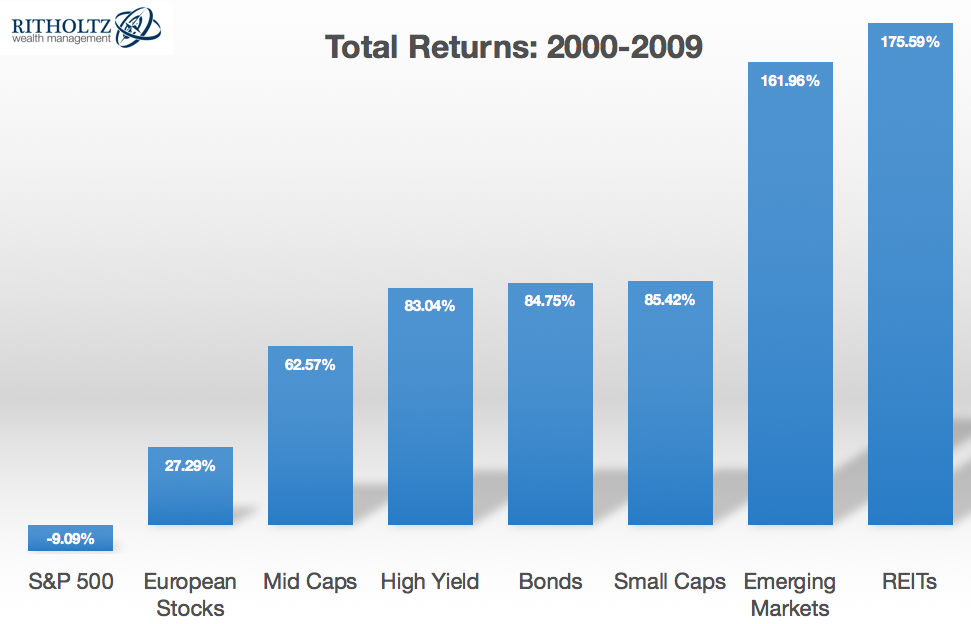

A decent bull market sandwiched between two of the most brutal bear markets in history produced one of the worst 10 year stretches ever in the S&P 500* in the first decade of the 21st century. Many investors labeled the 2000s as the “lost decade” for stocks. Considering the S&P lost around 1% a year in this time, it’s hard to argue with that classification.

However, this is just one group of stocks. Other markets, asset classes and regions of the world did much better during this period:

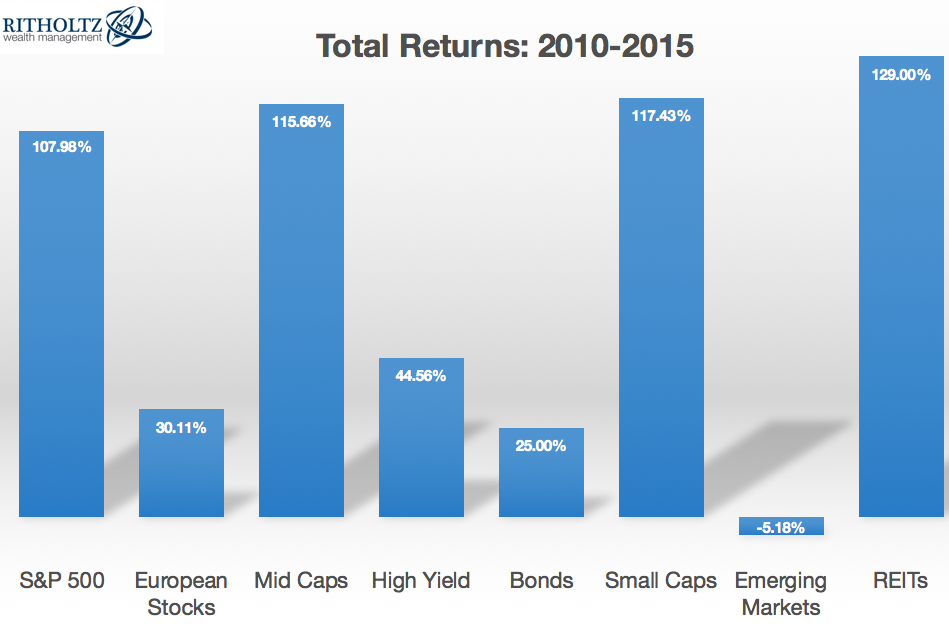

Nothing lasts forever in the markets and the follow-up to the lost decade has seen some massive mean reversion in these standings, most notably between the S&P 500 and Emerging Markets:

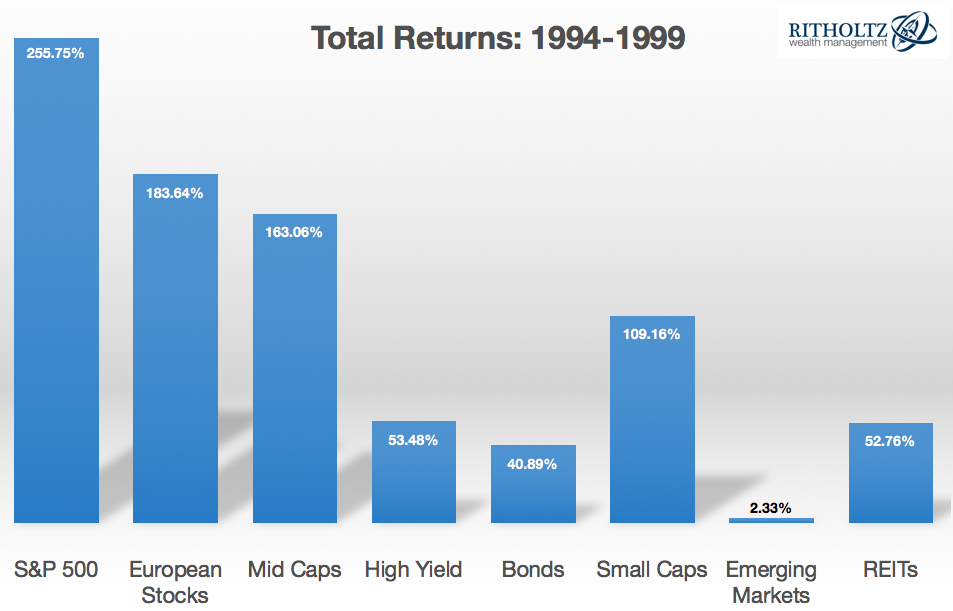

To bring things full circle, here are the returns for the six year period preceding the lost decade:

The cycle of great performance-terrible performance-great performance in the S&P 500 is pretty striking in these numbers. Emerging markets are the exact opposite with a streak of terrible performance-great performance-terrible performance. Apparently un-correlated returns do still exist in a more globalized financial world.

A few more thoughts on these numbers because I always find the cyclical nature of asset returns to be fascinating:

- The S&P 500 and emerging market returns offer a clean example of mean reversion in action, but not all of these markets exhibited the same boom-bust cycle. REITs were the strongest performers during each of the past two periods (perhaps making them a candidate for future mean reversion?).

- Even during seemingly terrible decades such as the 2000s, we can still see certain markets perform well (EM, REITs and bonds). And even during seemingly amazing decades such as the 1990s, we can still see certain markets perform poorly (EM).

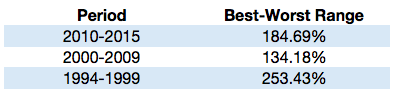

- The ranges between the best and worst performers in these cycles can be enormous, showcasing the volatile nature of these asset classes:

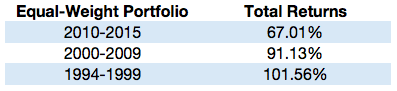

- The total returns for these various markets are all over the map. However, if you were to simply take the average of an equal weighted portfolio of these eight different markets you would get a total return stream that is much more stable for each time frame:

- Risk assets are unpredictable and yes, risky. Bonds can outperform stocks at times. Lost decades are going to happen in certain markets. Higher expected returns don’t always translate into actual higher returns in the real world because nothing lasts forever and trees don’t grow to the sky.

- Diversification isn’t just about spreading your bets and ensuring that you’re likely to participate in the best performing asset class or strategy; it’s about ensuring that you’re not overly exposed to the worst performer.

Further Reading:

When Diversification Works

*The worst 10 year return on the S&P 500 going back to 1927 was a loss os 5% a year in the aftermath of the Great Depression in the 1930s.

Data from Returns 2.0: S&P 500, MSCI European Index, Russell MidCap Index, S&P 600 Small Cap Index, Barclays High Yield, Barclays Aggregate, MSCI Emerging Markets and Dow Jones Wilshire REIT Index