One of my favorite exercises is examining conventional wisdom—sometimes called the “Consensus”—and identifying where it might be wrong.

This can be challenging. Most of the time, the crowd, more or less, gets it right. Markets are mostly (eventually) efficient, and when the crowd votes with its capital or its feet, they drive big, often sustainable trends.

This is why it’s difficult to be a contrarian investor—you are betting against a large, diverse, informed, and motivated group that determines the direction and amplitude of markets. They get it right most of the time. However, on occasion, this group loses its anchor to reality and/or becomes wildly overstimulated, resulting in bubbles and crashes.

Election Day is in one week(!), and given that, let’s consider some places where the consensus might be wrong:

Prediction markets

Are we still litigating the accuracy of prediction markets? I thought we figured this out back in the 2000s. I have written extensively on the failure of prediction markets. It’s useful if you understand when they succeed and why they often do not.

The are several key reasons for failure: Unlike the stock market, the incentives here are not big enough to attract a critical mass of capital. Polymarket is the latest prediction market to find some media attention, but its total dollar volume is equal to a few minutes of trading Nvidia or Apple.

The other issue is that these market participants don’t look much like US voters. Think of the bettors here as all participating in a giant poll. To be more accurate, the polling group should be as representative of the electorate that will be voting as possible. The more the traders as a group deviate from the electorate, the less accurate the poll (i.e., betting) tends to be. The more overseas participants are (it’s illegal in the US), the more techno, crypto, or finance-bro oriented it is, the greater the deviation from the pool of average U.S. voters.

Bloomberg reported that “A trader who spent more than $45 million on Polymarket bets that Donald Trump will win the upcoming US presidential election has been identified as a French national, following an investigation by the cryptocurrency-based prediction markets platform.”

That single person moved Polymarket, which then spilled into other prediction markets, which then spilled into polling. There is a 50/50 chance this trader is right – the same as your best guess or mine; the question is why would we imagine this French national has any special insights into the future of US electoral politics?

Counterpoint: My friend Jim Bianco lays out the Pro-prediction market case and why it’s not manipulated.

The Polls:

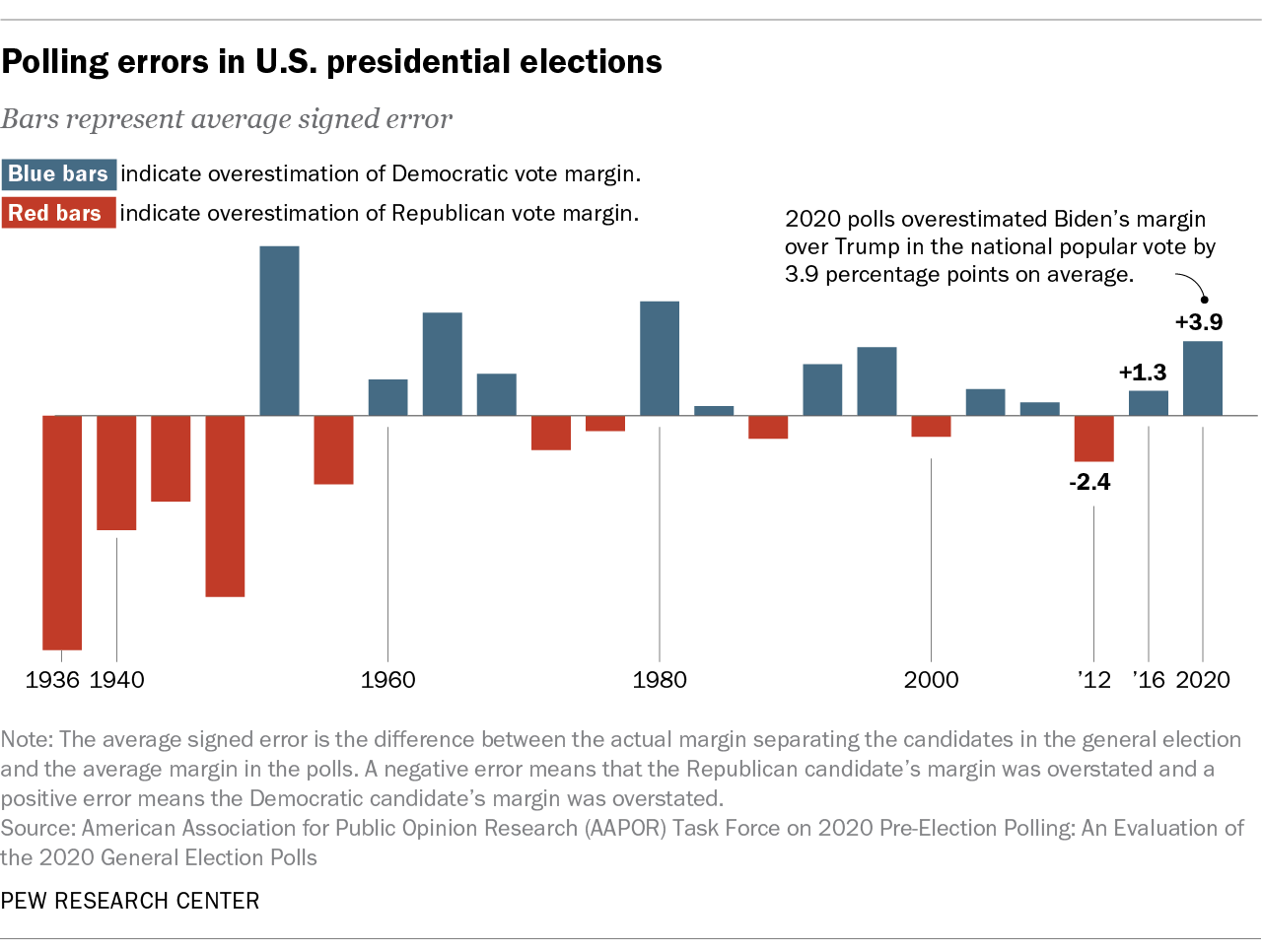

Polling has a poor historical track record. Consider the recent misses: In 2016, Trump’s support was undercounted; in 2020, Biden’s support was overcounted; and in the 2022 Congressional election, the widely-anticipated-by-polling Red Wave never materialized.

As we discussed previously, a year ahead of elections, polling is no better than random guesses; more than 10 weeks out, it is a coin toss — about a 50% accuracy rate. We are now within a week of the election where Polls tend to be about 60% accurate, e.g., 60% chance of the result falling within the margin of error. Meaning, 2 out of 5 cycles, the polls are off by a much bigger margin.

I previously noted why polling is a behavioral issue, but let’s add some meat to those bones. I just recorded a Master’s in Business with Professor Colin Camerer, who teaches behavioral finance and economics at the California Institute of Technology. His work on risk, self-control, and strategic choice led to his being named a MacArthur Genius Fellow in 2013.

We discussed the concept of the “hypothetical bias.” When scientists ask hypothetical questions—“Will you vote in this election?”—about 70% of study participants answer affirmatively. However, people’s real-life behavior differs dramatically from their answers: Only 45% of the surveyed group actually voted.

In races where a 1%-point swing can determine an election, a 25% difference between intention and behavior is massive. Is it any surprise political pollsters keep getting their projections so wrong?

Margin of Error:

In polling, the margin of error is the variance between a census of the entire population versus an incompletely sampled one. Hence, when we see a 1-3% margin of error, it implies a far smaller variance than what we have seen historically. My guess is the actual margin of error is 2X to 4X bigger.

Pollsters won’t admit to a 6-8% margin of error because margins of error that large make polls appear useless. Nobody wants to admit their entire profession is a waste of time…

Billionaire-owned Media + Endorsements

There has been a lot of buzz the past week about the L.A. Times and Washington Post not doing their usual endorsements – both are owned by billionaires, each of whom has corporate interests that do business with the federal government. For Jeff Bezos, who owns the Washington Post, it’s his Blue Origin space venture; for Patrick Soon-Shiong, who owns the L.A. Times, it’s his healthcare and pharmaceutical firms.

If your conflicts interfere with your ability to run the paper, perhaps it’s worth considering the solution put in place at The Guardian. Its ownership structure is a limited trust created in 1936. The paper’s revenues come from subscriptions, advertising, The Guardian.org Foundation, and print revenue.

Media-owning billionaires could set up a not-for-profit Foundation, donate their newspapers to it, and then generously fund it. (A billion-dollar foundation would cover the Washington Post in perpetuity). The (former) owner sits on the board but no longer has direct control over hiring, firing, or editorial. The paper becomes truly independent, and the billionaires no longer have business problems.

This used to be described as La noblesse oblige…

It’s a Close Race:

Is it really as close as claimed, or is that a media meme focused on the horse race (and not the issues)? We won’t know just how close it will be for another week or so. Maybe its close, but the outlier possibility is the election will break substantially one way or the other.

Has Donald Trump made his case that life was better when he was President? If he did, he could pick up 320+ EC votes. Did Kamala Harris convince enough people that life was worse under Trump and that she is ready to be Commander-in-Chief? If so, then she can accomplish the same. Will the Blue Wall in the Midwest hold for Harris? Will Trump win Arizona and North Carolina? Might Georgia and Nevada go Harris? It’s not impossible to see the election being called sooner rather than later.

I like Jason Kottke’s thoughts on this:

“Polls are not votes. The candidates are not deadlocked. There is no ahead or behind, even “with 72% of precincts reporting” on election night. The way elections work is they’re 0-0 all the way up until the votes are counted and then someone wins.”

That’s how elections work…

Previously:

Bad Polling is a Behavioral Problem (October 6, 2024)

Another Reason Why Polling is So Bad (August 15, 2024)

Nobody Knows Anything, 2023 Polling Edition (November 8, 2023)

The kinda-eventually-sorta-mostly-almost Efficient Market Theory (November 20th, 2004)

See also:

Poll results depend on pollster choices as much as voters’ decisions

Josh Clinton

Good Authority, October 28, 2024

Election-Betting Site Polymarket Says Trump Whale Identified as French Trader

By Emily Nicolle

Bloomberg, October 24, 2024

Key things to know about U.S. election polling in 2024

By Scott Keeter and Courtney Kennedy

Pew, August 28, 2024