Investing is a smart way to build wealth for your future. However, if you want to go beyond investing in a tried and true index fund, it can seem daunting as well as time-consuming to pick individual stocks.

Fortunately, building a profitable portfolio doesn’t have to take a lot of time or be stressful. As a Motley Fool Rule Breakers member, you can skip the time commitment and jump straight to the good stuff.

But is Motley Fool Rule Breakers the right move for your stock portfolio? Here’s what you need to know.

Summary

The Motley Fool is a well-known source of stock investment information. With Motley Fool Rule Breakers, you’ll have access to two stock picks each month. These picks can help investors find potential winners without putting too much time into research.

Pros

- Two monthly stock picks

- Easy to implement

- Track record of success

Cons

- Annual fee

- No short-term picks

- No guaranteed success

What is Motley Fool Rule Breakers?

The Motley Fool was founded by Tom and David Gardner. Their goal was to provide investment ideas to the average investor based on solid research.

What started as a print newsletter offering investment guidance from a pair of brothers has grown into a well-respected research service for investors.

With over 100,000 loyal members using the service, you can feel comfortable trusting this long-standing platform. Motley Fool Rule Breakers regularly provides top-notch guidance to investors seeking individual stock picks.

In an industry full of scams, it is reassuring to know that The Motley Fool offers a proven track record with products designed for individual investors.

Instead of dealing with a pump and dump scheme, working with The Motley Fool provides useful tools for everyday investors.

If you identify as a regular investor without hours to commit to your portfolio each week, then Motley Fool Rule Breakers could be the right tool for you.

How Does Motley Fool Rule Breakers Work?

You are cutting out the major time commitment that is typically involved with stock research when you sign up for Motley Fool Rule Breakers. Instead, the service will handle the bulk of the research for you.

Each month, members receive two new stock picks. From there, you can choose to invest in those stocks or not.

Before you start looking for overnight returns, keep in mind that this service is designed for long-term investors.

Motley Fool Rule Breakers suggests that you hold at least 25 of the stock picks for at least five years to build wealth for the long term.

Although there are no guarantees that the provided stock picks will do well, the site’s proven track record can help you feel more comfortable with this strategy.

Cost Of Motley Fool Rule Breakers

Working with Motley Fool Rule Breakers isn’t free. Luckily, it is more affordable than you might expect.

New members can sign up for $99* for their first year. If you decide to renew for another year, the price will jump to $299 per year.

You’ll have up to 30 days to enjoy a membership fee-back guarantee to see what the service is like. In the event you decide it is not a good fit for your needs, you can get your membership fee back.

Key Features

If you want to build a profitable portfolio of individual stocks with considerable growth potential, without sinking hours into it, then Motley Fool Rule Breakers should be a top consideration.

At a relatively affordable price point, you’ll unlock the following features.

Two Stock Picks Per Month

The main draw of Motley Fool Rule Breakers is that the company conducts extensive research for members. Instead of sitting down to dive into the details of potential investments, you can see what The Motley Fool has suggested.

With two new stock picks each month, you can build a robust portfolio of 24 individual stocks within a year. The best part is that experts are working behind the scenes to find stock picks that they anticipate can outperform the market.

Easy-to-Implement Guidance

Once you receive the stock picks for the month, it shouldn’t take more than a few minutes to implement the guidance in your portfolio.

Essentially, you’ll need to decide whether or not you want to move forward with that particular stock purchase. If you do, then it is just a matter of logging into your brokerage account to execute a buy order.

Long-Term Outlook for Individual Stocks

This service is designed for investors looking to build a portfolio for the long term. The Motley Fool believes that “the best chance to succeed in the stock market is to buy at least 25 stocks and hold them for at least five years.”

If you have a relatively long-term outlook for your portfolio, then the Motley Fool Rule Breakers service could be a good fit. You’ll need to be ready to hold onto your stock picks for at least five years to see the potential upsides.

It is important to keep in mind that stocks go up and down. If you’ve paid attention to the market in the last year, it is easy to see the volatility embedded in this popular investment option.

Although investing can pay off in the long run, you shouldn’t bank on these stock picks earning great returns overnight.

Proven Track Record

The goal of any individual stock investor is to grow their portfolio. The Motley Fool Rule Breakers service is designed to help members do exactly that.

Better yet, they have the numbers to back up their claims.

In the past 15 years, the service has more than tripled the S&P 500. That’s an impressive stat for any investor. Here’s another look at the stats.

On average, the Rule Breakers recommendations have returned over 201%**.

A few of the top picks include:

- MercadoLibre – Up 5,307% as of July 2022

- Shopify – Up 1,677% as of July 2022

- Tesla – Up 12,855% as of July 2022

These are just the tip of the iceberg. The service has recommended more than 137 stocks that have achieved returns of over 100%. With such impressive numbers, I think it’s possible to find some success with these picks.

Remember that not all picks are winners. It is entirely possible to lose money on these investment selections. With that, it is important to consider your risk tolerance before jumping into the stock market at all.

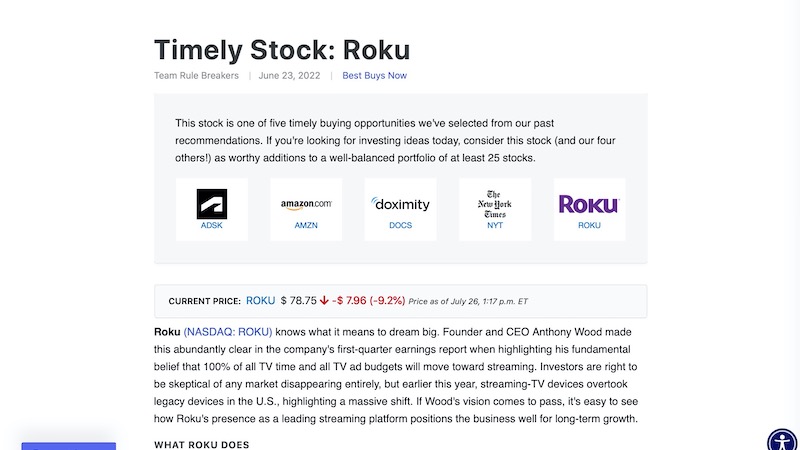

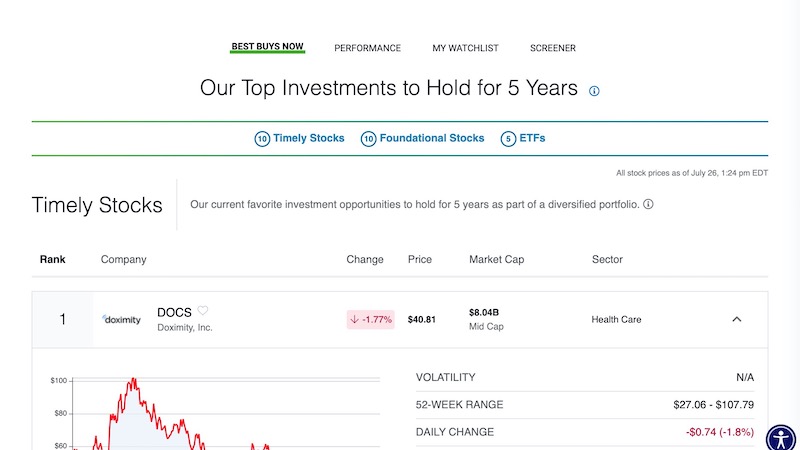

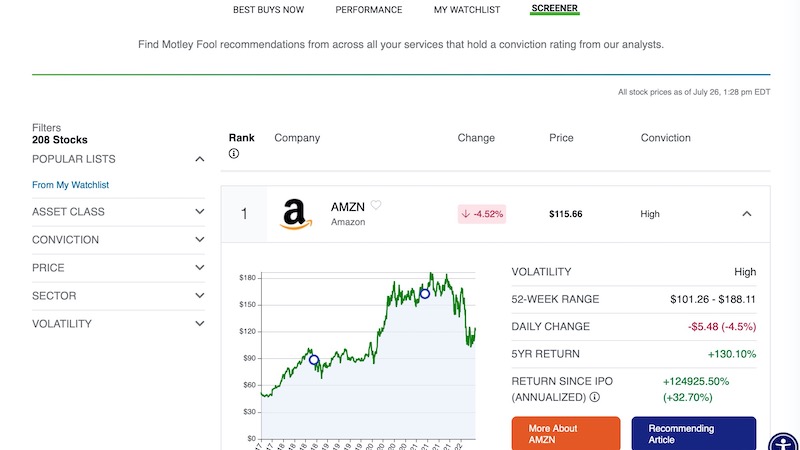

Stock Screener

The members-only stock screener lets you quickly identify potential investments from the open recommendations in the Rule Breakers portfolio.

It can be challenging to invest in every monthly pick and the screener can help find stocks fitting your criteria to maintain a diversified portfolio.

Rule Breakers Reviews

Here are some reviews from people who have used the platform:

“Motley Fool’s changed my life in this main respect: I’m financially independent today. I didn’t think that would be possible until maybe my mid or late 60s. I have the ability to make choices and quality-of-life decisions now that I would never be able to make before.” – Mark T

“I use the Fool to do the things that I don’t have time to do. If you have a busy life and want to invest in the market, this is one of the best vehicles to support you in doing that.” – Bob A

Is Motley Fool Rule Breakers Worth It?

Joining Rule Breakers can be worth it if you’re an aggressive investor with a long-term investment horizon. This service looks for growing companies that most investors don’t know about and it can take several years of volatility to realize a profit.

You must also be comfortable with the $299 annual subscription fee after the introductory $99 rate for the first year. In comparison, this cost is cheaper than similar competitors.

Motley Fool Rule Breakers Alternatives

If you are looking for help with researching investments and the high ratings aren’t compelling enough, the Motley Fool Rule Breakers service is not your only option. In fact, it isn’t even the only offering available from Motley Fool.

Here are a few other options worth considering.

Motley Fool Stock Advisor

The Motley Fool Stock Advisor is a premium newsletter service that also offers two new stock picks each month.

Motley Fool Stock Advisor provides two monthly stock picks, ten “Starter Stocks,” a “Best Buys Now” feature and more to help investors find great options for their portfolios.

This service is a bit cheaper than Motley Fool Rule Breakers when it comes time to renew your subscription. The first year for new members costs $99^, and the second year costs $199.

You can also take advantage of a 30-day membership-fee back guarantee.

^Based on $199/year list price. Introductory promotion of $99 for the first year is for new members only

Seeking Alpha

If you want to stay away from The Motley Fool altogether, consider trying Seeking Alpha.

Seeking Alpha gives you access to investment research and a rating system to assist with your research. With unlimited investment ideas, you’ll have to do a bit more work to determine which stocks are poised for growth.

The platform offers a few subscription options, ranging in price from free to $299 per month. You can also access a free 14-day trial to determine if the service is right for you.

Stock Rover

Stock Rover can be another great choice if you are looking to branch out beyond The Motley Fool investment products.

The service offers useful tools like a stock screener, portfolio tracking and comparison tools. It costs anywhere from $79.99 to $279.99 annually depending on the subscription you select.

Customers can try the service for free for 14 days.

Zacks Premium

Another option if you’d like to avoid The Motley Fool services is Zacks Premium. This investment research service is the cheapest option offered by Zacks.

At a cost of $249 per year, you’ll get stock rankings, premium stock screeners, analyst reports and more. You can also take advantage of a 30-day free trial and a 90-day money-back guarantee.

Zacks offers other subscriptions as well, each with varying costs and features. Check out the Zacks website for more information.

FAQ

If you are still on the fence about using Motley Fool Rule Breakers, these frequently asked questions might be able to help you make a decision.

The annual fee of $299 for Motley Fool Rule Breakers could be worth it, but it depends on your unique situation. If you are looking to receive regular stock picks to help you grow your portfolio for the long term, it could be a great choice.

However, if you are looking for a quick return on your investment, then you may want to look elsewhere.

Yes, The Motley Fool is a legitimate company. You’ll find a variety of services designed to help investors build portfolios that meet their financial goals. It also has a long history of helping investors pick individual stocks.

The Motley Fool offers an online database of support articles to help you. You can also get email support if you have questions about your account.

The service offers a 30-day membership-fee-back guarantee. If you are not happy with the service, you can get a refund of your membership fee as long as you cancel within 30 days.

Summary

Motley Fool Rule Breakers presents a great opportunity for investors who are short on time. Without putting too much time into your portfolio, you can access hand-picked stock choices that The Motley Fool believes are bound to grow.

Of course, not every pick will knock it out of the park. That said, if you decide to invest with the help of Motley Fool Rule Breakers, you could be on the path to building long-term wealth.

*Rule Breakers discount based on $299/year. Introductory promotion of $99/year for new members only.

**Returns as of 7/26/22. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.