A quick announcement before I begin today’s post – I am hosting a new online Masterclass, titled “Thinking Clearly in A Market Crisis”, on Saturday, 19th April 2025, 7 PM IST Onwards.

The underlying idea is to help you deal with the messiness of market panics and crises, so you can protect your wealth, peace of mind, and long-term goals.

I had 100 seats available for the Masterclass, and now just 50 remain. Click here to know more and join.

I am writing this series of letters on the art of investing, addressed to a young investor, with the aim to provide timeless wisdom and practical advice that helped me when I was starting out. My goal is to help young investors navigate the complexities of the financial world, avoid misinformation, and harness the power of compounding by starting early with the right principles and actions. This series is part of a joint investor education initiative between Safal Niveshak and DSP Mutual Fund.

Dear Young Investor,

I hope you are doing well, and that the lessons we have covered so far have helped you in guiding you through the early stages of your investing journey.

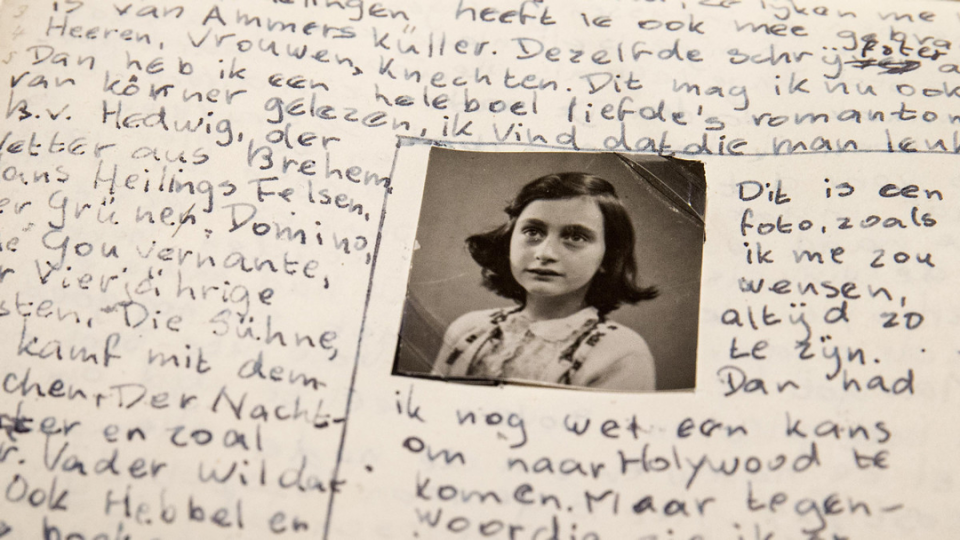

I wish to start today’s letter with a tragic yet magnificent story from World War II that has stayed with me for years. It’s the story of Anne Frank.

Frank was born in Frankfurt, Germany but moved to the Netherlands for safety in 1934, five years after she was born. The Frank family hid in their basement with four other Jews when Germany took control of the Netherlands.

Frank then began to write, at age thirteen, in a diary of her life, feelings and the outside world. She wrote in the diary every day for two years until their hiding place was found and she was forced into a concentration camp where she died with her sister due to a sickness. She was just fifteen when she died.

Although she wasn’t only a tragic girl in this war, her diary that is available to read as The Diary of a Young Girl displays the strength of her character. The diary portrays her as a brave and hopeful girl, character traits that are hard to manage in the kind of hardship that she was a part of.

One of her diary entries reads –

Human greatness does not lie in wealth or power, but in character and goodness.

Strong character is what Anne displayed through here little life. And strong character is what makes people great in their lives.

In the broader scheme of this Universe, even when I look at an unimportant field like investing, I find that investors who have done wonders for themselves are the ones who have displayed strong character at various points in their investment lifetimes.

That’s right. Character.

Markets rise and fall. Fads come and go. But the investors who endure, who compound wealth quietly over decades, are the ones who display strong character in the face of uncertainty, failure, and temptation.

Now, the thing about character is that no book or course can teach you on this, though very few of them talk about how you can gradually build it. Ben Graham’s The Intelligent Investor is one of them, which I highly recommend you read as you start your investing journey. Seth Klarman’s Margin of Safety is another. Philip Fisher’s Common Stocks Uncommon Profits is the third. And then you have Howard Marks’ memos and Warren Buffett’s letters to shareholders. Most of other stuff written on investing through the years, including this blog, is just commentary.

Anyways, if I were to draw down the lessons I have learned from these books and from watching successful investors on building a strong character required to do well in investing, here are five traits that stand out. Let me walk you through them.

1. HUMILITY, especially intellectual.

Being humble in investing isn’t about being doubtful of yourself, or believing that you are untalented, unintelligent, or unworthy. On the contrary, it is about being humble about our own intellect, to question whether what we know is actually correct and even to adjust our beliefs if we are presented with new information. In other words, it is largely to do with intellectual humility.

As Philip Tetlock wrote in Superforecasting, true humility (in investing) is about recognizing that “…reality is profoundly complex, that seeing things clearly is a constant struggle when it can be done at all, and that human judgment must, therefore, be riddled with mistakes.”

Very few investors have the nerve to say, “I don’t know.” But that’s how you build humility in your investment process. If you start with “I don’t know,” then you are unlikely to act so boldly as to get into trouble.

2. INTEGRITY, which is the quality of being honest and having strong principles.

Successful investors focus on their investment process with unwavering steadfastness and honesty, whatever the stock market is doing and however others around them are behaving.

They show how, to be a successful investor, you must have a philosophy and a process that you stick to even when the times get tough. This is very important. If you don’t have the courage of your conviction and patience and toughness, you can’t be an investor because you’ll constantly be driven to fall in line with the consensus by buying at the top and selling at the bottom.

But it’s important to know that no approach will allow you to profit from all kinds of opportunities in all environments. You must be willing not to participate in everything that goes up (like what’s happening now), and only the things that fit your process and investment approach.

3. TENACITY, which is the determination to work hard and keep faith in your investment process and the power of compounding.

Over the years I have met a multitude of investors who knew about the power of compounding, but very few who truly understood its real power because that shows up not in one, three, or five years…but ten, fifteen and twenty years. And in an age of instant gratification, since not many have the tenacity to hold on to their faith in this power and in high-quality companies to create wealth, not many investors end up successful.

American investor, hedge fund manager, and philanthropist Leon Cooperman is quoted as saying –

It doesn’t matter whether you are a lion or a gazelle; when the sun comes up you’d better be running.

Cooperman is seemingly talking about the importance of hard work here, which is a direct offshoot of tenacity. Sensible investing is hard work.

But then, Jesse Livermore, one of the greatest stock speculators of all times, is supposed to have said –

The main reason why money is lost in stock speculations is not because Wall Street is dishonest, but because so many people persist in thinking that you can make money without working for it and that the stock exchange is the place where this miracle can be performed.

Warren Buffett has said –

I learned at a very early age how important it is to work hard and be honest.

Hard work you put in identifying businesses you want to own, and then the hard work you put in just staying put, doing nothing, is what should help you succeed in your investment endeavors. There are no shortcuts to the top.

4. SELF-AWARENESS, which is the conscious knowledge of one’s own character and abilities.

George Goodman aka Adam Smith wrote in his book The Money Game –

If you don’t know who you are, [stock market] is an expensive place to find out.

Mere gathering of facts and bookish knowledge can only lead us to chaos. That chaos is what causes most people to fail in their investing lives despite all the books they read and courses they attend. While it is obviously necessary to read the wisdom and ideas contained in all those great investment books, they will only help us with the “techniques.”

But without understanding ourselves, those techniques would only lead us to frustration (maybe, an ‘intelligent’ frustration) and ultimately failure.

In studying successful investors over the years, I have come to realize that the right kind of investing education comes with the transformation of ourselves, which entirely depends on our awareness of ourselves – our behaviour, risk-taking capacities, and habits.

When we are aware of ourselves, we are in a better position to behave well. And that can help us save ourselves from self-destruction that most other investors lead them to.

5. ADAPTABILITY, which is the quality of being able to adjust to new, changing conditions.

This is the core of Charles Darwin’s theory of evolution –

It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.

Adaptability is one of the few skills that are hard to learn but pay off for the rest of your life.

Given the ever-changing world we inhabit, and given that this change is unlikely to ever slow down, what mattered very much yesterday (e.g. skill, knowledge, etc.) might not be worth a dime tomorrow. Change used to be slow and incremental: now it is rapid, radical and unpredictable.

Adaptability enables us to dwell on new circumstances and stay on top of the situation. Of course, this skill is best when combined with insight, giving us fresh perspective before the change itself. Growth depends on how adaptable you are.

Combine adaptability with agility in these changing times and you have the right ingredients of success as an investor.

Oh yes, it takes time!

You won’t build these traits overnight. In fact, you won’t even know you have them until you’re tested by a crash, a bubble, a terrible mistake, or a long period of underperformance.

But you can learn by observing. Watch how investors behave during extremes, when the market is drunk on greed or trembling with fear. That’s when character is loudest.

Most people reveal themselves in how they act when they think no one is watching, or when they believe they’re invincible.

Your job is to listen—then do better.

Investing, at its core, isn’t about beating the market. It’s about becoming the kind of person who can live through its chaos, and still stay sane.

And that, young investor, is a matter of character.

With admiration and belief in your journey,

Vishal.

Disclaimer: This article is published as part of a joint investor education initiative between Safal Niveshak and DSP Mutual Fund. All Mutual fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF & procedure to lodge/ redress any complaints, visit dspim.com/IEID. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Also Read: