Currently the Government of India 10 Yrs Gsec is showing a yield of 6.8%. Which is almost around 1.3% more than the SBI Bank FD rate for the same tenure. Hence, obviously, the question that will arise in our mind is – between 10 Yrs Govt Bond Yield 6.8% Vs 10 Yrs SBI Bank 5.5% FD, which is best for us.

Let us understand the positivity and negativity of both products for better decision-making.

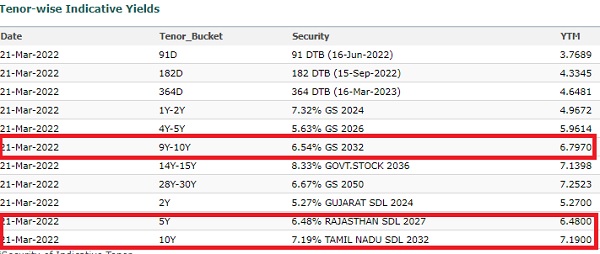

After the launch of RBI Retail Direct, many are trying to explore buying direct Government Of India Bonds or some SDLs also. Especially in the case of SDLs, the yield is around 7%. Hence, obviously, people will think better than typical nationalized bank FDs.

However, the game of investing in Bank FDs is different than the game of investing directly in Bonds.

10 Yrs Govt Bond Yield 6.8% Vs 10 Yrs SBI Bank 5.5% FD – Which one to invest?

Here, I am not sharing the features of 10 Yrs 5.5% SBI Bank FD as you may all know the features of such products. Hence, my point is towards the 6.8% Government Of India Bond. See the below image for the current yield of such Govt Bonds and even you noticed that SDL offers a higher yield.

# Constant Stream of Income –

If you are looking for some constant stream of income up to the maturity period of the bond and decided not to sell during the bond period, then obviously this seems to be one of the best options for you.

As current FD rates are below the 10 year Gsec Bond yield, better you explore buying.

# Liquidity –

Retail participation is still not up to the mark and I am not sure whether you are able to sell in the secondary market so easily. Even though the online platform is provided by RBI through RBI Retail Direct, we have to see the participation and volumes traded here. Hence, the risk of liquidating is always there.

# Safety –

As you are all aware, the issuer is the Government Of India. Hence, there is no question of default or downgrade risk. Hence, if someone is looking for the safest form of investment, then you can explore.

# Volatility –

The current yield is for the current investors. As these bonds are highly sensitive to the interest rate movement, volatility in the price of the bond is natural. Hence, the yield will also fluctuate accordingly (Bond Price and Yields are inversely proportional). If you are ready to digest such volatility, then enter (especially the plan is to sell before maturity).

# Taxation –

Taxation is one more hurdle with such bonds. The coupon (half-yearly interest) that you receive is taxable income for you.

Along with this, if you try to sell it in the secondary market and if there is a capital gain, then such gain attracts the tax.

If your holding period is less than a year, then the gain is taxed as per your income tax slab.

However, if your holding period is more than a year, then you have to pay 10% tax (without indexation benefit).

Hence, such bonds are beneficial for those who are in the lower tax bracket rather than for those who are in the higher tax bracket.

Conclusion – Just because the yield is high compared to Bank FDs or other debt alternatives does not mean we blindly jump into buying. Such bonds are suitable for those who are looking for a constant stream of income and ready to hold up to maturity. For others, who are looking for a higher yield, it is a waste game considering the volatility, liquidity, taxation, and reinvestment risk of the coupon you receive. Hence, better to avoid such experiments. Rather, stick to typical Bank FDs (if requirement is less than 3 years), Money Market or Ultra Short Term Bond Funds (if requirement is more than 3 years but less than 10 years) and if your requirement is more than 10 years, then you can explore PPF, EPF, SSY, and Gilt Constant Maturity Funds.