Latest FCA data has revealed that 300 newly-authorised firms failed to survive their first year and nearly 3,000 firm did not make it to their fifth year.

The figures, analysed by Autus Data Services, show a high rate of attrition rate of firms.

Despite this the number of individuals working in FCA-authorised firms grew by more than 3,000 over the past six months to nearly 228,000, suggesting considerable growth in recruitment.

Over the same period the number of active firms fell by 1.1% to 80,925 implying consolidation is leading to more people working for larger firms.

Overall 5,320 firms joined the FCA register in H2 2022 while 7,481 became de-authorised, according to FCA register data analysed by Autus.

The era of the one-man band is not over yet, however. More than 36,000 firms still have a single registered individual (RI).

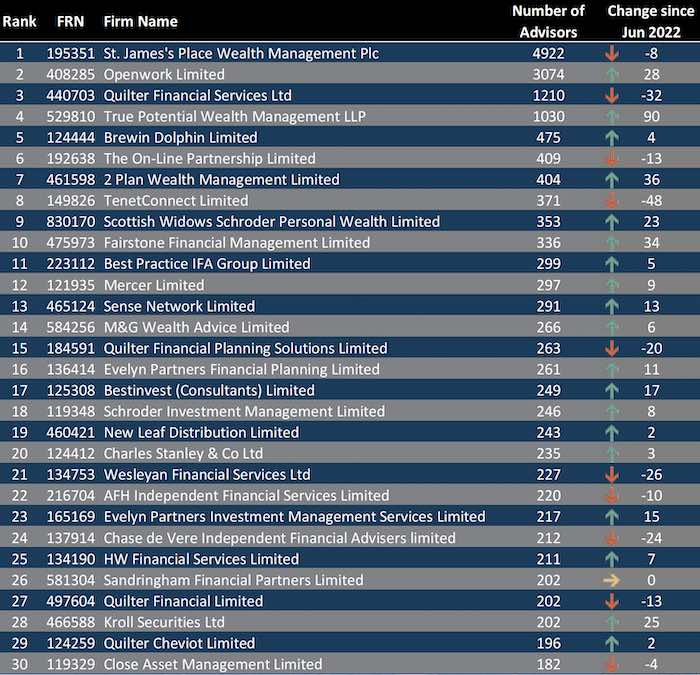

The data revealed that St James’s Place remains the UK’s largest wealth manager / Financial Planner with adviser numbers nearing 5,000 (4,922). Despite its size, the number of SJP adviser fell by 8 compared to six months ago although the number of RIs rose suggesting more head office RI roles.

SJP’s nearest rival in terms of adviser numbers is Openwork which has 3,074 which had an increase in adviser numbers of 28. Quilter is third with 1,210 (down 32) followed by True Potential Wealth Management with 1,030 (up 90) and Brewin Dolphin a long way behind with 475 (down 4).

True Potential had the biggest increase in adviser numbers in the wealth management sector, adding 90 in H2 2022. Tenet Connect continued to contract in size with a net reduction of 48 while Quilter Financial Services reduced by 32 following a decrease of 140 in H1 2022.

Source: Autus Data Services

Other key changes shown in the study:

- There are currently 38,337 individuals licensed to provide investment advice and 35,324 licensed to advise on mortgages. Of these, nearly 9,000 are licensed for both investment and mortgage advice.

- More than 4,000 people moved firm in the last 6 months. Some 928 of those moved from one advice firm to another and 626 from one mortgage firm to another.

- 12,935 joined the Register/Directory for the first time in H2 2022

Andy Marson, managing director, operations, at Autus said: “The number of investment advisers has increased by around 4,000 in the last year while the number of mortgage advisers has stayed almost the same. This demonstrates an increasing desire for firms to meet the needs of an ageing population who often need advice more than ever, particularly as individual pension pots become more prevalent than final salary schemes for people in middle age.

“With over 4,000 individuals moving firm – nearly 12,935 joining the Register/Directory for the first time and 14,740 leaving it in H2 2022 alone – it is clear that the velocity of change isn’t slowing down despite the uncertain times for both investment and mortgage markets over that period.

“Of the firms that became de-authorised in H2 2022 over 300 had been authorised for less than 12 months and nearly 3,000 of them had been authorised for less than 5 years. This shows that the business environment remains difficult for many organisations as they struggle to deal with the many challenges faced.”