In this era of high-yield savings accounts offered by banks, did you know that our SRS funds yield only 0.05% p.a.? If you want to protect your SRS funds from losing purchasing power due to inflation, consider investing in ETFs, which can potentially offer higher returns.

Disclosure: This post is brought to you in collaboration with Nikko Asset Management. All research and opinions are that of my own, and should not be taken as financial advice for your specific situation(s) as I know nothing about your individual financial circumstances, risk tolerance or investment objectives. I highly recommend that you use this as a starting point to understand more about the various ETFs offered by NikkoAM which you can use for SRS investing, and then click into the respective links above to retrieve the fund prospectus and performance so as to help you decide whether it fits into your investment objectives.

With the year coming to an end, some folks are topping up their Supplementary Retirement Scheme (SRS) accounts to reduce their tax bill when It is time to file tax returns in the new year.

If you’re trying to do the same, remember to complete your funds transfer within this month – by 31 December of each year – in order to qualify for the tax relief on your tax bill served to you in April.

But what happens after you top up your SRS?

If you’re guilty of leaving the funds idle in your account, that’s a big missed opportunity because over time, inflation alone would negate any tax benefits you get from contributing to your SRS account. Your money not only loses its purchasing power each year, but you’re also missing out on the chance to have grown the money for higher returns that may earn you more than just 0.05% per annum. However, you will need to be aware of and manage the investment risks of being exposed to the financial markets when you put your SRS monies to work, vs leaving it in your bank account to earn 0.05% pa interest.

Even though most banks have raised their interest rates over the last few years, this does not apply to your SRS account. Go ahead and check – you’re still only earning 50 cents for every $1,000 saved. If you had maximized your SRS contributions to reduce your income tax, that’s only $7.65 on every $15,300!

If you asked me, I think it is silly to just contribute to your SRS account; you will need to invest your funds as well.

What do people invest their SRS funds in?

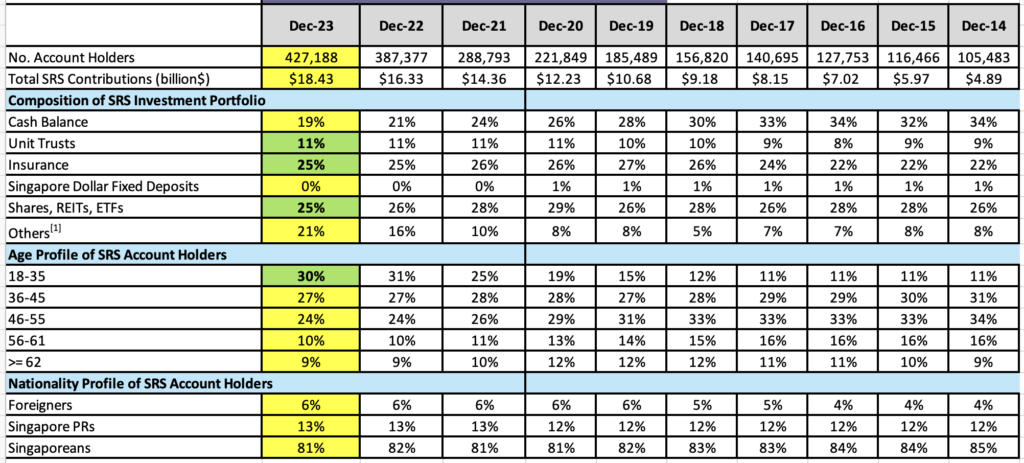

To get an idea of what most people invest their SRS money in, you can refer to these statistics released by the Ministry of Finance here, which shows that the most popular tools used are:

- insurance (25%)

- stocks, real estate investment trusts (REITs) or exchange traded funds (ETFs) (25%)

- Singapore Government Bonds, Corporate Bonds, Foreign Currency Fixed Deposits and Fund Management (Others) (21%)

- unit trusts (11%)

[1] “Others” comprise of Singapore Government Bonds, Corporate Bonds, Foreign Currency Fixed Deposits and Fund Management

Single Premium Insurance Policies

Buying a single premium insurance plan has typically been a very popular option among SRS account holders. These are usually your endowment or annuity plans, which are sold by insurance agents and are designed to provide a lump sum payout at maturity or a steady stream of income in the future, starting from a date* of your choice. Its attractiveness lies in the fact that a portion of investment returns is usually guaranteed, which explains why such insurance plans have traditionally been well-received among those who are more conservative.

*Sidenote: you might want to set a date after you turn 62 years old, or later. This is so you won’t incur the 5% early withdrawal penalty and be subjected to only 50% of the withdrawn amount being taxable.

Stocks, REITs or ETFs?

If you’re looking for investments with lower fees, then buying individual stocks, REITs or ETFs directly from an exchange might be more of your cup of tea as compared to non-listed products.

And if you prefer not to manage individual counters, then investing through ETFs can provide a cost-effective approach that also takes less time to analyse and monitor. A single ETF can help you achieve diversification as you are exposed to different companies and industries, and diversification can often help to dilute volatilities coming from the individual stock counters. .

For example, the Nikko AM Singapore STI ETF –tracks the top 30 companies listed on the SGX-ST Mainboard ranked by full market capitalisation.– and has a low total expense ratio (TER)of 0.26% p.a (audited as of financial period ended 30 June 2024) and the ETF has a TER cap of 0.25% p.a.2.

Over the long-run, especially if you intend to invest long-term for your SRS monies before withdrawing them in your retirement years, putting this sum to work will help avoid having its value being eroded by inflation.

Bonds

1 in 5 SRS account holders have currently invested their monies in bonds, which generally come issued with fixed maturity dates, allowing you as an investor to know when you can expect to receive your principal back. What’s more, bonds are popular for their fixed income payouts (known as “coupons”) which goes back into your SRS account.

Some examples of bonds that you could invest in with your SRS funds are the Singapore Government Securities (SGS) bonds and Treasury Bills (T-Bills), which have a minimum application amount of S$1,000 and is subject to a $2 transaction fee.

If you prefer to invest in a basket of bonds rather than manage individual bond positions yourself, then other alternatives you could look at include the ABF Singapore Bond Index Fund which invests mainly in Singapore government/government-linked bonds, or the Nikko AM SGD Investment Grade Corporate Bond ETF which tracks the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index, which is made up of investment grade bonds issued mainly by established and credible Singaporean companies (such as DBS and Singtel)* and Singaporean statutory boards.

*as of 31 October 2024

Check out this article: Are Bond ETFs worth investing in?

Unit Trusts

As you can see from the table, unit trusts are another option that SRS investors go for. A quick search on FSMOne’s Funds & ETF Selector with “SRS” selected as the payment method will show up its entire universe of approximately 1,230 funds for investors to choose from.

These unit trusts are actively managed by a fund manager. As such, active management fees will apply.

What ETFs can I use my SRS funds for?

Your SRS monies can be used to purchase any ETFs listed on SGX, where there are currently over 70 types of ETFs that you can choose from. You can use a stock screener such as FSMOne’s Funds & ETF Selector to filter through and see what makes sense to you (see below screenshot).

Some of the more prominent names include the Nikko AM Singapore STI ETF, which has a 1-year return of 21.92% as of 31 Oct 2024,* or the NikkoAM-Straits Trading Asia ex Japan REIT ETF that has consistently been paying distributions 4 times a year, for the past 7 years^.

*Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Past performance is not indicative of future performance. Please refer to the Fund factsheet for the full range of returns.^Distributions are not guaranteed and are at the absolute discretion of the Manager. Any distribution is expected to result in an immediate reduction of Fund’s NAV. Distributions may be paid out of capital which will result in capital erosion and reduction in the Fund’s NAV, which will be reflected in the redemption price of the Units.

The fees you pay for such passively-managed funds are generally low. Here’s the total fund fees investors can expect to pay on the above 4 funds:

Source: Nikko AM website, November 2024

Footnotes:1 Audited as of financial period ended 30 Jun 2024. Management Fee and Trustee Fee are included in the calculation of Total Expense Ratio.

2 Audited as of financial period ended 30 Jun 2024. The Manager has reduced the cap on the total expense ratio of the Fund to 0.25% per annum of the Deposited Property with effect from 1 December 2023. Any fees and expenses that are payable by the Fund and are in excess of 0.25% per annum of the Deposited Property will be borne by the Manager and not the Fund.

3 Audited as of financial period ended 30 Jun 2024. Management Fee and Trustee Fee are included in the calculation of Total Expense Ratio.

4 Audited as of financial period ended 30 Jun 2024. The Manager intends to cap the total expense ratio at 0.55% per annum. Any fees and expenses that are payable by the Fund and are in excess of 0.55% per annum of the Deposited Property will be borne by the Manager and not the Fund.

However, note that aside from the total expense ratio, you will also incur brokerage fees each time you make a buy or sell transaction. To minimize this, some SRS investors may choose to invest only once or twice a year, but if you prefer not to try timing the markets and do dollar-cost averaging instead, then you can set up a Regular Savings Plan (RSP) to invest consistently every month, regardless of the trading price.

Sponsored Message

Did you know? Investors can now use their SRS monies to buy ETFs using the ETF RSP feature on FSMOne for you to invest regularly with zero processing fees on each purchase!

- FSMOne is running an SRS promo from 1st November 2024 till 31st Jan 2025.

- This SRS promo is available for all SRS-enabled ETFs.

- The SRS promo mechanism is as follows:

| ETF Net Investment Amount *(Normal Buy + ETF RSP Buy – Sell) **Qualifying Period from 1st November 2024 till 31st Jan 2025 | Existing SRS Investors | New SRS Investors (i.e. have not performed any SRS transaction on FSMOne platform before) |

| S$10,000 – S$19,999 | S$10 + S$5* | S$20 + S$5* |

| S$20,000 – S$49,999 | S$20 + S$5* | S$40 + S$5* |

| S$50,000 and above | S$50 + S$5* | S$100 + S$5* |

*You can earn an additional S$5 bonus when you invest at least S$10,000 in aggregate into any Nikko AM ETF through your SRS account and meeting the required Net Investment Amount.

Visit Nikko AM ETF site to find all their ETFs. There are 4 Nikko AM ETFs which you can invest using your SRS :

To read more about how to invest using SRS, visit How to invest in ETFs using SRS.

TL;DR Conclusion

Regardless of your preferred frequency, it is important to note that allowing your SRS funds to remain idle in your bank account may result in missed opportunities for potential growth. If you’ve been procrastinating, Budget Babe is telling you now: make today the last day you do so.

Note: While ETFs provide a fuss-free way to invest, you should note that all investments are not without risks. Specifically, key risks of the ETFs mentioned include market and credit risks, liquidity risks, product-specific risks including tracking error risks, risk associated with the investment strategy of the Fund or a lack of discretion by the Manager to adapt to market changes, emerging market risks (in addition for the ABF Singapore Bond Index Fund), and interest rate risk and credit risk (in addition for Nikko AM SGD Investment Grade Corporate Bond ETF). Investments in the Fund may also be exposed to other risks of an exceptional nature from time to time. Please refer to the Fund Prospectus and Product Highlights Sheet for further details.

Important Information by Nikko Asset Management Asia Limited:

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

The units of Nikko AM Singapore STI ETF are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited ("FTSE"), the London Stock Exchange Plc (the "Exchange"), The Financial Times Limited ("FT") SPH Data Services Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Parties") and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Straits Times Index ("Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. None of the Licensor Parties shall be under any obligation to advise any person of any error therein. "FTSE®", "FT-SE®" are trade marks of the Exchange and the FT and are used by FTSE under license. "STI" and "Straits Times Index" are trade marks of SPH and are used by FTSE under licence. All intellectual property rights in the ST index vest in SPH and SGP.

The units of NikkoAM-StraitsTrading Asia ex Japan REIT ETF are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited ("FTSE''), by the London Stock Exchange Group companies ("LSEG''), Euronext N.V. ("Euronext"), European Public Real Estate Association ("EPRA"), or the National Association of Real Estate Investment Trusts ("NAREIT") (together the "Licensor Parties") and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE EPRA/NAREIT Asia ex Japan Net Total Return REIT Index (the "Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. However, none of the Licensor Parties shall be liable (whether in negligence or otherwise) to any person for any error in the Index and none of the Licensor Parties shall be under any obligation to advise any person of any error therein. "FTSE®" is a trade mark of LSEG, "NAREIT®" is a trade mark of the National Association of Real Estate Investment Trusts and "EPRA®" is a trade mark of EPRA and all are used by FTSE under licence."

Neither Markit, its Affiliates or any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herewith nor as to the results to be obtained by recipients of the data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the data for any inaccuracies, errors or omissions in the Markit data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Markit has no obligation to update, modify or amend the data or to otherwise notify a recipient thereof in the event that any matter stated herein changes or subsequently becomes inaccurate. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the content, information or materials contained herein. Copyright © 2024, Markit Indices Limited.

The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index are marks of Markit Indices Lmited and have been licensed for use by Nikko Asset Management Asia Limited. The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index referenced herein is the property of Markit Indices Limited and is used under license. The Nikko AM SGD Investment Grade Corporate Bond ETF is not sponsored, endorsed, or promoted by Markit Indices Limited

Nikko Asset Management Asia Limited. Registration Number 198202562H.