Dear friends,

Welcome to June and the unequivocal beginning of summer. I celebrated my 38th set of Augustana graduates.

Those of you who attend professional sports events think you’ve experienced “the roar of the crowd.” Pfah. Until you’ve been there on the moment when a young person becomes the first member of their family, ever, to earn a college degree, you’ve heard nothing.

I also bade farewell to nine of my faculty colleagues (some of whom I had a hand in hiring, which makes me wonder why they’re going so soon?) and my college’s president, Steve Bahls, who served us for 19 years. Steve is Augustana’s eighth president in 162 years.

It’s all good, and it’s all a touch bittersweet. I’ll miss them. I always do. And I’ll celebrate them. I always do.

My son celebrated, perhaps a bit more vigorously, the successful completion of his B.A. (and the impending beginning of his graduate work in counseling psychology) by charging through a 10’ geyser of water on a 50-degree day.

I nodded.

There is much to celebrate. And there is much to complain about. The question is, which will you choose to do?

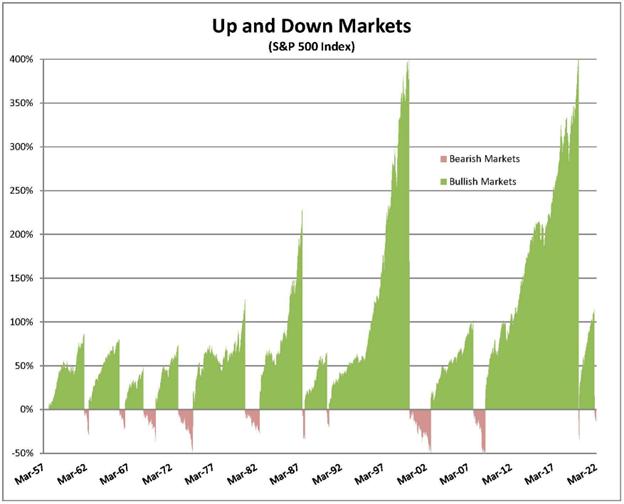

The stock market has been the source of some anxiety.

The 14% in broad market indexes so far this year certainly is unpleasant. I should imagine that the declines experienced by yesterday’s Kings (and Queens) of the World are even more so: ARK Innovation is down 53%, the Meme Team stocks – tracked by the BUZZ ETF – are down 36%, a number of cryptocurrencies have been entirely wiped out with fan faves like Doge Coin and Shiba Inu dropping 50-70%, the average company brought public via a SPAC is down 43% YTD … you know bad stuff.

On the other hand, an investor holding the boring ol’ Vanguard Total Stock Market Index Fund (VTSMX) is down a whopping 4% in the past year, and still sitting on annual gains of 13.8% over the past decade. Dan Wiener, mastermind of the Independent Adviser for Vanguard Investors, shared a beautiful bit of perspective in a March 2022 note:

Dan wrote: “Your best defense, as a long-term investor, is to try and tune out the noise …The history of the stock market is littered with reasons to sell including wars, recessions, assassinations, invasions, and yes, even a recent pandemic. Those who sold out almost certainly weren’t able to time their re-entries. Me, I’ve done some buying. What about you?”

The market’s bottom is near … unless it’s not.

The bottom might be imminent. Morningstar (5/17/2022) has become convinced that “the market is undervalued.” Optimists rejoice that we’ve already reached “maximum bearishness” and corporate insiders are buying billions in their companies’ stock. Of course, “maximum bearishness” actually means “compared to recent years, using one measure of a fallible construct.” And insiders buy for many reasons, sometimes to convince the rest of us to follow.

Or the bottom might be cataclysmically far down. One measure of the market’s valuation, the Shiller PE ratio, sits at 32 even after the carnage, not quite twice the historic average. Jeremy Grantham, founder of GMO, estimates it as 40% further down. Not to be outdone, some random hedge fund manager claims it will be 78%. Economist David Rosenberg, the optimist in this group, calls for “a crash” but only by 17% more.

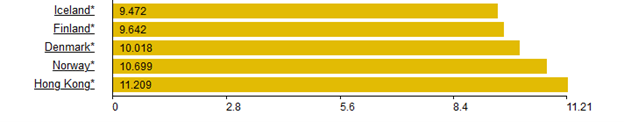

The price of gasoline is worrisome to many

Gas at over $4.00 a gallon? $5.00 a gallon? Who can put up with such madness‽‽

Virtually the rest of the developed world. For the past 25 years.

Price conversions are a bit tricky since petrol is priced in pounds or Euros per litre but the broad pattern is this: petrol topped a $4 / gallon mark in the last 1990s when Bill Clinton was in office and has never dropped below it. Here’s the British price in pence per litre. Any price about 105 pc is above $4 / gallon.

As of May 22, 2022, the per-gallon price in northern Europe was pretty striking.

During Mr. Trump’s last full month in office, the US produced 11M barrels of oil. Currently, we’re producing 11.7M.

Which is to say, it’s not us. It’s not Mr. Biden. It’s not a green cabal. And it’s not unusual … except for us.

And on and on. There are a lot of problems. We’ve created some of them through our own choices, voluntarily made. “We” thought day trading NFTs from our couches was a sure road to riches. “We” thought that driving the six-thousand-pound descendant of a military transport (the progenitor of the SUV) was a good idea. “We” thought that the best way to protect our children was to be sure that as many Americans had as many firearms as possible. (The Economist, 5/28/2022, laments that, in many states, it’s easier to acquire a gun than a puppy.) And many of us thought that shouting, rather than listening, was the way to solve our shared problems.

Perhaps we were wrong.

If you need to breathe, consider gardening (the psychological health effects of which can be pretty dramatic), supporting the slowly reopening business in Ukraine or perhaps picking up a copy of The Bright Ages: A New History of Medieval Europe (2021) at your local independent bookseller. It does a nice job of helping us rethink our tendency to see, and perhaps, celebrate the darkness (in this case, of “the dark ages”) while ignoring a wealth of evidence that the average person, on the average day, had a pretty good life.

Most importantly, consider stepping away from your newsfeed. To be clear: nothing you do today erases the losses your portfolio has already incurred. Staring and making yourself sick won’t help, and will likely lead to more imprudence. If you’ve got a long-term plan, stick with it and get on with your day. If you now reflect on your long-term plan, stick with it until you’ve had the opportunity to think clearly (about asset allocation, tax loss harvesting, and options for the next phase of the market).

Answer: Daily.

The Wall Street Journal publishes, daily among its market tables, a list of the ten most active stocks. Two oddnesses on this list:

- The most active stock is not a stock. On this fine day in May, it was the TQQQ ETF.

That’s a 2x leveraged bet on the NASDAQ; the fund rises 2% for every 1% the NASDAQ rises that day.

That’s not usual. Virtually every day in May, at least one ETF finished in the top three spots.

- There are signs of a mania, or perhaps madness or panic, here.

The “most active stock” is actually a leveraged bet in favor of the NASDAQ. The third most active stock is an equally leveraged bet against the NASDAQ, the fifth and 10th are straight bets on the S&P 500 and NASDAQ, respectively.

On several days in May, the #1 and #2 spots were occupied by the leveraged and reversed leverage NASDAQ with nearly 160 million leveraged bets being placed simultaneously in each direction.

The only way to win that game is not to play it. Either own a stock market yourself (the house always gets its cut) or invest with an eye of how a stock or asset class acts over the course of years or decades, not hours or days.

It’s an interesting and vexing question, whose answer is always the same: “it depends.”

Several unconstrained, long-term funds at least give you a starting point for the discussion. FPA Crescent (FPACX), a ferociously independent fund that’s Gold rated at Morningstar (and my single largest personal holding) is 27% cash and 70% equity. Leuthold Core (LCORX), a rigorously quantitative allocation fund that’s also Gold rated, is 34% cash and 49% equities. GMO Implementation (GIMFX), which used to be called GMO Benchmark-Free Allocation and will sport a $5 million minimum, is 28% cash and 58% equities.

My own portfolio remains about where I intend it to be: around half growth and half stability, half in the US and half international. In May, I made three purchases above and beyond my automatic monthly investments. In two cases, I gave $1,000 (a lot for me) to managers who have the freedom to buy stocks or to hold cash: Eric Cinnamond at Palm Valley Capital Fund (PVCFX) and Steve Romick at FPA Crescent (FPACX). I trust them to obsess so I don’t have to. The third purchase was moving money from “pure” cash to my cash surrogate, David Sherman’s RiverPark Short-Term High Yield Fund (RPHIX).

No one knows how the end of the Russian invasion of Europe will play out. It appears that Mr. Putin has been backed into a corner and, like any cornered creature, is lashing blindly out. The military strategy now appears centered on simple, brutal acts of annihilation: a “destroy everything, kill everyone” spasm. The US has shown remarkable leadership and most European countries have shown remarkable fortitude in opposing the invasion, supporting the Ukrainian military without escalating the war and welcoming refugees – some two million of them – into their countries.

No one knows how the end of the Russian invasion of Europe will play out. It appears that Mr. Putin has been backed into a corner and, like any cornered creature, is lashing blindly out. The military strategy now appears centered on simple, brutal acts of annihilation: a “destroy everything, kill everyone” spasm. The US has shown remarkable leadership and most European countries have shown remarkable fortitude in opposing the invasion, supporting the Ukrainian military without escalating the war and welcoming refugees – some two million of them – into their countries.

Their need is great. Help if you can. Dan Wiener reports that a young friend has launched a line of shirts and caps to raise money for the Ukrainian people. She’s been getting some nice press in the Bay Area for her efforts. Chip launched herself at the website early; I think I might know what Father’s Day will bring.

Their need is great. Help if you can. Dan Wiener reports that a young friend has launched a line of shirts and caps to raise money for the Ukrainian people. She’s been getting some nice press in the Bay Area for her efforts. Chip launched herself at the website early; I think I might know what Father’s Day will bring.

One of the highlights of my short visit to the Morningstar Investment Conference was a quiet talk with Victoria Odinotska, a native of Ukraine and president of a really good media relations firm, Kanter Public Relations. Blessedly, Victoria’s family is now all of the country though many of her friends remain resolutely behind.

In Victoria’s judgment, two of the most compelling options for those looking to offer support is Razom for Ukraine (where “razom” translates as “together”) and United Help Ukraine, which has both humanitarian aid for civilians and a wounded warriors outreach.

In addition to my reflections above, there’s a theme of learning and growth this month.

Devesh Shah reflects on his recent journeys, both physical and mental, and on what they might offer the average investor in uncertain times

Mark Freeland writes about real estate investing and real estate funds, areas that he was not previously experienced with but which is essayed to master.

Charles Boccadoro shares his reflections on average personalization, multi-asset oysters and the pain, even now, of reliving Bill Gross’s unraveling.

And The Shadow does what The Shadow does: tracking down some of the industry’s many twists, twirls and disappearances.

I think you’ll enjoy, and hope you’ll learn.

I have a number of healthy conversations with really bright people. Those are the jumping off point for some mid-year content: an updated profile of Moerus Worldwide Value following a conversation with Michael Campagna, an updated profile of Harbor International Small Cap in light of some data Waldemar Mozes shared, and a long-overdue refresh for Matthews Asia Growth & Income which continues to do exactly what it’s supposed to do: provide really strong absolute returns in up markets (think 16-17% per year when its relative performance looks terrible) and top tier relative returns (think top 25% of the peer group) in falling ones. Met a new manager there, Siddharth Bhargava, and we’ll talk about what I might have learned!

This month we profile an interesting new fund, Conestoga Micro Cap Fund. It uses the same discipline as their very successful Small Cap Fund but applies it to smaller names in a less efficient corner of the market. The new fund is a converted hedge fund with a solid record.

If you’re an advisor, read the profile and think “huh … that’s interesting,” you would do them a favor? Call your brokerage – Fido, TD, Schwab, whoever – and ask them to add the fund to their platform? I had a nice chat with one of the Conestoga guys who I’ve known for a long while and he says the platforms tell him that they won’t act until they hear from advisors who say they want it.

And thanks!