Life happens. Bad things happen to cars, homes, and even apartments. Although you may be lucky for years at a time, it is likely that you will need to file an insurance claim at some point.

If you have already had the misfortune to go through the insurance claims process, then you know it can be an awful ordeal. You may have to battle with unhelpful agents and rules to get your claim covered.

Finding home insurance can be difficult, too, because not everyone is willing to take a chance on you.

Throughout the process of getting insurance and filing a claim, you have to realize that the insurance company profits when they deny you a claim. They usually want to keep the premiums high and the payout low. That is where Lemonade is different.

Summary

Lemonade is a great insurance company that offers good policies to many people. However, insurance is a very personal thing, so make sure that you are signing up for the right plan for you and your home.

Pros

- Easy to apply

- Competitive pricing

- Fast claims processing

Cons

- Limited state availability

- No bundle option

What is Lemonade?

Lemonade is a company that sells renters insurance, as well as homeowners insurance and condo insurance.

It is different from most other renters insurance providers on the market because of its unique business model, which seems to support the claim that the company is genuinely dedicated to helping its customers and the communities it operates in.

They even have an A+ rating with the Better Business Bureau.

How does Lemonade work?

When you pay your premium, 20% will go toward operating the business. This includes things like paying salaries, updating the app, building a better product and more.

The remaining 80% is used to cover claims from customers. Once a year, leftover money is given away to charity. Without the incentive for extra profits, the policies at Lemonade allow for a very fair coverage of claims.

The policies are fairly basic, but still useful. Some of the things the policies provide include personal liability coverage, theft or damage to your possessions, medical assistance if someone is injured in your house, and assistance to cover the cost of accommodation if your residence becomes uninhabitable for any reason.

You have the option to add to your insurance coverage for an extra fee. A few of the things you can add on include earthquake damage, accidental damage to your things or extra coverage for valuables.

If you choose to insure your valuables, the items will be covered for loss, theft or accidental damage no matter where it happens. Currently, you can buy additional coverage for fine art, bikes, cameras, jewelry and musical instruments.

Who can get covered by Lemonade?

The company is operating in several states and Germany, but it is not available across the country. As of January 8, 2021, the company offers policies in Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, and Wisconsin.

The startup is growing quickly, and most of its customers are under 35. Although you can get insured through Lemonade at any age, the digital transparency of the company has attracted a young demographic.

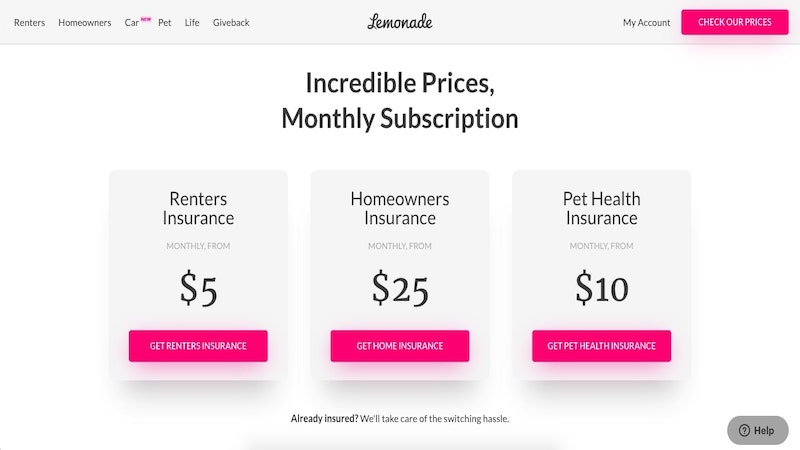

Lemonade costs

Insurance is a variable item, so it is impossible to know what kind of rate you would receive. Many factors go into the premium decision including your recent claims, credit history, property details, and more.

However, renters insurance policies start at just $5 per month. The $5 will give you very basic coverage, but you are able to add on to your plan to get the coverage you want.

As a general rule, the more coverage you want, the higher premium you will have to pay. That is standard with every insurance company, including Lemonade.

What are the best features of Lemonade?

Easy coverage add-ons

You can choose to add coverage for valuable items that matter to you. As you decide on a policy, Lemonade will show you exactly how much extra you will need to pay for each additional protection.

It is hard to beat the ease of coverage through this company.

Growing coverage

The company is currently expanding, which is great for you. The more coverage areas the company has, the more options you have. If you don’t live in an available state yet, don’t worry. Lemonade is trying to make its way to you soon!

Zero everything policy

In some states, you are able to choose the Zero Everything policy. The policy offers a zero deductible for claims, which means that if any of your items are damaged or stolen, you can make the claim without having to put up some of your own money. This is great in situations where you do not have extra cash lying around to replace your items.

Also, you do not have to worry too much about rising rates. The company will not raise your rate because of a claim. That promise is good for your first two claims. After that, Lemonade may raise your rates after you file a claim.

Outside coverage

Although it’s great to have coverage within your apartment, sometimes things happen outside. Many of us have an outside storage locker to hold our things. Most insurance companies do not cover claims for items in this storage area, but Lemonade does.

So, you do not have to worry about anything happening in the storage area, you are covered. The items will be covered for 10% of their value or $1000, whichever is the higher value.

In addition to onsite storage, your personal items are covered anywhere in the world. So, your items are still covered if you happen to be on a trip. The only catch is that your deductible will apply and you will have to go through the process of filing a police report with the local PD.

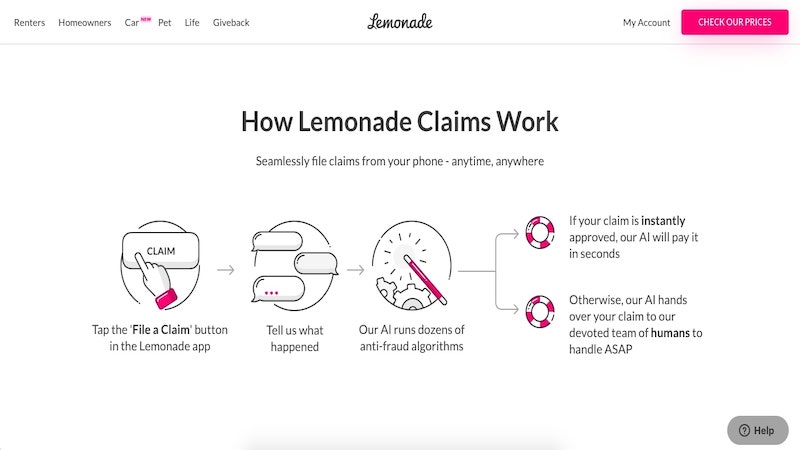

Fast and painless settlements

You do not have to deal with an actual insurance agent or fill out a mountain of paperwork. In fact, most of the claims made through Lemonade are paid digitally within minutes. Instead of fighting for your claim, you can just send a list of what is missing and a video to explain what happened.

Lemonade says typically, claims are paid within minutes, even in seconds. In fact, the company set a world record for the fastest processing of an insurance claim in just three seconds. Occasionally, it will take longer but only if your claim needs to be processed by a human, instead of the company’s artificial intelligence program.

Family coverage

Your policy will cover all of your family members at no extra cost. Additionally, you can have your landlord covered if your lease agreement requires it.

Roommates are not covered by your plan, so they will need to get their own insurance.

But, you will not have to pay extra for a spouse. Also, the company says that you do not have to pay extra for a significant other, but you should make sure to get enough coverage for both of you.

Covers 16 perils

Lemonade will cover you from the 16 perils that are outlined in your policy. Should any of the perils destroy your stuff, you will be paid the replacement value quickly.

The 16 perils covered by Lemonade are:

- Volcanic eruption

- Freezing

- Sudden and accidental tearing, cracking, burning or bulging

- Sudden and accidental damage due to short-circuiting

- Weight of ice, snow or sleet

- Theft

- Falling objects

- Accidental discharge or overflow of water or steam

- Smoke

- Vehicles

- Aircraft

- Explosion

- Vandalism

- Riots

- Windstorm or hail

- Fire or lightning

Some of these perils are only covered in certain states.

It is good to note that these 16 perils cover more than most insurance companies do. You will be able to make a claim if any of these perils break your things.

Simple cancellation

If you choose to cancel your policy, you can do so at any time through the app. It is a quick process that should take a few minutes. After you have canceled, the company will give you a full refund for the remaining time on your coverage period.

If you change your mind, you are always able to come back. Keep in mind that if you come back it will be under a new policy that may have a different rate.

Covers medical expenses if your dog bites someone

If your dog bites someone, you will generally be covered. The dog needs to have a clean history and not be categorized as a high-risk breed. If it passes those standards, then you do not have to worry about the medical expenses that would follow your dog biting someone.

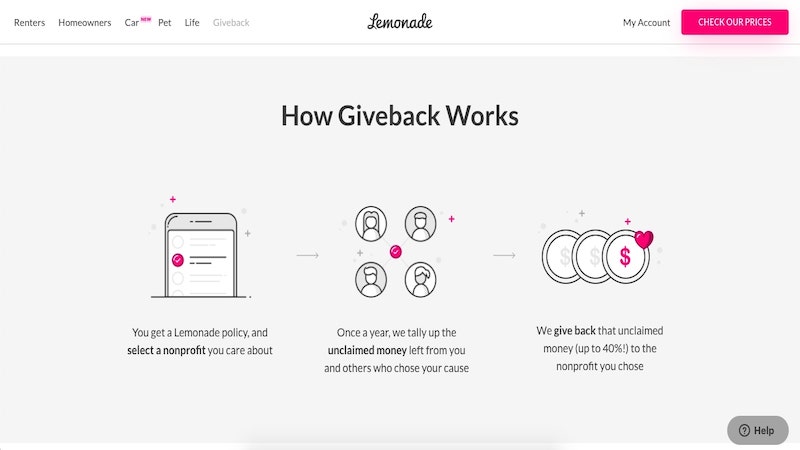

What is Lemonade Giveback?

Lemonade has something called “Giveback” as a part of its business plan. Each year Lemonade donates leftover claim funds to charity.

The company takes its role of giving back to the community and protecting the consumer seriously. It is classified as a B-corporation, which is a for-profit corporate entity that includes having a positive impact on society, workers, the community and the environment as part of its legally defined goals.

Lemonade will treat policyholders that care about similar causes as a group of peers. The extra claim money from each peer group will be donated to a charity that champions a common cause.

Giveback is a unique program. If you want to do business with an insurance company that is helping others in your community then this is the perfect solution. Although Giveback is not guaranteed every year, the company hopes that it will be able to support worthy charities at every opportunity.

How to get started

It is very easy to switch over to Lemonade. Before you decide to make the jump, check out the prices on their website. The company has a very simple series of questions that will find out more about you, your home and your stuff.

After you make it through the questions, the site will give you an insurance quote. You have the option to sign up for that new rate right away. It should take just a few minutes to sign up with the company.

If you are worried about switching from a different insurance company, don’t be. Many people have left other insurance companies to work with Lemonade. The company will even help you make the transition from the other insurance company.

Read your policy carefully before you sign up. It is important to know exactly what kind of coverage you are paying for. If you feel that you need more coverage then look into the optional add-ons.

How to file a claim

Once you are a customer, you may have to file a claim. Hopefully, you don’t have too, but sometimes things happen. The good news is that it is extremely simple to file a claim with Lemonade. You can go through the app’s claim center.

It should take less than five minutes to file the claim. As a part of the claim, you will submit a video about what happened. Once your claim is approved, you can expect to be paid quickly.

The ease of this process is the best part of Lemonade. You never have to battle with an insurance agent again.

The perspective of a current customer

I had the chance to talk with a current user of Lemonade insurance, Russel Sinclair. He is a renter in New York City and is the vice president of product at Prevu Real Estate. Below are excerpts from my interview:

Why did you start using Lemonade?

The main reason I joined was that my renters’ insurance rates kept going up, despite my lack of claims, and I had heard Lemonade was offering rates as low as $5 a month. I was previously paying $300/year or about $25/month.

How long have you been using Lemonade?

I signed up with Lemonade in February of 2017.

Have you ever had to make a claim?

While I have never had to file a claim, I did ask about something I was not sure was covered by Lemonade.

My wife lost a ring and I asked them if it was covered and if my insurance rates would change. I was informed it was not covered but I could apply for jewelry coverage that would have covered it with no deductible had I added it to my policy in the past.

What is your favorite thing about Lemonade?

My favorite thing about Lemonade is that I never had to deal with a person on the phone to set up my policy. And it was so easy to set up. The last time I got insurance, I had to price compare on a third-party website.

I eventually picked Allstate because they had the coverage and price I was happy with. Then I had to submit the application on their site. A day later, I get a call from an insurance broker to finalize it all. It was tedious.

With Lemonade, it took about 10 minutes to get what I wanted, and they quickly set up my new policy and took care of my old cancellation. I was actually a bit suspicious at first because when my policy documents arrived, it felt too easy.

What is your least favorite thing about Lemonade?

My least favorite thing is that, like the “free” coverage you have with a credit card on car rental insurance, Lemonade’s basic $5 coverage is very basic. If you are at all concerned about the other incidents that can cause an issue with your renter insurance, you really need to add more coverage.

My policy costs my wife and I about $15/month. For couples that aren’t married, there’s another $7.67 charge to add a “significant other” which I feel isn’t really fair. All that said, it’s still a great deal.

Do you have any advice for a first-time user?

First-time users should be careful to discuss what coverage they really need on their insurance with Lemonade or a qualified advisor. It’s very easy to just go basic and end up regretting it later. (I actually got quoted on jewelry but declined when I signed up).

The coverage you need is dependent on where you are in life, what you own, and how much inconvenience you are willing to put up within a bad situation. Think about your personal situation before just jumping into the $5 deal.

Summary

Finding the right home insurance company can be exhausting. Knowing what you need coverage for is important.

Before you decide to sign up for Lemonade, take a closer look at the amount of coverage you need. Having a cheaper policy can be the wrong choice if your valuables are not covered.

Lemonade is a great insurance company that offers good policies for many people. Make sure you get the right coverage so you can rest easy knowing you are covered.