Most American households own a car. One expense you can’t avoid is auto insurance. With so many auto insurance companies to choose from, it can be hard to choose.

For a few minutes, forget about the jingles and celebrity endorsements. Great commercials don’t make a great auto insurance company.

Instead, focus on picking a quality company. Perhaps, the best auto insurance provider is a name you have yet to hear.

You can get a free online quote from most of the companies below. Switching insurance providers can save you hundreds of dollars each year.

The Best Auto Insurance Companies

When car insurance shopping, get quotes from multiple providers. And make sure your quotes are for identical coverage amounts. This comparison gives you an accurate assessment of how much you will pay each month.

In addition to looking at different companies, you should get multiple quotes from the same provider. For example, you can try varying deductible and coverage amounts. Extra coverage might be more affordable than you think.

Getting a quote only takes a few minutes. These days, most companies provide online quotes. Some companies still require you to talk to an agent. But, if you need coverage today, you can get insurance in an instant.

Top Auto Insurance Companies

When looking for the right insurance for your car, you have lots of choices. Here’s a look at our top picks.

1. Liberty Mutual

Liberty Mutual is a great auto insurance option as over 18,000,000 drivers trust them.

The process of getting a quote is simple, and you will get a quote in minutes. In fact, buying a policy online shaves 12% off your price. Bundling your homeowner’s insurance reduces your rate further.

Besides, they have a 12-month rate guarantee, and they have 4.6/5 stars from Consumers Advocate.

Teachers can also benefit from special perks at Liberty Mutual. When an incident occurs on school business, you can get this coverage for free:

- Vandalism loss

- Stolen or lost personal property

- Collision coverage

Liberty also offers discounts for:

- Military families

- Newlyweds

- New retirees

- New graduates

Teen drivers and good students can also enjoy discounts. Plus, hybrid vehicles receive a price break. You can also save up to 30% for good driving behavior with the RightTrack program.

In regards to customer service, Liberty Mutual is average. This rating is from the 2019 J.D. Power survey. Similar industry reviews show comparable results.

Pros

- Free benefits for teachers

- Unique discounts for new couples and retirees

- Hybrid vehicles get discounts

Cons

- Single policies can be expensive. So consider getting a multi-policy for extra discounts.

2. Esurance

Esurance is an online-only insurer owned by Allstate. You won’t get a local agent, but your monthly premiums can be lower than using an agent.

In over 30 states, Esurance offers the DriveSense usage-based car insurance. The actual number of miles you drive helps set your premium. Your driving habits and the time of day you drive also play a factor.

Esurance lets you browse discounts for the state you live in before you join. You can also get a discount by being a first-time customer. Plus, there are other common industry discounts.

Some of the other Esurance discounts include:

- Paid-in-full discount

- Multi-policy discount (Esurance offers other insurance products)

- Defensive driver discount

Also, you get a discount for insuring multiple drivers and vehicles. Some discounts like the Good Driver discount can help you save up to 40% on your premium. You qualify for this discount by being accident-free for three years.

The Esurance call center staff also has J.D. Power’s highest rating.

Pros

- Can be cheaper than a local Allstate agent

- Drivers can save more with the usage-based DriveSense

Cons

- No local agent access

- Some regional insurance providers are still more affordable

3. MetroMile

If you drive only a few miles each month, Metromile can be your cheapest option. In fact, this might be your best option if you drive less than 10,000 miles a year.

Each month, you pay a base rate plus per-mile rate. For example, your base rate might be $29 a month and six cents ($0.06) per mile you drive. If you drive 300 miles in a month, your premium is $47.

For long trips, MetroMile only charges on the first 250 miles each day. However, if you’re a New Jersey resident, it only charges you for the first 150 miles each day.

You want to avoid Metromile if you don’t want a variable premium. Plus, you must plug their Pulse device into your OBD-II port. This device tracks your mileage, but it doesn’t track your driving habits like other pay-per-mile insurance plans – more on that below.

Telematic Car Insurance Policies

Metromile uses telematics to determine your premium. Other insurance providers use telematics too, but most companies call it usage-based policies.

By sharing your driving habits, you can save money. First, plug the device into your car’s OBD-II port. Then the device wirelessly transmits your driving activity. The device logs the time of day you drive and the number of miles per trip.

With other insurance companies, the devices also monitor how long you idle and how rapidly you accelerate or decelerate. So safe drivers can earn a discount of up to 40%. Right now, telematics is optional for auto insurance.

At this time, MetroMile only tracks the number of miles you drive. That way, you pay less if you drive less. This is a less invasive use of telematics than monitoring other details of how you drive.

Pros

- You pay per mile you drive

- Driving habits don’t influence your premium

- Telematics device also monitors your car health

- Rideshare insurance also available

Cons

- Can be more expensive than other insurers when you drive more than 10,000 miles a year

- Only available in eight states

4. Root Insurance

Tired of overpaying for car insurance just because you’re young, single or some other “risky” demographic? To be sure, safe and careful drivers are in every people group. This is where Root Insurance comes in to help you save money.

Root uses your actual driving habits to help determine your monthly rate. This way, you’ll pay based on whether or not your actual driving behavior is risky or not.

Root may also choose not to offer you insurance if your driving behaviors are too risky. By making this choice, it means they’re able to offer even better rates to the drivers they do insure. According to their website, they can save good drivers as much as 52% on car insurance!

All you have to do is download the app to your iPhone or Android, go for a test drive and choose from the recommended policies in the app after your drive. You can even pay for your insurance right there in the app. Now that’s easy!

5. Amica Mutual

One provider that gets high overall marks is Amica Mutual. This can be a good option if you prefer having a local agent. The 2019 J.D. Power U.S. Auto Insurance Survey gives Amica a 5/5 rating for customer satisfaction in the New England region.

Some other unique perks of Amica include:

- No deductible for door lock or airbag replacement

- Full vehicle replacement in the first year of ownership

And, if your car needs repairs, you can take it to any body shop. Most insurance providers only partner with select repair shops.

For the best Amica coverage, choose the Platinum Choice Auto package. With this package, you can enjoy these three extra benefits:

- Accident forgiveness

- No deductible for replacing auto glass

- Identity fraud monitoring with all three credit bureaus

- $5,000 credit for rental car coverage

You can also add these benefits to your standard policy a la carte.

Pros

- 5/5 J.D. Power rating for customer satisfaction in New England

- Platinum Choice offers some of the most extensive benefits

- No restrictions for body shop repairs

Cons

- Must talk to an agent to complete the quote process

- Fewer discounts than the average insurance company

6. USAA

If you’re a military brat like me, you likely know about USAA. It receives high ratings in many insurance surveys. USAA is popular for its competitive rates and good customer service. In fact, it’s one of two providers to have an overall 5/5 J.D. Power rating.

I happen to be a USAA auto insurance member. I stay with USAA for its competitive premiums and great customer service.

Another reason we like USAA is that you can get a small annual dividend. USAA returns a portion of the unused payments to its members. This dividend can help offset your insurance premium for a month.

We have our policy with another home insurance provider. USAA is still more affordable than bundling with our home insurance. That’s the case for me, but it might be different for you.

One benefit you might enjoy is accident forgiveness. You qualify when your household is accident-free for five years. And, if an at-fault accident happens, your premium won’t increase.

You qualify for USAA membership in these instances:

- Active military

- Former military

- Eligible family member (Child or spouse)

- Cadet or Midshipman (U.S. Service Academy or ROTC candidates)

Membership is free to people who meet those conditions. And active-duty members can enjoy special benefits when they deploy.

Pros

- Some of the best rates for military members and their families

- A high-ranking customer service team

- Can get an annual dividend for unused payments

Cons

- Must be a U.S. military member or family to join USAA

7. Erie Insurance

Erie Insurance ranks #1 in the 2019 J.D. Power Insurance Shopping Study for the Mid-Atlantic region. Also, this company ranks high for its pricing and customer service. Some neat features include a rate lock and diminishing deductibles.

One reason why you might be switching policies is that your rates keep rising. But if you have a clean driving record and don’t buy new vehicles, you don’t have to suffer rising rates. With a rate lock, you pay the same amount each term. Your rate only changes in these situations:

- Add or remove drivers or vehicles

- Move to a new house

Another unique benefit this company provides is a diminishing deductible. With most providers, lower deductibles increase your monthly premium. But Erie drops your deductible $100 each year you’re claim-free. In all, Erie will drop your deductible up to $500.

One downside is that Erie only operates in several states. You must live in the Mid-Atlantic or Midwest regions to join.

Pros

- Highest J.D Power rating in 2018 Insurance Shopping Study

- Up to $1,000 Pet Injury Coverage

- Diminishing deductible up to $500

- Rate lock when your insurance profile remains the same

Cons

- Only available in the Mid-Atlantic and Midwestern states

8. The AARP Auto Insurance Program from The Hartford

A well-respected auto insurance provider is The Hartford. However, to get Hartford insurance, you must be an AARP member and at least age 50. AARP members can enjoy exclusive discounts and benefits.

Annual membership costs $16 and gets you other AARP discounts. With AARP membership, you can enjoy great coverage.

One other benefit you might enjoy is RecoverCare. In covered accidents, Hartford pays for home services until you recover. For instance, it may pay for home cleaning, lawn maintenance, food prep and dog walking.

Pros

- Competitive rates for drivers 50+ years old

- Excellent coverage options

- RecoverCare pays essential home expenses if you’re hurt

Cons

- Only available to AARP members

9. Gabi

Let’s face it; getting insurance quotes takes time. Even if it’s only a few minutes for each quote, that’s time you never get back. This is where Gabi comes in. Gabi is a licensed insurance broker in all 50 states and the District of Columbia.

When time is precious, Gabi makes finding cheap auto insurance easy. This company doesn’t provide coverage directly. Instead, Gabi helps you get the best deal by comparing rate quotes from over 40 different providers.

The comparison process is simple. If you currently have insurance, Gabi pulls your current policy details. This way, you get a true apples-to-apples comparison.

Gabi provides most rate quotes right away. And if you happen to have a more complex situation, you’ll still get your rates within 24 hours.

If you don’t have insurance, Gabi helps you find a policy too.

Once you find a quote, Gabi will assist you in completing the sign-up process and obtaining your policy.

With Gabi, the comparison process doesn’t end when you pick a quote. It will continue to monitor your premium amount to find the best rate. As you switch vehicles or add teen drivers, Gabi provides fresh quotes.

Pros

- Get multiple quotes for free

- Gabi continues to monitor for extra discounts

Cons

- Can take up to 24 hours for Gabi to compare rates to your current policy

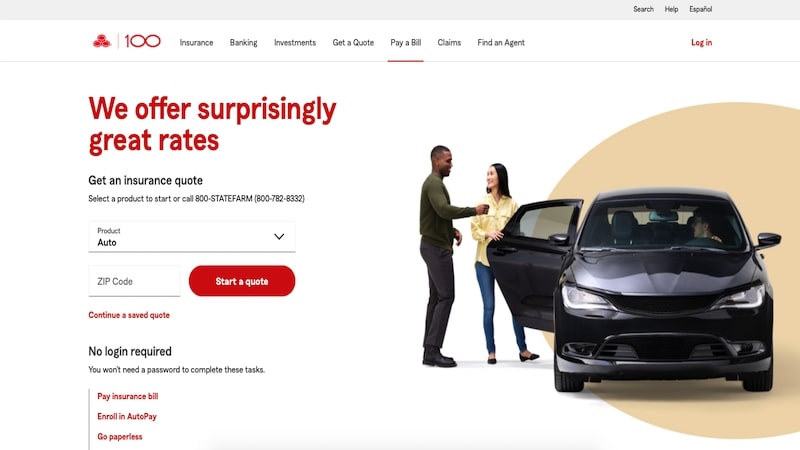

10. State Farm

If you prefer having a local agent, State Farm is a common choice. Most U.S. cities have a nearby agent. By some measures, it is the nation’s largest auto insurance provider. It can also insure your dwelling for a multi-policy discount too.

For rideshare drivers, insurance is available in most states and D.C. According to State Farm, this option increases your premium between 15% and 20%. So, if your premium is $60 a month, your new premium might be $72.

With the State Farm Drive Safe & Save plan, you can save up to 30%. As with other insurers, you must install a device to track your driving habits. You must link the device to the State Farm app or in-car OnStar to enroll.

Devices from other providers wirelessly transmit your driving data. So Safe & Save can be more hassle in its current form. Connecting to your phone can make sure you don’t text and drive.

Any driver under the age of 25 can also take State Farm’s Steer Clear discount. This is an online driver safety course. After completion, you get a discount worth up to 15%.

If you’re in a wreck at least 50 miles from home, State Farm is very helpful. It will cover the cost of your rental car, meals, lodging and transit. Not every driver needs this coverage. But it can be worth it if you travel away from home often.

While most insurance providers have a mobile app, State Farm’s is one of the best. With it, you can quickly submit claims. And you need the app to enroll in Drive Safe & Save or Steer Clear.

Pros

- Usage-based and defensive driver training discounts

- Rideshare insurance in most states and District of Columbia

- User-friendly mobile app

Cons

- Must use the app or OnStar to get Drive Safe & Save or Steer Clear discounts

11. Auto-Owners

This agent-only company provides many insurance products. Auto-Owners has a 5/5 rating for customer satisfaction in the 2019 J.D. Power survey.

Auto-Owners offers many coverage options. You might like the Personal Automobile Plus Package. This option features extra perks like cell phone replacement and rekeying locks.

Also, Auto-Owners has two loyalty bonuses that can save you money. Let’s say you’re in a collision with another Auto-Owners client. If so, the company waives your collision deductible. For example, if your deductible is $1,000, it pays the first $1,000 of repairs.

Plus, Auto-Owners is flexible when you strike an animal. It compares your collision and comprehensive coverage. Whichever pays the most is what it uses to pay you.

Pros

- Flexible collision coverage

- High customer service ratings

Cons

- Must get a policy with a local agent

- Only operates in 26 states

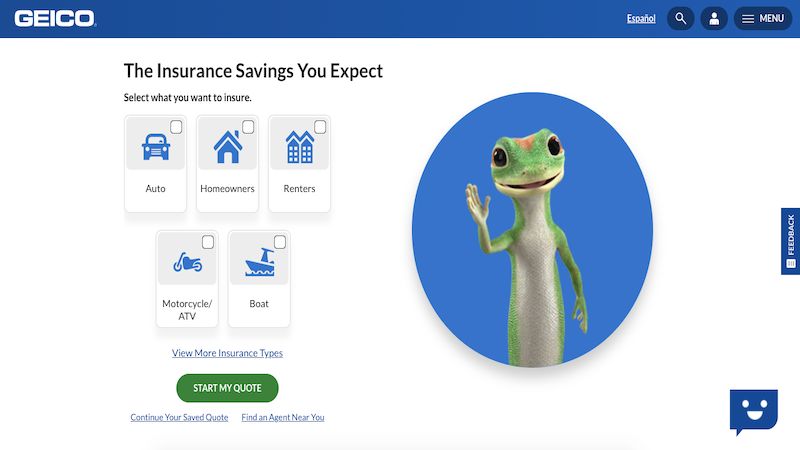

12. Geico

If you qualify for a Geico discount, you can save on car insurance. Geico offers discounts to over 500 groups, including:

- Federal employees

- Military members

- Affinity groups

- Alumni groups

- Fraternities and sororities

And anyone can save up to 26% if you’re accident-free for five years.

Without a discount, Geico ranks about average for plan prices. Its customer service also receives average marks. Both of these findings come from the 2019 J.D. Power survey.

You can get a quote online or through a local agent.

The Geico app is well-rated. You can use it to get digital insurance cards and to track vehicle maintenance. Also, it looks for any open recalls.

Geico has one coverage option you may want to add. Its emergency road service plan starts at $14 a year per car. However, note that some other insurers charge only $5 a month for similar coverage. This assistance covers these unwanted events:

- Battery jumpstart

- Flat tire change

- Towing (not accident-related)

- Lockout services (up to $100)

You can also add mechanical breakdown insurance (MBI). This option helps offset the cost of auto repairs. But first, you should compare the monthly price to your average repair spending.

For you, it might be cheaper to pay these expenses with cash. With MBI, you must still pay a $250 deductible.

Pros

- Discounts for 500+ employers and social groups

- Feature-rich mobile app

- Safe driver discount when accident-free for five years

Cons

- Policy costs are relatively high without a discount

- Not as many local agents as other national providers

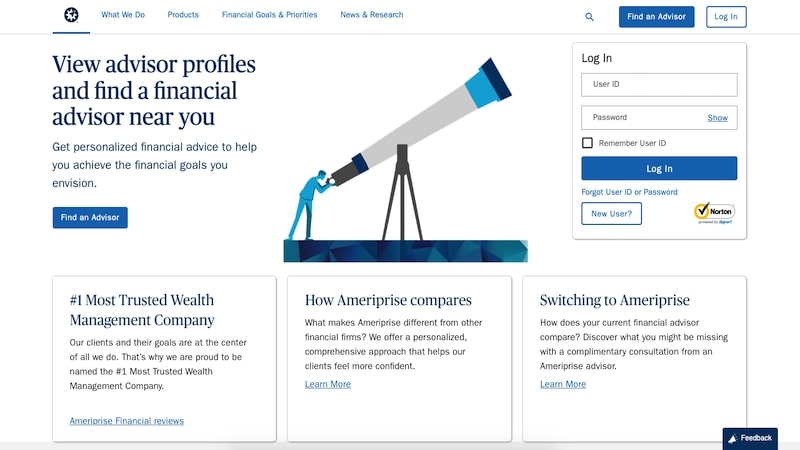

13. Ameriprise

Ameriprise is better known for its life insurance products. But it ranks #1 in California for car insurance, according to J.D. Power.

Costco members can get auto insurance discounts from Ameriprise.

For example, Costco executive members can get free roadside assistance. An executive membership to Costco costs $120 a year. That’s $60 more than the standard Costco membership.

But the roadside assistance benefit helps defray the executive membership fee. And, you save money on car insurance, too.

However, you don’t have to be a Costco member to join Ameriprise. And you don’t have to live in the Golden State either. It offers many auto insurance options for most U.S. states. You can see if Ameriprise is a good option for you with an online quote.

At its heart, Ameriprise still focuses more on investing. So its website and app cater to this service. For this reason, you may wish to have a dedicated auto insurance provider instead.

Pros

- Special discounts for Costco members

- 4/5 rating in California from 2019 J.D. Power Auto Survey

Cons

- Mobile app lags peers for auto insurance options

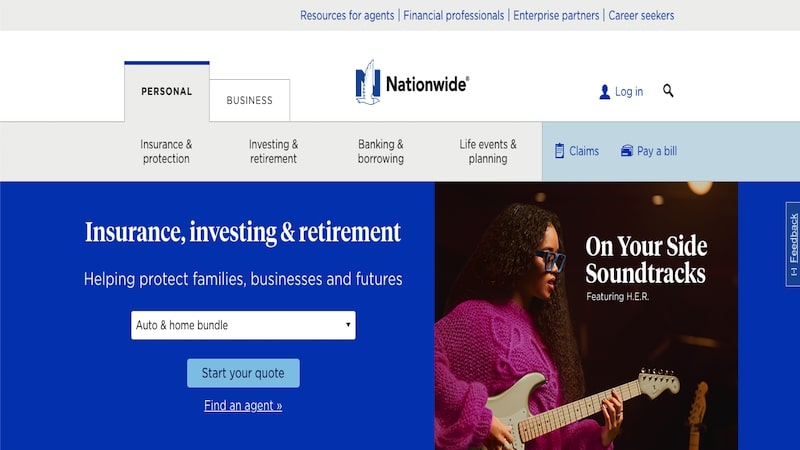

14. Nationwide

Nationwide has above average (4 out of 5) J.D. Power ratings for policy offerings. Besides, it has positive ratings for its website and local agents, too.

Like a few other insurers, you can save up to 40% by driving safely. The SmartRide telematic device tracks these driving habits:

- Number of miles you drive

- Hard braking or accelerate too quickly

- Idle time

- Nighttime driving

The SmartMiles programs can save you money if you only drive a few miles per month. Like MetroMile, You only pay for the first 250 miles you drive each day. Expect to pay a flat monthly base rate plus $0.06 per mile you drive.

Nationwide offers discounts for various affinity groups. And you can get discounts for enrolling in auto-pay.

Like other insurers, Nationwide offers vanishing deductibles. When you’re accident-free, your deductible drops $100 a year up to five years ($500 reduction). However, if you get in an accident, your deductible resets. But it drops $100 again each accident-free year.

Pros

- Save up to 40% with SmartRide telematics

- Access to local agent

Cons

- Below average J.D. Power rating for customer satisfaction (2 out of 5 stars)

15. Auto Club Group (AAA)

When you travel, maybe you use AAA. In addition to great travel deals, AAA offers auto insurance. In fact, it’s one of the nation’s largest providers.

Auto Club Group is an offshoot of AAA. J.D. Power gives Auto Club an above-average (4 of 5) rating for plan prices.

You can enjoy these discounts:

- Disappearing deductible

- AAADrive usage-based telematics

- Cash rewards each year you’re claim-free

AAA has three different plan levels: Essential, Advantage and Ultimate. To get most of the discounts, you must have a premium plan. For instance, only the Ultimate plan has a disappearing deductible benefit.

With the AAADrive telematic, you can save up to 30%. When you drive, connect your car device to the mobile app. AAADrive monitors these driving factors:

- Cell phone usage

- Smooth vs. hard-driving

- Speed relative to other drivers

- Time of day

- Length of a trip without breaks

Also, Auto Club has small-claim forgiveness. Your premiums don’t increase when damage is less than $250 when you’re at fault. For other claims, the threshold is $750 before they adjust your premium.

Finally, you can also enjoy AAA discounts and roadside assistance. These two benefits are maybe what AAA is best known for. Both of them help you save money when you travel or when you must perform car repairs.

Pros

- Responsible drivers save up to 30% with AAADrive telematics

- Industry-leading discounts including a disappearing deductible

- Roadside assistance plans

Cons

- Must be a AAA member

- Not the best option for bargain shoppers

FAQs About Auto Insurance

Auto insurance has many moving parts. The number of coverage options can be confusing. Below are several questions to help you pick the best policy.

How Much Does Auto Insurance Cost?

According to Business Insider, the national 12-month premium is $1,566, or, $130 each month.

Of course, many factors that go into your car insurance premium. These factors include:

- Where you live

- Your driving record

- Number of insured drivers

- Age of cars

- Number of cars

- Coverage amounts

- Size of deductible

- Size of policy discounts

- Amount of miles you drive each year

- Your credit score

Your auto insurer also influences your premium cost. Each provider weights these factors differently. This variance is why you must get quotes from multiple providers.

Not every insurance company charges the same.

Plus, if you’re a rideshare driver, you should compare different providers, too. After all, you must have rideshare insurance when driving with Lyft or Uber. You may find these options cheaper than buying insurance from Uber or Lyft.

Differences Between Liability and Collision

The primary purpose of car insurance is to protect your personal wealth. If you cause an accident, you’re liable for any repair bills. Plus, you must pay any medical bills too. In contrast, with insurance, you most likely don’t pay for any costs.

Without insurance, you must pull from savings to pay any bills. Literally, a single accident can bankrupt you. For this reason alone, you need car insurance.

But your insurance might not cover the repair costs for your own at-fault events. It depends on whether you have a basic or full coverage plan.

There are three basic auto insurance coverage types:

- Liability

- Collision

- Comprehensive

Here’s a brief description of each one.

Liability Coverage

For at-fault accidents, this coverage covers these expenses:

- Bodily injury

- Property damage

Many states now require drivers to have liability coverage. If not, you may have to pay a fine each year. Plus, you might not be able to renew your car registration either.

Remember, liability only pays for damages to the other car. Your insurance won’t pay for your medical bills or your car’s damage.

On the other hand, if the other driver is at fault, their insurance pays your bills.

Collision

This coverage covers any damage not caused by an animal. For example, you might hit a car or tree. If so, your collision benefits includes the repair bill. But only the amount after your deductible.

If you own your vehicle outright, collision coverage is optional. But, if you have a car loan, your bank requires you to have collision coverage.

Comprehensive

This coverage covers animal and nature-related damage repairs. Maybe, you hit a deer or a hail storm happens. Since you’re not at fault, collision coverage doesn’t cover these claims. You need comprehensive for this type of damage.

You must purchase this coverage separate from collision coverage. Like collision, you may have to own it if you have a car loan.

Other Insurance Coverage Options

You may also choose these extra coverage options. Keep in mind that each option raises your premium. Besides, you have to decide if the potential payout is worth the added cost

- Roadside assistance

- Rental car assistance

- Underinsured motorist coverage

- Rideshare insurance

- Car replacement assistance

- Disability assistance

- Lost wages reimbursement

How Much Car Insurance Do I Need?

Only you know the answer to this question. You have to determine your spending limit. And you may want to receive compensation if your vehicle needs repairs.

But, the more coverage you have, the more you pay.

Each state has a minimum liability coverage requirement. However, you may decide to choose a higher amount. After all, car accidents and medical bills can be expensive.

Also, most banks require you to have “full coverage” while you have a car loan.

When to Get Collision Coverage

If you don’t have a car loan, you can get by with liability coverage only. This is an easy way to lower your car insurance costs. In this case, you must pay cash for all vehicle repairs.

When you can’t afford the expensive repairs, keep the extra coverage. Also, keep the coverage if you can’t afford to replace your vehicle.

But it can make sense to drop the coverage if you have an older vehicle.

For example, we only have collision coverage on one of our cars. The car is only worth $1,500. Any major repair costs more than the vehicle is worth. And we have $1,500 in emergency fund savings to replace this car if necessary.

However, we still have full coverage on our second vehicle that’s worth $7,500. After we pay a $500 deductible, insurance pays the rest.

We pay an extra $20 a month for full coverage. But we can save thousands if we file a claim. So, if we must replace this vehicle, insurance covers most of the costs.

How to Lower Your Car Insurance Bill

Most auto insurance companies offer policy discounts. When switching companies, you might choose a company with the most discounts. After all, you get similar coverage amounts for less.

These are some options you have to reduce your insurance bill:

- Raise your deductible (i.e. $500 to $1000)

- Drop optional coverages like rental car assistance

- Add a non-auto insurance policy

- Don’t carry collision or comprehensive on older vehicles

- Be a safe driver

- Use a telematics device that tracks your driving habit

- Own a safe car or a hybrid

- Improve your credit score

Some of these changes lower your premium right away. These include dropping optional coverages and raising your deductible.

Other changes take time. For example, you may need to go five years accident-free. Also, your premium is related to the cash value of your car. As a result, when your car depreciates, your premiums naturally decrease.

Summary

Cost is the main factor when choosing an auto insurance company. But customer service quality is important too. For this reason, take the time to get quotes from at least two companies. And don’t be afraid to compare local agents with online-only companies.

Did we forget your favorite auto insurance company? Let us know in the comments.