If you’re looking to save money towards a future goal – such as paying for a wedding or a new home – would it be a better idea to put your money in a bank, a fixed deposit, or a short to mid-term endowment policy?

In this article, I’m going to bring you through 2 main methods you can explore using to get to your goal:

- The first method assumes that you prioritize disciplined savings and prefer not to take on any investment risk to get there.

- The second method requires you to take on more risk, in exchange for potentially higher returns.

Method 1: Use capital-guaranteed options

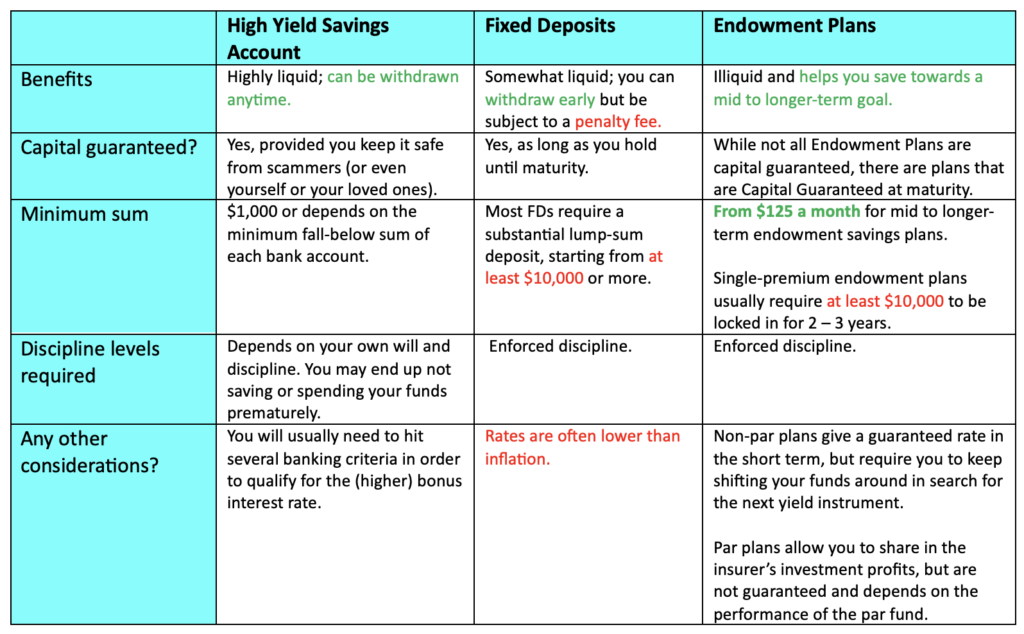

If your top priority is to save and preserve your capital, then you’d be better off with either a high yield savings account (HYSA), a fixed deposit or an endowment plan that guarantees 100% capital return.

High Yield Savings Accounts (HYSAs)

The easiest and most accessible way would be to open a HYSA with any local bank, and then save a portion of your income regularly and park it inside the account.

Most of these accounts require you to fulfil certain banking actions – such as depositing your salary and spending a minimum on eligible credit cards – before you qualify to unlock higher bonus interest. These rates currently range between 2 – 6% p.a.

| Pros | Cons |

| Highly liquid: you can withdraw anytime. | Its liquidity is also your biggest weakness as you could end up not saving, or even spending it prematurely.

To earn a higher bonus interest, you will need to perform several banking actions every month. If you do not hit the eligibility conditions, you are more likely to earn a rate closer to 1 – 2% p.a. instead. |

Fixed Deposits

If you do not want the hassle of having to hit multiple banking criteria each month before you can unlock higher interest, then a simpler option would be to go for fixed deposits instead.

Fixed deposits allow you to earn a fixed interest rate on your lump sum savings, which you lock up with the bank for a set duration. These often have minimum deposit sums, such as $10k to $20k if you’re hoping to enjoy more attractive rates.

Current prevailing rates for fixed deposits are hovering at about 3% p.a. in today’s climate.

| Pros | Cons |

| Fairly liquid: you can withdraw early if you need to and be subjected to a penalty fee. | Most fixed deposits require a substantial lump-sum deposit, starting from at least $10,000 or more. |

Thus, fixed deposits would be a more suitable option only AFTER you have saved up a sizeable amount, and wish to get some returns on them while holding on to it for an upcoming goal.

If you’re trying to save a sum of money each month to accumulate towards a future goal, then fixed deposits aren’t going to help you get there.

Endowment Plans

What about endowment plans or policies, such as those typically offered by an insurer?

With endowment plans, you can choose from the (i) term and (ii) premium payment frequency. Here are a few examples:

- Short term – a single-premium endowment plan, usually with a short lock-in period of 1 – 3 years with guaranteed returns upon maturity

- Medium or long term – usually a participating endowment plan with annual premiums paid over 2 – 10 years and saved for 6 – 20 years. Returns upon maturity are a mix of guaranteed and non-guaranteed, subject to the performance of the par fund.

| Pros | Cons |

| There are endowment plans that can get up to 5% p.a. guaranteed and non-guaranteed returns | Illiquid: if you surrender your plan before maturity, you will only get back the surrender value indicated (usually less than what you paid) |

| There are capital guaranteed options available where you will not get back less than what you put in – as long as you do not terminate prematurely | Short term endowments may have a shorter lock-in period, but the problem comes when you need to find the next place to shift your funds into, and you will not know what the rates are thereafter.

Most short-term, single-premium endowment plans also typically require a minimum of $10,000 lump sum. |

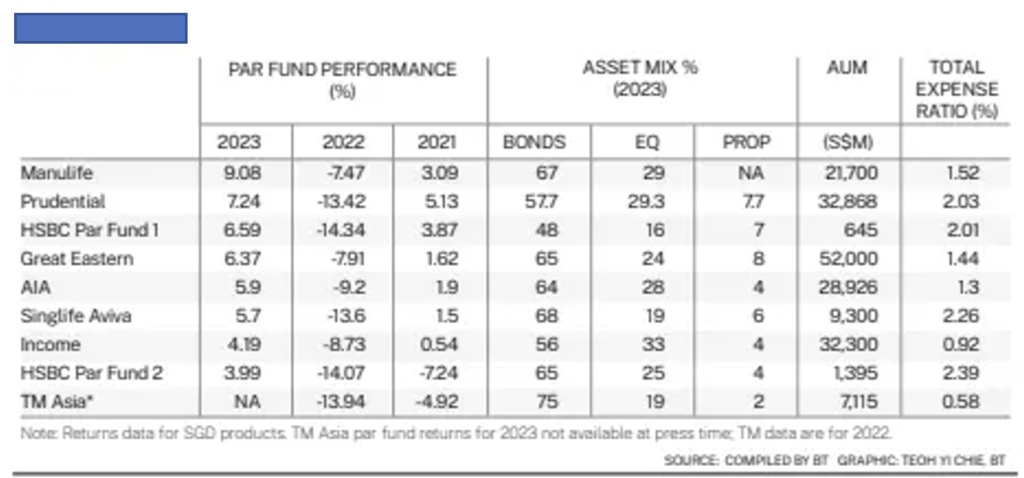

Endowment policies are typically categorized into either participating or non-participating plans, or par and non-par for short. Par plans mean that policyholders get a share of the profits from the insurance company’s participating funds, which are paid out in the form of bonuses or dividends and can possibly enhance the maturity pay-out in good years.

Important Note: There are key differences between par and non-par endowment plans.

- Non-par plans: these are not entitled to any profits that the insurance company makes. You can spot them as they offer a guaranteed return that you will get back together with your capital at the end of the holding term.- Par plans: insurance policies that participate or share in the profits of the insurance company's par fund. Aside from the guaranteed benefits, they also provide non-guaranteed benefits may include bonuses and cash dividends – these depend on how the par fund's investments are performing, how many claims are made on the fund and the expenses incurred by the par fund. You can spot these by looking for the illustrated rates of return (usually 3% and 4.35%, or 3.25% and 4.75%) shown in your policy document (the non-guaranteed bonuses).

For instance, in good years (like 2023 and 2024), many insurers were able to post a profit and hence higher bonuses were paid out, which was beneficial to policyholders. But in difficult years like 2022, that was not the case as global markets were generally down and investment performances were mostly muted across the board.

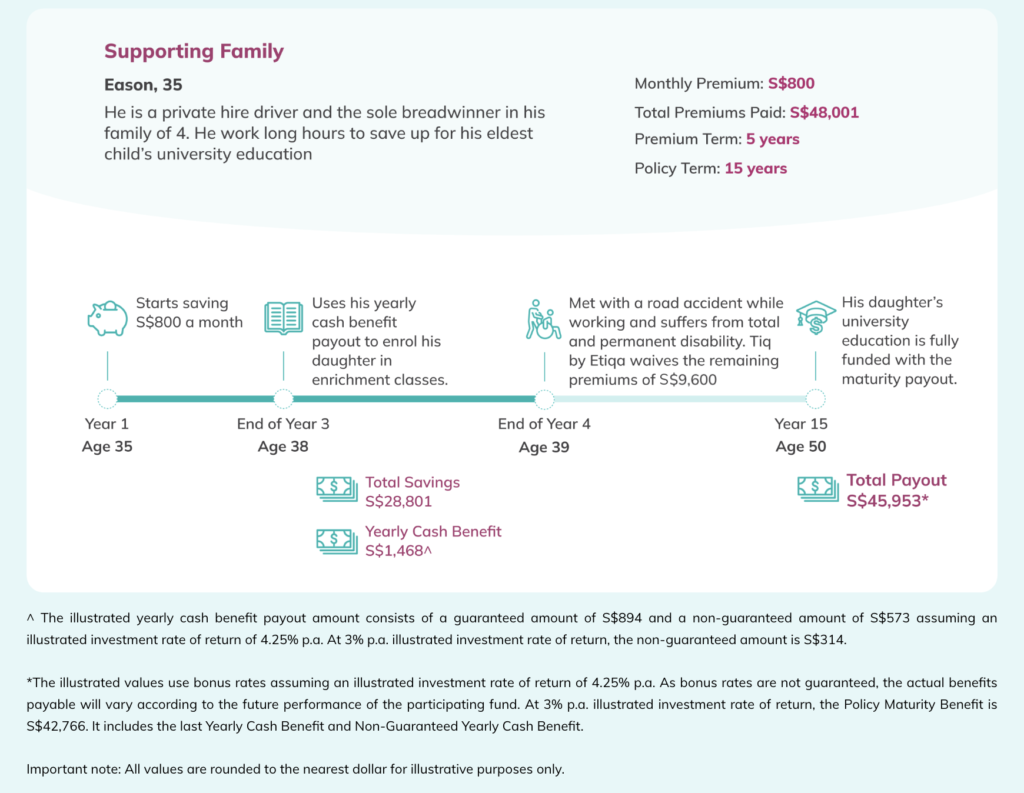

For instance, endowment plans are typically popular among parents who use it as a means to save towards their children’s university fees. Some even use the yearly cash benefits to pay for enrichment or private tuition classes, while others choose to reinvest it further. Here’s an illustrated example:

Key Considerations

As with every financial tool, whether it is suitable for you will ultimately depend on your personal circumstances, risk appetite and expectations of returns.

If your priority is to enforce discipline and have a plan that forces you to save so that you WILL hit your goal no matter what happens, then the best option will probably be that of an endowment policy.

By helping you to build a savings habit (each time you pay for your premiums), endowment plans serve as a tool used by many people whose top priority is to make sure they hit their future financial goals. As your capital is usually guaranteed (as long as you hold to maturity), this naturally comes at a trade-off i.e. lower returns than if you had invested it through other means.

Hence, you have to decide whether you care more about the level of returns, or the absolute guarantee offered by an endowment plan.

Sponsored Message

If you need to save for an upcoming life milestone or for your child’s education, let Tiq CashSaver help you cultivate the habit of regular savings and get you to your goal.

You can start saving from as little as S$125# a month, and receive a steady flow of supplementary income from the end of your second policy year. Otherwise, you can also opt to accumulate your yearly cash benefit to further grow your savings at the prevailing interest rates!

You can tailor your plan to fit your savings horizon, from choosing to pay your premiums over 2 years or 5 years. Underwritten by Etiqa, Tiq CashSaver is a 100% capital guaranteed endowment plan upon maturity and provides you with a lump sum payout as you arrive at your goalpost.

#Based on a premium term of 5 years and ~$1,500 yearly payment.

What’s more, another benefit that most endowment plans come with is the option to add a premium waiver rider i.e. so that in case something unfortunate were to happen to the policy owner, the remaining premiums will be waived and the plan continues to stay in-force.

For Tiq CashSaver, this benefit is not a rider but integrated with the main plan.

Endowment (par) plans like Tiq CashSaver offer high flexibility for individuals who want to cultivate the habit of saving (even if it is just a modest amount), while making investing simple and accessible through its participating funds. What’s more, parents who wish to place the endowment plan under their child’s name while they remain insured (against unexpected TPD) can choose to do so; in the event that anything untoward happens during the term that renders the parent permanently disabled, the remaining premiums will be waived but the savings and compounded investment returns continue.

You have to know yourself best in order to determine what is most appropriate for you.

If you don’t have discipline, then endowment policies will be better for you than if you simply left your money in the bank, or relied on your own (lack of) will to transfer a portion of your salary and save up.

Method 2: Invest directly for higher potential returns

Of course, if you’re savvy and know how to invest, then a better way to get to your goal faster would be to invest directly in the markets.

You could do this by investing into unit trusts, exchange traded funds (ETFs) that track the broader market, or even through a diversified portfolio of stocks and bonds. Even if you were to simply invest in low-cost exchange traded funds tracking the S&P 500 or the STI Index, the odds that you’ll make returns higher than 3 – 5% p.a. can be pretty decent, as long as you do not make any major mistakes or use leverage – note that this statement is based on the historical returns of the S&P 500 over the last 40 years. This is the method that I personally use, and you can see some of my returns captured here (2023 financial review) and here (for last month, August 2024). However, it has not been without its own challenges, as you can see documented in this reflection article.

Having said that, I generally do not advocate investing any money that you need within the next 1 – 3 years into the stock market, especially if you need the money for a non-negotiable event by then! Given the unpredictability of the market, there is no certainty that when you need the money, the markets will be doing well – you could thus be exiting at a significant capital loss if you’re unlucky.

Need an example? Imagine John, who read “advice” on Reddit and decided to invest into an ETF tracking the S&P 500 in 2021 for a financial goal that he needs to meet within 1 year. Well, guess what happened to unlucky John? That timing also happened to be when the broader markets crashed, and he lost 18% of his capital instead.

While you won’t lose money on an endowment plan (or any of the above capital-guaranteed options we explored earlier), you can lose money when you invest by yourself – especially if you’re not careful. We all know a friend or two who invested in stocks like Tesla or Peloton during the pandemic, only to go on and lose 20% – 90% of their invested capital.

The S&P 500 index clocked 26.3% in 2023 and has gained over 20% so far this year. Most of us who have been invested in the markets for long enough know that this is not the norm; the last time this happened was in 1995 – 1999, when the S&P notched double-digit gains for 5 consecutive years before going on to fall by double-digits every year for the next 3 years.

If you’re investing for the long term, investing in ETFs that track the S&P 500 isn’t such a bad idea, since the index has historically returned 8 – 10% over the last few decades.

However, if you need the money in a certain year or by a fixed timing, then the problem with blindly following advice on the Internet is that while the popular financial mandate of “just invest in the S&P 500” is spreading like wildfire, no one can predict the market cycle at the point in time when you need the money.

You will need to personally decide and choose between certainty and returns. If you need the certainty, then you need to be prepared to pay the price in the form of lower returns. But if you can and willing to take the risk of possible loss, then your upside returns can also be much higher.

Conclusion

I’m not a fan of long-term endowment plans (especially those that you have to hold for 20 years or more), as I feel that their fees vs. returns have not kept up with the other market alternatives that have sprung up in recent years.

However, I’ve talked about short-term endowment plans on this blog fairly often before – especially when an attractive rate comes up, from time to time.

As for medium term endowment plans, I feel they can be a decent tool for people who need to enforce a saving habit for themselves, as well as those who seek out a capital-guaranteed option for the next few years without wanting to take on the risks of investing in the financial markets.

In fact, rather than having to choose between either option, I would also encourage you to think about dividing up your cash into 2 pots – building your foundation with a capital-guaranteed tool such as endowment plans, while also learning how to invest in the markets for greater potential returns.

Sponsored Message

If you would like to invest for potentially higher returns but you’re unsure about doing it yourself, you can also check out Tiq Invest here, which gives you access to funds by Dimensional Fund Advisors, PIMCO Global Advisors (Ireland), BlackRock Global Funds and/or Lion Global Investors.

There is no lock-in period, and you can invest in a variety of fund portfolios that suit your risk objectives. You can start investing from as little as S$1,000 is all you need, and ride through market volatility by setting up regular top-ups with fixed frequency from $100 per month.

With the lowest management charge of only 0.75% p.a., this removes the biggest problem with traditional ILPs – their high fees. This ensures that more of your funds get allocated towards investing for returns instead.

If you choose to invest with Tiq Invest between now to 31 December 2024, you can also get cashback of up to S$200. Terms apply.

Disclosure: This article is brought to you in collaboration with Etiqa Insurance.

All products mentioned in this article are underwritten by Etiqa Insurance Pte. Ltd (Company Reg. No. 201331905K).This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

Tiq Invest is an Investment-linked Plan (ILP) which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance and returns of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s). A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from Etiqa or via https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Etiqa or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is correct as of 30 October 2024.