The stock market fell around 5% last week. It did the same the week before that. The last few years made investing look easy. This year is setting the record straight.

What makes this decline particularly unsettling is everyone saw it coming. If we do enter a recession, or if we are already in one, it will be the most widely anticipated economic slowdown in the history of time.

The Fed is trying to destroy demand, and it sure looks like it’s working. At least that’s what the bond market is saying. And the housing market. And the stock market. The year obviously isn’t over, but if it were to close at these levels, it would be the fourth worst calendar year since 1950.

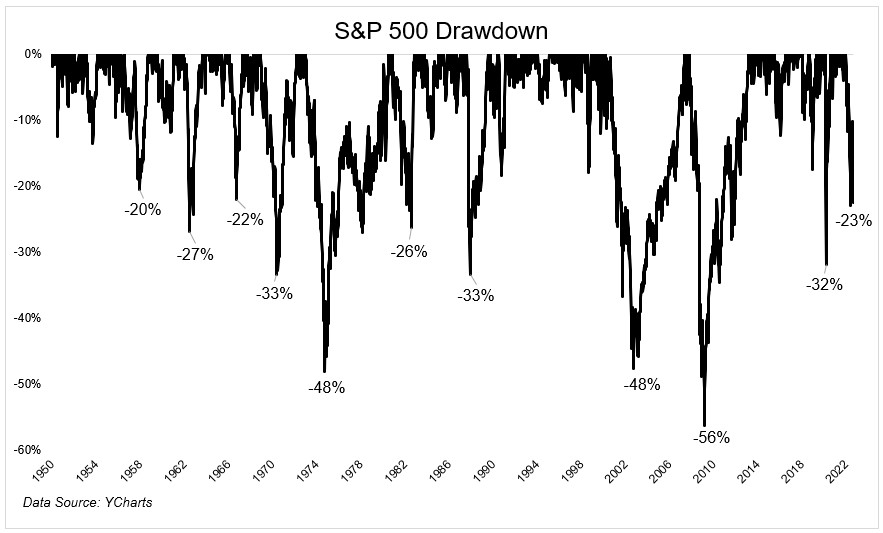

We’ve seen this chart a thousand times, but now we’re living in it. It might feel like we’re in unprecedented times, but as far as the stock market goes, this decline is rather ordinary.

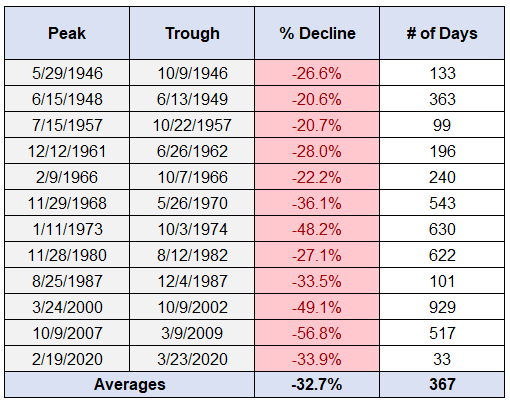

Can this get worse? Yes, it can get a lot worse. Ben showed that the average bear market is a 32.7% decline and lasts 367 days. At -23%, we’re still a decent way away from average.

And investors think it will get worse, at least those that The American Association of Individual Investors surveys. This is the third most extreme bearish reading ever.

The bear case is very obvious. So obvious that many have wondered, “Why is the S&P 500 only down 22% from its high?” I don’t want to rehash what’s been dominating the headlines all year. We all understand the challenges ahead of us. Instead, I want to go back to the basics.

Why are we putting ourselves through this? It’s because we believe that the future will look better than the past. We believe that people are motivated to provide for their families. We believe in innovation and the dynamism that is our economy. And we believe, ultimately, that businesses will continue to earn more money and return more capital back to their shareholders. This mentality has served U.S. investors very well over the last couple of decades.

Dividends have grown at 6% a year since 1988.

Earnings have grown at 7% a year over the same time.

It’s easy to lose sight of the fact that we’re investing in businesses when all we’re reacting to are prices on a screen. The American economy is not nearly as volatile as the stock market would make you believe.

A wise man once said “All past declines look like an opportunity, all future declines look like a risk.”

This current decline sure looks like a risk. But with the S&P 500 22% off its high and Nasdaq 100 32% off its high, it’s fair to say that the market is already doing a lot of the worrying for you.

If you can accept that it might get worse before it gets better, and if you can accept that declines lay the foundation for future returns, you will be much better off than the person who thinks otherwise.