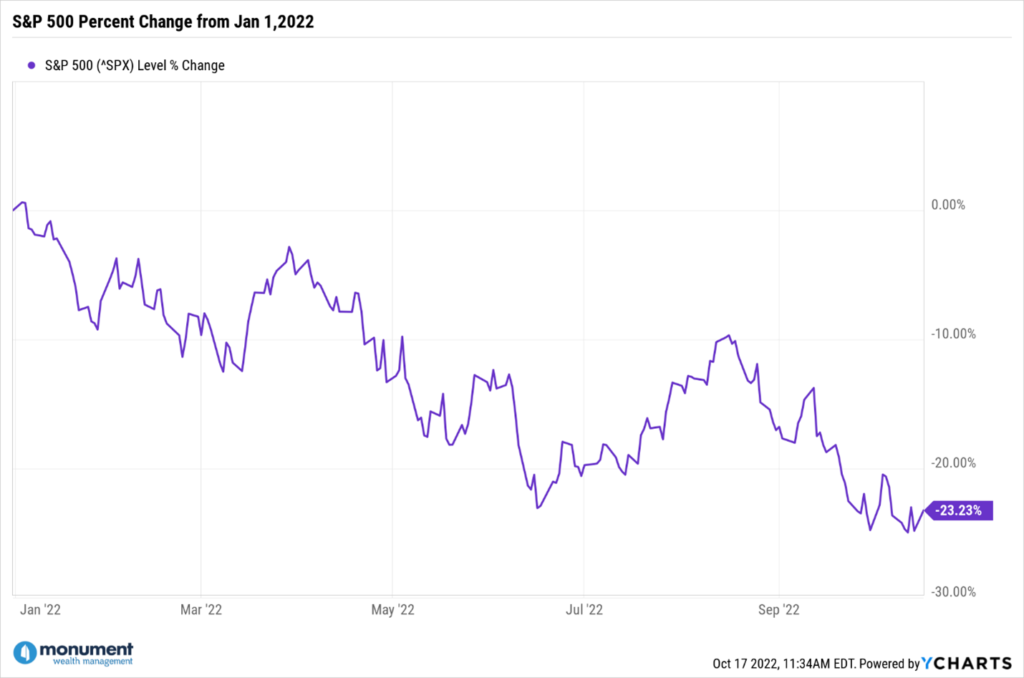

Everyone is talking about “the recession,” but I’ll argue it’s irrelevant. The S&P 500 is down around 23% off its most recent high, and that’s what’s relevant.

This is why I say it’s never about THE recession, it should always be about A recession.

A recession is always on the horizon, and the market reaction is rarely ever exactly synced.

But the market participants (you and 7 billion other people on the planet) have already priced in all the news and expectations, so even if we are in a recession, the current level reflects that AND has priced in all expectations and future outcomes.

You think the Fed will cause a hard landing? It’s already in there.

You think the Fed will keep raising interest rates? It’s already in there.

You think inflation is high and will stay high? It’s already in there.

The continued war in Ukraine, freezing winter in Europe, the possibility of Russia using a nuclear weapon, oil prices going higher due to OPEC reductions, unrest in Iran, November U.S. elections…

It’s. All. In. There.

Here’s where mistakes get made…

People always try to outthink it. To outsmart it. To find that recession investment strategy “nugget” that no one else sees or knows, and then take action in their portfolio to account for that.

And by taking action, I mean they trade – i.e., sell, exchange securities, raise cash, deploy cash, panic liquidate…all of that.

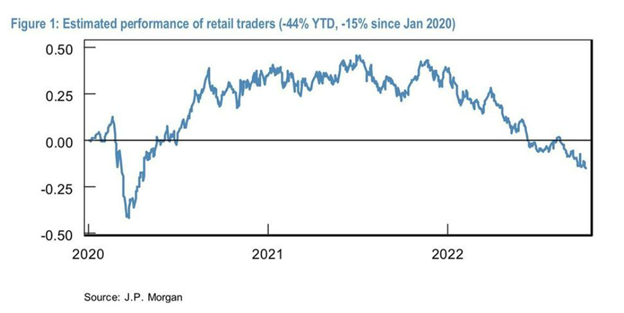

How do I know most people are getting it wrong? JP Morgan published this:

Don’t ask me how they figured that out; they are JP Morgan. They have reams of Patagonia vest-wearing dorks that do the work, reams of clients who pay inflated fees, and then they make a nice graph for the rest of us non-dorks.

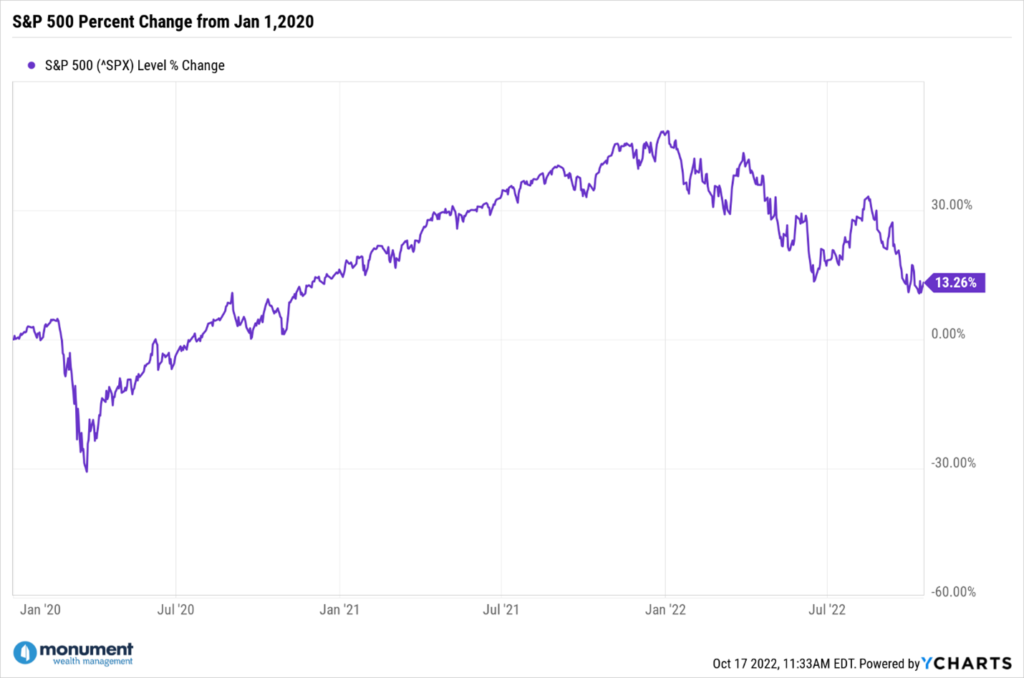

But look, retail traders are down -44% year-to-date and -15% going back to January 2020 (so basically, all the way from pre-covid through the ensuing market rally and current pullback).

Here’s how the S&P 500 has done over the same two periods:

To find that recession investment strategy nugget that no one else knows, identify the game you are playing and determine how you should best keep score.

Keeping score against others, Cramer, or anyone else prognosticating on TV or in print is silly because they are probably not playing the same game you are. (They are playing the audience and ad revenue “game”.)

Know what the money is for and when you need it. Get good advice that keeps you out of trouble and out of the “retail trading is down -44%” category.

No one likes losing money, and I’m not downplaying the pain, but sometimes the best time to reevaluate how you invest, why you are investing, and who’s giving you advice is when the pain is real.

Mumbling to yourself, “I knew I should have sold in January,” is a good thing to remember when the market eventually recovers. Because it will — the market is undefeated over time.

Also, our latest podcast episode 33 is worth checking out. We have a free-flowing conversation about the market, end of the quarter, and more details on what we think about inflation.

Keep looking forward,