Bond vigilantes reflect the idea that bond investors can attack a government debt market and dictate terms that the government wouldn’t otherwise desire. I’ve never liked this concept as I think it misconstrues the power dynamic at play in sovereign bond markets so let’s dig into this some more given the relevance in today’s high inflation environment.

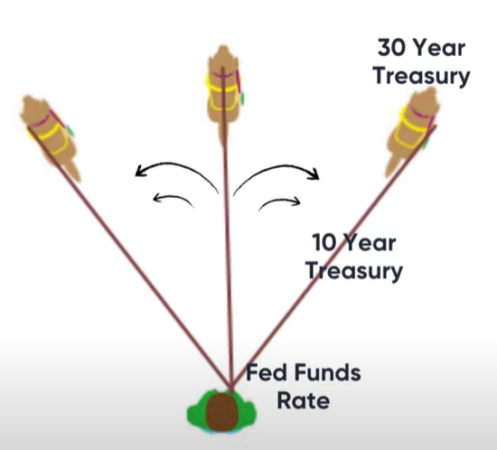

In a recent Three Minute Money video I explained how interest rates are set. The analogy I’ve always liked is a man walking a dog. The Fed is the man and the dog reflects the long end of the bond market. The leash can be thought of as reflecting the yield curve where the Fed has absolute control at the short-end and lets the dog wander at the long end (long bonds). The government and Central Bank are currency monopolists and if they wanted to roll the leash in and set rates at 0% there is nothing that can stop them from doing so. In other words, the dog cannot control its ability to wander if the Central Bank decides not to let it wander.

One of the other important insights from Pragmatic Capitalism is that governments are inherently different from households when they fund their spending. Governments collect income from the aggregate economy and because they operate like an aggregate sector their ability to fund their spending is much more flexible than something like a household which cannot tax the aggregate household sector. This also means that the government can issue the nominally risk free instruments in the economy because they are the entity that taxes all of the income in the economy. In other words, if we were to build a hierarchy of credit quality the government naturally sits atop the hierarchy because it has the largest income stream in the economy.

One of the interesting insights from this understanding is that a government doesn’t have to issue an interest bearing instrument to fund its spending. It can literally just print cash and there will be some level of demand for it because that instrument is the nominally risk free instrument in the economy. So, as stated before, the government could have its Central Bank buyback every single outstanding bond at a 0% interest rate, leave it there and then issue nothing but 0% yielding currency. So, for instance, in today’s environment the US government could buyback every single outstanding longer maturity bond and exchange it with a 0% interest bearing deposit (assuming the Fed held rates at 0%).

But this “debt monetization” isn’t a free lunch for the government. Despite having a much more flexible line of credit the government doesn’t have a widow’s cruse (an endless supply of money). And this constraint will always show up in the form of inflation and/or foreign exchange prices. As a result of this the government will be forced to do things it might not otherwise desire. This will include budget tightening and possibly rate hikes (to increase demand for money).

If we take this back to our dog walking analogy you could say that exogenous events force the government to change the way it walks the dog. So, for instance, high inflation is like a rain storm that forces the dog walker to run for shelter. In the process of doing so the dog walker might let the leash out to allow the dog to run with greater ease. If one were looking at this event you might say that the dog is pulling the walker when in reality the dog walker allowed the leash out because the exogenous event forced him to do so. It wasn’t the dog acting like a vigilante, it was the man responding to the rain storm and allowing the dog to wander more than it normally would.

Cauasality is a big part of proper monetary understandings. And in this case it’s important to understand that the cause of the surge in bond yields is not “bond vigilantes”, but a response to inflation that has forced the government to run for shelter in an inflation storm.