Central banks are determined to bring inflation back under control. This was the message from Jay Powell, chair of the Federal Reserve, and Isabel Schnabel, an influential member of the board of the European Central Bank at the Jackson Hole symposium last week. So, why were the central banks so insistent on this message? Are they right? Above all, what might it imply for future policy and the economy?

“Reducing inflation is likely to require a sustained period of below-trend growth . . . While higher interest rates, slower growth, and softer labour market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” These were the words of Powell. Again, Schnabel argued that central banks must act decisively, since expectations risk being de-anchored, inflation has been persistently too high, and the costs of bringing it under control will rise the longer action is delayed. There are risks of doing too much and of doing too little. Yet “determination” to act is a better choice than “caution”.

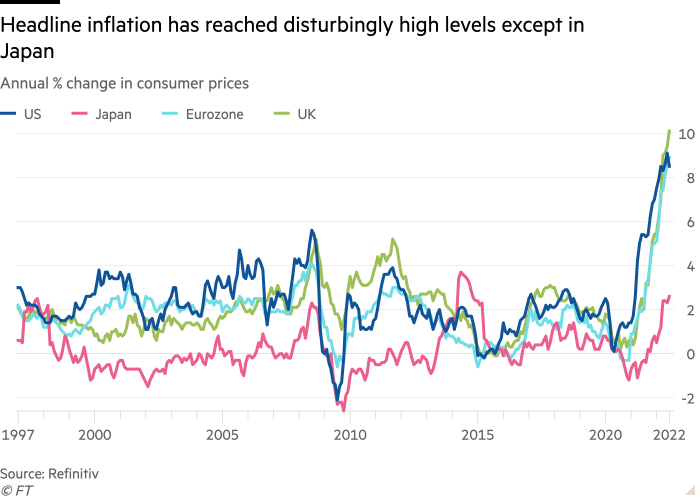

It is not difficult to understand why central bankers say what they are saying. They have a clear mandate to control inflation on which they have failed to deliver. Not just headline inflation, but core inflation (excluding energy and food) has been above target for a prolonged period. Of course, this unhappy outcome has much to do with a series of unexpected supply shocks, in the context of the post-pandemic shift towards consumption of goods, the constraints on energy supply and now the war in Ukraine. But the scissors have two blades: demand, as well as supply. Central banks, notably the Fed, persisted with the pandemic’s ultra-loose policies for too long, though US fiscal policy was also too expansionary.

In an important analysis, Ricardo Reis of the London School of Economics points to four reasons why this happened. First, central banks repeatedly interpreted supply shocks as temporary interruptions, not quasi-permanent hits to potential output. Second, they misread short-term expectations, focusing too much on the mean rather than the shift towards higher expectations at the upper edges of the distribution. Third, they tended to view credibility as an infinitely deep well, instead of a shallow one that needs to be refilled promptly. Thus, they failed to note that the distributions of long-term inflation expectations were also shifting against them. Finally, their belief in a low neutral rate of interest led them to worry too much about deflation and too little about the return of inflation. A central point is that these were intellectual mistakes. So, in my view, has been the lack of attention paid to monetary data.

In essence, central banks are playing catch-up because they fear that they risk losing credibility and, if they did, the costs of regaining it would be far higher than of acting now. This fear is reinforced by the risks to wage inflation from the combination of high price inflation with strong labour markets. The fact that higher energy prices raise the prices of essentially everything makes this risk bigger. This could then start a second-round wage-price spiral.

They are right to take this judgment. A shift into a 1970s-style era of high and unstable inflation would be a calamity. Yet there is indeed a risk that the slowdown in economies caused by a combination of falling real incomes, and tightening financial conditions will cause an unnecessarily deep slowdown. One part of the problem is that calibrating monetary tightening is particularly difficult today, because it involves raising short-term rates and shrinking balance sheets at the same time. A bigger one is that policymakers have not confronted anything like this for four decades.

In the US, there is a particularly optimistic view of “immaculate disinflation”, promulgated by the Federal Reserve. This debate focuses on whether it is possible to reduce labour market pressure by lowering vacancies without raising unemployment. An important paper by Olivier Blanchard, Alex Domash and Lawrence Summers argues that this would be unprecedented. The Fed has responded by saying that everything now is unprecedented, so why not this, too? In reply, the authors of the original paper insist that there is no good reason to believe things are that unprecedented. Think about it: how can one expect a general monetary tightening only to hit firms with vacancies? It is sure to hit firms that would then have to lay off workers, as well.

If the planned tightening of monetary policy is likely to generate a recession in the US, what might happen in Europe? The answer is that the recessions there are likely to be deep, given that the energy price shock is so large. Here too, the balance between the impact on supply and demand is unclear. If the impact of higher energy prices on the former is larger than on the latter, demand will need to be curbed, too.

Monetary policy will play a part in the European story. But the core of its current crisis is the energy shock. Central banks cannot do anything directly about such real economic disturbances. They must stick to their mandate of price stability. But a huge effort must be made to shield the most vulnerable from the crisis. Moreover, those most vulnerable will include not just people, but countries. A high level of fiscal co-operation will be needed in the eurozone. A political understanding of the need for solidarity within countries and among them is a precondition.

A storm has come from Europe’s east. It must be weathered. How best to do so will be the subject of future columns.