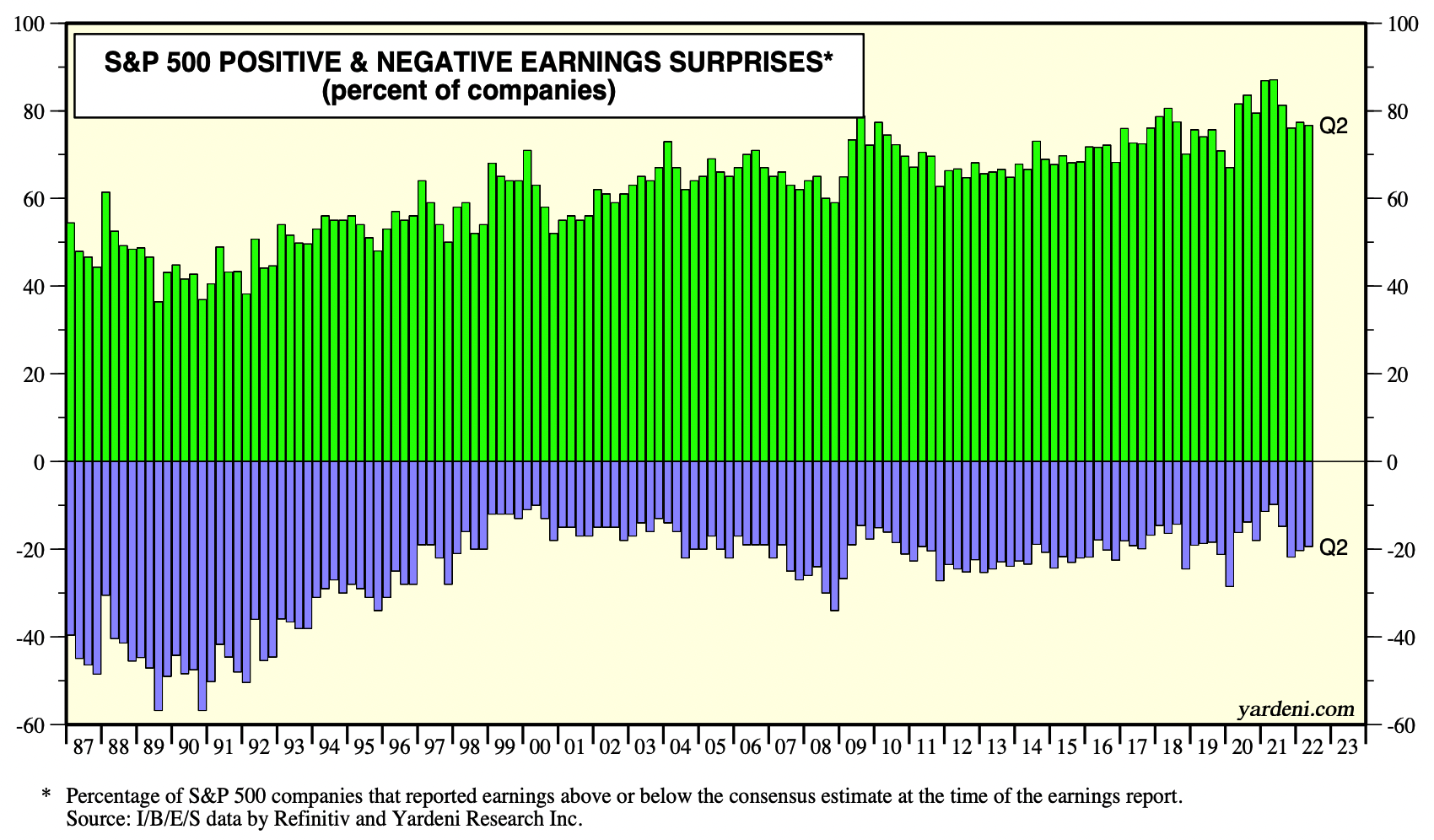

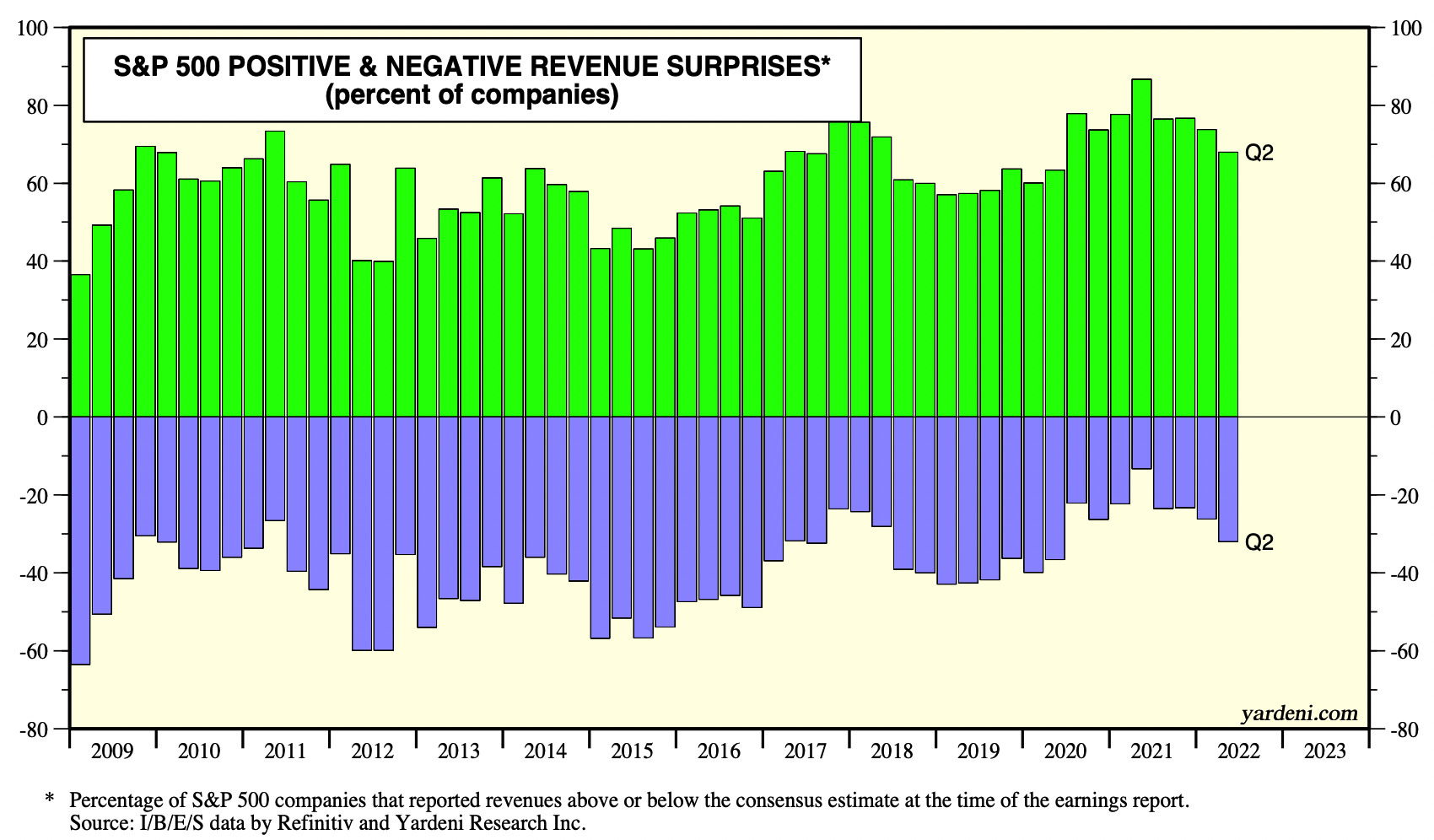

“With over 71% of S&P 500 companies finished reporting revenues and earnings for Q2-2021, the revenue and earnings surprises are at their lowest levels since the pandemic recovery began. Revenues are beating the consensus forecast by 2.5%, and earnings have exceeded estimates by 5.6%.” –Ed Yardeni

We enter the dog days of summer with markets coming off of their best July in years. There is some hope that the lows set in June will be “the bottom” and that markets can return to their prior upward bias.

Plenty of skepticism remains that it’s this easy: Markets have seemingly discounted a mild recession already but nothing more serious; the 2/10s yield curve has inverted a little more deeply than last time; CPI comes out next week, providing a fresh hint as to where inflation is, and what the Fed might do at their September meeting. If all goes well, perhaps all the optimism is warranted.

And yet . . .

There are lots of ways this rally can peter out. The biggest concerns are corporate revenue and earnings. All things considered, they have been holding up rather well. It appears investors are relying on earnings to stay robust even if the economy suffers a short, shallow recession.

Consider the Yardeni chart (top) showing earning surprises: Despite a variety of economic and geopolitical negatives, earnings have been holding up relatively well. (Revenues, too). And given that we are just about 3/4s of the way through Q2 earnings season you know, the odds of further surprises tend to drift lower (the bigger upside/downside surprises tend to pre-announce).

My concern is not Q2 earnings but rather, Q3: As we have shown repeatedly, the consumer and businesses have shown continued strength throughout the first half of the year. My concern is the impact of the aggressive FOMC tightening cycle. The dynamic results of these changes were not felt in the first two quarters of the year. The consecutive negative GDP prints were more a technical combination of inventory build trade, a strong dollar, and high inflation than an actual contraction of economic activity.

But that was before we had two consecutive 75 basis increases in rates — we went from zero a year ago to 2.25-2.50% from what was effectively zero prior to March of this year. And that is before we ended quantitative easing (QE), and replaced it with quantitative tightening (QT).

September is when we could see preannouncements that are rather ugly. It’s a bit too neat to expect an October revisit of the lows as the FOMC’s overtightening impacts corporate profits, but that is certainly one possibility.

I noted near the lows in June that I “The contrarian in me is just starting to get that itch to buy here, but it’s not a full-throated “Gotta gotta gotta get some” like 2020 or 2009.” I suspect the possibility of a great trading entry is out there somewhere. End of Q2 or beginning of Q3 are possible dates, depending upon how things play out.

In the meantime, the Dog Days of Summer are here. Enjoy them while you can . . .

Source: Yardeni Research

Previously:

Signs of Softening (July 29, 2022)

Soft Landing RIP (July 25, 2022)

Why Recessions Matter to Investors (July 11, 2022)

Too Late to Sell, Too Early to Buy… (June 16, 2022)