A reader asks:

I’ve been buying the dip for the past couple of months in the market and feel pretty comfortable in my positions. Should I continue to buy the dip or invest in my home (ie, new fence, additional rooms/bathroom, etc.?

I understand the line of thinking here but I look at the stock market and investing in your home as two separate categories when it comes to capital allocation decisions.

People invest in the stock market to grow their wealth, increase their standard of living and beat the rate of inflation over the long run.

The stock market doesn’t guarantee these outcomes but it offers a high probability of hitting those goals over the long run.

Reinvesting in your home rarely offers excess returns.

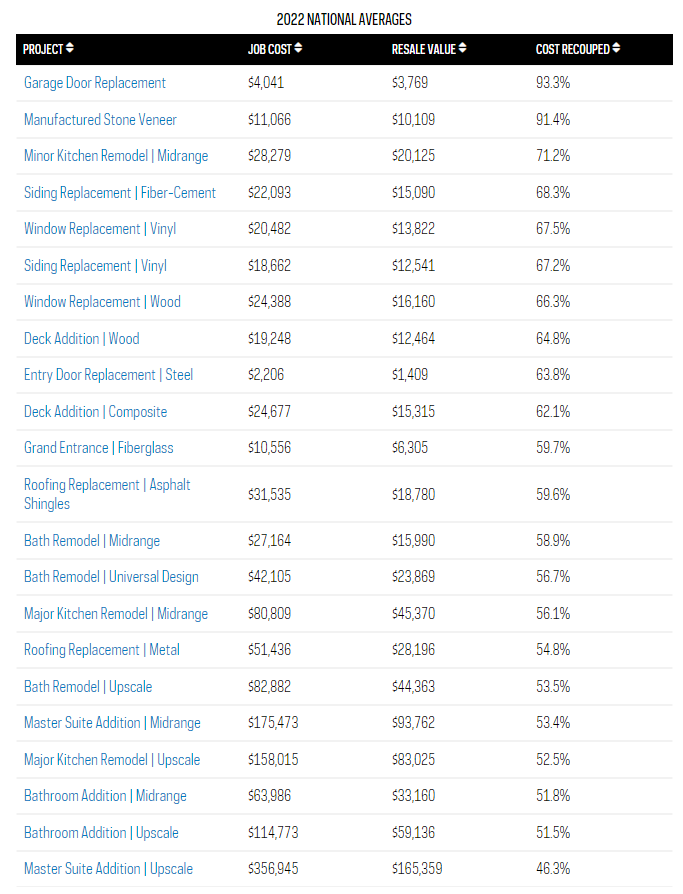

Housing research firm Zonda put out a list of the expected payback on various updates to your home:

Most of them are in the 50-70% range in terms of the cost recouped.

That’s not bad but it’s certainly not as good as what you could earn in the stock market over time.

I blame the home flipping shows on HGTV for inflating people’s expectations of home renovations.

We put in $50k and increased the value of the home by $150k. Yay profits!

They fail to tell you the labor is probably free and there are discounts galore because these people want to be on TV.

I hate to break it to you but HGTV is not realistic. But I digress.

A friend recently told me the estimate for new hardwood floors in his home. The number (dad joke incoming) floored me. There’s no possible way they are going to make up that investment on re-sale.

But maybe it doesn’t need to be a good investment to earn income. Maybe it just pays a different kind of income.

In the early-1900s, economist Irving Fisher laid out three different types of interest.

(1) Money or basically the way in which commerce is done.

(2) The stuff we buy like clothes, houses, transportation, food, etc.

(3) Psychic income which is more or less consciousness.

Here is the takeaway from his book on the topic:

In Man’s early history he had little command over his environment. He was largely at the mercy of natural forces—wind and lightning, rain and snow, heat and cold. But today Man protects himself from these by means of those contrivances called houses, clothing, and furnaces. He diverts the lightning by means of lightning rods. He increases his food supply by means of appropriated land, farm buildings, plows, and other implements. He then refashions the food by means of mills, grinding machinery, cook-stoves and other agencies, and by the labor of human bodies, including his own.

Neither these intermediate processes of creation and alteration nor the money transactions following them are of significance except as they are the necessary or helpful preliminaries to psychic income—human enjoyment.

Psychic income is basically human enjoyment.

The best example of psychic income I’ve come across is this:

Why do brides spend hundreds or thousands of dollars on a wedding dress they’re going to wear exactly one time?

It makes no sense on the surface. But it does when you consider wearing that dress on one of the most important days of their lives makes them happy. It brings them joy.

Homes can be a decent investment depending on your timing but most of the time they’re an investment in psychic income, especially when it comes to renovations. So thinking through the cost-benefit in terms of home renovations is a different hurdle rate.

Putting up a new fence, adding a bedroom, or fixing up a bathroom might not make you as much money as investing in the stock market, but that doesn’t mean you shouldn’t do it.

You just have to think about that investment in a different way.

Will fixing up your home bring you more joy? Will it improve the quality of your life? Will it make you happier?

Probably.

And what if I told you it’s possible to buy the dip in stocks and fix up your home?

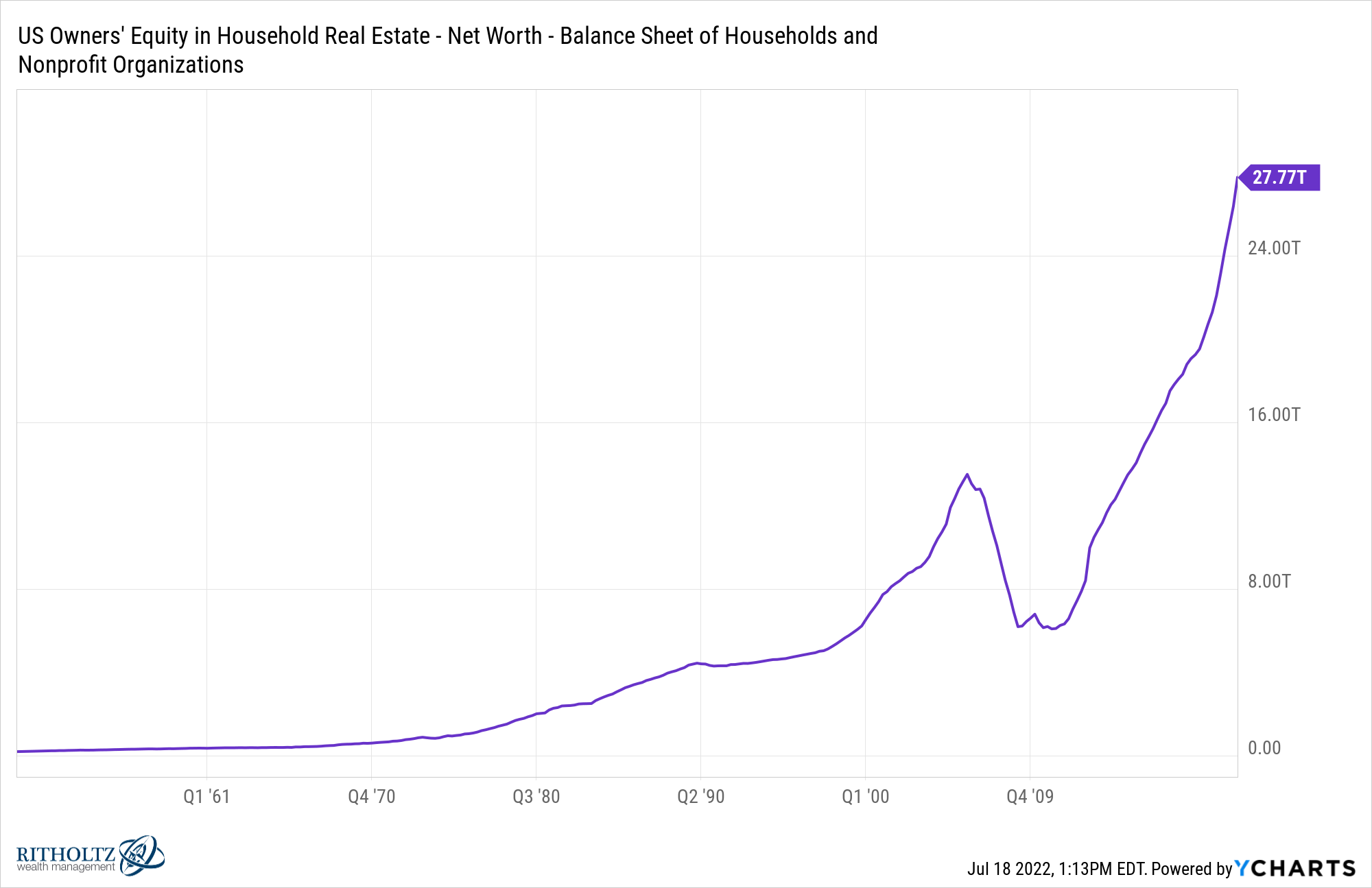

There is currently a record amount of home equity in the U.S. housing market right now:

The best reason for taking out a home equity line of credit (HELOC) is to renovate your home. You can write off the interest for tax purposes and upgrade it in a way that increases your enjoyment of the house.

HELOC rates are higher than they were in the recent past and they float with the level of interest rates but they’re not exorbitant.

When I took out my HELOC in the summer of 2020 the rate was 3%. It’s now up to 4.5%. It will probably go higher if rates continue to move up.

But if you happen to have a lot of equity just sitting in your home I could think of worse things to do with it than invest it right back into your house.

The typical term of these loans is 10 years of interest-only payments and then 15 years after that to pay back the principal but you can pay it back at any time. As long as you can service that debt this is why those loans exist in the first place.

This would also allow you to continue deploying your liquid savings into the stock market.

There are trade-offs to this strategy just like everything else when it comes to financial decisions but something worth running the numbers on.

We spoke about this question on this week’s Portfolio Rescue:

Alex Palumbo also joined me to discuss hiring a financial advisor, how to sell down a concentrated stock position, where the money goes in a bear market,

Further Reading:

Did HGTV Ruin the Housing Market For Millennials?

Here’s the podcast version of the show: