Whenever you make a sale or purchase, the amount of money your business has will change. Keeping track of your business’s financial transactions is key to your business’s future. Luckily, those sales and purchases create documents such as invoices and receipts. Bookkeeping tracks your finances through the documentation that your business creates on a day-to-day basis. But, what is bookkeeping, exactly?

What is bookkeeping?

When thinking of a bookkeeping definition, it may be best to think of your business’s paper trail—all the documentation your business creates for sales, purchases, loans, and assets. Bookkeeping includes the recording and storing of financial transactions for your business.

You may be wondering what’s the difference between bookkeeping vs. accounting. While they are related, the two are very different.

Bookkeeping is the process of recording and storing the financial information of a business (e.g., purchases, receipts, sales, and payments). Bookkeeping is objective. The numbers and receipts tell a straightforward story through the accounting equation. You don’t have to be an accountant to be good at bookkeeping.

Accounting is the process of interpreting a business’s financial information for business owners and shareholders. Accounting is subjective. Accounting looks at bookkeeping to understand patterns and possibilities for moving forward.

Being an accountant requires certification, which means an accountant can be a bookkeeper, but a bookkeeper can’t automatically be considered an accountant.

How bookkeeping works

To begin bookkeeping, separate your business’s transactions into categories. This way, your finances are easier to track.

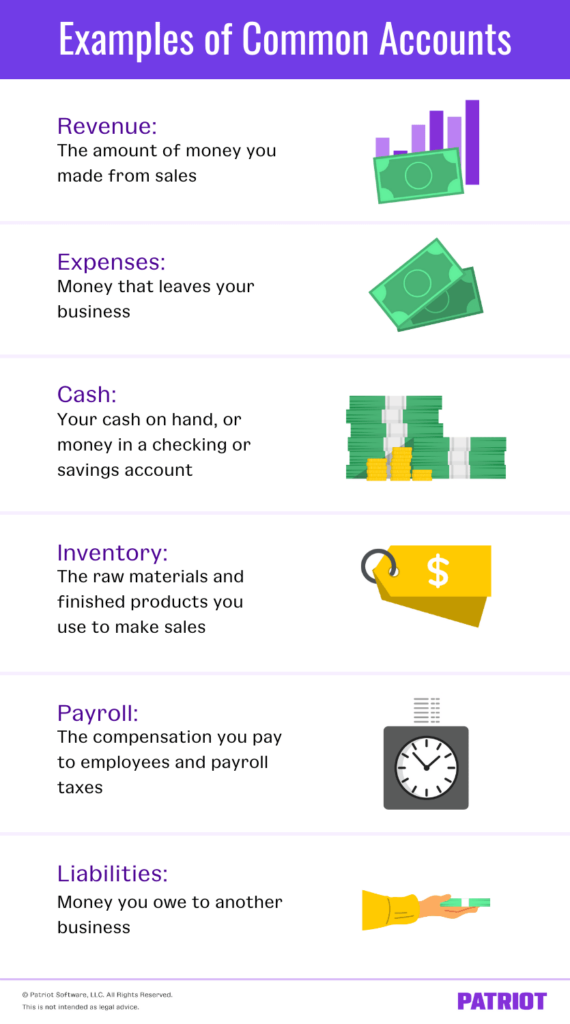

These are common accounts that you will likely use in your books:

- Revenue: The amount of money you made from sales

- Expenses: Money that leaves your business

- Cash: Your cash on hand, or money in a checking or savings account

- Inventory: The raw materials and finished products you use to make sales

- Payroll: The compensation you pay to employees and payroll taxes

- Liabilities: Money you owe to another business

You may have more accounts than those listed above. You can divide your main accounts into smaller, more specific accounts. For example, within your expense account you could have accounts for overhead, cost of goods sold (COGS), and advertising.

Record every transaction in your books under the correct account. Your books won’t be helpful if they are incorrect or missing information.

Why is bookkeeping important?

So, why is bookkeeping important? Answering this question is key to the success of your business. Dependable bookkeeping helps you organize your financial information. Think of it this way: The more knowledge you have about your finances, the easier it is for you to plan for the future.

Bookkeeping helps you:

- Organize and create your financial records

- Make intelligent decisions about the future of your business

- File your taxes on time and without a hassle

- Create a good budget

- Find investors

Bookkeeping isn’t as simple as this may make it seem. There are plenty of things you’ll need to consider, such as:

- The method of accounting that is right for your business

- If you should use single-entry bookkeeping or double-entry bookkeeping

Luckily, these questions have shared answers. Read on to find out what accounting method you should use and if single or double-entry bookkeeping is right for you.

What method of accounting should I use?

There are three methods of accounting to consider:

- Cash basis

- Modified cash basis

- Accrual basis

Cash-basis accounting is the simplest of the three methods because you only use cash accounts to track and record your transactions. In other words, cash-basis accounting only deals with the way money is moving right now, not long-term liabilities like loans or inventory.

Cash-basis accounting operates in real-time. Record inventory as you receive it and record expenses when you pay them.

Many businesses choose cash-basis accounting because it is:

- Cheap and easy to use

- Good for a small business

- Easier to maintain because of how little information is tracked

Modified cash basis mixes aspects of cash basis and accrual basis. It helps businesses that deal with both short- and long-term transactions. Long-term liabilities are recorded on the accrual basis, while short-term transactions are recorded on the cash basis.

Keep in mind that cash basis and modified cash basis do not follow the generally accepted accounting principles (GAAP).

Accrual basis is the most thorough of the three accounting methods. Because of this, it is GAAP certified and used widely. But because it is so thorough, it is also somewhat complicated to do correctly.

Accrual-basis accounting is great for tracking long-term financial liabilities because you record income when transactions take place, not when money moves from one account to the other. In other words, while cash-basis accounting records information as soon as the money changes hands, accrual-basis accounting records information as soon any documents change hands (bills, invoices, or loans).

Many businesses choose accrual-basis accounting because it helps you:

- Plan for future income and expenses

- Understand long-term profitability

- Track transactions across many different accounts

Should I use single-entry or double-entry bookkeeping?

Cash-basis bookkeeping uses single-entry accounting. Single-entry accounting records one entry for every transaction in a cash book. A cash book will contain:

- The date of a transaction

- An explanation of a transaction

- The transaction’s value

- A running total of cash on hand

Single-entry accounting and cash-basis accounting only deal with the present moment—when cash changes hands, an entry is made. If your business is small enough and your transactions simple and immediate, single-entry accounting may be best for you.

But if your business is more complicated, you may want to consider double-entry accounting.

Double-entry bookkeeping means that a single transaction affects two accounts. When a credit is made to one account, a debit is made to another account. All records are made in a general ledger. The general ledger organizes information through the use of accounts including your business’s:

- Assets: What you own (e.g., property, patents, vehicles, and inventory)

- Liabilities: The bills you need to pay

- Equity: The difference between your assets and liabilities

- Revenue: The money you earn

- Expenses: the general expense of running a business

Double-entry bookkeeping uses a two-column journal entry accounting system. On the left side of the ledger, you’ll have assets and expenses. And on the right side, revenue and equity. When things are working well, both sides will have equal balances. This aspect of double-entry bookkeeping can be really helpful if you want to see if you’ve missed an entry—if things don’t balance out, you may have an accounting error on your hands.

Double-entry bookkeeping also helps you run a trial balance. A trial balance is impossible with single-entry bookkeeping The key difference between the two is that with a double-entry bookkeeping system, the information you need for a trial balance is already available. With a single entry system, that information doesn’t exist.

This article has been updated from its original publication date of December 10, 2015.

This is not intended as legal advice; for more information, please click here.