Like just about every other deSPAC, DMS came to the market with inflated expectations, they originally guided to $78MM EBITDA in 2021, but only delivered $58MM. DMS started 2022 with flat guidance of $55-60MM EBITDA, but now only expect $30-35MM due to wage inflation hitting their cost structure (500+ employees), marketing budgets getting slashed and LTV models being adjusted down in their core auto insurance market (Allstate and State Farm are two of their largest customers). Management expects to return to growth in 2023.

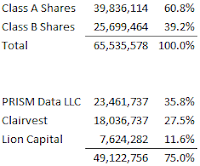

DMS is founder led, the company was started in 2012, the three co-founders are still in the c-suite today and own 35.8% of DMS through their “Prism Data LLC” investment vehicle. In 2016, DMS took on a PE investment from Clairvest, who still owns 27.5% of DMS, and rounding out the top 3 holders is Lion Capital at 11.6% ownership, Lion was the sponsor of the SPAC. In total, these three firms own 75% of DMS, the remaining 25% has very little institutional ownership and is likely held by retail holders who were caught up in the SPAC mania.

On Monday 9/8, via Prism Data, management made a non-binding offer to acquire all of the publicly traded Class A shares for $2.50/share, a 121% premium from where the stock closed the previous Friday. In their letter, they indicate that Clairvest and Lion “are likely to agree to participate” alongside Prism, leaving only 25% of shares needing to be purchased, or about $40MM. The offer is not subject to a financing condition (important in today’s market), but DMS does have $26MM cash on its balance sheet and Prism has $50MM in pre-committed financing from B. Riley (RILY) to complete the transaction.

The offer values the minority interest at somewhere around ~10x potentially trough EBITDA, again management expects to return to growth in 2023 (they’re the best positioned to know if there is indeed an inflection) so this could be an opportune time for them to take it private again. In August 2021, the company announced they were exploring strategic alternatives, on the last two conference calls, CEO Joe Marinucci (the signatory on the Prism offer letter), has stated they were “hoping to have an update today” regarding strategic alternatives, this offer is likely the end result. Marinucci would know where third parties offers were for the business before offering $2.50 to the board, this is likely the best offer and the independent board members will take it given there are no vocal or significant minority shareholders.

Shares closed today at $1.94/share, a 28% spread to the Prism offer. Yes, there is significant downside given where DMS traded before the offer, but there are no shareholders to put up a fight and likely this is the best offer after the company ran a process. Otherwise, I think the spread is wide because it is a low float former SPAC. I bought a smallish position. Given the number of deSPACs, I anticipate this being a similar fruitful hunting ground as the “broken/busted biotechs”, please send me any others that sound or feel like this one.

Disclosure: I own shares of DMS