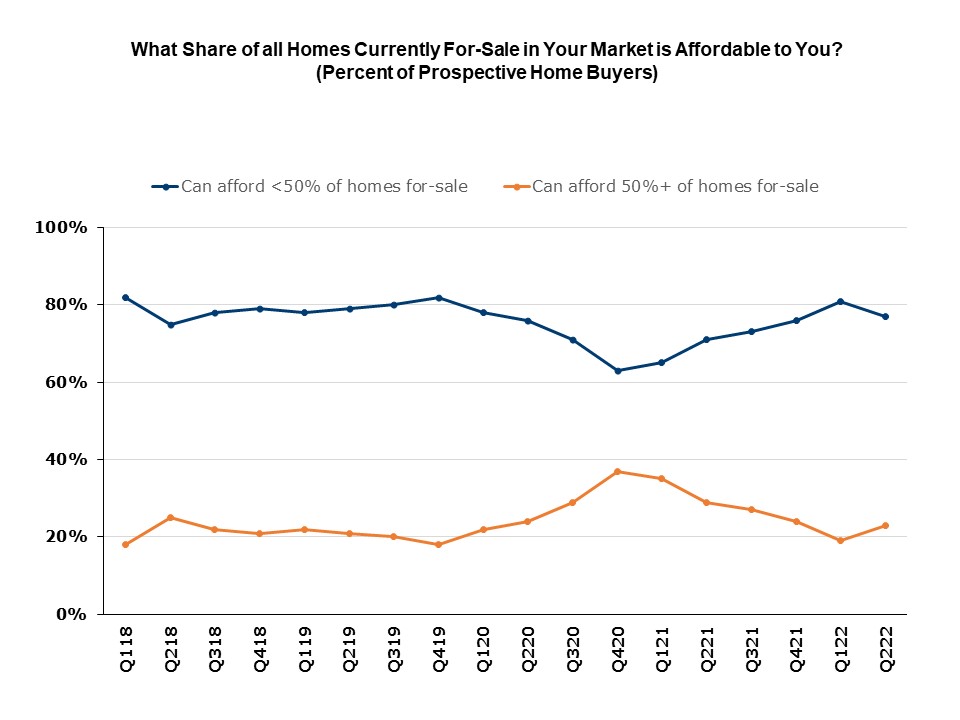

For the first time since 2020, affordability expectations improved in the second quarter of 2022. After rising steadily for five straight quarters, the share of buyers who can only afford a minority of the homes for sale in their markets declined to 77%, down from 81% a quarter earlier. Conversely, the share able to afford at least half the homes available rose from 19% to 23%. A likely reason for the pivot is that the exit of 1st-time home buyers from the market is tilting the composition of the pool of buyers towards wealthier buyers better able to absorb recent increases in mortgage rates.

Affordability expectations between the first and second quarters of 2022 improved in two regions. In the West, the share of buyers only able to afford a minority of homes dropped from 78% to 70%; and in the Northeast, from 77% to 73%. The share edged up in the Midwest (83% to 84%) and in the South (79% to 82%).

**Results come from the Housing Trends Report (HTR) – a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples of American adults conducted for NAHB by Morning Consult. Results are seasonally adjusted. A description of the poll’s methodology and sample characteristics can be found here. This is the fourth in a series of six posts highlighting results for the 2nd quarter of 2022.

Related