A reader asks:

For all these new home buyers who bought at massive house prices due to ultra-low rates…will they then get screwed when house prices normalize with ~6% rates being the norm? So like when they sell their home to move, they may be selling at a loss? Is this not a bubble waiting to pop?

This is always a possibility.

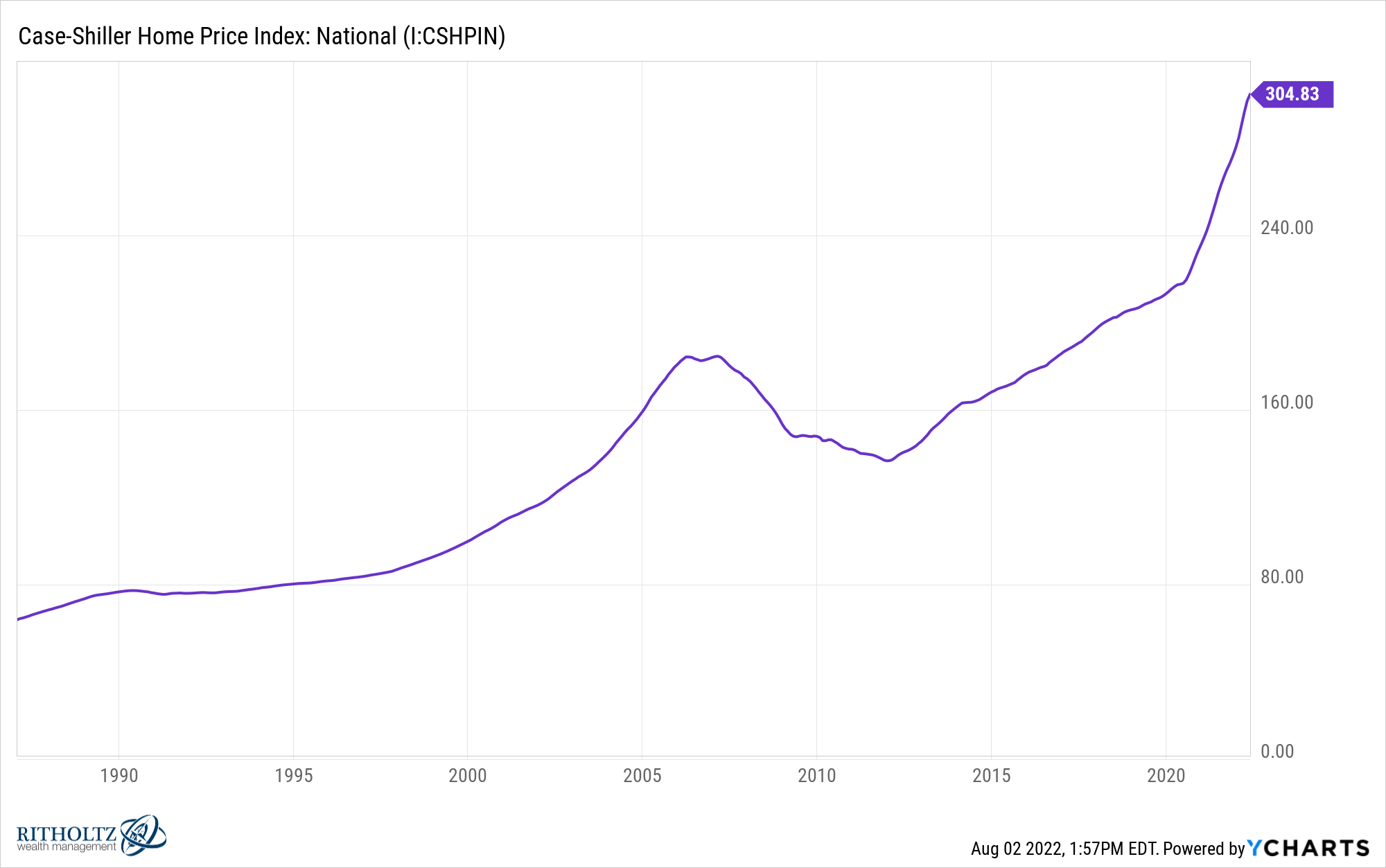

There was a massive pull forward in housing returns these past couple of years.

Just look at how off trend that spike is since the summer of 2020:

If higher mortgage rates stick around for the foreseeable future it wouldn’t surprise me if that led to a slowdown in housing prices or even a downturn.

It would probably be healthy to see prices fall 5-10% nationwide (and even more downside in the hottest markets).

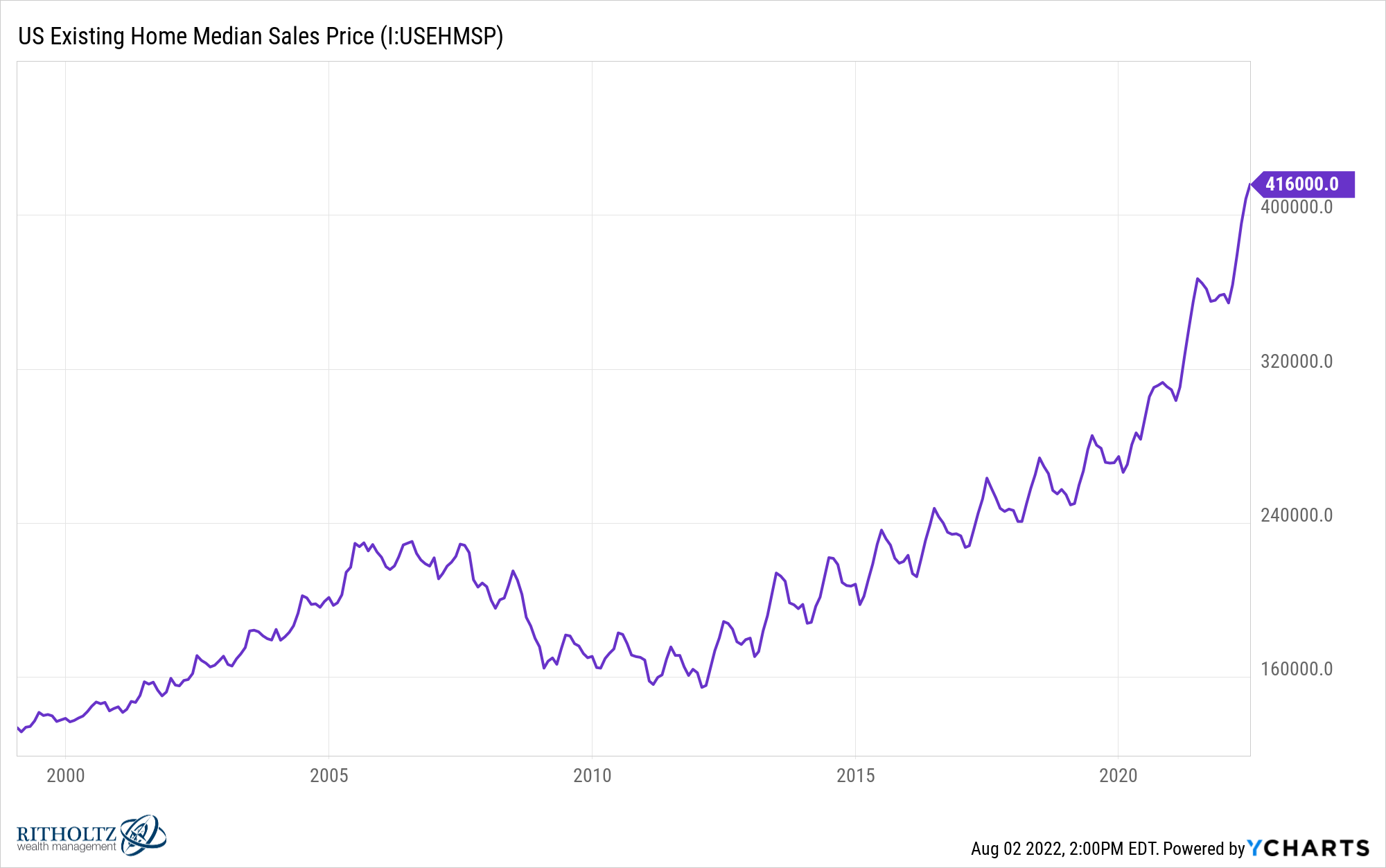

People have been forced to pay much higher prices in recent years because of the gains we’ve seen:

As recently as July of 2020 the median existing home sales price was just over $300k. It’s now well over $400k.

Does this mean all of the people who bought at these much higher prices are in trouble? Is this all a bubble waiting to pop?

I don’t think so.

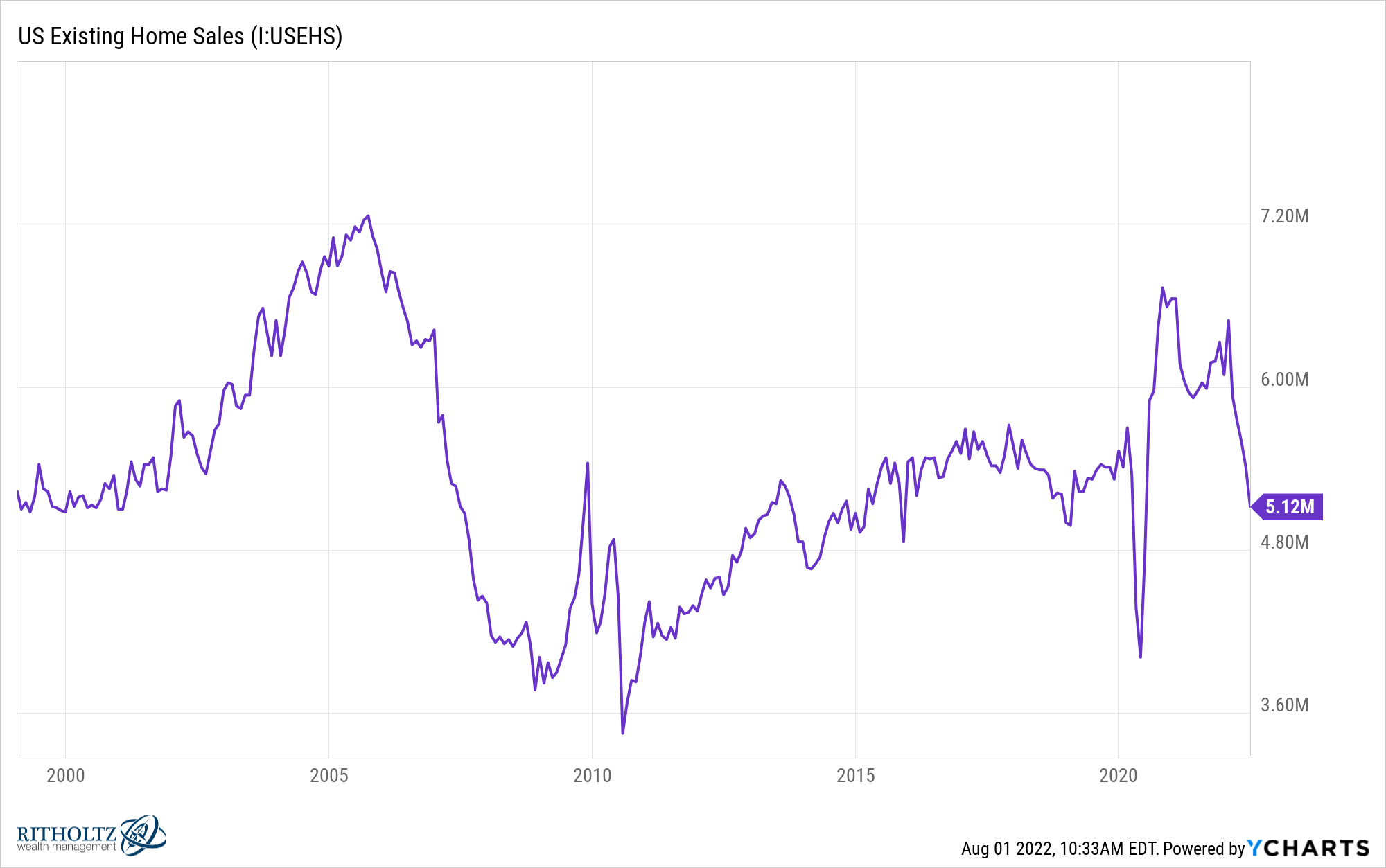

First of all, there have only been somewhere in the range of 5-6 million existing home sales per year in this run-up:

In the grand scheme of things that’s not nearly enough households to have an impact on the entire housing market.

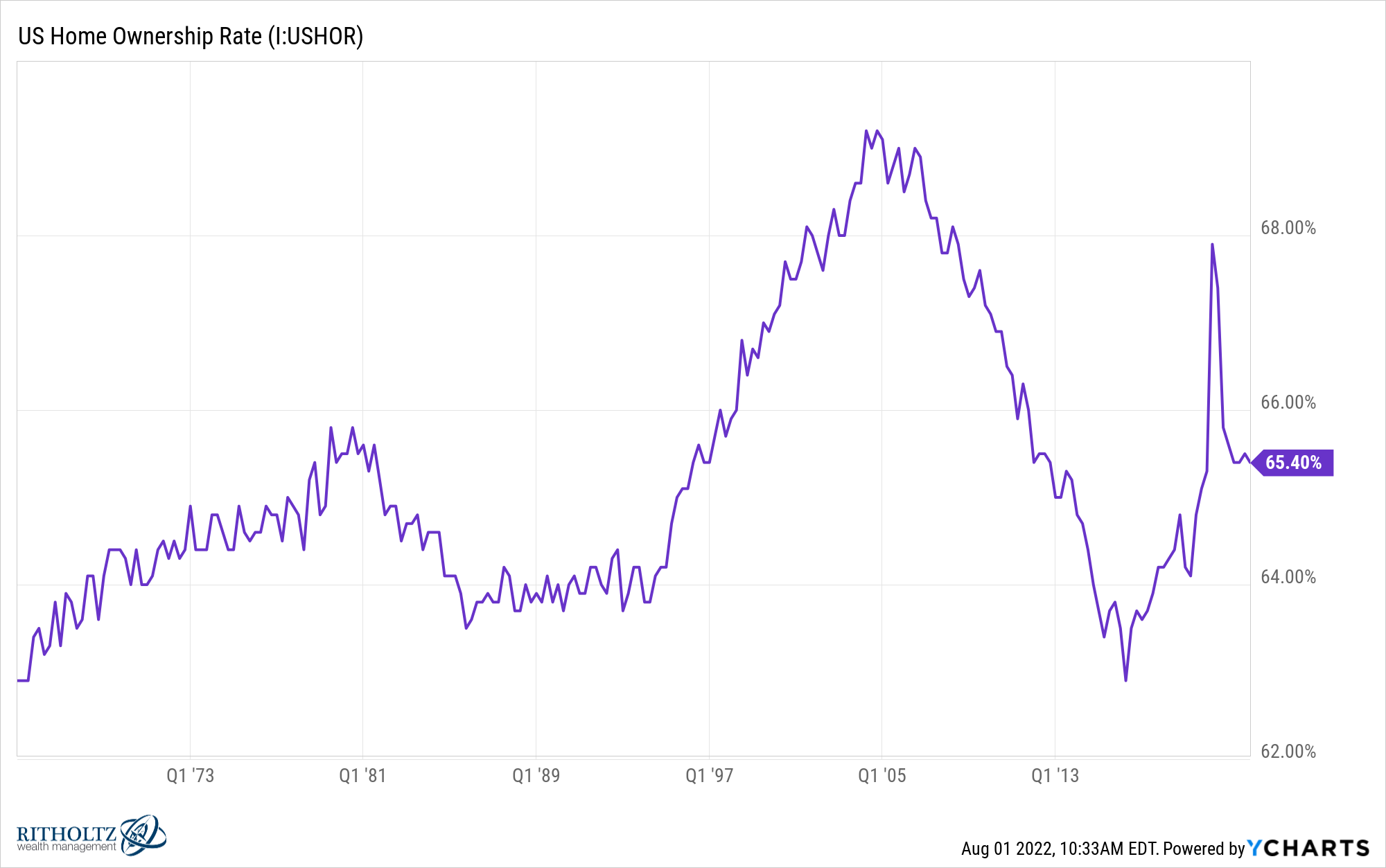

The home ownership rate in this country is still around two-thirds:

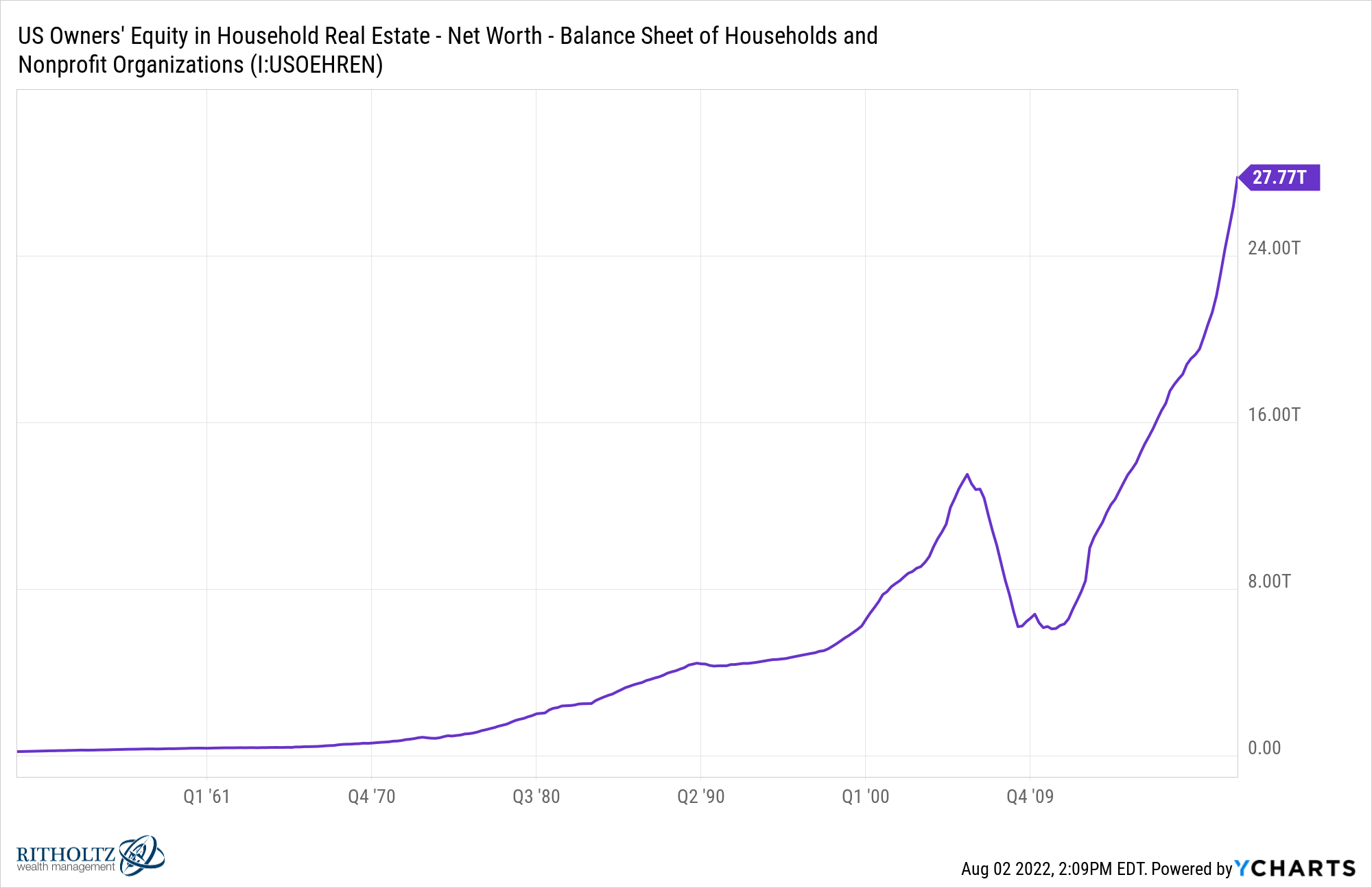

That’s a lot of people who have been in their house for much longer than the past couple of years. This is why the amount of home equity (house values less debt owed) is so high right now:

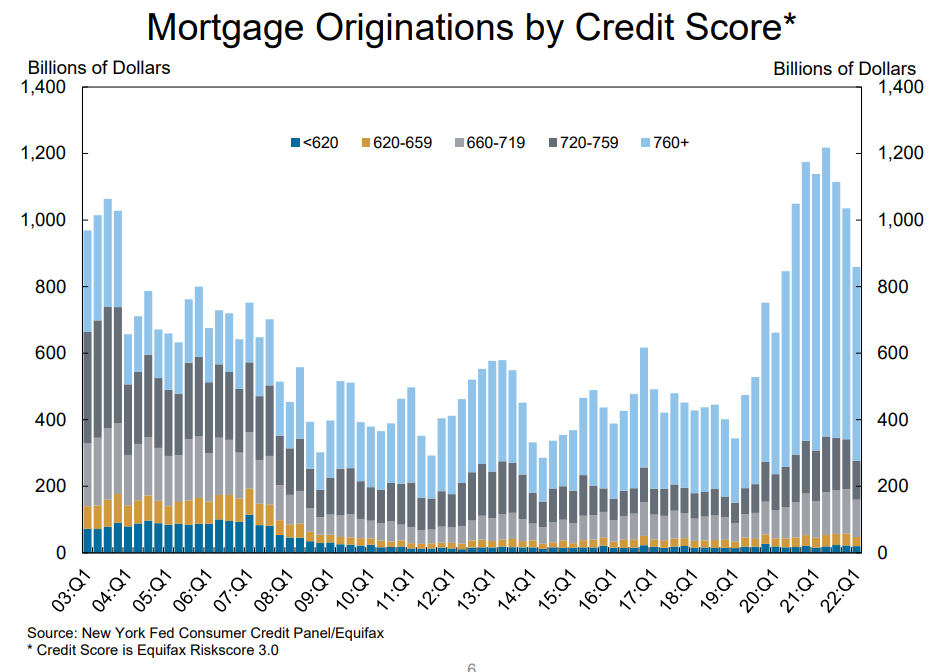

The people who have been buying these past few years have much better credit scores than the last time we had a housing boom in the early-to-mid 2000s:

These are households that can afford to service their debt, even if it came at higher levels than it was in the past from higher prices.

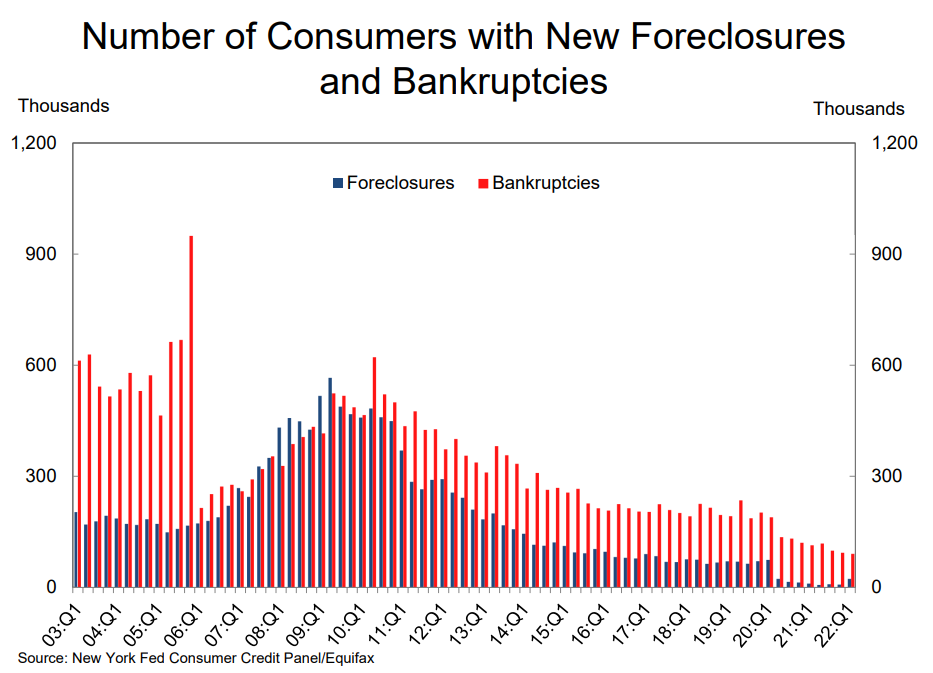

Look at how low the foreclosure and bankruptcies are right now:

I know the pandemic had a lot to do with these numbers but even if they rise in the coming months they remain well below historical averages.

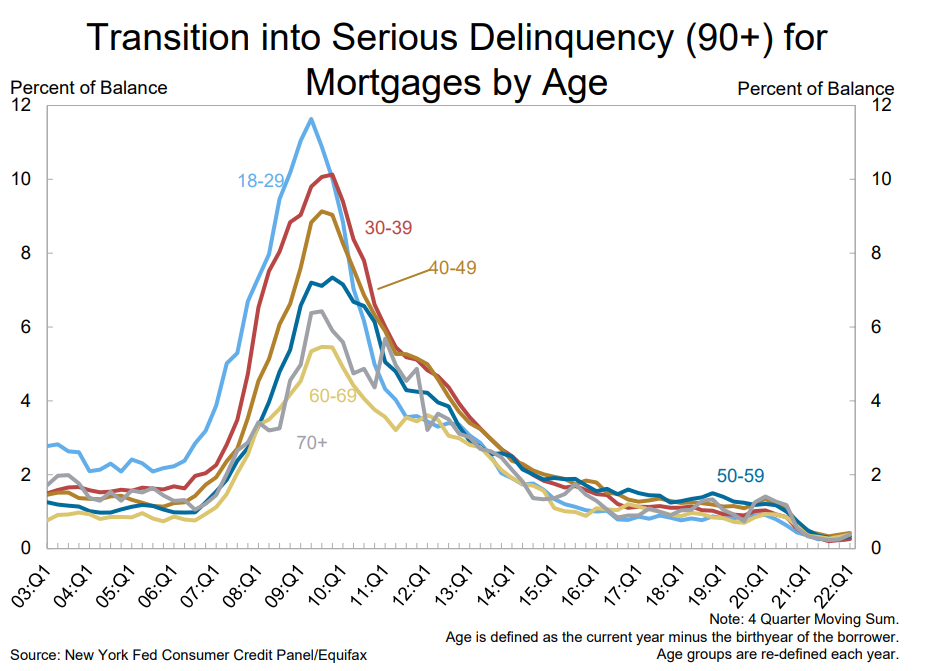

The same is true of mortgage delinquencies:

Let’s say housing prices fall 5% nationwide.

The median purchase price is a little more than $400k right now. That’s a loss of around $20k on the median home price. That might sting but it’s not the end of the world.

You also have to remember it’s rare for most people to turn around and sell their house immediately. Sure, it can happen when people have to move for career or family reasons or whatever but most people stay put in their home for longer than you think.

The average length people live in their homes is now 13 years.

If anything, a bunch of people holding 3% mortgages in a world of 5-6% rates should only lengthen that average, causing people to stay in their homes for longer.

Housing is a long-term asset. As long as you can afford the monthly mortgage payment, the price shouldn’t matter all that much until you have to sell it.

One of the reasons the housing bubble of the aughts was so painful is because so many people were being given loans beyond their means. Many of those loans were made using adjustable-rate mortgages that made monthly payments out of reach when rates began to rise later in the cycle.

ARM loans have increased in recent months but heading into this year they made up just 3% of all purchase applications.

There was no subprime debt orgy this time around.

It sure feels like a bubble when you consider the rise in prices since the summer of 2020. But the majority of home purchases in that time have gone to credit-worthy borrowers who now have an equity cushion in their homes.

Prices could definitely fall and they probably should. But this doesn’t mean the housing market is a giant bubble waiting to be popped.

This is not a big short situation even if prices have gotten ahead of themselves.

Further Reading:

How to Hedge Falling Housing Prices

No Portfolio Rescue today because Duncan is in London on his honeymoon and I’m in Northern Michigan on a family vacation. Back at it next week.