Do some or all of your staff make a good deal of their income off of tips? Wait staff, bartenders, and taxi drivers depend on tip income. Just like wages, tips have a few tax-related requirements that come with them. If your employees make more than $30 per month in tips, you may wonder how must an employer report tips to the IRS? This all starts with the employee filling out their tip reporting sheet.

And when it comes to tip reporting sheets, there are two IRS forms you should know about: Form 4070 and Form 4070A.

Employer responsibilities for reporting tips

It’s important to accurately report your employees’ tip income. You have multiple responsibilities when it comes to employee tip income. As an employer, you must:

- Keep employee tip reports

- Withhold employee taxes based on wages and tip income

- Pay your share of FICA tax (Social Security and Medicare taxes) based on wages and tip income

Now that you know why tip reporting is so important, let’s look at who reports tips and how tip reporting is done.

Tracking tips with Form 4070A

If employees make more than $30 a month in tips, they need to keep track of their tip income. Employees should keep a daily tip record so they can:

- Report their tips to you every month

- Note their tips on their tax return

- Prove their tip income if their return is questioned

The most widely available way for an employee to keep track of their tips is by using a daily tip reporting form or Form 4070A, Employee’s Daily Record of Tips. Form 4070A is the first step for employees to report their tips to their employer with Form 4070. To be clear, Form 4070A and Form 4070 are two entirely different documents with a similar goal in mind.

Form 4070A helps tipped employees keep track of their tips daily. Form 4070A asks employees to log:

- Their name and address

- Your name

- The business name, if different than yours

- The month and year of the tip reporting period

- Date when tips were received

- Credit and debit card tips

- Tips paid out to other employees or pools

- Names of employees who received a tip out

You can stock up on copies of Form 4070A through IRS Publication 1244.

It’s up to your employees whether or not they use Form 4070A. If your employees choose not to use Form 4070A let them know that they’ll still need to keep track of their:

- Tips received from customers or other employees

- Value of noncash tips (e.g., tickets, passes, etc.)

- Amount of tips received

- Credit and debit card tips

- Tips paid out to other employees, tip pools, or other arrangements—including employee names

Once your employees have their monthly income from tips, they can report their tips to you using Form 4070.

Reporting tips with Form 4070

Employees use Form 4070, Employee’s Report of Tips to Employer, to let you know about the tips they made in the last month. Form 4070 is simple to fill out if your employees keep track of their daily tips.

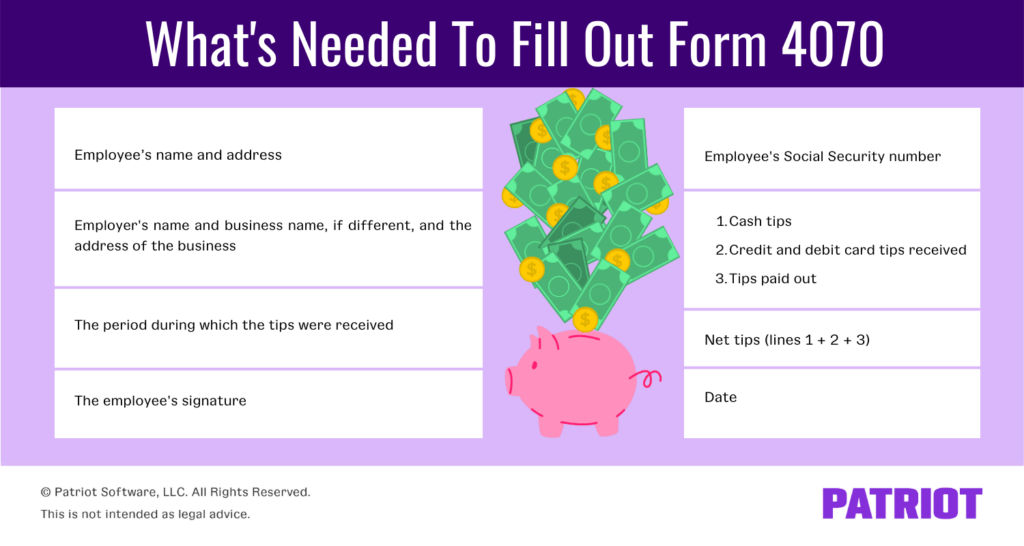

Form 4070 asks for:

- The employee’s name and address

- Their Social Security number

- Your name, address, and business name, if different from yours

- Cash tips received

- Credit and debit tips received

- Tips paid out

- The sum of cash tips, credit and debit tips, and tips paid out

- The period or month during which the tips were received

- The employee’s signature

Again, employees must report tips if they receive more than $30 in tips for the month. Report tips by the 10th day of the month following the month they earned their tips. In other words, an employee must report their June tips before the 10th of July, their July tips before the 10th of August, and so on.

If the 10th of the following month happens to fall on a Saturday, Sunday, or legal holiday, report tips as soon as possible as long as that day is not a Saturday, Sunday, or legal holiday.

Employees do not have to use Form 4070. They can submit their own document, but it must contain the same information as Form 4070.

Reporting tips at the point of sale

Tracking and reporting tips can be time-consuming for both you and your employees. Luckily, POS systems have been designed to help. There is a chance that your POS can help employees report their tips.

If your POS can help employees keep a daily record of their tips, Forms 4070A and 4070 may not be needed. Make sure that the correct information is available when your employees add up their tip income and send that information to you.

Reporting tipped employee’s income to the IRS

When it comes to your employee taxes, there are a few things to keep in mind. When completing your employees’ W-2, use Box 1 to report wages, tips, and other compensation, Box 5 for Medicare wages and tips, and Box 7 for Social Security tips. If there is any uncollected Social Security tax and Medicare tax, enter this in Box 12.

Use Form 941 to report income tax and FICA taxes withheld from employee wages, as well as your share of FICA taxes.

If you operate a large food or beverage business, you may also need to file Form 8027.

And last but not least, whatever way your employees choose to report their tip income, make sure that you’re prepared to store the information for at least four years after the reporting date.

Using payroll software can make keeping track of tips a breeze. Input is simple, and storage and retrieval of information are just as easy. If you’re looking for a better way to handle payroll for your small business, sign up for Patriot’s payroll software. We’re top-ranked for functionality, ease of use, value for money, AND customer support.

This is not intended as legal advice; for more information, please click here.