This will be a brief post and not the most exciting idea given the current chaotic market backdrop, but I wanted to throw something out there as it has been a while since hitting publish. I’ve mostly just been sitting tight, waiting for events to play out and adding to a few current positions during this downturn. I also don’t have much experience with insurance companies so be easy on me in the comment section.

Argo Group International (ARGO) is a specialty insurer (~$1.5B market cap) that first popped up on my radar screen in 2019 when it faced a proxy contest from Voce Capital, their largest shareholder (9-10%), which eventually added three representatives to the board. Voce put out an entertaining deck that outlined the now ex-CEO’s lavish lifestyle (corporate penthouses, art collection, sailing sponsorships, private jets, etc.) that was essentially being expensed through Argo.

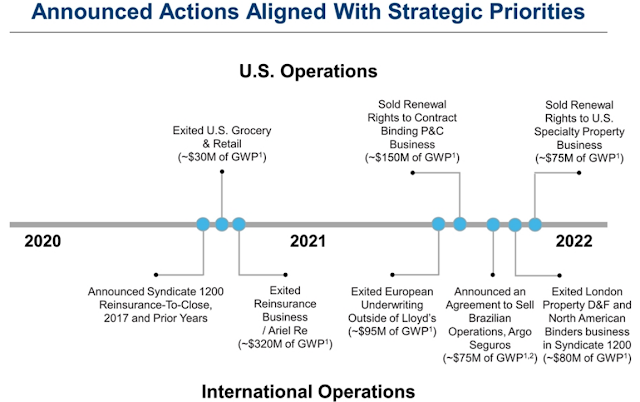

In the ~2 years since Voce refreshed the board and the ex-CEO resigned, Argo has gone about shedding unprofitable or volatile business lines to highlight the strong U.S. focused specialty insurance business.

The crown jewel is their excess and surplus business line that focuses on risks that standard insurance markets are unwilling or unable to underwrite. This the non-commoditized, less regulated corner of the insurance market and thus should be more profitable. The transformation goal has been to uncover and highlight this business:

However, the perceived slow speed of the transition and a surprise reserve adjustment in February brought forward another activist pushing for board representation in Capital Returns Management, an insurance focused hedge fund. Capital Returns has also insisted the company put itself up for a sale and the board agreed last week to run a strategic alternatives process which includes exploring a sale of the company. While, Capital Returns argues the board doesn’t have skin in the game (in aggregate they own ~1% of the company), there are three Voce representatives on the board and they’ve moved the business down Voce’s suggested path. My guess is Voce is in agreement that now is a good time to pursue a sale and the board is unlikely to resist a reasonable offer. In short, this may go from semi-hostile to friendly, the verbiage from the recent earnings call seems to imply that as well:

Thomas A. Bradley Argo Group International Holdings, Ltd. – Chairman of the Board & Acting CEO

Thank you, Greg, and thank you to everybody for joining us today. Before I jump into our results for the quarter, I’d like to take a moment to discuss our announcement last week. Over the last year, Argo has instituted a number of substantive strategic initiatives, actions that we believe have positioned the company for a clear and consistent long-term path to stable growth and profitability. The Board of Directors and management team, however, do not believe these initiatives are adequately reflected in the company’s current market valuation.

After much thoughtful and deliberate discussion and analysis, our Board with the assistance of our advisers has initiated an exploration of potential strategic alternatives. In this review process, our objective is simple: to maximize the value of the company’s strategy and its considerable long-term prospects for the benefit of all shareholders. To that end, the Board will consider a wide range of options for the company, including, among other things, a potential sale, merger or other strategic transaction.

What would be a reasonable valuation in a sale? Again, I’ve only looked seriously at 1-2 insurance companies here in the last decade. But below is a list of U.S. based peers that I took from Capital Returns’ proxy, and the data is from TIKR.

The sale process could take some time, maybe we hear something in 5-7 months, so again, there are likely more immediate/actionable opportunities in the current market dislocation, but keep this one on the watchlist.

Disclosure: I own shares of ARGO