Avanti Feeds Ltd – Aiding sustainability & reliability to aquaculture

Incorporated in 1993 and headquartered in Hyderabad, Avanti Feeds Ltd. offers comprehensive shrimp farming solutions and renewable energy through wind power. The company operates 6 shrimp feed units, 1 hatchery, and a 3.2 MW wind plant. As of FY24, it boasts a shrimp feed capacity of 7,75,000 metric tonnes, shrimp processing/export capacity of 29,000 metric tonnes, and a hatchery producing 600 million post-larvae annually. Avanti Feeds also maintains a strong partnership with Thai Union, a global seafood leader.

Products and Services

Avanti Feeds Ltd. operates through four key divisions:

- Feeds: Offers a range of shrimp feed brands like Manamei, Profeed 3M, Prostar, Titan, and High Boost.

- Hatchery: Provides premium shrimp seeds and inputs, complemented by disease monitoring and biosecurity services.

- Processing: Produces raw & cooked (head-on, headless, peeled & deveined) and value-added shrimp products (marinated, breaded, skewers, and shrimp rings).

- Windmills: Operates 4 windmills with a 3.2 MW capacity, generating 43.34 lakh units of power in FY24, sold under a PPA to Karnataka Power Transmission Corporation Ltd.

Subsidiaries: As of FY24, the company has 3 subsidiaries and one associate company.

Growth Strategies

- Partnership with Thai Union: Collaboration enhances R&D, advanced seed formulation, disease management, and global market expertise.

- Entry into Pet Care: Avanti has partnered with Thailand’s Bluefalo to launch pet food trading in India by March 2025, with plans for a manufacturing facility on a 30-acre site.

- Fish Feed Expansion: The company is testing imported fish feeds from Thai Union Feedmill across six farms to explore the Indian market.

- Capacity Expansion: Shrimp feed capacity increased to 775,000 MT in FY24, with a new 7,000 MT shrimp processing plant in Krishnapuram to boost exports by FY25.

- Global Reach: Avanti caters to major global markets, including the USA, Europe, and Japan, holding a ~50% market share in India’s shrimp feed segment.

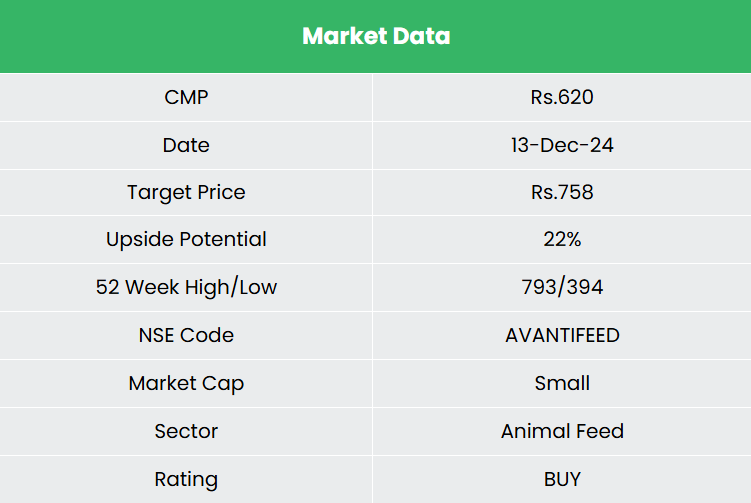

Q2FY25

- Revenue Growth: Revenue increased by 6% YoY to ₹1,355 crore, compared to ₹1,279 crore in Q2FY24.

- EBITDA Growth: EBITDA rose by 39% YoY to ₹178 crore, up from ₹128 crore in Q2FY24.

- Net Profit Surge: Net profit grew 47% YoY to ₹122 crore, compared to ₹83 crore in Q2FY24.

- Improved Margins: EBITDA margin improved from 10% to 13%, and net profit margin rose from 6% to 9%, driven by lower raw material costs, particularly fish meal and soybean.

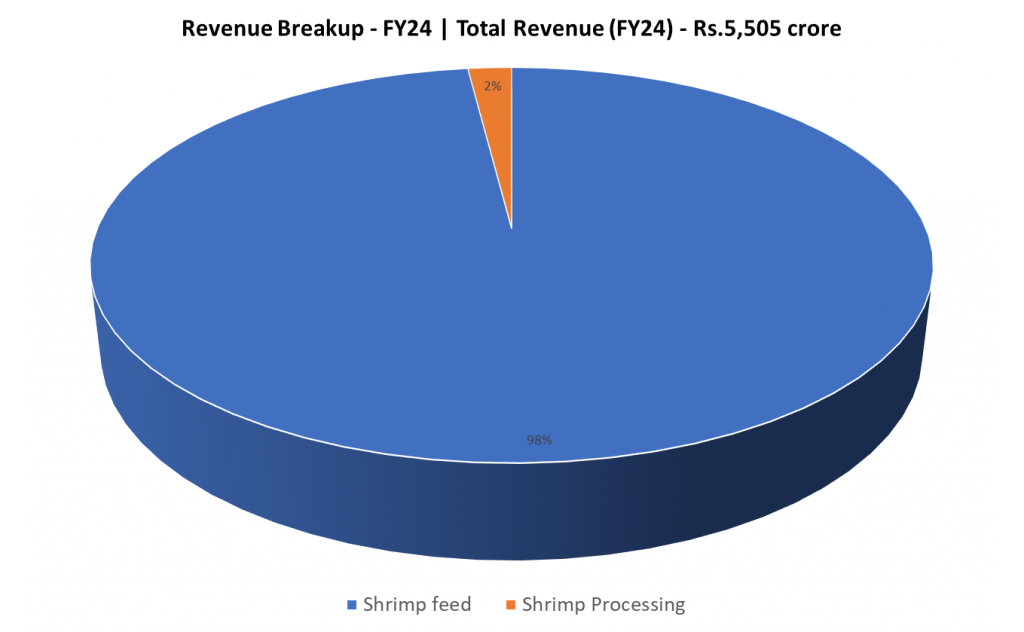

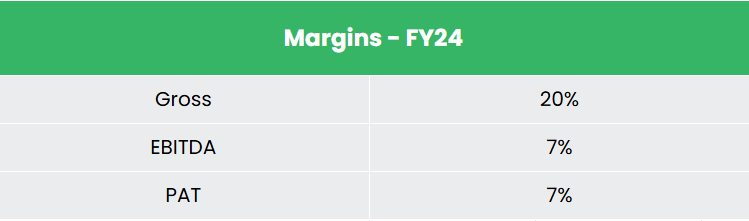

FY24

- Revenue Growth: Revenue increased by 6% YoY to ₹5,505 crore, compared to FY23.

- Operating Profit Surge: Operating profit rose by 26% YoY to ₹595 crore.

- Net Profit Growth: Net profit jumped 26% YoY to ₹393 crore.

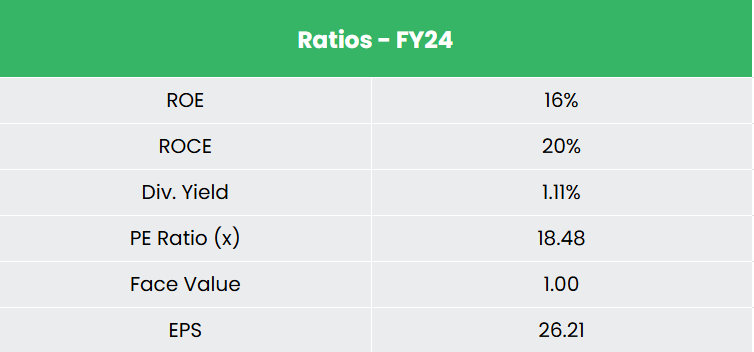

Financial Performance (FY21-24)

- 3-Year CAGR (FY21-24): Revenue grew at 9%, while PAT grew at 1%.

- TTM Growth: Sales increased by 7%, and profit surged by 23%.

- Profitability Metrics: Average 3-year ROE and ROCE stood at 14% and 18%, respectively.

- Strong Capital Structure: The company maintains a healthy debt-to-equity ratio of 0.01.

Industry outlook

- Dynamic Growth: India’s food processing sector is evolving rapidly, playing a vital role in the economy.

- Rising Aqua Demand: Increasing domestic demand for value-added aqua products, driven by awareness of their nutritional benefits.

- Government Support: Financial incentives and initiatives for aquaculture, especially fisheries, aim to boost farmer incomes and public health.

- Export Leadership: Frozen shrimp leads Indian seafood exports, with the USA and China as top importers.

- Future Drivers: Growth is fueled by health-conscious consumers, rising seafood consumption, demand for fish oil, urbanization, and global population growth.

Growth Drivers

- PLI Scheme: A ₹10,900 crore Production-Linked Incentive scheme aims to enhance domestic manufacturing, promote exports, and generate employment in the food processing sector.

- FDI Inflows: The sector attracted $12,587.53 million in FDI equity inflows from April 2000 to March 2024, representing 1.85% of India’s total FDI.

- PMMSY Expansion: The FY24-25 budget focuses on scaling up the “Pradhan Mantri Matsya Sampada Yojana” to:

Boost aquaculture productivity from 3 to 5 Ton/Hectare.

Double exports to ₹1 lakh crore.

Create 55 lakh jobs.

Establish 5 integrated aqua parks.

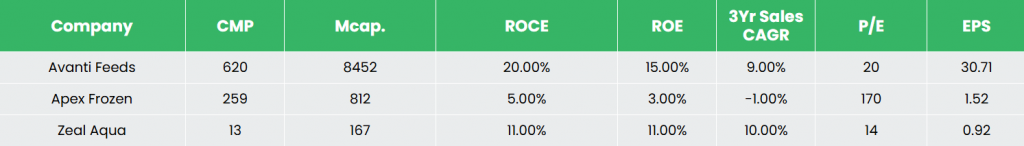

Competitive Advantage

Avanti Feeds stands out among its peers, such as Apex Frozen Foods Ltd. and Zeal Aqua Ltd., as the most undervalued stock. The company delivers healthy returns on capital employed and demonstrates stable sales growth. Notably, Avanti Feeds operates at a scale unmatched by any listed competitors in terms of market cap or operational capacity, making it a leader in its segment.

Outlook

- Strong Market Position: Avanti Feeds has secured a robust market position through excellent operational performance and execution.

- Farmer-Centric Initiatives: The company’s focus on farmer support has further solidified its market penetration.

- Value-Added Product Growth: Avanti is focusing on increasing the processing and export of value-added products in FY25.

- Export Expansion: Exports of value-added products grew by 142% in FY24 compared to the previous year.

- Global Market Exploration: While strengthening exports to the US and Canada, the company is exploring new markets like Japan and Korea.

Valuation

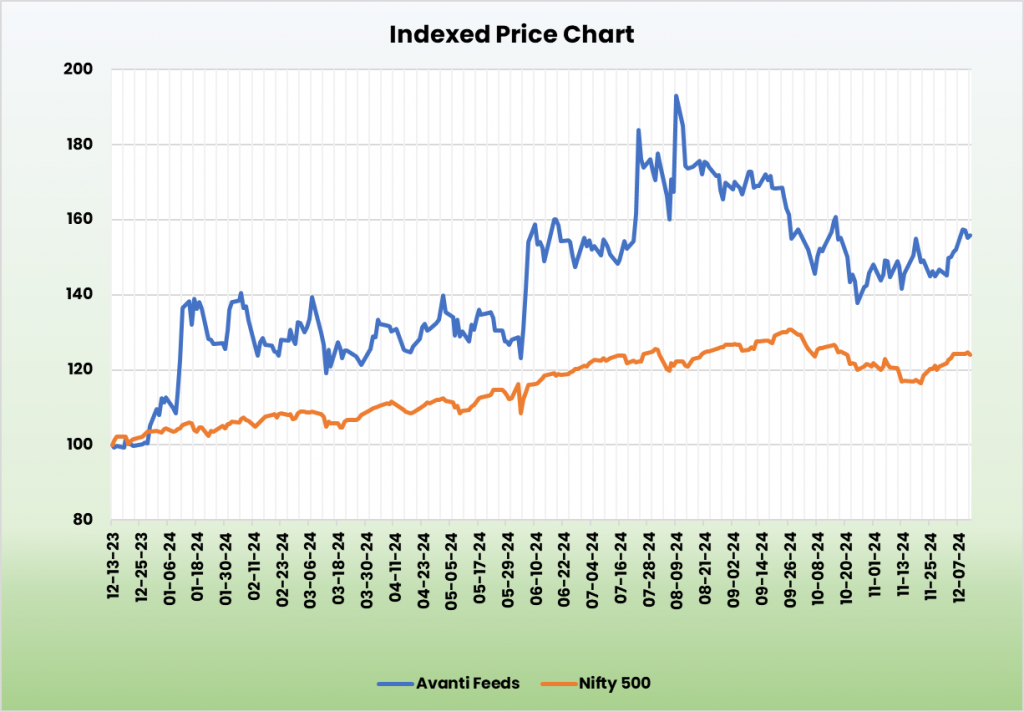

Avanti Feeds is well-positioned to maintain its growth momentum due to the increasing demand for shrimp in domestic and international markets, the government’s favorable outlook on the sector, and the company’s proactive strategies to capture market share. Based on these factors, we recommend a BUY rating for the stock with a target price (TP) of ₹758, which reflects a 28x multiple of FY26E EPS.

Risks

- Climate-Related Risk: The shrimp production industry is highly dependent on favorable climatic conditions. Events such as floods, cyclones, changing water temperatures, ocean acidification, and rising sea levels can disrupt production.

- Market Volatility: Fluctuations in foreign exchange rates and increasing raw material prices may impact margins and profitability.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

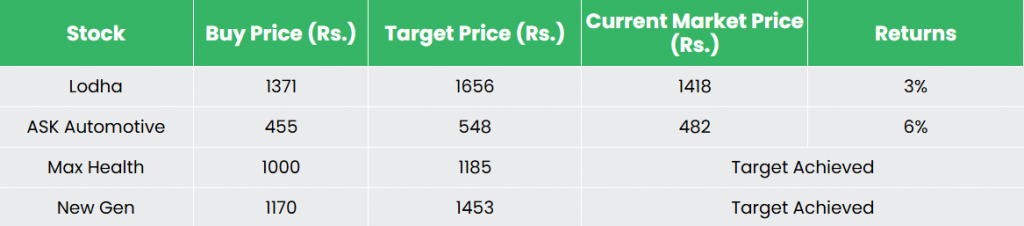

Recap of our previous recommendations (As on 13 December 2024)

Newgen Software Technologies Ltd

Other articles you may like