Finally, the much-awaited IPO of Life Insurance Corporation of India (LIC), the largest insurance provider in India is here. The IPO opens on May 04, 2022

Let us all look into a few points that help us answer the question ‘Why should you invest in LIC”?

- LIC was established on September 01, 1956, by merging 245 private life insurance companies.

- It is a 100% Government-owned insurance company and it was the only life insurance company in India until the Government permitted private companies to enter the insurance field in 2000.

- It is the 5th largest player in the global life insurance arena in terms of Gross Written Premium(GWP) and the 10th largest life insurance company in terms of total assets.

- It has its presence in 14 countries all over the globe with 2,048 branches, 113 divisional offices, 8 zonal offices, and 1,554 Satellite Offices.

- It has its presence in Fiji, Mauritius, Bangladesh, Nepal, Singapore, Sri Lanka, UAE, Bahrain, Qatar, Kuwait, and the United Kingdom.

- It holds a big share of 74.6% in terms of all the individual life insurance issued in India every year.

- It has around 290 million active life insurance policies.

Competitive Advantages

- Largest insurance provider in India

- It has earned a huge amount of trust in the public for both life insurance as well as investment products. In simple words, LIC is synonymous with insurance in India.

- Over 13.5 lakh agents who help in the growth of LIC’s business.

Company Financials

| Particulars | For the year ended 31 Dec’21 (Rs. in millions) |

For the year ended 31 Mar’21 (Rs. in millions) |

For the year ended 31 Mar’20 (Rs. in millions) |

For the year ended 31 Mar’20 (Rs. in millions) |

| Total Assets | 4,09,07,867 | 3,74,64,044 | 3,41,41,745 | 3,36,63,346 |

| Total Revenue | 17,573 | 29,855 | 27,309 | 26,449 |

| Profit After Tax | 17,153 | 29,741 | 27,104 | 26,273 |

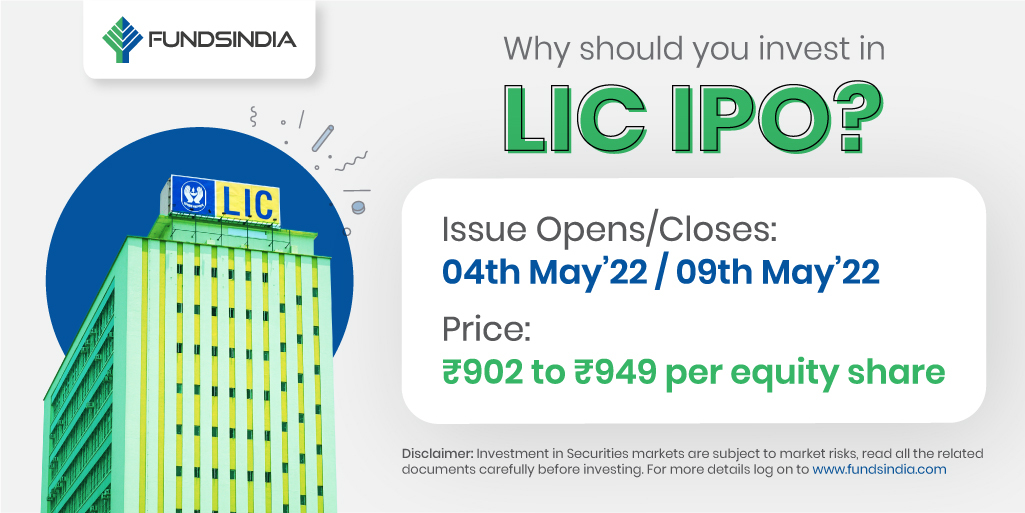

IPO Details

| IPO Date | May 4, 2022 – May 9, 2022 |

| IPO Price | ₹ 902 to ₹ 949 per equity share |

| Issue Size | Equity Shares of ₹ 10 (aggregating up to ₹22,13,74,920 Cr) |

| Market Lot | 15 shares |

| Minimum Order Quantity | 15 shares |

| Employee Discount | Rs. 45 per share |

| Policyholder Discount | Rs. 60 per share |

| Retail Discount | Rs. 45 per share |

| Listing At | BSE, NSE |

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 15 | ₹14,235 |

| Maximum | 14 | 210 | ₹ 1,99,290 |

So, why are you waiting?

Invest in one of the largest insurance providers in the global insurance arena and class up your portfolio

To know how to buy an IPO, click here.

Other articles you may like

Post Views:

5,132