaways – Caters to the coastal cargo requirements for transporting containers and bulk cargo.

- TCI Chemical Logistics Solutions – Specialised in the storage and transportation of various chemicals, including liquids, dry substances, and gases, in compliant warehouses.

Subsidiaries: As of FY24, TCI has 9 subsidiaries, 1 joint venture, and 1 associate company.

Growth Strategies

- TCI has ordered two new ships (7,300 DWT) worth $38.8 million, expected in CY 2026-27, and is considering acquiring second-hand ships.

- Despite a FY24 decline, Q1FY25 saw increased seaway sales, with plans for capacity expansion.

- Rs.375 crore capex for FY25, including Rs.80 crore for ship advance payments.

- The company purchased two new trucks and plans to add 75 new branches in the LTL business, focusing on cold chain opportunities.

- Supply chain business delivered strong results, particularly in automotive, with growth in the EV and components market.

- Seaways operations outperformed expectations, with stability anticipated despite fuel price fluctuations.

- The joint venture with Concur achieved 13.8% growth, and the cold chain segment expanded by over one-third.

Q1FY25

- Revenue: ₹1,056 crore in Q1FY25, up 10% from ₹958 crore in Q1FY24.

- Operating Profit: ₹136 crore in Q1FY25, a 7% YoY growth from ₹127 crore in Q1FY24.

- Net Profit: ₹92 crore in Q1FY25, an 11% increase from ₹83 crore in Q1FY24.

FY24

- Revenue: ₹4,024 crore in FY24, up 6% from FY23.

- Operating Profit: ₹532 crore in FY24, a 7% YoY growth.

- Net Profit: ₹355 crore in FY24, an 11% increase YoY.

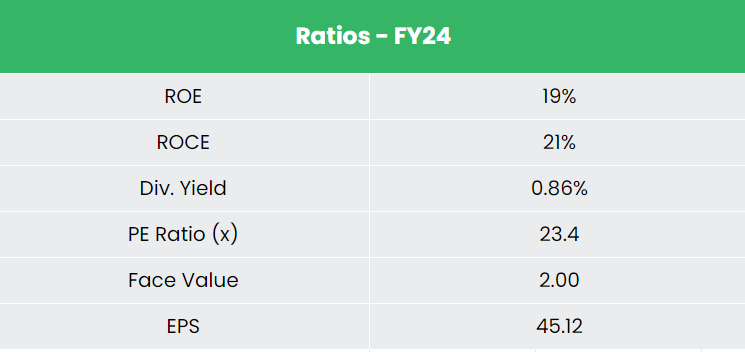

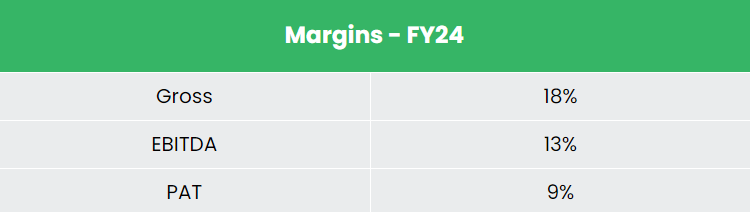

Financial Performance (FY21-24)

- Revenue CAGR: ~13%

- PAT CAGR: ~31%

- 3-Year Average ROE: ~20%

- 3-Year Average ROCE: ~22%

- Debt-to-Equity Ratio: 0.10 (strong capital structure)

Industry outlook

- The global logistics market is projected to exceed $15.79 trillion by FY2028 and reach $18.23 trillion by 2030.

- Growth drivers include evolving consumer preferences, e-commerce expansion, and global trade.

- India’s logistics sector is forecasted to grow at a CAGR of 7.85%, rising from $282.3 billion to $563 billion by 2030.

- The Indian government’s VISION 2047 aims to enhance the transport network across all key modes, unlocking logistics potential and boosting competitiveness.

Growth Drivers

- Government initiatives such as the PLI scheme, Atmanirbhar Bharat, and Make in India.

- Rising demand for multimodal logistics, digitalization, automation, and sustainable transportation solutions.

- Capex allocation of ₹11 trillion for the logistics sector in the FY24-25 budget, a 10% YoY increase.

Competitive Advantage

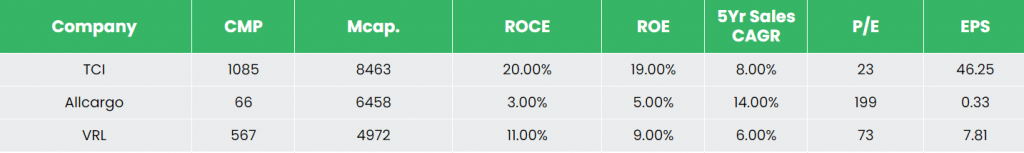

TCI is considered the most undervalued stock among competitors like Allcargo Logistics Ltd and VRL Logistics Ltd, boasting healthy returns on capital employed and stable sales growth.

Outlook

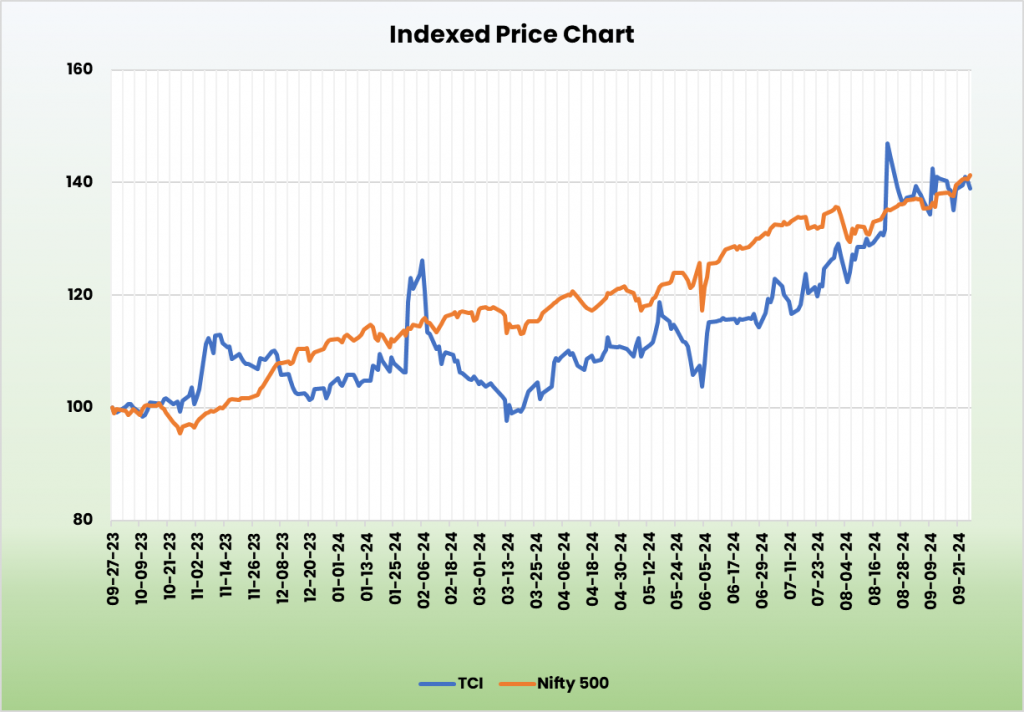

- TCI is poised to benefit from an improving domestic trade environment, driven by festive season stocking, monsoon withdrawal, and enhanced quarterly performance across segments.

- The company is well-positioned to improve market penetration through its integrated diversified services and multimodal capabilities.

- Expected growth of 10-15% in both top line and bottom line for overall business.

- Anticipated ROCE maintenance at 20%.

- Management projects 10% growth in seaways.

- Planning ₹1,100 crore in capex over the next 4 years.

Valuation

We believe TCI is well placed to cater to the requirements of its diverse client base due to its national network and multimodal capabilities. We recommend a BUY rating in the stock with the target price (TP) of Rs.1,271, 24x FY26E EPS.

Risks

- Input Costs: Rising tolls, fuel prices, manpower costs, and challenges in accessing quality labor may pressure margins.

- Socio-Economic Risk: Unforeseen events that disrupt the movement of goods across regions could adversely affect company operations.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

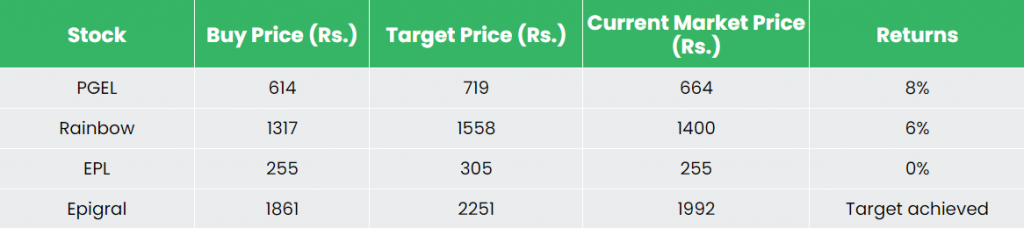

Recap of our previous recommendations (As on 27 September 2024)

Rainbow Children’s Medicare Ltd

Other articles you may like