It is without doubt that I declare 2024 as my most tiring year of work till date, but also one that has been financially rewarding as we reaped the fruits of our efforts this year.

The result? I’ve officially crossed the $1 million mark (the value of my HDB flat is not included in the equation).

Looking back, getting to $1M was possible only because I continuously (i) grew my income, (ii) kept expenses low and (iii) kept investing in stocks and cryptocurrencies over the past 10 years.

2024 saw the stock markets and cryptocurrencies explode to new all-time high, and my investment portfolio has been a beneficiary of that phenomenon. At the same time, this year was the year where my salaried income doubled and my side hustles took off exponentially.

If not for these, I probably wouldn’t have been able to cross a million dollars this year, but it still blows me away that this happened in 2024.

So as the year comes to an end, this is my annual review of my finances to check where we are now when it comes to our financial goals and progress. During this yearly review, I typically examine my income growth, expenses, savings, insurance coverage, and investment performance – which helps me to better strategize for the new year ahead.

Time flies, and this marks the 11th year that I’m doing this on the blog! Before I go into this year’s review, here’s a quick recap of my previous years:

- 2014: Saved $20,000

- 2015: Saved $30,000 and grew income

- 2016: Saved $40,000 and grew income, hit $100k in net worth at age 26 including CPF

- 2017: Saved $45,000 and doubled my net worth in a year

- 2018: Saved $50,000

- 2019: Saved $35,000 (didn’t realise I completely missed out on a round-up post, but here’s our child-related expenses instead)

- 2020: Saved $30,000 and achieved crazy (abnormal) investment returns

- 2021: Saved $40,000, grew income but saw reduced investment returns

- 2022: Saved $45,000 and battled a bearish investment climate

- 2023: Saved $60,000 and investments turned the corner

Savings & Income

This year’s savings hit an all-time high, largely fuelled by the growth in my income. As an employee, I 2X my paycheck by putting in double the time at work. On weekday evenings and weekends, I worked on my side hustles which then did another 3X this year.

Here’s my cumulative savings total since I started tracking on this blog:

| 2014 | $20,000 |

| 2015 | $30,000 |

| 2016 | $40,000 |

| 2017 | $45,000 |

| 2018 | $50,000 |

| 2019 | $35,000 |

| 2020 | $30,000 |

| 2021 | $40,000 |

| 2022 | $45,000 |

| 2023 | $60,000 |

| 2024 | $200,000 |

I mentioned here last year that I got promoted and was involved in building up a new line of business for the company, which was the reason that my bosses offered to double my salary last year. As a result, that kept me busy throughout this year, but thanks to working with the best colleagues and team at work, we pulled it off! The business foundation has now been laid and our CEO recently gave me a shoutout during our year-end company meeting – with a dedicated slide to our line of business (one which didn’t exist a year ago). I was also nominated as one of the company’s 6 “rockstars” (an award for those who embody all 6 values of the company), so the huge sense of accomplishment is indescribable.

Being able to do impactful work and get recognised for it? Awesome.

My side hustles also took off this year, as my Youtube channel finally qualified for monetisation. Word-of-mouth referrals meant that my e-commerce business continued to see new customers, recommended by their friends and family members who had benefited from my shop’s offerings.

While I slogged for active income, my passive income also grew significantly this year as the stocks I owned continued to raise their dividends, including DBS and Keppel, among others. It was truly a bumper year of dividends for me as an investor!

I also mentioned last year that I was trying to build a new source of income for 2024 (coaching and speaking), and I’m proud to say that it was an incredible success. So much so that I was invited to share about it onstage at the recent Nas Summit Asia in Singapore, where I was seated next to the IMDA team (Infocomm Media Development Authority) and had the privilege of meeting other global content creators with millions of followers, including Jordan Matter and his children, Salish and Husdon.

It is worth noting that a lot of 2024’s work accomplishments were not an overnight success; rather, it was my track record, results and reputation over 10 years of content creation that compounded and bore fruit these few years. For that, I’m incredibly thankful – especially to all my readers and the brands who have supported me throughout this journey.

I’m looking to build another new source of income for 2025, in the form of royalties. That’s because my childhood dream to become a published author is about to happen; an international publisher approached me to write a book and of course I said yes! Although that led to many sleepless nights as I worked on the manuscript, I’m sure it’ll pay off in 2025 when the book makes it to print, and I’m excited to see where that will take me.

To sum up, my record income growth this year was fuelled by the following:

- Salaried income (corporate)

- E-commerce business

- Speaking and coaching business

- Content creation (across various platforms as Budget Babe)

- Passive income through stock dividends

However, I’ll have to caveat that this growth in income came at a cost. My health has suffered; I’ve mostly been surviving on 4-5 hours of sleep daily for this year, and it got to the point where I experienced 3 bouts of debilitating migraine attacks which left me unable to work for several days each time. My immune system became so weak that I contracted COVID-19 twice, even though none of my family members had it (and didn’t catch it from me afterwards either)!

As a result, my focus for 2025 would be to build back my HEALTH. I intend to commit to regular workouts and visit the gym more often – a habit that I developed in 2022 – 2023 but fell off track this year on.

Health is wealth, and I’m gonna get that back next year instead of just focusing on one side of the equation like I did this year.

Expenses

This marks the last year we’ll be paying high childcare fees, as my eldest child will be entering Primary 1 next year so our expenses should go down as a result.

Our current monthly household spending this year remained fairly similar to what we spent in 2023:

| Nate: childcare & enrichment | $1,200 |

| Finn: childcare & enrichment | $1,000 |

| Helper salary and levy | $1,000 |

| Mortgage & home insurance | $1,300 |

| Town council, carpark and utilities | $650 |

| Dining & groceries | $1,500 |

| Family insurance policies | $1,200 |

This excludes our individual dining expenses, the allowances that we give to our parents (a 5-figure sum each year) and other miscellaneous expenses that aren’t recurring in nature, so the actual sum is a lot higher.

Our household’s biggest expense this year was on travelling. My husband and I went on a 2-week trip in the US in February/March, where I got to visit my alma matter and best friend who lives abroad. Shortly after in April, I was sent to New York on a short 3-day trip to represent Singapore finfluencers at the NASDAQ headquarters, which was truly a moment to remember! In addition, my husband and I had to make several business trips to Malaysia and China for my e-commerce business, and the year-end holidays saw us travelling to Batam and Shanghai upon the kids’ requests. I was too busy to really track our travel spending this year, but I estimate that it would have crossed $25,000 in total (although not all would have been at our own cost since some were claimable under business expenses).

Insurance

We didn’t make any new moves in our insurance portfolio this year, since there were no new life milestones. However, one highlight was getting our portfolio reviewed by the experts at Havend, and I was pretty proud to hear that they too, agreed with the decisions I’d made for our family policies.

If you’re looking for unbiased insurance advice and would like to have licensed professionals review your portfolio, I cannot recommend the folks at Havend enough. Read about my experience here to decide if it’ll be worth your time booking a review with them!

Investments

I saved the best for the last, because this year was truly a huge breakthrough for our investment portfolio. Anyone who has stayed invested throughout the last few years and kept buying should probably see their portfolio up by at least 2 if not 3 digits too.

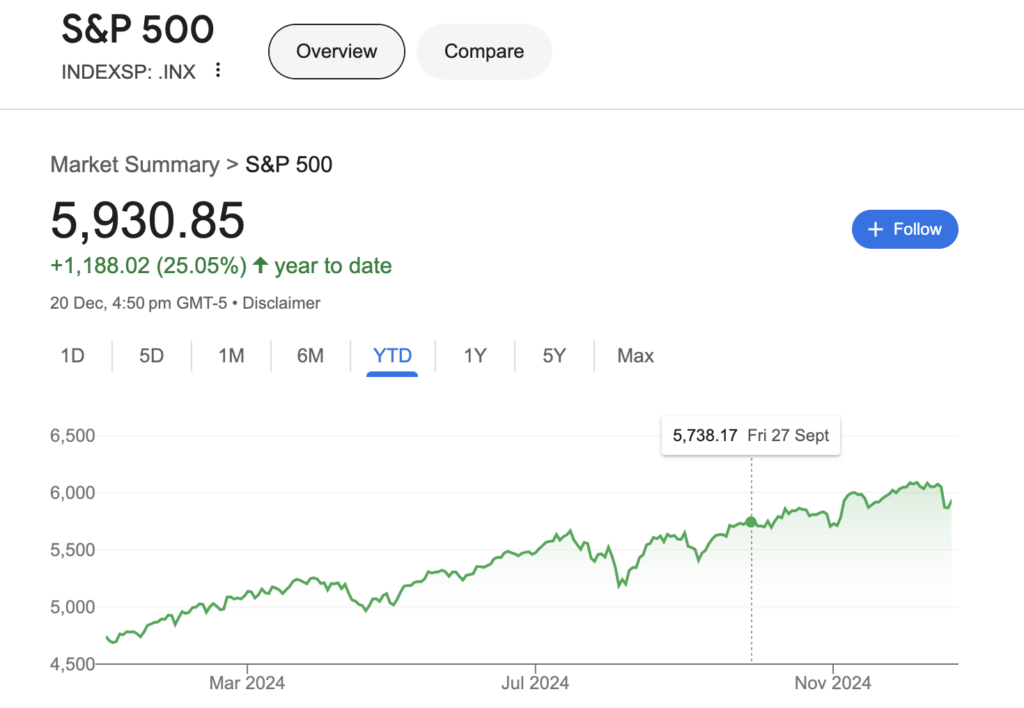

If you thought the S&P500’s +25% gain last year was crazy, guess what? The index repeated its feat again this year, coming in at another +25%. This is starting to feel a little bubbly though, so I’ve been paying closer attention to valuations because I don’t want to make the mistake of overpaying for stocks in this climate:

The bullishness of the markets were attributed to the hype and excitement over artificial intelligence, which propelled NVIDA and Broadcom to new heights. I own both stocks, so I benefited from their surge. Here’s some of the more notable gains I enjoyed this year, which has now pushed my investment portfolio to new all-time highs:

| Stock | Gains |

| Meta (bought in ’22 and ’23) | 200% |

| C*** (secret, finance) | 180% |

| M*** (secret, healthcare) | 50% |

| Tencent (bought more in Dec ’23) | 55% |

| S*** (secret, data) | 65% |

| DBS (new tranche bought in Feb ’24) | 50% |

| Keppel DC REIT (bought in Apr ’24) | 30% |

| Shopify (bought more in May ’24) | 88% |

| Zoom (bought more in June ’24) | 45% |

| Amazon | 36% |

| Disney | 25% |

All of these led to some incredible gains this year, especially liquidated ones like Great Eastern (where I made close to 50% in a few months) as my thesis that OCBC might privatise them materialised. While there were certainly some losers, the winners from my portfolio more than dwarfed these losses by several multiples. I didn’t liquidate any stocks at a loss though, as after analysing them I felt that the headwinds faced are merely temporary, so I’ll be holding them until the business recovers. I also moved aggressively to purchase several stocks during the August yen-carry trade collapse, which turned out to be a great move and these quickly recovered to be in the green right now.

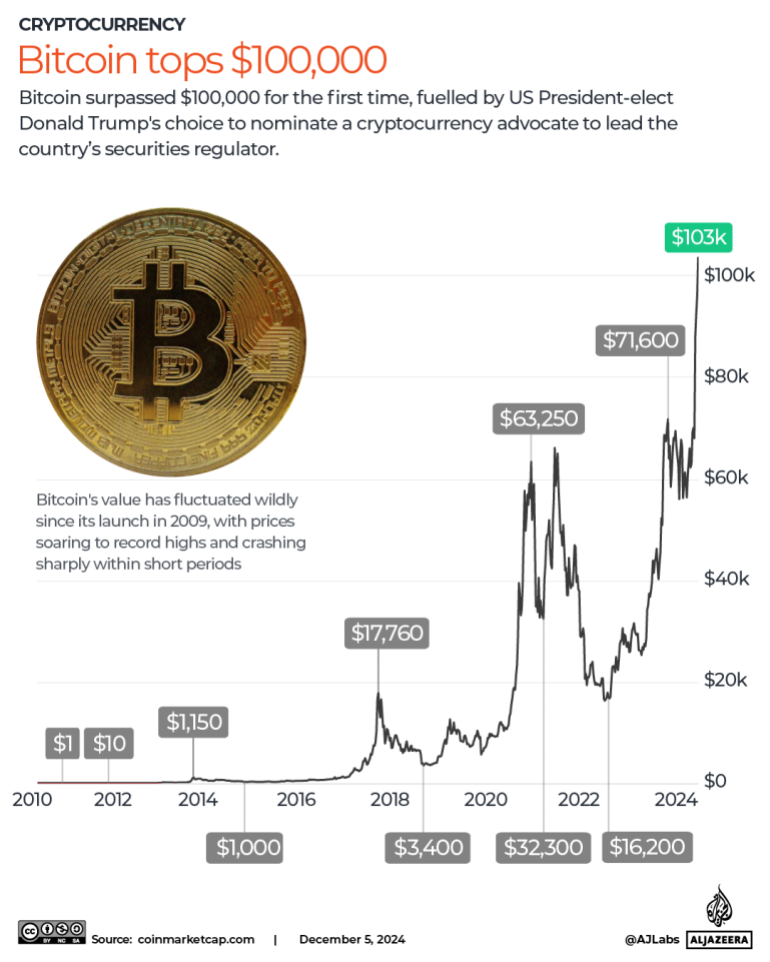

In the cryptocurrency markets, Bitcoin went on to hit new historic highs as it broke past $100,000 this year. Older readers might remember me saying this would happen in due time as I predicted that Bitcoin would eventually play a significant role in investors’ portfolios as an alternative asset, namely digital gold. That thesis played out this year as the SEC approved spot bitcoin and ethereum ETFs, and re-elected President Donald Trump announced his support for crypto as well as his intentions to build a Bitcoin strategic reserve for the country.

I started buying crypto in 2017, but received a lot of flak between 2017 – 2021 over my vocal support for cryptocurrencies then (especially as I’ve spoken numerous times about the potential of Bitcoin, Ethereum, BNB and Solana), so this year felt like a year of redemption as the skeptics were finally silenced and governments worldwide stopped calling it a scam. The best part? My crypto investments – the bulk of which were purchased between 2017 – 2022, yielded me insanely handsome returns. These are perks of staying the course and knowing fully well why you invested in it in the first place.

On the property side, I also bought a new property abroad using some of the business gains that I earned in the earlier half of the year. In Singapore, as prices are too high for our liking, we shelved our plans to invest in an industrial property this year. Instead, we plan to purchase another property in either Malaysia or China within the next 2 years, although it remains to be seen whether that will play out. The deals we saw this year haven’t been attractive enough to get us to part with our money just yet.

All in all, my investments and cash holdings have now crossed $1 million.

I never imagined that I’d become a millionaire before 35.

Building my multiple income streams

I remember when I first started writing this blog, I was still very much a salaried worker (with a take-home pay of $2,000 after CPF) who dreamed of achieving financial freedom by the age of 45.

Over the years, I’ve been extremely lucky that my content on social media resonated with so many of you, which then drew brands and sponsorships that have enabled me to create a second source of income via social media. While I spoke for free at events and conferences in the beginning, brands started paying me to speak afterwards as the power of my speeches and delivery became evident. Employers started to engage me to run financial literacy workshops for their employees, and I’ve since been able to earn in many different ways thanks to the strength of the Budget Babe brand today.

In 2021 – 2022, my weight loss journey unexpectedly led to another side hustle in the form of my e-commerce shop, which has since grown with every passing year by the power of successful customer testimonials and word-of-mouth referrals. I reluctantly gave up my tuition income to free up time for this, which, on hindsight, was a wise move as my business income grew to exceed my tuition income in less than a year!

I started podcasting work (see here) during the pandemic, and this started yielding income this year as brands started sponsoring the show and I got paid. One of my aspirations during university was to become a radio DJ, so hosting a podcast is a great way for me to achieve that dream!

In 2023 – 2024, my passive income through dividends grew as companies raised their dividend payouts (coming out from the pandemic crisis). I continued to make several investments into dividend stocks, which increased the passive income payouts I now enjoy – and I expect to invest even more in 2025 to continue building this towards my retirement years.

In 2025, I’ll have a new source of income (royalties) once my book gets published. I’ve been told that authors don’t make a lot, so you’ll have to stay tuned on this blog for my next few years of financial reviews to see how much this brings in!

The only downside of earning more is that you’ll have to pay higher income taxes as well – both in terms of my personal income taxes and corporate income taxes (a painful 17%), but that is an issue I’ll gladly accept because with higher income, everyone will have to pay higher taxes anyway! When I look back at how my taxes payable has gone up over the years, it is a reminder to me that my income has risen over the same time. What’s more, I got to make the biggest donation I’ve ever made this year (as a tax reduction move) to help improve underprivileged lives, so for that, I’m thankful.

Conclusion

Truth be told, I wasn’t expecting to cross the $1 million milestone this year, and I’ve been so busy working throughout 2024 that this didn’t even occur to me until I sat down to work on my income (and tax reduction moves) last month.

If you don’t know what to do to reduce your income tax bill for next year, read this article I wrote earlier this year here!

If you’ve been following my journey, you would have seen my hard work, sweat and tears.

This wouldn’t have been possible if not for the support of my husband and family members. I’m blessed to have really supportive in-laws, who have helped to step in and take care of the kids during the times where we were overseas. While I can never shrug off working mum guilt, I’ve consciously carved out time several times a week to be with my kids and read them their daily goodnight stories. We’ve built several precious memories this year as a family, including our visits to the Disney exhibition at MBS, Inside Out at Gardens by the Bay, Disney at OCBC My Account launch, attending friends’ birthday parties, several playdates and parent-accompanied school outings, celebrating Christmas early at illumina, and visiting the newest (and largest) Disneyland in Shanghai, among others. I hope that I’ve been a good role model for my kids as they see how hard their mother works – and never gives up – even when I encountered setbacks and challenges throughout the way.

I said this last year:

“We should continue to work hard and build through our 20s and 30s, so that we can have an easier time in our later years.”

This year was a year of reaping the fruits of our labour, and the seeds (from my investments) that were planted years ago. I’m not the only one; several of my friends who had also built diligently since the early 2010s (around the same time as I did) have also crossed the million-dollar mark this year. They don’t track or reveal their finances yearly like I do, so their wins are kept a little more hush-hush, but I can attest to the fact that most of us who continued to earn, save, invest and build through the last bull-and-bear cycles should have seen our net worth climb to new all-time highs this year.

For those of you who are still building, I hope this inspires you and shows you that it really is possible to achieve your financial goals. You don’t have to be rich or working a sales job to become a millionaire; as long as you keep at the 3 fundamental rules of money like I did, you’ll eventually get there. The stock market is truly a wondrous place when you’re in it for the long-run and invest wisely, and allocating a portion of my funds to cryptocurrencies back in 2017 proved to be a salient move.

What a crazy year of growth it has been in 2024! Don’t forget to stay tuned for my book, which will be published next year sometime in mid-2025. If you’ve stuck around these last 10 years, thank you for your support, and here’s to more to come in 2025.

I’m excited to see what next year will bring!

With love,

Budget Babe