FundAlarm (1996-2011), for which I penned a monthly column, was the site that gave rise to MFO. I was drawn to Fund Alarm long ago by the voice of its founder, Roy Weitz. During the lunatic optimism and opportunism of the 1990s (who now remembers Alberto Vilar, the NetNet and Nothing-but-Net funds, or mutual funds that clocked 200-300% annual returns?), Mr. Weitz and Morningstar’s John Rekenthaler spent a lot of time kicking over piles of trash – often piles that had attracted hundreds of millions of dollars from worshipful innocents. John had better statistical analyses, and Roy had better snarky graphics.

At the end of 2000, John shifted his attention from columnizing to Directing Research. He returned to writing a daily column in 2013, which he billed as an attempt to leverage his quarter century in the industry to “put today’s investment stories into perspective.” Rather than something mildly anodyne, John offered up “Die, Horse, Die!”

Roy and John represented, for me, two ideals: very smart people who cared deeply enough to be angry, annoyed, occasionally outraged, and vigilant on your behalf while being clear-eyed enough to know that each of us was the co-author of our own misfortunes. As investors, we want wizards to solve our problems. As an industry, they were willing to manufacture wizards for us.

“[I]nnovation in bond funds is a bad thing. Bond funds are best served simple …”

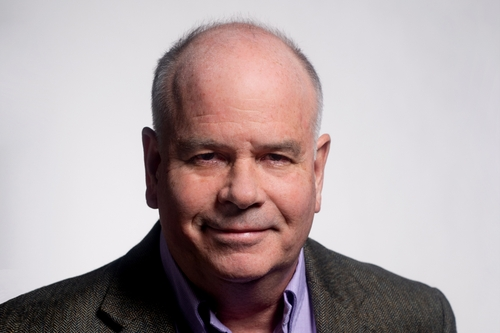

John Rekenthaler joined Morningstar in 1988, almost by happenstance. He was studying Shakespeare in grad school at Chicago, burned out after a year, and reconnected with Don Phillips who had also completed an M.A. in literature there before launching Morningstar. John joined as the firm’s first analyst. He announced his retirement from it on November 12, 2024, in a column entitled “Farewell (for Now).”

In 1988, the fund industry felt beholden to no one, and information about funds was limited to whatever the marketing department chose to share, however they chose to share it. His impact was immediate and foundational. Together with Don Phillips, he co-created the Morningstar Style Box in 1992, a tool that fundamentally changed how investors understand and classify mutual funds. As Morningstar’s Director of Research and later Vice President of Research, he helped develop the category classification system that became an industry standard. These weren’t merely technical innovations – they were revolutionary steps toward democratizing investment knowledge. They created a multibillion-dollar firm that initially held a multi-trillion-dollar industry to account, and more recently created the spectacularly challenging role of both watchman of the industry and active member of it. The firm now oversees more than $300 billion in assets.

“I used to be more gullible. Wisdom in this business means becoming less trusting.”

But perhaps Rekenthaler’s greatest contribution has been his voice. If Christine Benz is right (“To read John is to know him”), I know him well because I’ve read his work and admired his edge. Rekenthaler’s legacy extends beyond specific innovations or insights. He preaches what William Bernstein calls Rekenthaler’s Rule: “If the bozos know about it, it doesn’t work anymore.” (I suspect we’re the “bozos” in question.) His colleagues seem to distill his writing into the adage, “don’t try to get cute and don’t buy their crap. Create a portfolio no more complex than necessary, executed as economically as possible, then get on with life.”

Mr. Rekenthaler helped create a world where independent thinking in investment analysis isn’t just possible – it’s expected. As John Tipton reflects, he embodied Morningstar’s core values of “clarity, honesty, and advocacy on behalf of investors.” In doing so, he didn’t just serve investors; he showed them how to think better about investing.

David Harrell, Morningstar’s Editorial Director, recalls a memorable exchange with John:

“When John hired me as a young, inexperienced fund analyst over 30 years ago, I said something about passing the difficult writing test. He said, ‘Oh, you didn’t, but you failed less badly than others.’”

Bottom Line

It’s easy to be a skeptic about what others believe. It’s far more daunting, and far more useful, to be a skeptic about what you yourself believe. Curiosity helps. A willingness to learn hard things helps. Teaching it helps. Being immersed in it helps. Standing outside the game – not seeing every situation as one where you win or lose – helps. And a quiet self-confidence, having the inner peace to know what you are more than the sum of your errors, helps.

Thank you, good sir, for teaching us.

– – – – –

“When I began at Morningstar, outside of Fidelity Magellan, which legitimately was popular because it had a fantastic track record and history of success, the largest mutual funds were funds called government-plus bond funds. Government-plus bond funds don’t exist any longer, which tells you how good they were”

“I believe future returns will indeed fail to match those of the past. But I make that statement guardedly. Just as there were more things on heaven and earth that were dreamt of in my predecessors’ philosophies, Horatio, the stock market’s possibilities also exceed my imagination.”