This crypto winter has been especially brutal, and last week, shockwaves reverberated across the whole sector as FTX – the fourth largest crypto exchange in the world – declared bankruptcy after facing a liquidity crunch and a bank run on deposits. And now, with FUD surrounding Crypto.com and AAX pausing withdrawals, many retail investors are getting anxious, which isn’t surprising considering the headline fall-outs of CeFi players Celsius and Hodlnaut just not too long ago.

I’m still not convinced that crypto is dead yet, as I view these failures as a good thing for the decentralized vision of crypto that everyone is aspiring and working towards. While painful during this period, many of these failures will likely result in greater scrutiny and regulation for CeFi and exchange operators in the near future, which will be better for retail investors and newcomers. There has been something good that came out of every bear market and crypto failure in the past, and I believe this time will be no different – except that it will take longer for the industry as a whole to regain trust, now that so much of it has already been eroded.

In the meantime, let this stark warning sit once more.

Most retail investors would on-ramp (deposit fiat / cash) into crypto by using an exchange. In Singapore, the most popular option has been to use Gemini and DBS Remit to on-ramp, but in the last 2 years FTX rose to prominence and became a strong contender, especially as (i) it offered free withdrawals back to your bank account whenever you wanted to and (ii) many high-profile investors had backed the exchange, including Temasek.

Those with a little more technical savviness would then have converted the USD into USDT / USDC and gotten it off the exchange to swap on DeFi protocols like UniSwap or Cake Defi.

The majority, however, would have simply bought crypto on the exchange itself.

What happens next is key – are you the kiasu one who withdraws it into your own cold hardware wallet for safekeeping, or the one who picks convenience and leaves their crypto in the exchange?

Unfortunately, the majority of people fall into the latter category.

The problem is, when you leave it on an exchange, you’re subject to all sort of risks, including but not limited to:

And, as the FTX saga is now showing us, exchanges can mismanage user funds and cause great financial pain to their users, who ultimately take the hit of the losses in the end. The same goes for CeFi platforms, which rose to popularity in the last 2 years as people who were lured by juicy DeFi yields wanted a stake without all that heavy lifting, giving birth to the rise of CeFi players such as Hodlnaut.

When you leave your assets in exchanges or CeFi platforms, you don’t have direct ownership of your assets. Which is why you need to memorize this phrase:

Not your keys, not your funds

Crypto may be a place that offers you opportunities to earn life-changing money, but don’t be drawn in by the greed and forget about the risk. Since crypto exchanges and CeFi are unregulated, it is even more important to manage your own risks, which starts from safekeeping your own assets.

And to do that, you need a cold / hardware wallet which holds your own private keys.

I personally use, and recommend, a Ledger. Here’s why.

Unlike hot wallets through cryptocurrency exchanges, Ledger users hold their private keys. They’re never removed from the device or accessible via the web, which means anyone who wants to steal your funds will need access to your physical device (and PIN) to sign the withdrawal transactions before it goes through.

I've been using a Ledger Nano S since 2016, but this has been discontinued earlier this year so I've upgraded my set to a Ledger Nano S Plus. It is easy to migrate your assets to your new Ledger, check out how here.

When it comes to hardware wallets, Ledger sets itself above the rest as it has been (i) battle-tested through multiple crypto winters, and (ii) is the only hardware wallet to receive CSPN certification by ANSSI (National Agency For Information Systems Security).

Ledger hardware wallets integrate a certified chip (secure element) which is designed to withstand cyber attacks, and capable of securely hosting cryptographic data like private keys. To make it even safer, Ledger wallets are also the only hardware wallet to have their own custom OS (BOLOS) which protects the device against malicious attacks. You can read more about their security protocols here.

For those who need a little bit more hand-holding through your transfer process, the Ledger team has also tons of resources on their website to guide you through how to transfer and securely send / receive your crypto, even for individual coins like Bitcoin, Ethereum or even alts like Cardano or Solana. Ledger continues to build functionalities for popular alts and new crypto tokens, and currently supports over 5,500+ different types of crypto and NFTs.

Many of you have asked me, Dawn, should I pay for a Ledger if I only have a few thousand dollars worth of crypto assets?

In my view, a Ledger is just like insurance. No one really thinks about buying it (except kiasu folks like me), no one likes to pay for it, but when sh*t hits the fan, you regret not having done so.

Given that you could get a Ledger for under USD 200 (the Ledger Nano S Plus), you can therefore ask yourself this question: would I be willing to pay this amount of money to secure my crypto assets and ensure that I have 100% ownership?

Most of you who have bought crypto must have done so because you’re expecting (or hoping) to make money from it. In this bear market, if you’ve not yet sold your crypto to fiat, it must be because you believe in the long-term premise and applications of crypto, like I do.

And if that plays out, could your assets now grow to be worth a fortune? That’s exactly what happened to early Bitcoin and Ethereum buyers…except that many of them lost access to their funds in hacks / fallen exchanges by the time their asset values shot up. Of course, the reverse also holds true, because if you’re holding sh*tcoins then there’s nothing stopping them from going to zero, in which case you would feel as though you wasted your money on a hardware wallet to store them.

Which is why an alternative is often to create a Metamask wallet, which is a desktop wallet that can be toggled to be a hot or cold wallet as you desire. However, even Metamask isn’t 100% safe, as your Metamask wallet can be hacked as well (see here), so I still wouldn’t use anything that sits online to store my main crypto assets. A better approach would be to create your Metamask wallet to make your transactions more convenient for trading, but to secure the bulk of your long-term crypto holdings with a Ledger.

Metamask + Ledger = a very safe combo that is unlikely to ever be hacked

Another limitation of Metamask is that you cannot store native Bitcoin here, since it isn’t an ERC-20 token. Hence, for those of you who are more technically savvy, you can look into multi-chain wallets; I personally use and recommend XDEFI, which you can download as a Chrome extension here. Don’t forget to secure with your Ledger as well, and instructions on how to do so can be found here.

TLDR: Get a Ledger and safekeep your own assets

An important aspect of being financially free is having assurance in the protection of your assets. Just like how you wouldn’t anyhow give someone you don’t know personally the key to your house, in the same vein, you really should stop giving away the keys to your own crypto (which is what you’re doing when you leave it on an exchange or a CeFi platform).

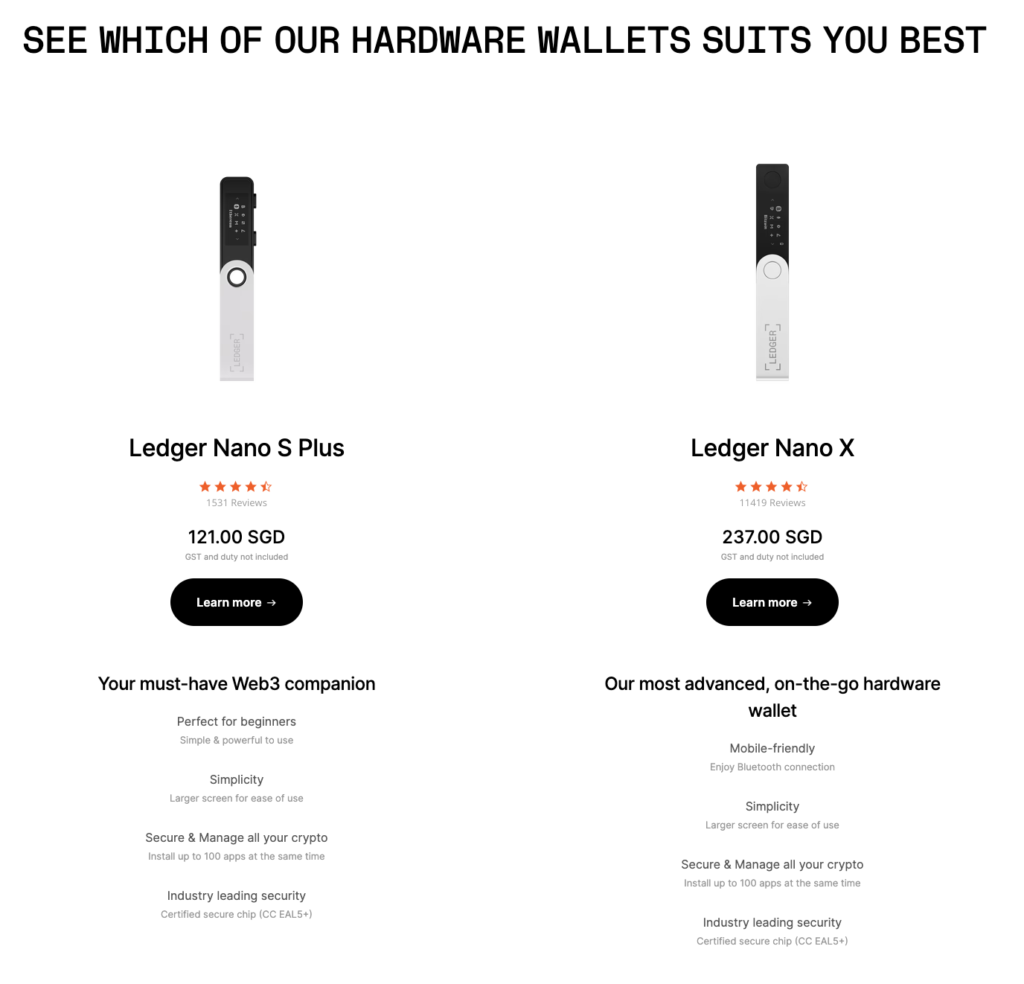

If you want to save money, the Ledger Nano S Plus will work just fine. But if you do a lot of your crypto transactions on mobile, then you might want to spend more and go for the Ledger Nano X instead for greater ease of use.

Buy only from the official store here. Do NOT ever buy a secondhand Ledger, as you don’t know what the previous owner has done with it. It could have been tampered with, or had malicious code installed designed to steal your keys and thus your funds. See this cautionary tale of a man who lost his life savings when he tried to save some money and get a secondhand Ledger. The risk you’re putting yourself at just to save a few dollars isn’t worth it (and ironic, even).

Stop procrastinating and safeguard your own crypto today.

With love,

Dawn

Disclosure: This article contains my affiliate link to Ledger. I don’t know how much the commission payout is, as I frankly don’t really care for it, but it appears to be nice kopi money for the previous referrals I’ve made. If you found this article useful, please do consider buying from my affiliate link as well. But if you’re just here to ride off my work and don’t want me to earn a cent from your purchase (which is also fine), simply remove the r= portion of the link once you’ve landed on the official Ledger site here and I won’t get paid.