Becoming a business owner is no easy task. It takes time, dedication, money, and more. Chances are, you’ll probably make a few mistakes along the way. But if you follow a few business tips for beginners, you can avoid making common startup mistakes and set yourself up for success.

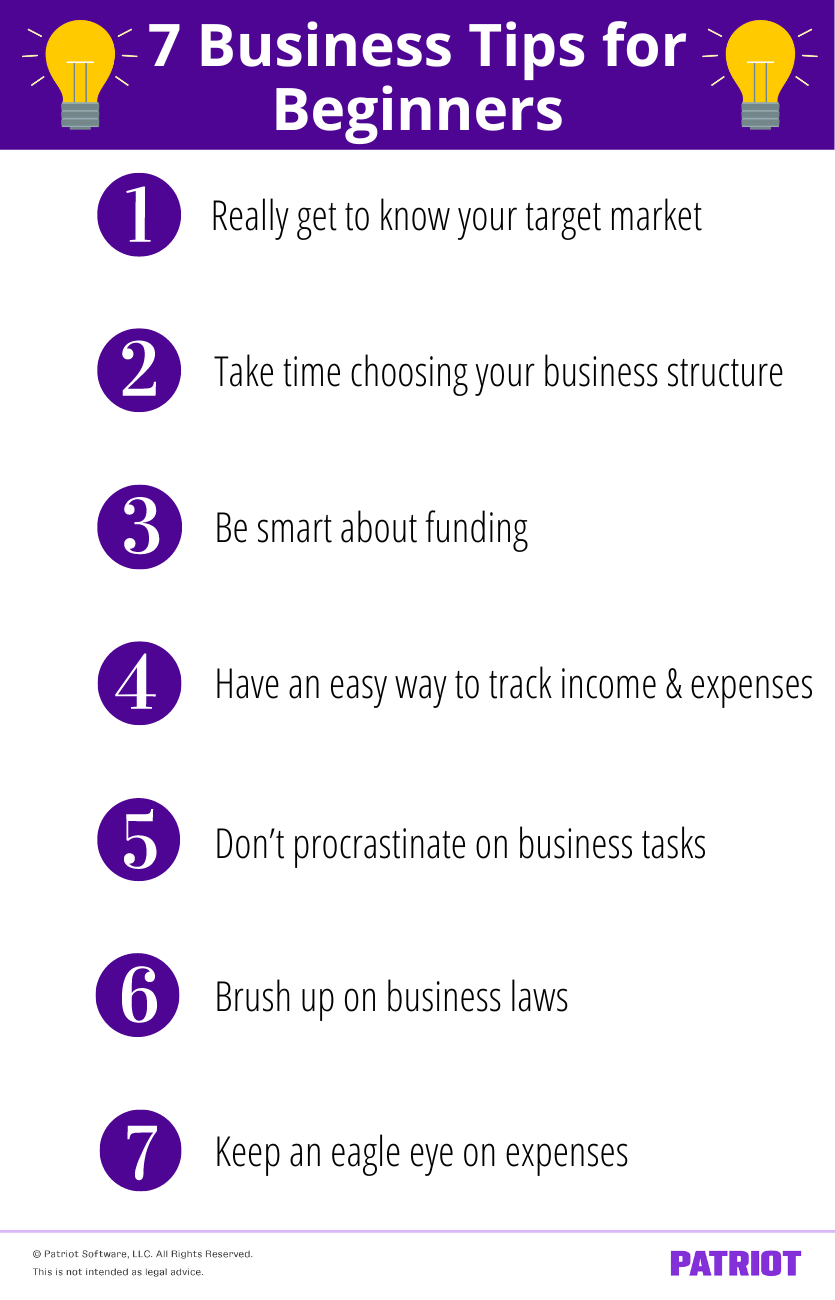

7 Business tips for beginners

When it comes to starting a business, there’s a whole lot to think about before you open your doors (and after you open up shop). Who’s your target market? How do you plan on accounting for income and expenses? Do you have enough funding? These are all questions to consider before setting up shop. To help you along the way when starting a business, use these seven tips.

1. Really get to know your target market

When it comes to starting a business, you have to know your target market like the back of your hand. Otherwise, you could wind up targeting the wrong group of people and wasting a whole lot of money and time.

To help narrow down your target market and better understand who you’re marketing to, you can conduct a market analysis. Be sure to:

- Look at demographics and interests

- Find out who your competition targets

- Gather data from reputable sources (e.g., Census Bureau)

Once you conduct market research, you can ask yourself some oh-so-important questions, like How much are customers willing to pay? and What’s my projected market share percentage?

2. Take time choosing your business structure

Business owners have a million and one responsibilities to worry about, especially when starting up. One of those important tasks to cross off your to-do list is choosing a business structure.

There are many types of business structures to choose from, including sole proprietorship, partnership, limited liability company, and corporation. So, which one is best for your business? Well, it depends.

When comparing business structures, take a look at the pros and cons of each. And, consider factors, like legal liability, taxes, cost, and flexibility.

Before you make a decision, think about which structure can grow with your startup. That way, you won’t have to stress about switching structures later on.

3. Be smart about funding

About 20% of small businesses fail within the first year. One big reason is because of cash. Thirty-eight percent of startups state the cause of their failure was due to running out of cash and not being able to raise new capital.

When it comes to starting a business, you’ve got to be smart about funding. Otherwise, you may wind up struggling to stay afloat.

Do your research on funding options for small businesses. Some financing options for business to choose from include:

- Bank loan

- SBA loan

- Credit

- Venture capitalist

- Angel investor

- Crowdfunding

- Grant

As a startup, you may even ask family and friends to loan you some money to get off the ground. Or, you may use personal funds (like 77% of startups) to get the ball rolling on your business.

Have a game plan for funding to ensure you can set your business up for success. Check out the advantages and disadvantages of each option, interest rates, etc. before making any decisions.

4. Have an easy way to track income and expenses

Running a business means you’re going to make money. And, you’re going to spend money along the way. You need to track incoming and outgoing money in your accounting books.

To ensure your books are in shipshape, you need an accurate and reliable accounting method. Here are a few options:

- Accounting software

- Accountant

- Spreadsheets

One method you can use is accounting software. Accounting software makes it a breeze to input transactions. Plus, you can automate certain tasks, like sending recurring invoices.

You can also hire an accountant to manage your books for you. Or, you can use accounting software along with an accountant. That way, you can pass along your reports and they can handle the rest.

Finally, you can do accounting manually using spreadsheets. Although this is a cost-effective option, it can also cause you to make more blunders. If you plan on using spreadsheets, double-check all of your entries and keep things organized.

5. Don’t procrastinate on business tasks

There are a number of tasks you have to do when you start a business. The last thing you want to do is procrastinate on the tasks and do them all at once.

Here are some tasks to cross off your checklist ahead of time:

- Register your business

- Get tax IDs

- Apply for business licenses and permits

- Open a business bank account

Get ahead of the game by completing the above business-related tasks early. That way, you can focus on your business and avoid any issues down the road.

6. Brush up on business laws

As a business owner, you need to stay compliant with business-related laws. Otherwise, you may have to face the consequences (e.g., penalties).

Before beginning a business, brush up on tax, employment, payroll, licensing, marketing, and privacy laws. Make sure you know all of the applicable laws inside and out to ensure you steer clear of any legal issues.

To help ensure you’re compliant with business laws, you can hire a small business lawyer.

7. Keep an eagle eye on expenses

Part of running a business means dealing with all kinds of expenses. From electricity to mortgage payments, you’ll have expenses big and small.

When starting out, keep an eagle eye on all of your expenses. That way, you can make sure you’re not overspending. Plus, monitoring your finances can help you build a solid business budget. Keep a close eye on your expenses in the beginning (and throughout your entrepreneurial journey) to help you decide where to cut costs if needed, too.

Some business expenses you may have include rent or mortgage payments, equipment, payroll costs, advertising, taxes, loan payments, utilities, insurance, or depreciation.

Starting a new business? Congratulations! Now it’s time to start tracking your income and expenses. Patriot’s online accounting software makes it a breeze to record transactions and keep your books in order. Try it for free today!

This is not intended as legal advice; for more information, please click here.