2022 has presented Americans with the highest inflation in over 40 years, rising interest rates and frequent volatility in U.S. stocks and other asset classes.

Despite these conditions, donors have been steadfast in their support of charities and causes that are important to them. In the first six months of the year, Schwab Charitable donors granted $2.1 billion to charities, a 16% increase over the same period in 2021.

Advisors are uniquely positioned to help clients meet their charitable goals through tax-smart giving.

Charitable contributions remain deductible for clients who itemize deductions when filing their tax returns. In 2022, annual deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non-cash assets, if the assets were held more than one year, and 60% of AGI for contributions of cash. Contribution amounts in excess of these deduction limits may be carried over up to five subsequent tax years.

These eight strategies will help donors continue to give with maximum charitable impact and minimize their taxes before year end.

1. Donate appreciated non-cash assets instead of cash.

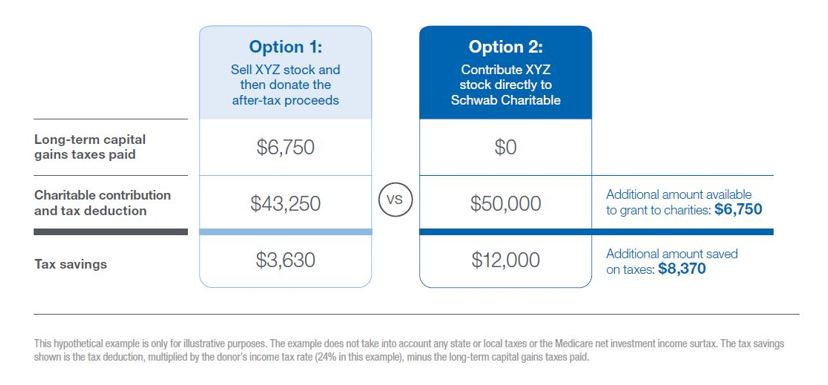

One of the most effective strategies for giving with maximum charitable impact and minimizing taxes is to donate appreciated non-cash assets held longer than one year. Clients who use this strategy generally can eliminate the capital gains tax they would otherwise incur if they sold the assets first and donated the proceeds.

The long-term capital gains tax is typically 15% or 20%, depending on the client’s income level. Eliminating this tax can increase the amount available for charities by up to 20% and increase the amount saved on taxes, as shown in option 2.

In the fiscal year that ended June 30, 61% of contributions to Schwab Charitable donor-advised fund accounts were in the form of non-cash assets, including publicly traded securities, restricted stock and private business interests.

2. Use both the standard deduction and itemized deductions by bunching two years of contributions into 2022.

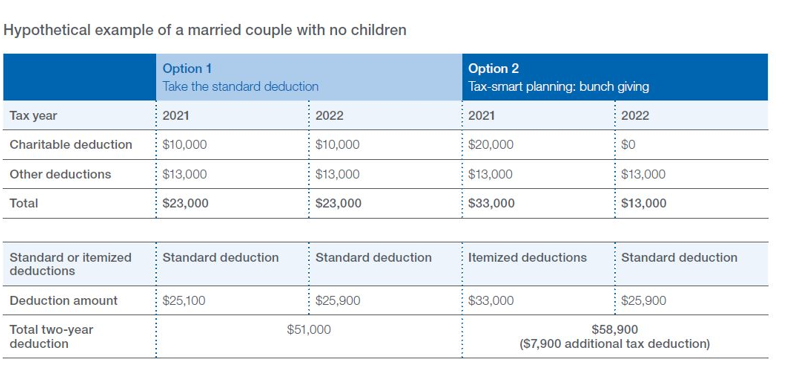

Some clients may estimate that the total of their itemized deductions will be below the level of the standard deduction for 2022: $12,950 for single filers or $25,900 for married couples filing jointly.

In that circumstance, it could be beneficial to combine or “bunch” their 2022 and 2023 charitable contributions into this year, itemize deductions on their 2022 tax returns, and take the standard deduction on their 2023 tax returns.

In addition to helping your client achieve a large charitable impact in 2022, a bunching strategy could produce a larger two-year deduction for them than two separate years of itemized deductions, depending on income level, tax filing status, and giving amounts each year. An example of bunching is shown in option 2.

3. Open a donor-advised fund account, make tax-deductible contributions before year end and decide on grant recommendations next year.

A donor-advised fund account may help clients separate the tax benefits of their philanthropy from their decisions about where to give. Any contributions of cash or non-cash assets received by December 31, including two years of bunched contributions, are eligible for a 2022 tax deduction. Clients who are unsure about which charities to support through their account may take time to develop a strategic giving plan and then start recommending grants to charities in 2023 using the charitable dollars they set aside in 2022.

4. Donate cash from the sale of depreciated securities.

Clients may also identify certain securities that are currently valued at less than original cost (cost basis) and sell those securities at a loss. Through tax-loss harvesting, capital losses can be used to offset capital gains and up to $3,000 of ordinary income. Your clients can then claim a charitable deduction if they donate cash from the sale proceeds.

5. Use a part gift, part sale strategy to offset capital gains tax from investment portfolio rebalancing at year end.

Clients can utilize a part gift, part sale strategy to reduce the tax impact of rebalancing. This goal is accomplished by claiming a charitable deduction for donating appreciated assets in an amount that offsets the capital gains tax on selling other appreciated assets.

6. Contribute appreciated privately held business interests or real estate.

These assets may have appreciated significantly over time for clients and retained more value than other assets in 2022. As with contributions of publicly traded securities, clients generally can eliminate the capital gains tax they would otherwise incur if they sold the assets first and donated the proceeds. They can claim a charitable deduction for their contributions.

Contributions of privately held business interests and real estate require special steps, including a qualified appraisal of the assets. Donor-advised funds, such as Schwab Charitable, have experience facilitating these contributions and can guide you and your clients through the steps and timelines.

7. Satisfy an IRA Required Minimum Distribution (RMD) through a Qualified Charitable Distribution (QCD).

Whether itemizing deductions or taking the standard deduction, any client age 70½ and older can direct up to $100,000 per year from their traditional IRAs to operating charities through QCDs.3 The QCD can be used to satisfy all or part of the client’s RMD for 2022 and is not considered taxable income for the client. Note that two individuals who submit tax returns with married filing jointly status each qualify for an annual QCD of up to $100,000.

8. Use a charitable deduction to offset the tax liability on a retirement account withdrawal or conversion to a Roth IRA.

Clients with tax-deferred retirement accounts, such as traditional IRAs, can use charitable deductions to help offset the tax liability on the amount withdrawn and converted to a Roth IRA. The primary benefits of a Roth IRA are tax-free growth, tax-free withdrawals (if holding period and age requirements are met), no annual RMD, and elimination of tax liability for beneficiaries (depending on the timing).

If your client is seeking to offset the tax liability on a standard withdrawal, remind them that if they aren’t over age 59½ they can incur an early withdrawal penalty.

What you can do next for your clients

Year-end deadlines always come faster than expected. Advisors may help clients start planning now to meet their goals.

Contributions must be received at charities by December 31 to qualify for charitable deductions on 2022 tax returns and some non-cash asset contributions have review and processing times spanning several weeks or longer.

In addition, a donor wishing to make a 2022 QCD should submit the request by the end of November to ensure the gift is received by December 31.

Sam Kang is President and Caleb Lund is Director, Charitable Strategies Group, both at Schwab Charitable, and Hayden Adams is Director of Tax Planning and Wealth Management, Schwab Center for Financial Research.