A reader asks:

We own a cash-flowing rental property with a sub-3% mortgage with 28 years remaining. On the Aug 18th episode of Portfolio Rescue, Barry said “Real estate more or less returns zero net of inflation.” However, does this statement take into account the leverage provided by a mortgage? Return comparisons between stocks and real estate seem to favor stocks, but it’s not clear whether these comparisons ever take into account mortgage leverage. Also, how does one factor a mortgage rate that is below current inflation into the calculus? On a 20-year time horizon, would it really theoretically be better to sell the property and invest the proceeds into some combination of stocks/bonds? -Nick

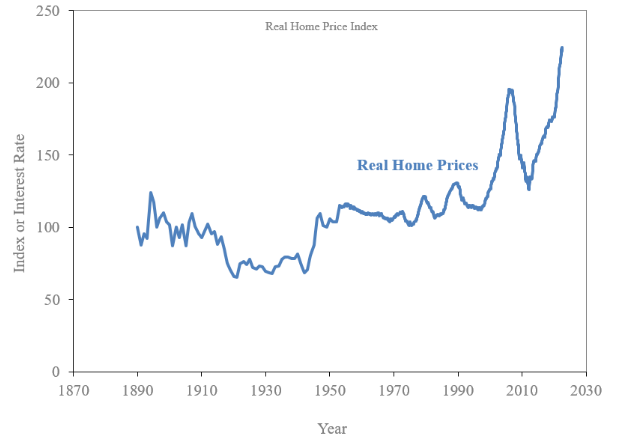

Robert Shiller painstakingly created an index of U.S. home prices going back to 1890.

When he produced it, Shiller mentioned, “Oddly, it appears that no such long series of home prices for any country has ever been published. No real estate professor I talked to could refer me to one.”

No one really knew how the housing market performed over the long run until Shiller put together his Real Home Price Index.

Here are the number updated through the latest 2022 data:

It’s important to note that this series uses real, after-inflation, data for returns.

Let’s dig into the numbers.

From 1890-2022 the U.S. housing market is up a total of just 122%. That’s 0.6% per year over the rate of inflation.

And the majority of that return has come in the past 3 decades or so.

From 1890-1989, the U.S. housing market appreciated just 30% in total or less than 0.3% per year. It basically went nowhere for 100 years after inflation. Since 1989, it’s now up more than 70% which is more than 1.6% per year above inflation.

Some people may look at these numbers and think they’re terrible. The stock market’s long-term return over the rate of inflation is more like 6-7% per year.

How could housing be so much lower?

Personally, I think beating the rate of inflation while holding onto fixed-rate debt in the form of a mortgage and providing a roof over your head is a pretty good deal.

It’s also important to note that Shiller’s data here doesn’t take into account the actual experience of someone owning a home. This is just prices.

Let’s say you purchased a home 10 years ago for $300,000 and you put 10% down ($30,000).

Now let’s say sell that house for $500,000 right now.

What’s your return on investment?

Well, you made $200,000 on the purchase price so it has to be a 67% return right?

Yeah but what about the leverage involved?

You only put $30,000 down so was your return more like 6x?

Wrong again.

Each month you paid your mortgage and home insurance. Plus you shelled our cash for upkeep, maintenance and landscaping. You probably bought some furniture, decorated the interior and made some home improvements.

When you purchased the house you would have had to pay closing costs. When you sell it there is a realtor fee and more closing costs. Then you have to pay for movers and such to get out.

There’s also the fact that you have to live somewhere. So do you net out your mortgage payments for what you would have paid in rent?

I’m not sure anyone knows what their actual all-in costs are when owning a home because housing is a form of consumption. Plus, it’s the most emotional of all financial assets in that it’s where you live, sleep, eat and put down roots.

That’s why it’s so difficult to compare it to investments in the financial markets. You don’t simply buy a house from a broker and pay an all-in expense ratio each year.

Housing is a complicated investment where the return calculation is often unclear.

Now, this reader is talking about a rental property so maybe it’s a little easier to figure out the return but there are still a lot of unknowns involved. That 3% mortgage rate is a huge asset for sure.

But the answer to this question will really come down to your tolerance for complexity.

Rental houses can offer a decent return on your investment. You have the ability to raise rents over time and your monthly payment is fixed so there is a nice inflation hedge there.

Plus you would hope the house price rises over time. Even if it’s only a little over the inflation rate like Shiller’s figures show, you would be building equity through both appreciation and principal payments.

There are also different risks involved when investing in rental properties:

- Concentration. It’s difficult to diversify with a single property (or even multiple properties). You have to deal with both the macro (inflation, rates, economic growth, etc.) but also the micro (location, local economy and housing market).

- Illiquidity. You do receive cash flows in the form of monthly rental payments but you have to net those out from the carrying costs involved. You can’t spend a home or trade it in as easily as you can with stocks and bonds.

- Potential Headaches. Owning a rental property involves finding tenants and fixing stuff when it breaks. If you can’t find renters for a few months you have to eat those costs. You could hire a management company to handle that for you but that just eats into your returns.

It comes down to how comfortable you are with those risks versus simply investing your money in low-cost ETFs and not having to worry about anything beyond market volatility.

Your index funds are never going to call you in the middle of the night to complain that the AC is broken in your rental unit.

On the other hand, there are benefits to owning real estate. The biggest one is that you’re not getting a price quote five days a week like you do in the stock market. That makes it way easier to think and act for the long-term.

The lack of volatility might allow you to sleep better at night too.

As with every investment, there are trade-offs involved.

Even if housing provides lower returns than the stock market, if it makes it easier for you to be a long-term investor, that might be worth the trade-offs.

We covered this question on the latest edition of Portfolio Rescue:

Your favorite tax expert, Bill Sweet, was back on the show as well covering questions about tax loss harvesting, decreasing your tax bill and how taxes change when your spouse exits the workforce.

Further Reading:

Why Housing is More Important Than the Stock Market

Here is the podcast version of this episode: