Executive Summary

Welcome to the October 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that DPL Financial Partners has raised $20M of capital to continue scaling up its marketplace of no-commission annuities for RIAs, as the ongoing development of new fee-based products – combined with deepening tech integrations for annuities into existing RIA systems – is leading to a steady rise in the use of annuities by RIAs, with more than $1B of new flows via DPL in just the past 12 months alone.

And notably, the fresh capital comes in the midst of a recent rise in interest rates that may, for the first time in nearly 15 years – since before the financial crisis – give annuity products enough yield to be able to innovate new offerings and more competitive pricing. While the growth of DPL’s marketplace may itself usher in a greater level of annuity competitiveness, as companies are forced to compete for RIA attention not by offering the biggest commissions but by offering the best features and benefits to get through the RIA-as-gatekeeper.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Ethic Investing raises a $50M Series C round as values-based “personalized indexing” through direct indexing tools continues to gain momentum

- Wealthfront’s acquisition deal with UBS falls through as incumbents still show they’d rather build than buy (at least at robo-advisor valuations)

- Morgan Stanley rolls out a held-away account aggregation feature for its 401(k) plan advisors to provide more holistic advice within the plan to participants (before they ever have a chance to roll over to an independent advisor in the future!?)

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

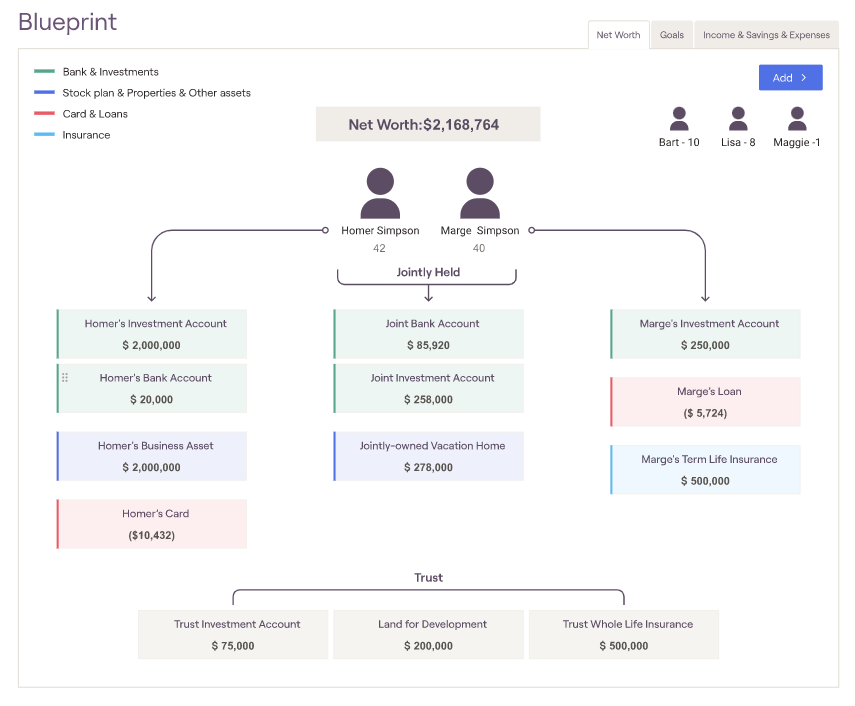

- RightCapital launches a new ‘Blueprint’ feature to create an Asset-Map-style visualization of the client’s financial household

- Elements creates a “One Page Financial Plan” solution, not to replace the traditional financial plan, but to more meaningfully engage clients and even prospects with a better financial monitoring process (until it’s time for their next financial plan update)

In the meantime, we’re also gearing up later this month for several new updates to our new Kitces AdvisorTech Directory, including Advisor Satisfaction scores from our Kitces AdvisorTech Research and Integration scores from Ezra Group’s research!

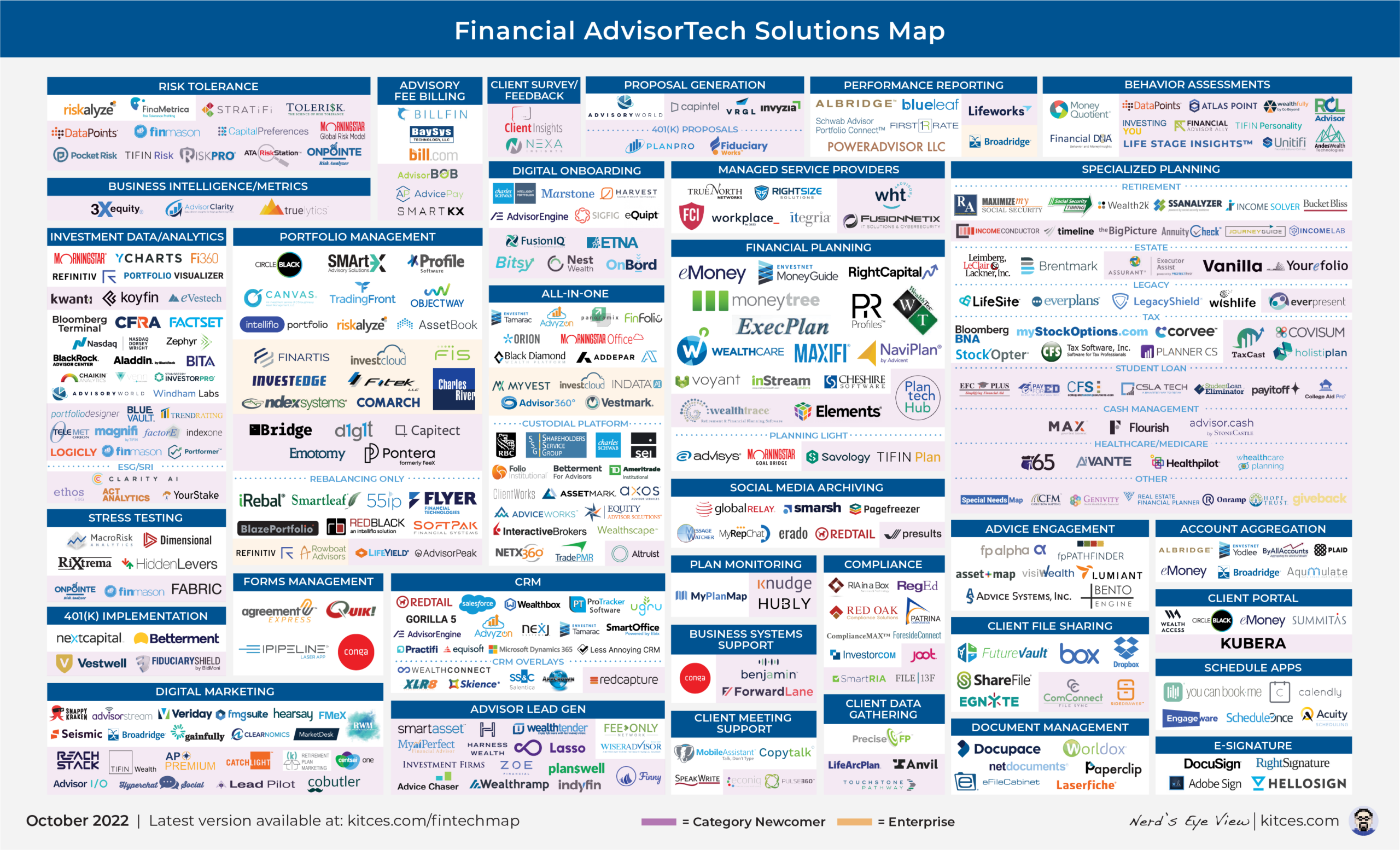

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Annuities have struggled for years with the (unfortunately earned) perception that they are high-cost products, driven in large part by the often-sizable commissions that are paid to annuity agents who sell them. The situation was further complicated after the financial crisis, when the Fed cut interest rates so low that there just wasn’t much room left for annuities to pay much in interest (or to have much interest yield available to provide other types of returns or income guarantees).

Yet agents still expected to get paid to sell the contracts, which means products increasingly became more complex and opaque as a means to mask how little return potential would be on the table in a low-rate environment. For which, in the aggregate, it appears that consumers weren’t fooled all that much, as according to LIMRA, total annuity sales in 2021 were $255B… a growth rate of 0%(!) over the preceding 14 years since the financial crisis (where total annuity sales were $257B in 2007!).

RIAs, in particular, have spent much of the past two decades selling heavily against annuities’ often-high costs, from Ken Fisher’s infamous “I Hate Annuities” campaigns, down to the individual RIA that simply tries to show how a low-cost portfolio, plus the advisor’s own fees, still may add up to far less than the cost of an annuity… and without the challenges of illiquidity (surrender charges), limited investment options, or contracts too opaque to even fully understand how they work in the first place.

However, the reality is that annuities are not inherently “bad”. They’re a tool, and one that doesn’t have to be designed and priced the way that they are; instead, product pricing and design have been a function of how annuities were distributed – through annuity salespeople.

Which began to change when the Department of Labor issued its fiduciary rule in 2016, and raised the prospect to annuity carriers of a potential future where annuities couldn’t be sold by commission-based salespeople, and might have to be sold by fiduciary advisors. And coupled with the ongoing growth of the (fiduciary, no-commission) RIA channel, and the 2019 issuance of a Private Letter Ruling from the IRS that RIAs could have their fees withdrawn directly from annuities on a pre-tax basis, fee-based annuities for RIAs are now gaining momentum.

Which provides context to why this month, DPL Financial Partners – which has created a fee-based annuity marketplace for RIAs, and the supporting consulting/expertise services that annuity-unfamiliar RIAs would need – announced a new $20M round of capital to continue scaling up its RIA annuity marketplace, having surpassed $1B in new annuity flows in the past year.

From the advisor perspective, more funding for DPL means an expansion to its already-sizable 85-person headcount to support the growing service demands of advisors (as well as investments into DPL’s technology, and likely investments into its own marketing and sales efforts to reach more advisors).

From the broader industry perspective, though, arguably the greater significance of this news is that as DPL continues to grow and gain momentum and demonstrate that RIAs are willing to buy more competitively-priced, client-centric annuities, it forces more and more annuity carriers to recognize the growth potential of the RIA marketplace… which means even more fee-based annuity offerings for RIAs (beyond the reported 25 carriers and 70 products that DPL already offers), and more competition amongst carriers for advisor attention… which tends to further bring down costs and improve benefits to the end client (given the fiduciary-gatekeeper approach of RIAs) in a positive feedback loop. Especially recognizing how big the RIA growth opportunity is – where DPL’s $1B of fee-based annuities is still just a drop in the bucket for an annuity industry with over $250B of new flows last year, which itself is minuscule relative to the $5T+ that independent RIAs and hybrids currently control.

All of which means, despite its sizable funding and growth momentum, arguably DPL still has an immense amount of room to grow and has only barely scratched the surface. The only real question now is how far RIAs will really go with an increasing range of annuity products available at increasingly competitive prices – a transition that may be further catalyzed by rising interest rates, which for the first time in nearly 15 years will provide annuity carriers enough yield to be able to design a potential new wave of (fee-based) annuity product innovation?

“Direct indexing” has existed in some format for nearly 30 years since it was pioneered by firms like Parametric and Aperio, who offered ultra-high-net-worth investors the opportunity to replace their ‘core’ holdings, like an S&P 500 index, with the 500 individual stocks of the S&P instead, creating the potential to engage in tax-loss harvesting at the individual stock level. As a result, even if the S&P in the aggregate was up for the year (which means there’s no opportunity to engage in loss harvesting on an index fund), if 150 of the individual stocks within the index had losses, the direct-indexed, ultra-HNW investor could harvest those individual stock losses – typically at top tax brackets – for immediate tax savings, while continuing to hold onto and not trigger gains on the other 350 stocks that were up.

Notably, though, for most of its history, direct indexing was an ultra-HNW solution. In part, simply because tax-loss harvesting produces more tax savings for those who are in higher tax brackets in the first place. But also because allocating a portfolio across 500 individual stocks could entail a non-trivial amount of trading costs if each stock trade cost $19.99, $9.99, or even $4.99 per trade (as ticket charges came down over time), such that investors had to have a sufficiently large allocation to ensure that racking up 500 ticket charges wouldn’t materially or fully offset the tax savings.

However, the dynamic was forever changed when, in October of 2019, Schwab announced that it was cutting stock trading commissions to $0, setting off a chain reaction where most competing brokerage firms quickly matched the offer, and suddenly there was no longer a cost to trade any – or very very many – stocks. In the new world of ‘ZeroCom’ (zero commissions), direct indexing was no longer constrained to those who had a large enough portfolio for the tax savings to beat the trading costs. In fact, it was no longer constrained to be ‘just’ a tax-loss-harvesting strategy in the first place.

As a result, in recent years four different types of direct indexing strategies have begun to emerge: tax-focused (where direct indexing is used primarily for tax-loss harvesting, and other individual-stock-related tax strategies like donating appreciated stock for charitable purposes); personalized preferences (where direct indexing is used to create a stock allocation based not on broad-based indices but on the client’s own individual values and preferences); rules-based (where direct indexing platforms are used to implement rules-based investment strategies like factor investing or other ‘smart beta’ approaches); and customized portfolios (created around specific client constraints, like completion portfolios around an existing legacy stock, or building a portfolio for a partner at a public accounting firm who can’t own certain stocks that their company audits).

And this month, Ethic Investing – one of the early players in the category of Personalized (values-based) direct indexing – announced a whopping $50M Series C round of funding to continue to scale up its direct indexing platform for advisors, having nearly doubled in 12 months from $1B of AUM in April of 2021 to nearly $2B by March of this year. Which, at a fee schedule of 0.2% (for standardized ‘Market Theme’ solutions) to 0.4% (for fully Custom values-based portfolios), implies a run-rate revenue of $6M to $8M earlier this year, and a very heady valuation… albeit one that may be quickly rationalized at 100%+ growth rates!?

What’s notably unique about Ethic – in an increasingly crowded space of direct indexing providers – is that the platform has stayed rather tightly focused specifically on its ‘values-based’ investing approach, with an interface built specifically to help clients articulate the causes that are important to them, develop a portfolio built around those values, and actually quantify the impact of those investments (e.g., how the portfolio’s reduced carbon impact is equivalent to taking X cars off the road, or its water savings is the equivalent of cutting out Y showers).

Which is unique because most direct indexing platforms have tried to check off all 4 types of direct indexing at once… and in the process, have not created an especially compelling or effective user experience for any one of them that is persuading advisors to make the shift. In other words, Ethic has excelled not by trying to optimize for all the direct indexing use cases, but by building a strong user experience to excel at one in particular, in a manner that is actually getting advisory firms to adopt.

Ultimately, it remains to be seen just how much demand there is from consumers – and thus the financial advisor community that serves them – when it comes to creating more values-based portfolios. But given ongoing generational research indicating that Millennials in particular care a lot more about aligning their portfolios with their values and seeing their capital allocated to causes that they want to see advanced, such that even mega-firms like Schwab are making a big bet on a “Personalized Indexing” solution, and the rapidly emerging growth of platforms like Ethic, it appears that a more ‘personalized’ values-based investing approach is a new version of direct indexing that is here to stay. The only question is which client segments in particular will want to adopt this approach?

When “robo-advisors” first burst onto the scene nearly a decade ago, they framed themselves as the ‘great disruptor’ of the status quo, claiming that they could provide the same services that human financial advisors provide for 1/4th the fee, and in doing so would be able to take down Wall Street. In fact, in the early years, then-Labor-Secretary Perez outright touted Wealthfront as a lower-cost fiduciary alternative to traditional Wall Street.

The caveat, though, is that as the number of robo-advisors quickly proliferated, consumers increasingly had to vet various robo-advisor options and choose which one had the best investment management solution… a decision not dissimilar to what consumers already faced in trying to pick a mutual fund or ETF. Which meant that, in practice, robo-advisors were not actually appealing to ‘delegators’ who hire human financial advisors – because they don’t want to make those investment choices themselves – and instead were primarily serving ‘do-it-yourselfers’ who like to research investment alternatives and make their own choice.

As a result, it was largely the DIY solutions – most notably, Schwab and Vanguard – that were the first to launch competing solutions in response, including Schwab’s Intelligent Portfolios and Vanguard’s Personal Advisor Services. For which the incumbents had one immense advantage – an existing base of retail (DIY) investors to whom the solution could be cross-sold, rather than needing to market their solution to ‘new’ investors who would have to open new accounts and move their money. As, in the end, it’s not the operational costs but the client acquisition costs that most drive up the cost of financial advice.

And because of those (prohibitive) client acquisition costs, within a few years, almost every pure robo-advisor but the original two – Wealthfront and Betterment – were driven out of business, and the last two were looking for an exit. Which Wealthfront managed to queue up earlier this year when UBS announced that they would acquire the platform for $1.4B… a rather stunning amount given that Wealthfront at the time had approximately $28B of reported assets, which at their 0.25% advisory fee would amount to about $70M in gross revenue, or a valuation of nearly 20X revenue! That ostensibly UBS hoped to justify by being able to proactively cross-sell Wealthfront to their existing UBS clients (similar to how Schwab and Vanguard had prevailed with their offerings), with a significant portion of the Wealthfront valuation reportedly tied to post-closing bonus payments that would be made if/when/as certain ‘performance’ targets were hit.

Except this month, the even-more-surprising news hit that the UBS-Wealthfront deal had fallen apart, and instead UBS would ‘just’ be making a $69.7M investment into Wealthfront at its $1.4B valuation instead, while Wealthfront would remain on its independent course. For which the big questions are now: “What happened!?” and “What does this portend for the valuation of robo-advisors in the future?”

Notably, a lot has changed in the nearly 9 months since the UBS-Wealthfront deal was first announced. Markets have tumbled more than 20% as inflation spiked and the Fed began to raise rates. Outflows and attrition are likely up because client turnover typically increases in a bear market. Rising interest rates have changed the cost of capital that fuels valuation multiples. And FinTech valuation multiples themselves have compressed industry-wide. Such that, what was at best a very ‘rich’ valuation in January, may have simply become untenable by September.

It’s also notable that this summer, UBS announced that Naureen Hassan will become its new president of UBS Americas. Hassan has been widely known as one of the key architects of Schwab’s original Intelligent Portfolios platform, and then went to Morgan Stanley, where she also helped to drive their popular “Next Best Action” initiative as their Chief Digital Officer. Which means Hassan knows exactly what it takes to build and roll out digital tools within a mega-enterprise like UBS. Is it possible that Hassan recognized that, even with the challenges of the “Innovator’s Dilemma”, that UBS could build an internal solution – or better leverage their existing SigFig partnership – than to acquire Wealthfront for $1.4B?

It’s also entirely possible that the UBS-Wealthfront deal blew up for some other reason, unknown to any. As the reality is that such deals typically require a “material adverse event” to be cut short – for which a change in leadership or change in market conditions alone is usually not sufficient. Or perhaps the market downturn simply made the post-closing growth targets so impossible that Wealthfront wanted out (realizing they may no longer be able to hit their post-deal performance targets) while UBS also wanted out (for the aforementioned reasons), and a funding round of ‘just’ $70M was a mutually-face-saving resolution (allowing UBS to risk ‘only’ $70M instead of $1.4B, and providing Wealthfront enough runway to keep growing independently and try to establish an even-higher exit valuation some number of additional years in the future).

In the end, though, the real moral of the story is simply that the financial services industry incumbents are far larger than almost anyone truly realizes… to the point that companies like Schwab and Vanguard could wait 3+ years and still quickly leapfrog well-funded robo-advisor startups, and even 10 years later the incumbents are still making the decision that it’s faster to build internally (a decade later) than to buy. When it comes to the financial services industry, the key to success is not disruption of an industry with incumbents so large that they can buy or build themselves long before they’re ever disrupted, but capitalizing on the incremental evolution that is very slow from year to year but absolutely immense with long-term compounding.

Since the arrival of the first RIA custodial platforms in the early 1990s, the growth of the RIA movement has been all about the growth of Assets Under Management (AUM), as investors have increasingly shifted from working with brokers (where the customer retains the decision about whether to purchase the investment being sold, or not) to working with advisors (where the advisor has discretion to manage the client’s investment accounts on their behalf). Which in turn led RIAs to be increasingly focused on working with prospective (i.e., near-) retirees, both because retirees tend to have more assets available to manage (that they accumulated over the decades, in order to retire), because retirement itself is a major life transition (where consumers tend to seek new services and new providers), and perhaps most importantly because most consumers can’t actually work with an advisor until they retire, as the typical advisor can’t actually manage assets in an employer retirement plan itself (only once those assets are able to be rolled over into an IRA).

The challenge, however, is that there are only ‘so many’ prospective retirees ready to retire and roll over their employer retirement plans in any particular year, and competition for those retirees’ rollovers has become increasingly intense as more and more firms try to win their business. As a result, a growing number of large enterprises are now trying to capture the attention of prospective retirees long before they’re actually ready to retire, by providing advice services into 401(k) plans themselves. Thus the acquisition of Edelman by Financial Engines, Empower acquiring Personal Capital, and Morgan Stanley acquiring E*Trade (which was not just about acquiring E*Trade’s retail brokerage business, but perhaps more importantly its stock plan administration business that now gives Morgan Stanley access to employees that have stock options and restricted stock being administered by E*Trade… otherwise known as upwardly-mobile, rising-asset pre-retirees).

At the same time, advisors have faced a growing pressure to “do more” to show their value and justify their ongoing advisory fees, which means providing advice on more than ‘just’ the portfolio the advisor manages, and may include more comprehensive financial planning beyond the client’s investments, and/or advice on “held-away” assets that aren’t being managed by the advisor directly and instead are simply “advised upon” (where the advisor may provide investment recommendation that the client subsequently implements themselves). Leading to an emerging shift from AUM to AUA.

And now this month, Morgan Stanley has announced a new integration that will account-aggregate the held-away employer retirement plan assets of client accounts directly into its Corporate Retirement Portal for advisors serving retirement plans. Allowing the advisors to get a more holistic view of all of the assets (and advice opportunities) of their plan participants, but also connecting to Morgan Stanley’s “Next Best Action” engine that tries to spot meaningful opportunities for advisors to engage in proactive outreach to clients on investment issues (e.g., by spotting a client has a concentrated position in a held-away account and prompting the advisor to reach out to the client when that company has a significant news event).

From the Morgan Stanley perspective, the new technology provides the firm even more opportunity to shift their existing employer retirement plan relationships from “just” being plan participants into more holistic client opportunities – where it’s actually the “traditional” investment accounts that are held-away and can be aggregated into the (usually much larger) retirement plan relationship, and deepening the advice relationship to the point that when it’s time to retire, the plan participants can simply continue with their existing Morgan Stanley advisor. Which in turn improves the long-term opportunity of the investments that Morgan Stanley has been making into its acquisitions of employer retirement plan businesses (including Solium’s stock plan business, E*Trade’s stock plan business, Cook Street Consulting, and American Financial Systems).

From the broader industry perspective, though, it’s hard to understate the significance of firms at the size and scale of Morgan Stanley making such substantial investments into turning the traditional employer retirement plan and stock plan administration business into more holistic advice offerings. The firm’s acquisitions in recent years represent more than $100B of what might have otherwise been future retirement plan rollovers… that might not be anymore, because Morgan Stanley will have years to establish advice relationships before those prospective retirees ever hit the radar screen for a ‘traditional’ advisor. Which can change the entire nature of how independent advisors find and obtain (or cannot obtain!) new clients in the coming decade.

In the early days of financial planning, many households had no idea what they were actually worth. Financial accounts were splintered across multiple banking and brokerage institutions; mutual funds and even individual stocks might be held directly with the companies; insurance lived in its own silo. As a result, one of the key benefits of going through the financial planning process, and getting “A Financial Plan”, was simply that it provided – for many, for the first time ever – a single consolidated balance sheet that reflected their entire household finances.

Over the years, the process of gathering financial data became easier as software rose to the challenge, automated by account aggregation, from Mint.com for consumers to eMoney for financial advisors. Which began to turn the tracking of a client’s household wealth into a value-add that could be provided over time, and not just as part of the upfront financial planning process.

The caveat, though, is that the classic balance sheet is arguably not necessarily the best way to help clients visualize their net worth. After all, the balance sheet originated as a way for accountants to report on the value of a business enterprise… not necessarily as a way for a not-necessarily-as-financially-sophisticated individual household to visualize its finances. Especially when there are multiple members of the household (where not all assets may be evenly split). Not to mention that a classic balance sheet only looks at the household’s assets and liabilities… not necessarily its income (which traditionally is a separate report – the Profit and Loss [P&L] Statement).

Which led in recent years to the growth of alternative ways to help clients visualize more of the big picture, such as the adoption of “mind mapping” techniques by financial advisors. Except traditional mind mapping is hard for advisors to create – especially on the fly with clients – and mind mapping has historically been focused more on creating a holistic view of concepts (and how they’re interconnected)… not necessarily as a means to visualize the breadth of a household’s finances (which still entails a lot of numbers). A gap that ultimately Asset-Map began to fill by adopting a more Mind-Mapping-style approach to create a one-page visualization for advisors (and their clients) of a household’s assets and liabilities, as well as their income and expenditures, and other key details (e.g., insurance coverage).

And now, this month RightCapital announced the launch of their own version of a holistic mind-map of the client’s household finances, dubbed Blueprint. Notably, RightCapital’s approach isn’t quite the same as Asset-Map – instead of a single-page visualization, RightCapital’s Blueprint is three pages, with one reflecting household net worth, a second for the client’s income and expenses (and savings), and a third that shows a timeline visualization of their major goals. Nonetheless, the key distinction of RightCapital’s Blueprint is its far-more-visual approach to showing clients their current financial situation (automatically updated over time via account aggregation).

For advisors who are fully invested into Asset-Map’s still-more-developed one-pager, RightCapital’s design likely isn’t enough to compel advisors to switch. Asset-Map has spent years iterating on its design and figuring out the best way to include so much information on a single page at the right level of abstraction without being overwhelming – which is no small feat! – and RightCapital will likely need multiple iterations over time to fully catch up.

For advisors who are fully invested into Asset-Map’s still-more-developed one-pager, RightCapital’s design likely isn’t enough to compel advisors to switch. Asset-Map has spent years iterating on its design and figuring out the best way to include so much information on a single page at the right level of abstraction without being overwhelming – which is no small feat! – and RightCapital will likely need multiple iterations over time to fully catch up.

On the other hand, for advisors who might be interested in the approach and new ways to create more tangible visualizations and deliverables for clients – and don’t want to buy and pay for Asset-Map on top of their existing planning software – RightCapital’s Blueprint will likely be appealing as a way to better engage clients with their financial health over time. Especially given the uptake of other more visual offerings, like One-Page Financial Plans (which RightCapital also released recently with its “Snapshot” solution).

From the broader industry perspective, the significance of RightCapital’s Snapshot launch is that it highlights the challenges of startups that offer a key component of the financial planning process that’s still separate from the financial planning software itself. As, in the end, planning-centric advisors – who care the most about such features – still typically anchor first and foremost around their planning software, and don’t like to have to deal with double data entry. Which means most will tend to use an embedded solution over other standalone offerings, unless the external one is so much better it’s worth the extra work (and extra cost).

Which will raise the question of whether Asset-Map needs to become an even more ‘full-fledged’ planning software to retain its market share and keep growing, especially if MoneyGuide and/or eMoney mimic RightCapital with their own one-page-mind-map-style visualizations. (A path that it already began last year with the launch of its ‘Target Maps’ to illustrate funding progress towards key financial planning goals.) Or, alternatively, whether another financial planning software company will look to acquire Asset-Map to jump-start its own capabilities in one-page visualizations (especially since Asset-Map has shown there’s a market of advisors who will pay for this, on top of their core planning software, as an ongoing tool for Client/Advice Engagement).

At the same time, though, RightCapital launching an Asset-Map-style visualization (and the possibility that another planning tool would acquire Asset-Map to catch up) also highlights how a lot of innovation in financial planning software is not actually happening within existing planning software platforms, but in new startups growing around the periphery. For which planning software will increasingly have to make decisions about whether to buy or build their own version of increasingly popular features from startups, as planning software itself increasingly becomes a ‘hub’ that advisors anchor to. Though in the end, it may ultimately be welcome news to many AdvisorTech startups to know that in the future, financial planning software providers may become the new exit-plan acquirers?

The typical financial planning client has a lot of complexity. In part, this is because the fees that financial planners charge are usually high enough that a client needs to have some non-trivial financial complexity just to have enough at stake to make it worthwhile to hire a financial advisor. And, in part, it’s because if the situation wasn’t that complex, the client would likely just figure out or look up the answer themselves on the internet.

Because of the complexity of most financial planning problems, along with the fact that they tend to play out over years (or more often, decades), over which most people cannot intuitively do compounding math in their heads, financial planning software evolved relatively sophisticated capabilities to model complex planning situations, enabling advisors to conduct the appropriate analyses to craft the right recommendations.

The challenge, however, is that complex situations take a lot of time to analyze (even with highly capable software). And as a result, financial advisors typically only update clients’ financial plans once every several years (or ‘only’ when an actual need arises). Which means clients have little means to keep track of how they’re doing until their situation merits a ‘full plan update’.

A decade ago, Carl Richards made the case that everything that really matters to a client’s financial situation could be consolidated down to a single page: the One-Page Financial Plan (OPFP). Which would capture the client’s values (or as Carl puts it, their “Statement of Financial Purpose”) and goals, their current financial situation, and the action steps recommended to them to take next. Because in the end, when clients are ‘freaking out’ about scary markets, that’s what we as advisors try to bring them back to anyway.

And this month, Elements announced the launch of its own version of a One-Page Financial Plan (OPFP), designed in collaboration with Carl Richards, to cover the same core elements – Purpose, Goals, Action Steps, and reporting on the client’s Financial Health (net worth, income/expenses, and a scorecard of their key household financial metrics).

Notably, the purpose of Elements’ OPFP is not necessarily to replace the traditional financial plan, or even to be part of the traditional initial financial planning process, but as a monitoring tool for the ongoing client to see how they’re doing over time, with a continuously-updated-by-software reporting of their financial health and key metrics (while also being reminded of their Purpose and Goals that have not changed!).

From the advisor perspective, Elements and its OPFP are appealing because of their focus on monitoring and its ability to fill a void in providing meaningful engagement for ongoing clients around their financial plan. As Elements was purpose-built for ongoing engagement, with a mobile-first design approach to its interface and visualizations and financial tracking for clients. Which is arguably relevant both as a means to engage (and retain) existing clients, and also for marketing to prospects (where the prospect may be invited to set up their financial dashboard to monitor their situation as a ‘freemium’ offer, akin to how Personal Capital built its lead generation funnel from its personal financial management app).

On the other hand, like other ‘value-add’ tools in financial planning, Elements may find it difficult for advisors to adopt as a client engagement tool on top of their existing financial planning software. As, contrasted with RightCapital, which recently launched its own OPFP module called Snapshot (which is embedded within the existing planning software), or eMoney which already has a rather robust (albeit not perfectly ‘OPFP’) financial dashboard for clients. Though Elements’ use in prospect marketing may stand on its own, as, in practice, most advisors aren’t using their financial planning software with prospects (who typically haven’t gone through the full financial planning process yet anyway).

The key point is simply that when it comes to ongoing engagement – with clients, or with prospects – the full financial plan is ‘overkill’; it’s time consuming to produce (so much so, that advisors typically don’t update it more often than every few years), and long-term retirement projections don’t change much from year to year anyway. Whereas financial monitoring of key nearer-term financial metrics – savings rate or spending rate, tax rates, etc. – can be more engaging on an ongoing basis. But such monitoring and engagement tools require a completely different kind of interface and client experience than traditional planning software. Which is exactly where Elements (and its OPFP) are focused.

In the long term, though, the real question will simply be whether advisors are willing to pay separately for a One-Page Financial Plan solution and ongoing financial monitoring tools like Elements, or if they will simply wait for their own planning software to offer it… or to acquire Elements to offer it for them!?

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Will RIAs really increase their adoption of annuities if more favorably priced, fee-based offerings are rolled out through DPL? Will values-based investing via direct indexing gain traction? As an advisor, would you use third-party client visualization tools if they added value to the client engagement, or do you expect (and wait for) your financial planning software to build and provide them? Let us know your thoughts by sharing in the comments below!