It’s very easy to reflect back on massive successes when you’re still bathing in the glory of those wins. It’s an entirely different thing to write about a project where you’re still deep in the trenches, and uncertain of the eventual outcome.

The write-up you’re reading here is certainly the latter. As I’m sitting here in front of my laptop, typing these words, the project in question is in the red by over $470,000 USD. That’s almost half a million dollars – not exactly a minuscule amount of money. Maybe small for the tech giants of the world, but not for a small business.

Fortunately, it’s not all doom and gloom. As of the time of this writing, the website does bring in about $6,000 per month in revenue.

It took a lot of toiling the land to reach that monthly amount, and I’m grateful for it, but the downside is that it’s not actually enough to cover our overhead. So, unfortunately, despite the revenue, we are generating a loss of around $15,000 every month.

So, what does all of this actually mean? Read on:

Initial Idea

The concept for FinMasters was born out of my experience growing CodeinWP and Themeisle into multi-million dollar projects, along with my newfound passion for finance. We had some reserve capital to invest, and the idea of starting a finance blog really excited me. My vision for it was to gradually grow it into a repository for timeless advice, as well as a research hub for interesting topics that didn’t get enough (or any) coverage in the finance space. In other words, I wanted to offer massive value to the reader, while simultaneously finding and filling-in information gaps in the current blogosphere.

After mulling it over for a while, I decided to move forward with it, but I wanted to be careful to not repeat any of my past mistakes. To be specific, I didn’t want to disturb any of our team members working on existing projects. This meant that I needed to find a new shipmate who would take this project by the helm.

As circumstance would have it, one such person applied to a WordPress developer ad we put out on LinkedIn. After looking over her credentials and seeing she had done something similar before, I knew I found my captain.

We began working on the project together in November of 2020, with the initial goal of laying down a foundation to build off of. This included finding a domain name, creating a fresh logo, putting together a basic design, and publishing 20 articles.

From the financial side of things, our plan was to get out of the red within two years of launching. More precisely, this meant that monthly revenue would surpass monthly expenses by that time.

Our growth strategy was to create content that would be too helpful for Google to ignore, and too irresistible for other sites to not link back to. While not easy to execute, the premise was straightforward: quality content begets awareness. The more quality content we put out, the more awareness around our site would grow.

We didn’t have a full-time SEO person on the team, and we weren’t doing outreach, guest posts, or otherwise putting in any special effort to get links.

Our approach was actually expensive and boring.

In my humble opinion, I think that trying to manipulate Google’s rankings by publishing overly optimized, sub-par content goes completely against what Google wants websites to do. It might work as a short-term ranking strategy, but if the goal is to build a successful brand that’s going to stick around for years, then taking this kind of approach doesn’t bode well for long-term survival. It’s too much of a risk to even bother. SEO is important, but quality must take precedence in the long game.

With that being our guiding principle, our vision was to create quality content that would eventually reach a tipping point in terms of traffic. Once reached, our backlink profile would continue to expand organically, and at an exponential rate.

In order to reach that critical mass, we used various types of ads to boost the visibility of our really interesting content, along with some hustling here and there. For example, we registered the site in some directories, created some tools, etc.

As for on-site SEO, again we didn’t do anything over-the-top. Our main tactic was to ensure that our internal structure was set up for search engines to be able to identify our most valuable content. This was typically done automatically by marking those pieces as such.

It goes without saying that we also placed a great deal of emphasis on E.A.T.;*being helpful to our audience; and having an aesthetic and fast-loading site. This is why we worked with the best writers we were able to find, and we invested heavily in editing, formatting, and proofreading.

*E.A.T. is a Google ranking criteria. You can read more about it starting at the bottom of page 22 in this Google document.

But as the saying goes: “The best-laid plans…“

The First 6 Months

As a jack-of-all-trades, Milica was able to do virtually all of the work by herself – the only exception being the writing of the content. We knew that we needed some assistance with that. To get things going, we checked out our competition and looked for freelancers who were producing good articles on these other sites. If they could write quality content elsewhere, they could do it for us too. We also placed ads on problogger.com, hoping it would bear some fruit.

In addition to securing a team of skilled, fairly-priced writers, our other main hurdle was finding an editor. Through experience, we learned that even if you’re working with great writers, an editor is an absolute must-have.

It took a while to get the content team started. In total, we ended up reaching out to over 30 writers who we thought might be interested in working with us, and who were charging reasonable-enough rates.

We asked them to write a test article first.

After some long nights of reading many, many samples, we finally narrowed it down to a core group of people that we felt would be the right fit.

With that said, we were still able to publish a good amount of articles. At the same time, Milica created some calculators and tools, and came up with a content plan centered around a few clusters. We made the decision to tackle one cluster at a time, with the idea being that we wanted Google to begin recognizing us as a topical authority for each cluster. Milica also began formatting the articles, which is a really important, but often overlooked aspect of running a blog.

The First Crossroad

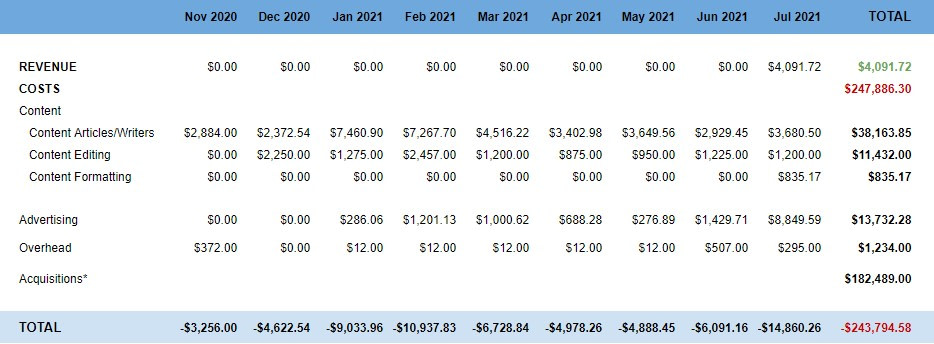

It was early April 2021. We were six months in at that point, and the traffic was close to zero.

Over the course of those six months, we managed to publish 100 articles, and we spent around $50,000 USD – most of that on content.

On the one hand, I was impressed with the job that the team had done in such a short amount of time. On the other hand, our traffic was nil.

After all of that hard work we put in, almost nobody was coming to our site and we had no real idea of how we were going to climb our way out of the hole of internet invisibility.

Here is a link to what the site looked like at that point.

Over the course of those six months, in an effort to get noticed, we tried some unorthodox tactics:

We created some Chrome and Firefox extensions for finance; built a couple of calculators; conducted a survey; and offered a printable file for downloading.

Unfortunately, none of this worked.

At the three month mark, we also started to experiment with doing a bit of advertising. We ended up spending $2,500 on Facebook ads, mostly to test if this would send a sort of signal to Google that we exist and we create good content.

I was personally starting to feel bad for the team. They were developing, writing, and doing a great overall job, despite knowing that no one was really reading or looking at the site. In terms of pure morale, I felt that it was even more detrimental than the negative financial position we were in as a company.

So I did what I usually do when something doesn’t work – I tried harder.

By sheer luck, I stumbled upon a passion project on Flippa that was focused on investing. It resonated with our philosophy. It had traffic. Most importantly, it was for sale for half of what we put into the project already. So I pulled the trigger.

We acquired Compounding.Works on April 15th, 2021 and immediately found a new home for 24 out of 35 articles that were on that site. In the process of relocating them to FinMasters, Milica cleaned them up, and the effort paid off – traffic to the articles increased.

Overall, the deal and the transfer went smoothly. I had the feeling that we were going in the right direction.

Doubling Down (Part 1)

At this point, our team was still heavily reliant on Milica, who worked on the design, development, content strategy, link building and anything else that was needed. We also had Steve, who was our editor, and a few freelance writers.

During this time, I was not heavily involved in the day-to-day minutiae. Instead, I was mostly focused on how we could better invest the money that we generated in 2020.

In light of that, I was constantly scanning various sites like Flippa, MicroAcquire, and EmpireFlippers, looking for possible investment targets. Unfortunately, it wasn’t really a buyers’ market. Since so many online businesses did well during the pandemic, everyone had pretty high expectations of their own future prospects. As a result, good deals were few and far between, and the opportunities that were available were overpriced.

After a month of heavy research, I did manage to discover another diamond-in-the-rough. It was listed on EmpireFlippers – CreditKnocks.com. The site had some great results in the past, but it lost most of its traffic and revenue at the start of the pandemic. It was still generating some revenue though.

The asking price was in the six figure range and the multiple was around 3.5x revenue.

I thought that acquiring the site would be a good strategic decision – to accelerate our desired growth.

However, I wasn’t naive. I knew it was a risky deal going into it. The fact that the site had lost its ranking for a number of positions wasn’t exactly a confidence booster. Our plans for it were even riskier: we wanted to redirect around 170 of the 550 articles to FinMasters. Why?

For one, we believed that the gains our content would get in authority would overpower the losses from the redirects and topical dilution. Personally, I thought the opportunity was a justifiable trade-off for what I saw as a small inefficiency.

Considering that the website was twice the size of FinMasters at the time, it probably would’ve been a better idea to have shifted gears and focused on it instead. We should’ve cleaned it up, and kept the two as separate projects – for at least a little while. But as the saying goes: hindsight is 20/20.

The transfer also was not as smooth as we had hoped for.

The original site used a particular page builder that we weren’t too keen on adopting. Our vision was to edit and rewrite most of the content, so it took us almost nine months to review everything and bring the content in line with our standard.

During this process, we lost 50% of the revenue that the site was generating – and remember that this was on top of the site already having lost revenue prior to us purchasing it.

However, we believed that our rationale was noble. We didn’t want to promote just any companies to our readers for the sake of making a quick buck. This led to us dialing down the previously aggressive strategy that the website had – as far as pushing offers to the audience. Quality over quantity was the idea.

I wasn’t really worried about the fact that our revenue dropped by 50%. Even though it was a hit, I still had the long game in mind, and overall, it was an accelerated step in the right direction.

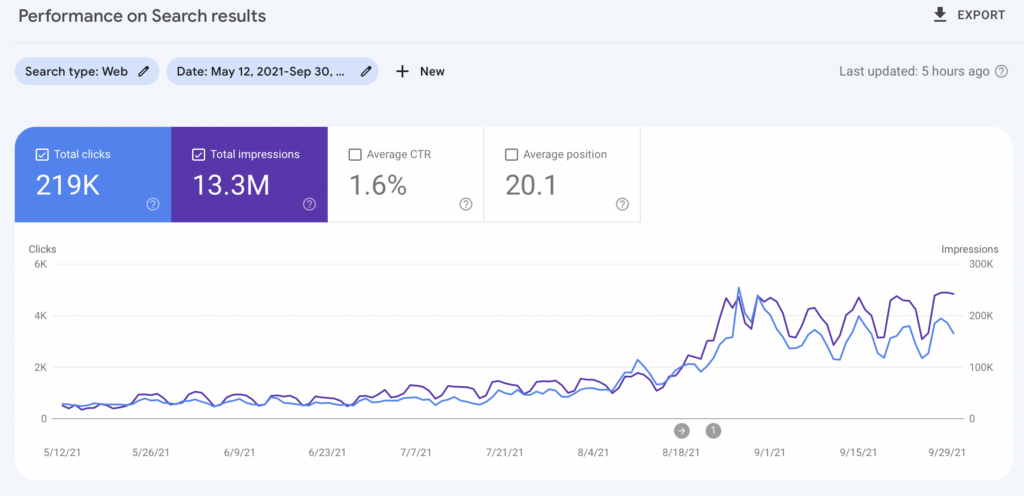

Plus, there were some immediate wins that happened during this process as well. For example, we were able to maintain the ranking of certain positions and we even increased a few. At this point, it appeared that Google started considering us as an authority on topics involving credit. This meant that most new credit-related articles we posted managed to rank pretty well upon publication. Our organic traffic was finally looking good.

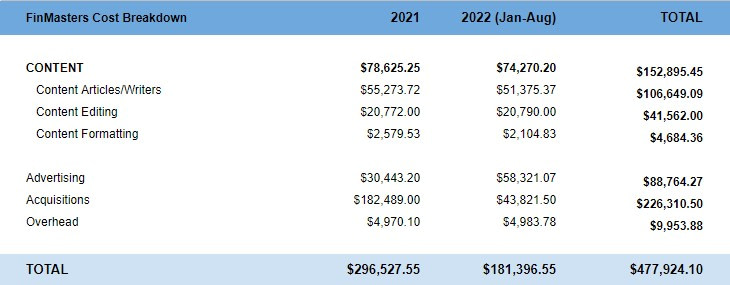

By the end of 2021 we ended up with 215 articles that we wrote ourselves. We spent $55,000 on written content, and $21,000 on editing that content prior to publishing it.

Below are some hard numbers on what our 2021 content expenditures looked like.

The editing costs appear high on all of our numbers because of the acquisitions we made. We didn’t keep a separate account for the cost of editing articles that we transferred over from other websites versus original content. Therefore, all costs are (inaccurately) attributed to new content.

In addition, we spent $30,000 on advertising, which included Facebook, Twitter and Reddit ads, and also a Pocket newsletter sponsorship. The idea was to get the word out, build some reputation, and generate mentions. Unfortunately, aside from the Pocket sponsorship, we didn’t get a lot of return on our investment with this particular strategy. It was way more challenging than we expected it to be.

As mentioned, the Pocket sponsorship worked out really well and helped create some buzz around that inflation piece. We paid $3,500 for the actual send, and after we tallied up the resulting traffic, we ended up paying a bit less than one dollar per click. We got a few mentions around the web as well.

The goal at that point wasn’t to generate revenue, but rather trust. This is why we promoted our best content.

We also had a sizeable windfall that came from our “Rivian stock” article. It was doing well right when the Rivian IPO dropped, and as a result, we generated more than $50,000 in affiliate revenue in only two weeks time.

While that was wonderful, the harsh reality was that we were still $250,000 in the hole. On the plus side, our organic traffic was stable and we were generating a steady $4,000 per month. This was near the same as after the redirection of articles from CreditKnocks.

Doubling Down (Part 2)

While the results were not there, we were happy with the direction things were going. Milica started working on offloading some of her recurrent tasks so she could work on various other initiatives – particularly on creating more interesting content.

We found someone on UpWork that ran a massive study about the financial education of women in Eastern Europe. The person gathered data from SurveyMonkey and combined it with live interviews. Unfortunately, we haven’t been able to publish the results due to the fact that the researcher was based in Ukraine and needed to flee due to the Russian invasion. This has resulted in a massive delay with being able to complete the project.

In January of 2022, we found another site for sale. It was also focused on investing, particularly value investing, which was something that I was deeply interested in. I also felt that it resonated with our general approach. The site was: VintageValueInvesting.com.

We acquired it for a low five figures. It didn’t have any revenue, but it had some great content and a paid newsletter. The newsletter didn’t make much money, but it was something that we wanted to experiment with.

We employed the same tactic that we had with the previous acquisitions: we redirected everything back to FinMasters. In addition, to our good fortune, the writer who had previously ghostwritten the newsletter decided to stay with us and continued working on it.

In a strategic move, we shifted the newsletter over to Substack because we felt it would be easier to manage that way. Prior to that, it was run using a combination of MemberPress and Mailchimp. We also changed the name to Stock Spotlight, and started publishing free content in addition to paid reports that were previously the only content. As of today, we have around 9,200 subscribers in total, including some paying subscribers.

On top of that, we started publishing the free content from that newsletter on the website. We also made the decision to share the premium reports two months after they are released to paid subscribers.

We started a weekly newsletter for the main FinMasters site as well. This is where we covered – and continue to cover – the most interesting financial news of the week. It’s also where our latest content is shared with subscribers. We repurpose it and post it on Medium.com for additional exposure.

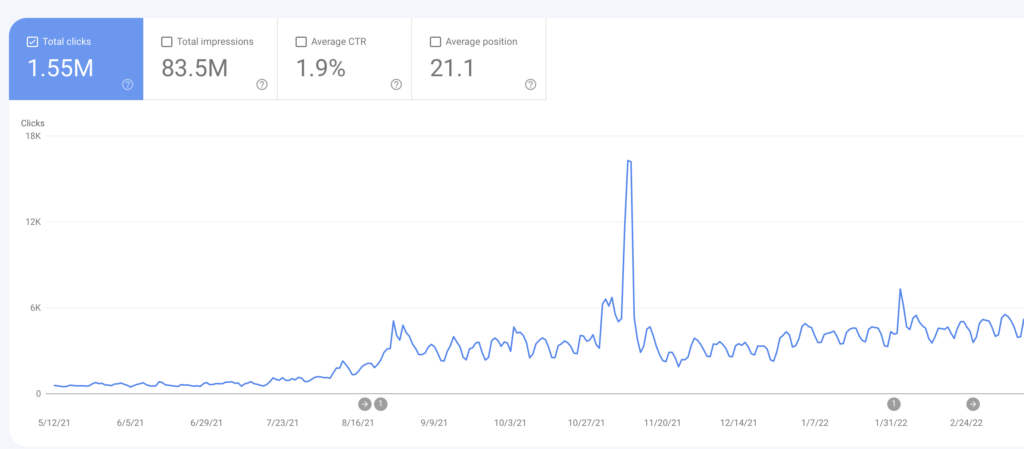

Overall, things were looking better. Our content was becoming stronger, and our traffic was picking up.

We managed to hire someone to take care of the content formatting and someone to help us with the research, fact-checking, and content updating. The new hires afforded Milica some extra time, so she began working on re-designing the website. This was our next major project, with the goal of improving E.A.T.

May 2022 Google Core Update

The end of May/beginning of June was a super busy month for us and it came with both some good and some bad.

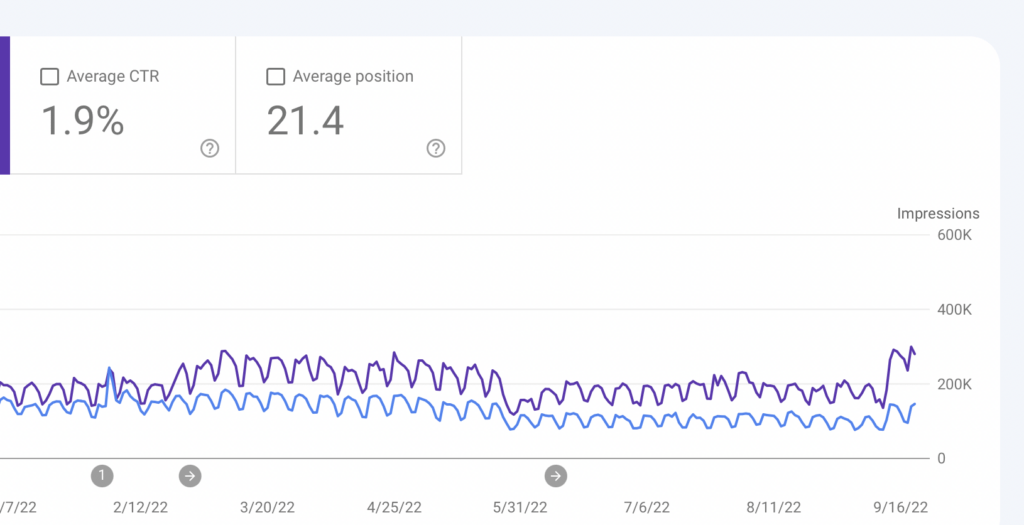

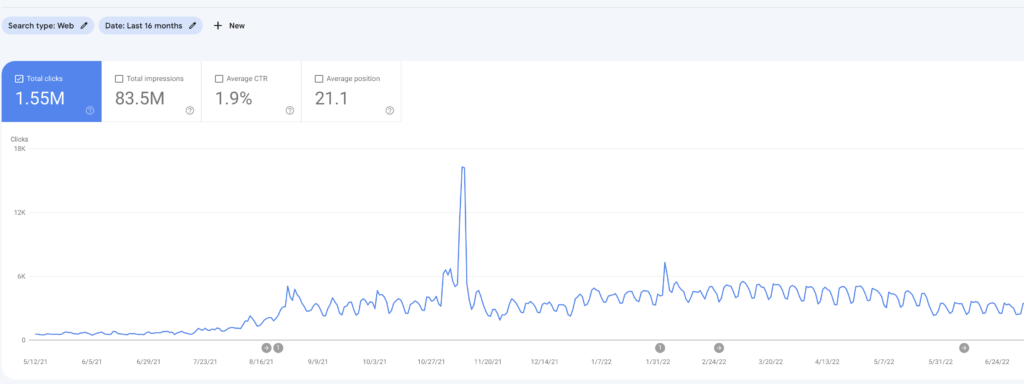

On the bad side, there was a Google core update at the end of May, which caused us to lose ~30% of our traffic.

On the good side, we acquired a few more small sites: StockChoker.com, InvestOpen.com and 60MinuteFinance.com – the latter mostly for its content, since it had no substantial traffic. We were struggling with producing steady content for the site and we thought this would help us speed things up.

We also integrated the tools from StockChoker into the website, and transferred over around 40 articles from InvestOpen and 60MinuteFinance.

Here is what our traffic looked like at the time:

What Did We Do to Address This Drop?

In short, as I’ve already mentioned before, my response in these situations is simply to work harder – and that’s exactly what we did. During this period, our focus was mainly on three things: promoting the website, finishing the redesign, and scaling up our content production.

We began ramping up our advertising, particularly for this article: Why Are Gas Prices so High?

We tried the Pocket newsletter again, as well as Facebook, Reddit, and Twitter ads. We also tried promoting our inflation piece from last year, and it proved to be even more successful than it was the first time around. We spent around $40,000 on ads in June – trying to see if throwing a lot of money at some amazing content would help in any way. We tested more newsletter placements and tried some outreach and partnership, but nothing really moved the needle.

In the end, all the money we spent on ads did spike our traffic significantly, but unfortunately, none of it really stuck. The boost was temporary and we mainly got a pricey learning experience that cost us $40,000.

Even though the extra traffic tapered off once we stopped putting money into the ads, we did decide to keep running retargeting ads on Facebook – but just on a much smaller scale (somewhere in the ballpark of one to two thousand dollars per month).

We also looked for new newsletters that we could try advertising in. The ones that worked best for us were The Daily Upside and The Gist by Finny.

In an effort to try and get more visibility, we also released our first survey on the impact of inflation which got 339 pickups – some from major sites like Morningstar, Market Insider, and Seeking Alpha. We’ve seen the survey strategy work well for other websites, so we wanted to see if we could replicate it with something similar. The survey cost us around $1,600 ($710 for SurveyMonkey Audiences and $950 for PR Newswire).

We decided to increase the amount of content that we would publish and we recruited writers with higher profiles. Instead of posting another “freelance writers wanted” ad, we looked at other websites again, and found authors we liked that were working with them. Then we reached out directly, which resulted in us establishing new relationships with five writers.

This enabled us to double our content production. We went from publishing an average of three posts per week to publishing six per week.

As the summer of 2022 started winding down, we launched our re-design, complete with an improved UX and an updated logo. We also touched on some key E.A.T. elements, and tweaked the internal link structure of the website.

The Second Crossroad

This brings us to today.

We are more than $477,924 in the red, but we have a project, a team, and content that is better than ever. However, with 700 articles published, our organic traffic doesn’t look any different than it did a year ago. Also, excluding the money we spent on major advertising campaigns, we’ve been losing around $15,000 per month for the last three months.

We’re almost two years into the project, and our initial goal of not losing money on a monthly basis has not come to fruition.

- Downscale and keep the loss to a minimum while hoping that there will be some growth later on?

- Continue to double down on the good things and extend the timeline by one more year while committing $150,000 more into the project?

These are tough questions. Nevertheless, we are going to continue to create authentic, interesting content, and release more studies and research. Hopefully, they will be picked up. We will also test out some new promotion strategies.

I don’t know, but for now, we have not exhausted all ideas around software, video and more, so there is still room to experiment.

I am writing this mostly from an observer’s point of view and as the capital allocator. I don’t work on this project daily myself.

This gives me a different perspective and one that is relevant to investors. I might get into more detail on why I think this is a good investment in a separate article. I do want to add that if you agree with private market valuations of these kinds of websites, then you might not agree with me.

However, the way I see it, if I compare this investment to 2020-2021 stock market valuations (which were arguably the easiest option for allocating capital), I still consider this a better alternative.

Update: After writing this, but before publishing it, we got a +30% bump in organic traffic. This is right after the latest Google update. While it’s definitely a welcome positive, for the moment it doesn’t change the big picture all that much.

Update: After writing this, but before publishing it, we got a +30% bump in organic traffic. This is right after the latest Google update. While it’s definitely a welcome positive, for the moment it doesn’t change the big picture all that much.