If you’ve ever tried to boost your credit score, you know how challenging it can be. Every time you take one step forward, it seems like it’s followed by two steps back.

The process can be particularly difficult since people with low credit scores often can’t access the tools they need to improve their credit. Fortunately, that’s where Sesame Cash comes in.

While it’s technically a debit card, Sesame Cash allows you to increase your credit score and get rewards like you would with a credit card. This Sesame Cash review can help you learn how it works and whether it’s right for you.

Summary

Sesame Cash makes it easy to boost your credit score and earn rewards while spending on a debit card. It offers additional features like credit monitoring, mobile device protection, early direct deposit and more.

Pros

- Helps you build your credit

- Free to use

- Allows you to earn cash rewards

- Set your own credit utilization rate

- Comes with credit monitoring

Cons

- Requires separate bank account

- Funds not held with Credit Sesame

- Upgrade features not free

What is Sesame Cash?

Sesame Cash is a prepaid debit card and bank account that helps users boost their credit scores while earning rewards. It is offered by Credit Sesame, one of the most popular credit monitoring services.

Credit Sesame’s mission is to help people reach their financial goals and take charge of their credit. It does this by providing free products aimed at helping consumers improve their financial wellness.

The company has helped millions of consumers increase their credit scores. Sesame Cash is one of their newest products. It is designed to help consumers grow their cash and credit together.

Is Sesame Cash Legit?

Yes, Sesame Cash is legit. While Credit Sesame isn’t a bank itself, it works with Community Federal Savings Bank, which issues the debit card and reports to the major credit bureaus.

Community Federal Savings Bank is FDIC insured, so your money is protected in case the company goes bankrupt or ends up going out of business.

Not only is the bank Credit Sesame works with legitimate and insured, but Credit Sesame itself is a well-established company. It has been in business for more than a decade and is accredited by the Better Business Bureau.

How Does Sesame Cash Work?

Sesame Cash is a prepaid debit card from Credit Sesame that offers many of the features of a credit card, including the ability to boost your credit score and earn rewards when you spend money.

Here’s how it works.

1. Get a Sesame Cash Credit Builder Account

To open a Sesame Cash account, you’ll first need a Credit Sesame account. This takes less than a minute to set up, and you’ll only have to share a few pieces of information.

To set up a Credit Sesame account, you’ll need to provide:

- Your name

- An email address

- Your phone number

- The last four digits of your Social Security number

- Your address

Once your Credit Sesame account is set up, you can open your Sesame Cash account right from your dashboard. You’ll simply click the button that says “Sesame Cash” and then proceed to claim your account.

Claiming your account only requires two steps, meaning your account will be set up almost immediately.

2. Move Money Into the Account

The next step to start using your Sesame Cash account is to move money into your account. Like any other bank account and debit card, you can only spend the money that’s in your account.

There’s no minimum balance required, though the maximum balance on your Sesame Cash Card is limited to $20,000.

It’s important to note that, while it’s technically a prepaid debit card, the Sesame Cash Card works like a secured credit card. The money you prepay serves as your credit limit, just as the security deposit on a secured credit card would.

3. Set Your Utilization Limit and Start Shopping

Once you’ve transferred money into your Sesame Cash account, you can set your utilization limit and start spending on your debit card.

This process works just like spending on any other debit card. You swipe your card, and the money comes out of your account.

The main difference between a Sesame Cash Card and a traditional debit card is that when you spend on your debit card, Credit Sesame actually takes the money from your account.

Then, it sets it aside to serve as your virtual secured line of credit, which it then uses to “pay off” the credit line.

4. Build Credit History via Payments

Most debit cards won’t help you build credit because they don’t report your transactions to the credit bureaus.

But your Sesame Cash account from Credit Sesame is different because it operates like a secured line of credit, similar to a credit card.

Since it’s technically a credit line instead of a traditional debit card, Community Federal Savings Bank reports your monthly activity to the credit bureaus.

As we mentioned, when you spend on your Sesame Cash debit card, the money you’ve spent is set aside to serve as your virtual credit line, which is then used to “pay off” the card. These payments can be completed automatically or manually.

Payments appear as credit card payments so that they can be reported to the credit bureaus.

5. Watch Your Score Grow

Growing your positive payment history is one of the best ways to boost your credit score, and that’s exactly what your Sesame Cash account helps you do.

Each month, your debit card activity is reported to the credit bureaus. The more positive payment history you build up, the more your credit score will increase.

Another way you can improve your credit report with Sesame Cash is by decreasing your credit utilization.

When you sign up for your Sesame Cash account and corresponding card, you’ll be asked to make a small security deposit from your account, which serves as your credit limit.

By increasing your security deposit and increasing your credit limit, you can reduce your credit utilization, which also boosts your credit score.

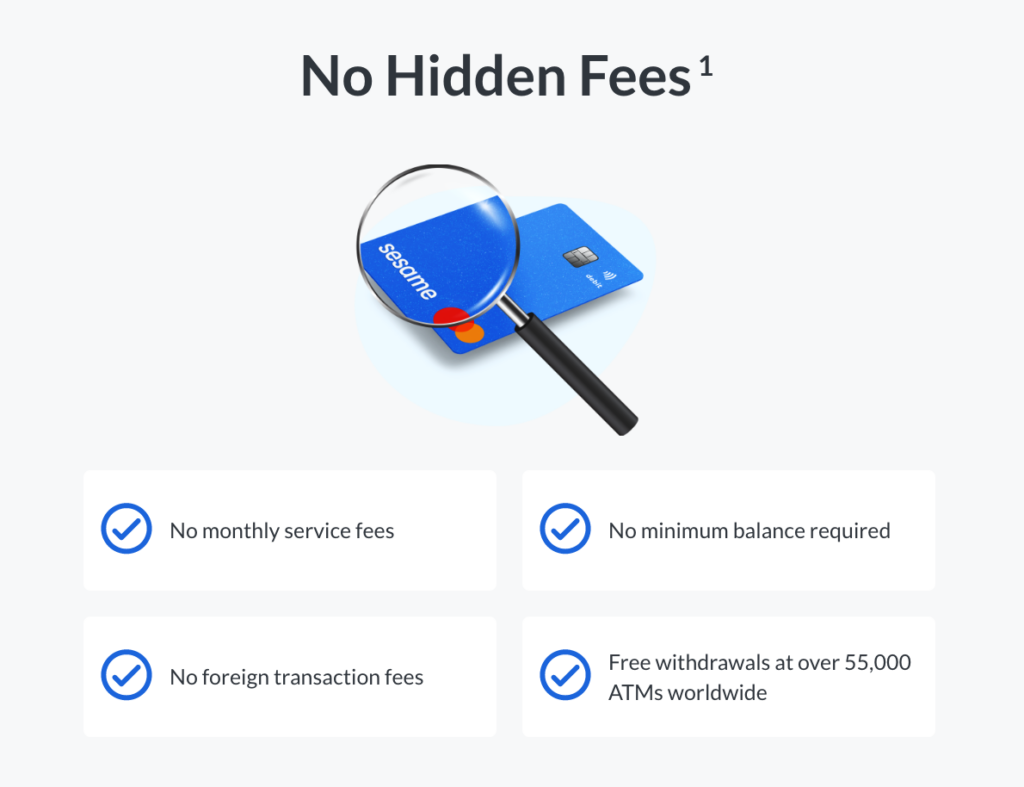

How Much Does Sesame Cash Cost?

Sesame Cash is free to use. There’s no charge to open your account. There are also no monthly fees like you might find with other credit-building accounts.

Better yet, there are also no ATM fees, meaning you can access your money easily.

Key Features

Sesame Cash has many features that help it stand out from other credit-building services. Below are just a few of the top benefits the service offers.

Early Direct Deposit

Like some of the other popular checking accounts, Sesame Cash allows you to get direct deposits to your account up to two days early. You won’t pay interest on the money, nor are there any fees associated with the early deposits.

Mobile Device Protection

When you open your Sesame Cash account, you’ll get up to $500 in free mobile device protection. This means that if your phone breaks or is stolen, you’ll get $500 to replace it.

There’s no additional charge to add this protection to your account.

Improve Your Credit

One of the most appealing features of Sesame Cash is the ability to improve your credit. Your debit card activity each month is reported to the credit bureaus as an on-time payment.

This positive and consistent payment history appears on your credit report and helps to boost your credit score over time.

Monitor Your Credit Score

Sesame Cash is just one of the services offered by Credit Sesame. By opening an account, you’ll also get access to all the other free features the company has to offer, including credit monitoring.

You’ll be able to see your credit report and score, understand what’s impacting it, view your full credit report and get tips on additional ways to boost your score.

Rewards and Cash Back

Another excellent feature of Sesame Cash is the ability to earn cash back and rewards.

To be eligible for cash rewards, you’ll need a credit score of at least 300. You also need to make at least one $100 deposit into your account each 30-day rewards cycle.

There are two different ways to earn rewards from your Sesame Cash account. First, you can earn rewards by boosting your credit score. If your credit score goes up at least 10 points within a 30-day rewards cycle, you’ll receive $10 in cash rewards.

For an increase of 100 points or more within a 30-day period, you’ll receive a $100 cash reward.

The other way to earn cash rewards is cash back on your purchases. These cash back offers are powered by Empyr, Inc. and Button, Inc.

You’ll have to activate offers to actually earn the reward. Unlike other cash back programs, you won’t earn a flat rate for each purchase. Instead, you’ll earn a specified reward at certain retailers.

Sesame Cash Reviews

Before signing up for any financial product, reading the reviews from customers can help you decide if it could be a good solution for your needs.

While there aren’t specific ratings for Sesame Cash, Credit Sesame has ratings on different sites.

Here is how Credit Sesame ranks according to user feedback:

Here’s what customers have to say about Credit Sesame:

“Credit Sesame is a great tool. Ever since I joined Credit Sesame, my credit score increased 142 points in one year. I joined premium a while ago. This motivated me to learn how to increase my credit.” – Rick L

“Signed up and immediately got locked out of my account. Didn’t even get a chance to review the site. The verification codes were not sent to me in a timely manner and my attempts to access the acct were exhausted.” – Pat

“Great way to track your credit score for FREE! It updates each month and gives you suggestions on how to improve or build up your credit score so that you can plan your finances and budget.” – Thadya V.

“They have the worst email support and their website has the same info their competitors do.” – Monique B.

Alternatives to Sesame Cash

Sesame Cash is one of the most popular services of its kind, but it’s not the only one you can use. Here are a few alternatives to consider if you aren’t convinced that Sesame Cash is right for you.

The Extra Debit Card is a debit card that allows you to build credit with your purchases. Like Sesame Cash, it reports your monthly spending to the credit bureaus to build your payment history.

It also offers rewards up to 1% on your purchases. However, instead of offering cash back, it offers rewards points you can spend in the rewards store.

A key difference between Sesame Cash and Extra is the Extra Debit Card doesn’t require you to open a separate bank account. Instead, the card simply connects to your existing bank account at your current financial institution.

When you spend money on your Extra Debit Card, it automatically pulls the money from your account the next business day.

Grain

Grain is a service that works more like a credit card than a debit card. First, you sync your account with your current debit card.

Then, Grain approves you for a line of credit based on your cash flow. This means that even someone with poor credit can be approved if they have consistent cash flow each month.

Once your Grain account is set up, you’ll spend on your debit card as you normally would. You can also transfer money from your Grain account to your bank account.

You’ll pay interest at a rate of 15% until you repay the credit line. Additionally, Grain charges an annual service fee of 8% of your credit limit and a sign-up fee of 7.5% of your credit limit.

Sequin

The Sequin Rewards Card connects to your existing bank account to help you build credit and get cash rewards on your spending.

Once you set up your Sequin Rewards card, you’ll earn 1% unlimited cash back on your purchases.

You can also add a line of credit to your account for free, which then reports your payments to the credit bureaus.

While Sequin is geared towards women, anyone of any gender can sign up and use the card to improve their credit.

FAQ

If you are still uncertain about whether or not Sesame Cash is ideal for your financial needs, these questions might be able to help.

Credit Sesame has a couple of different ways for Sesame Cash customers to get support. There’s a member support form on the website, which will initiate email support.

You can also contact the company at 1-877-751-1859.

Yes, Sesame Cash is safe to use. Your money is held in an account with Community Federal Savings Bank, which uses bank-level encryption and is FDIC-insured.

The primary way that Sesame Cash differs from a secured credit card is that, when you use the card, money is removed from your account in the same way it would be for a debit card.

This way, you don’t have to pay off your balance each month.

Summary

Sesame Cash offers a free solution for consumers who need help boosting their credit score but aren’t able to qualify for a traditional credit card.

In addition to boosting your credit card by spending on the prepaid debit card, you can also earn rewards by making purchases at certain retailers and boosting your credit score.

Ultimately, if you want to boost your credit score, Sesame Cash is worth checking out.