Capital asset typically refers to anything that you own for personal or investment purposes. It includes all kinds of property; movable or immovable, tangible or intangible, fixed or circulating.

Capital assets are further classified as Financial Assets and Non-Financial Assets. Financial assets are intangible and represent the monetary value of a physical item.

Stocks (Shares) and mutual funds are the best examples of Financial Assets.

The profit (if any) that you make on your mutual fund investments when you redeem or sell the MF units is referred to as Capital Gains. It can be a Short Term Capital Gain (STCG) or a Long Term Capital Gain (LTCG) depending upon the ‘Period of Holding’. The tax that is applicable on these profits is known as ‘Capital Gains Tax’.

In this post let us understand: What are the factors that determine the tax status of mutual funds? What are the tax implications on mutual fund investments? What are the Budget 2018-19 proposals related to Mutual Funds Taxation? – Mutual funds taxation & capital gains tax rates on mutual funds for Financial year 2018-2019 (Assessment year 2019-2020).

Factors determining the tax status of mutual funds

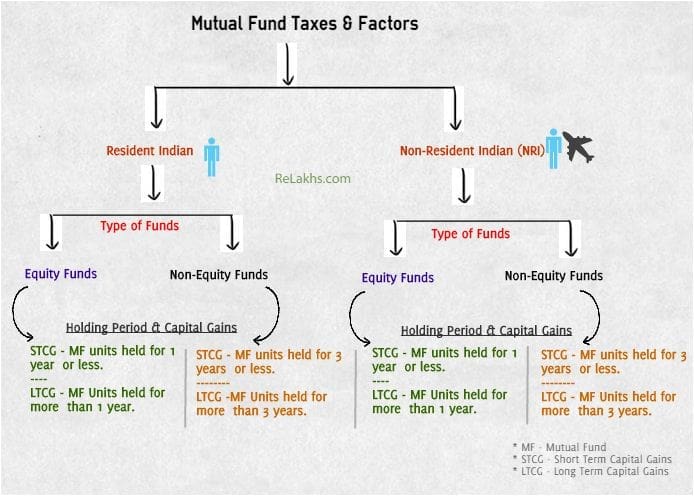

The capital gains tax on mutual fund withdrawals is based on the factors as below;

- Residential Status

- Fund Type (whether the fund is an Equity-oriented fund (or) a Non-Equity Oriented Fund)

- Holding Period (Duration of your investment)

1. Residential Status & Mutual Funds Taxation

The capital gains tax rates are determined based on the residential status of an individual / investor. Residential status can be either ‘Resident Indian’ or ‘Non-Resident India” (NRI). (Related article : ‘Residential Status online calculator.’)

2. Type of Funds & Mutual Funds Taxation

What are Equity-oriented Mutual Funds? – MF schemes that invest at least 65% of its fund corpus into equity and equity related instruments are known as equity mutual funds. Examples are : Large cap, ELSS tax saving funds, Mid-cap, Balanced funds (equity oriented), Sector funds etc.,

What are Non-Equity Mutual Funds? – MF schemes that hold less than 65% of their portfolio in equities and equity related instruments are known as Non-Equity Funds / Debt funds. Examples are : Liquid Mutual funds, Money Market funds, Gold funds, Infrastructure debt funds, MIPs, FMPs, Hybrid funds (Debt oriented) etc.,

3. Period of Holding & Capital Gains on Mutual Funds

Capital gains on Mutual funds could be either long term capital gains or short term capital gains, depending on your investment horizon.

- Long Term Capital Gains

- If you make a gain / profit on your investment in a Equity Mutual Fund scheme that you have held for over 1 year, it will be classified as Long Term Capital Gain.

- If you make a gain / profit on your investment in a Non-Equity Mutual Fund scheme (or in a Debt Fund) that you have held for over 3 years, it will be classified as Long Term Capital Gain.

- Short Term Capital Gains

- If your holding in a Equity mutual fund scheme is less than 1 year i.e. if you withdraw your mutual fund units before 1 year, after making a profit, then the profit will be considered as Short Term Capital Gain.

- If you make a gain / profit on your Debt fund (or other than equity oriented schemes) that you have held for less than 36 months (3 years), it will be treated as Short Term Capital Gain.

Budget 2018-19 & Mutual Fund Taxation

Mutual Funds Capital Gains Taxation Rules FY 2018-19 | Latest Mutual Funds Capital Gains Tax Rates AY 2019-20

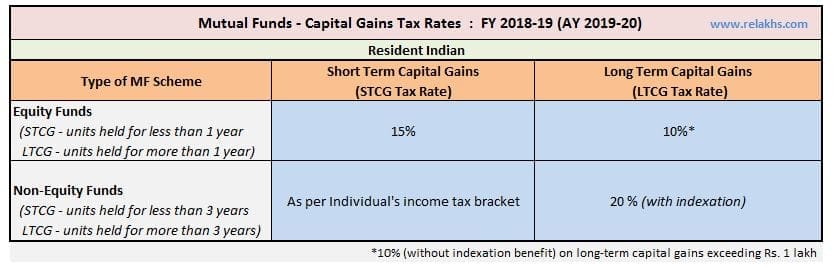

Capital Gains Tax Rates on Mutual Fund Investments of a Resident Indian are as below;

- The STCG (Short Term Capital Gains) tax rate on equity funds is 15%.

- The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate.

- The LTCG (Long Term Capital Gains) tax rate on equity funds is 10% on LTCG exceeding Rs 1 Lakh.

- The LTCG tax rate on non-equity funds is 20% (with Indexation benefit)

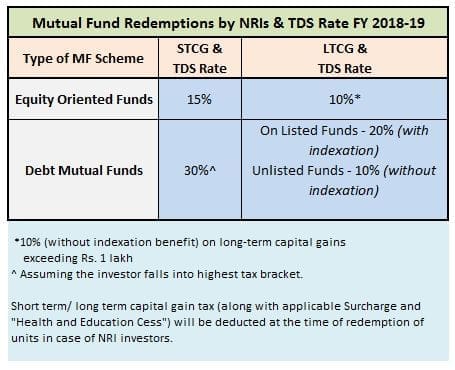

Capital Gains Tax Rates on NRI Mutual Fund Investments for the Financial Year 2018-19 (Assessment Year 2019-20) are as below;

- The STCG tax rate on equity funds is 15%.

- In case the short-term capital gains were on account of listed equity shares which were sold on a stock exchange or equity-oriented mutual fund, then the provisions for tax calculations as per section 111A of the Income Tax Act provide that 15% tax is payable by non-residents on a flat basis without getting any benefit of the initial exemption limit of Rs 2,50,000. Unfortunately, the basic exemption limit is available only for resident individuals and HUFs, and not for any other entities. If the short-term capital gains is not on account of either of the two types of sale mentioned above, then the benefit of initial exemption will be available even to non residents.

- The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate. (Tax Deducted at Source – TDS @ 30% is applicable)

- The LTCG tax rate on equity funds is 10%, on LTCG exceeding Rs 1 Lakh.

- The LTCG tax rate on non-equity funds is 20% (with Indexation) on listed mutual fund units and 10% on unlisted funds.

Base Year & Indexation : As per Budget (2017-18), the base year for calculation of Indexation has been changed to 2001. It has an affect (mostly positive) on investments where indexation benefit is available when calculating Capital gain taxes.

- For example: Suppose you are holding on to your investments made in debt funds (or) Property before 2001, the Fair Market Value (NAV) as on 1 st April, 2001 will be considered as cost of acquisition for calculating capital gains. This will help the investor to reduce the capital gains taxes.

- As of now, the base year is 1981. To calculate the capital gains at the time of selling any Deb fund units / property purchased before 1981, its purchase price is now calculated on the basis of the fair market value of 1981. Calculation at the fair market value of 2001 will increase the cost of acquisition and lower the capital gain.

(How do you calculate the indexed cost of purchase? The indexed cost is calculated with the help of above table of cost inflation index.

Divide the cost at which you purchased the Mutual Fund units by the index as on the date of the purchase. Multiply this by the index as on the date of sale.

For Example : If purchase year is 2011 and year of sale is in Financial Year 2015. Then indexed cost of purchase would be –

Indexed cost of purchase = (Purchase price / 184) * 254.)

Taxation of Mutual Fund Dividends

- Dividends on Equity Mutual Funds : The dividend received in the hands of an unit holder for an equity mutual fund is completely tax free. However, w.e.f. FY 2018-19, the fund houses have to pay 10% Dividend Distribution Tax (DDT) on equity oriented mutual fund schemes. (Effective DDT rate is 11.648% inclusive of 12% surcharge & 4% cess.)

- Dividends on Debt Funds : The dividend income received by a debt fund unit holder is also tax free. But, the mutual fund company has to pay a dividend distribution tax (DDT) before distributing this dividend income to its Unit-holders. DDT on Debt Mutual Funds is 29.12% (inclusive of surcharge & cess).

NRI Mutual Fund Investments & TDS Rate

Below are the TDS rate applicable on MF redemptions by NRIs for AY 2019-20.

Hope this post is informative. Do you check your capital gains statement(s) every year? Do you include your capital gains taxes (if any) in Income Tax Returns (ITR). Share your comments.

Continue reading :

(Assumption – STT (Securities Transaction Tax) is payable) (Featured Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (Post published on 01-March-2018)