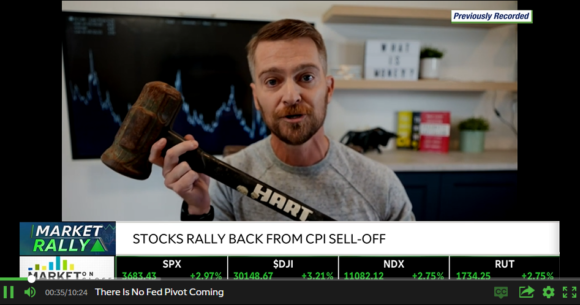

Here’s my interview with Oliver Renick and TD from yesterday. I brought my sledge hammer with me to demonstrate how Fed policy is currently operating. I also go into detail about the current macro environment and the risks going forward. Specifically:

- This environment is transitioning from an interest rate risk environment to a credit risk environment. This means credit markets could reamin under duress as benchmark interest rates adjust higher and debt gets reassessed at these higher rates.

- This is a credit and housing driven downturn. That means it’s going to be more of a disinflation story in the future and a longer drawn out economic event.

- The Fed can’t pivot at this point because they’ve already turned over the ball. I think they’re way behind the curve on inflation and this story will become more and more of a disinflation story as we head into 2023.

- This isn’t quite 2008 and it isn’t quite 2002. But it definitely isn’t 1978 in my view. That means it’s going to be a tough road to hoe. Patience and discipline are going to be essential for navigating this tough environment.

I hope you enjoy the interview.

RELATED ARTICLES