This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The US and China are close to an agreement to allow US regulators access to audits of Chinese companies that are listed on US exchanges, a potential breakthrough in talks that have languished for more than a decade.

Bankers in Hong Kong were informed of a possible deal earlier this week, according to people familiar with the matter. American depository receipts linked to shares in Chinese companies — including Baidu, JD.com and Pinduoduo — started trading higher on Tuesday, suggesting a resolution was in the works.

The US has demanded that Chinese companies and auditors make their financial audits available for inspection every three years by the Public Company Accounting and Oversight Board, a US auditor watchdog, or face a ban from Wall Street listings.

But China does not allow foreign regulators to inspect Chinese company audits, citing a desire to protect state secrets. Earlier this month, five state-owned Chinese companies said they would voluntarily delist from US exchanges before they were ousted in 2024 as a result of the pending ban.

Additional information about the potential deal and the timing of a possible announcement could not be learnt, but the PCAOB has said any agreement would include full US access to Chinese auditors. The PCAOB declined to comment on Thursday.

Thanks for reading FirstFT Asia. Have a restful weekend — Emily

Five more stories in the news

1. Shelling disconnects nuclear plant from Ukraine’s grid Fears of a catastrophic accident at one of Europe’s largest nuclear power plants escalated after Ukraine’s Zaporizhzhia reactor complex was cut off from the country’s electric grid owing to shelling. Ukraine’s state nuclear power company said the temporary interruption was the first time the plant had been disconnected from the grid. But it added that there were “no concerns” over a full-scale accident after back-up systems kicked in.

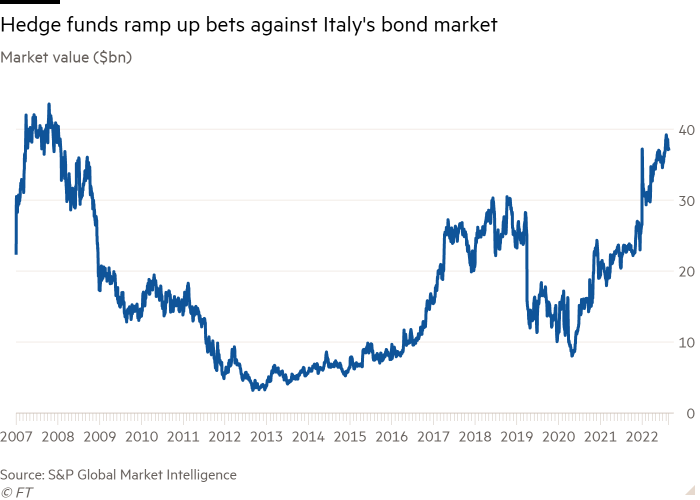

2. Hedge funds build biggest bet against Italian debt since 2008 Amid turmoil in Rome and the country’s dependence on Russian gas imports, the total value of Italy’s bonds borrowed by investors to wager on a fall in prices hit its highest level since January 2008 this month, at more than €39bn, according to data from S&P Global Market Intelligence.

3. China unveils $44bn in aid to bolster battered economy Beijing has announced tens of billions of dollars in stimulus measures in a bid to shore up confidence as China’s economy is battered by a snowballing property sector downturn and President Xi Jinping’s stifling zero-Covid policies.

4. Myanmar regime arrests former UK ambassador Vicky Bowman, the UK’s envoy to Myanmar from 2002 to 2006, and her husband, artist and former political prisoner Htein Lin, were arrested yesterday by the military regime, which seized power in a coup against Aung San Suu Kyi’s government in February last year.

5. Yen weakness forces unprecedented PlayStation price rise Sony has raised the price of its PlayStation 5 console in Europe, Japan, China and other key markets by as much as 10 per cent, as surging inflation and the plunging yen force the company to break with years of marketing strategy.

How well did you keep up with the news this week? Take our quiz.

The days ahead

Jianzhi Education Technology Group to start trading on Nasdaq When the education group filed for a US IPO last year, it was the first Chinese online firm to do so since Beijing tightened rules on overseas listings. (SCMP)

Federal Reserve chair Jay Powell in spotlight Powell will be the headline act in Jackson Hole, where central bankers are gathered this week. The audience will be keen to hear guidance on the US rate-setting path. His comments are likely to be hawkish given recent data on the US jobs market and views from the Federal Open Market Committee.

-

Opinion: The Fed’s travails over inflation show that narrative matters at least as much as models, writes Gillian Tett.

Asia Cup Twenty20 International The cricket tournament will kick off in the UAE on Saturday and run through to September 11. Afghanistan and Sri Lanka will play in the opener in Dubai.

What else we’re reading

China’s distressed asset funds struggle to profit from collapsing property sector Almost a dozen distressed investment funds told the Financial Times that they had not increased their exposure to residential and commercial properties, usually the most popular form of collateral in Chinese debt restructurings, despite soaring defaults in the real estate sector.

Higgin Kim: ‘People are genuinely rough. Art works like a tenderiser’ There is a rich recent history of South Korean conglomerates spending big on art in Seoul as part of their philanthropic activities. Conglomerate boss Kim has taken a different tack. The art is all his own, not Byucksan’s, and he has decided against building it a dedicated home.

Capital Group: the slow-moving giant in dangerous waters In a sea full of predators, Capital Group is like a whale shark: slow-moving, friendly and enormous. Its collaborative culture, low fees and dedication to active stock picking make it a well-respected outlier in the increasingly cut-throat world of asset management.

The budget drone changing global warfare The sleek Bayraktar TB2 is fast, cheap — with a seven-figure price tag — and deadly. Ukraine’s drone of choice has made Turkey one of the world’s top drone powers, pointing to a new era in which the technology becomes accessible to regimes that cannot buy from more established arms producers.

Big budget blockbusters land amid ‘peak TV’ fears Audiences can enjoy some of the most expensive programmes ever produced this autumn, from Amazon Prime’s The Rings of Power to HBO Max’s House of the Dragon. But the shows are being served at subsidised prices by streaming platforms making record losses, begging the question: have we finally reached “peak TV”?

Reader poll

This week, a group of Apple workers launched a petition as part of efforts to resist an order from chief executive Tim Cook to return to the office. Other Silicon Valley companies are more relaxed. Facebook’s owner Meta has embraced virtual working as a permanent alternative while Dropbox has declared itself a “Virtual First” company. Do you think staff should be forced back to the office? Vote in our latest poll.