Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla’s follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently solve their clients’ needs for estate document preparation (beyond ‘just’ estate planning software), but on the other hand raises questions about how big the market opportunity really is for advisor-driven estate document preparation, given that unlike tax planning tools (which have an annual cadence for filing tax returns with the IRS) most clients may only update their estate documents only 10–15 years (often amounting to no more than 2–4 clients per advisor per year).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- VRGL has announced a new venture capital funding round to continue building out its capabilities to extract data from prospects’ investment statements and automatically generate investment proposals – which while having proven popular among advisors for its ability to save time spent poring over paper statements, may run into challenges with clients who want to use their own investment analysis methods with the data VRGL extracts (to the extent that there could be pressure for VRGL to allow for more customized analytics approaches, or even to let advisors run its data through other analytics tools, to achieve the user growth it wants)

- Cashmere, an AI-driven prospecting tool aiming to help advisors “identify, enrich and engage” with prospective clients, has announced a $3.6 million seed capital funding round – although, as multiple new solutions have cropped up in recent years that also seek to help advisors catch money-in-movement events, fill in gaps in data on prospects, and match advisors with their best-fitting prospects, the question remains how many different solutions the market for prospecting tools can support (especially given that most firms tend to move away from prospecting as soon as it’s feasible to generate most of their new growth from referrals)

- Fidelity has announced that it plans to effectively cut off access to 401(k) plans on its platform by Pontera and other technology that uses client credentials to view and trade in held-away accounts – which while putatively being about protecting client data and privacy, also serves to highlight Fidelity’s conflicts as both a 401(k) provider and custodian (since now in order to manage within Fidelity-held 401(k) accounts, advisors will need to have custody assets on Fidelity as well), and raises questions about how Pontera can resolve its disputes with both state regulators and now plan recordkeepers to continue allowing advisors to manage clients’ 401(k) assets on its platform

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Charles Schwab has announced that it plans to shut down its Institutional Intelligent Portfolios “robo-advisor for advisors” in the coming year, further accentuating the decline of the B2B robo-advisor space in recent years as the costs of attracting next-generation clients to sign up have continued to outpace the growth of new assets, to the extent that only a small handful of the original crop of B2B robo-advisors from the mid-2010s still exist today

- Retirement planning platform Income Lab has announced the launch of a new Annuity Planning tool aiming to model the impact of a wide range of different types of annuities on a client’s overall retirement picture – which is arguably the first tool capable of subjecting many annuities to a robust and objective analysis (rather than the optimistic projections included in annuity sales literature), and may help to settle some debates over how certain annuities might perform in a range of different scenarios

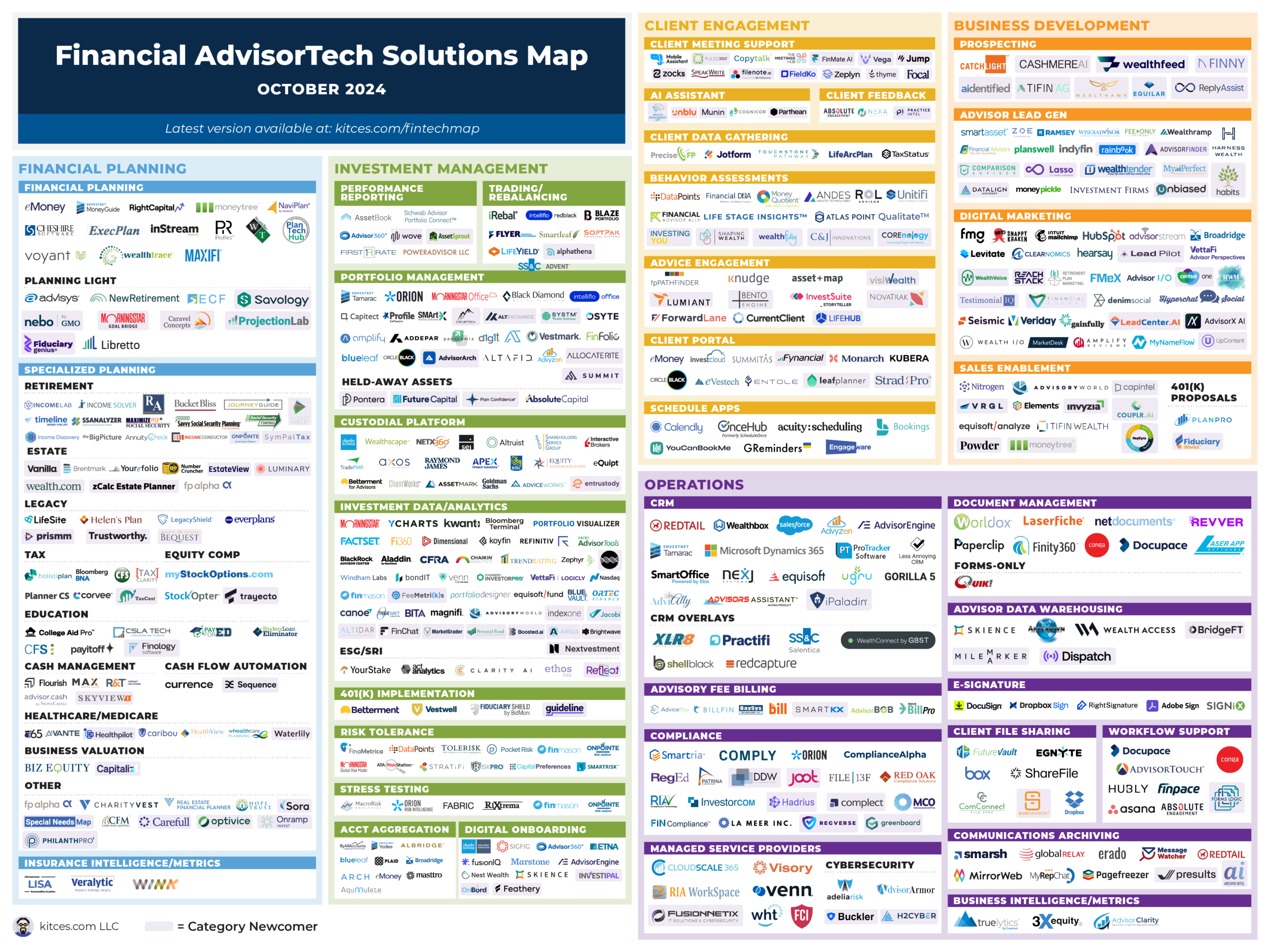

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!