This will be a relatively quick one, thank you to Writser for pointing me in this direction.

Magenta Therapeutics (MGTA) (~$47MM market cap) is another addition to my growing basket of failed biotechnology companies that are pursuing strategic alternatives like a reverse merger or liquidation. Magenta is a clinical stage biotech focused on improving stem cell transplantation. Their primary product, MGTA-117, initially had positive data readouts in December for their ongoing Phase 1/2 trial, but shortly after, patients using higher doses started experiencing adverse effects, culminating with the death of one trial participant and the subsequent shutdown of the MGTA-117 clinical trial. Then yesterday afternoon, Magenta announced they were going to explore strategic alternatives, the press release is rather vague and generic. But similar to SESN and others, I anticipate Magenta first trying to explore a buzzy reverse merger with a more promising biotech, if that doesn’t work, pursue a liquidation.

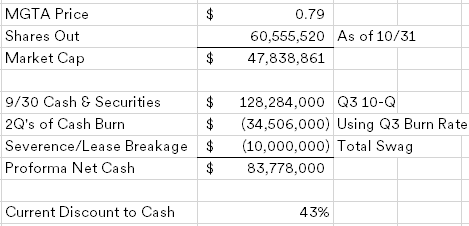

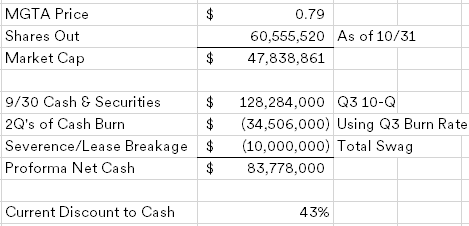

Magenta’s balance sheet is fairly simple, they had $128.3MM in cash and treasuries as of 9/30, no debt other than subleased space in a Cambridge, MA office/lab complex.

Since we’re getting close to half way through Q1, I annualized the Q3 burn rate for two quarters. The company hasn’t given any initial indication of eliminating their workforce (as of the last 10-K, they had 75 people), but I expect that to follow shortly, along with breaking their lease. Cambridge is a biotech hot spot, Magenta or the primary lessee shouldn’t have too much trouble finding a new tenant. Feel free to make your own assumptions, but I come up with MGTA trading at about a 40% discount to proforma net cash even after spiking on the news today. In terms of other assets, Magenta does have $247.2MM in NOLs and two other early stage product candidates (one has a Phase 2 trial ongoing), but as always, difficult to put a value on those.

The primary risk here could be the company deciding to double down on their two other early stage products, but the discount is wide enough here to warrant an add to the basket.

Disclosure: I own shares of MGTA