1) Soft Landing, Hard Landing, No Landing?1

The COVID years just get weirder and weirder. The COVID hangover is especially weird. We’ve all been hoping for inflation to decelerate, but it remains stubbornly high. Meanwhile the economy is decelerating across the board, but remains…surprisingly strong.

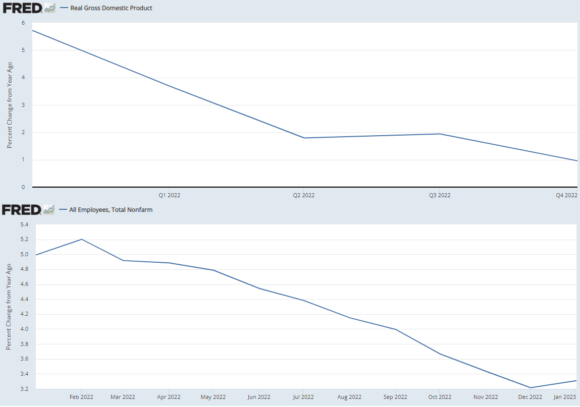

You see it in almost all the data. For example, below is a chart of Real GDP and payroll growth on a one year basis. You’ve had a pretty significant slowdown in both. But they’re not going negative!

So now people are starting to talk about the “no landing” scenario – a situation in which the plane just continues to fly without ever landing.

Personally, I still think this has a long ways to go. The math on the economy isn’t that complicated in my opinion. When mortgage rates went over 5% the housing market ground to a halt. And so with mortgage rates at 6.75% as I write we’re still in an environment where housing is likely to remain very challenged. And as long as housing remains weak the broader economy will remain weak and fragile. So yeah, maybe the plane isn’t going to crash, but as I stated in my 2023 outlook the potential for a “muddle through” year looks like the most likely outcome here and I wouldn’t let a few good data points cloud the bigger picture here.

2) The Secret Sauce of ETFs is Still a Secret

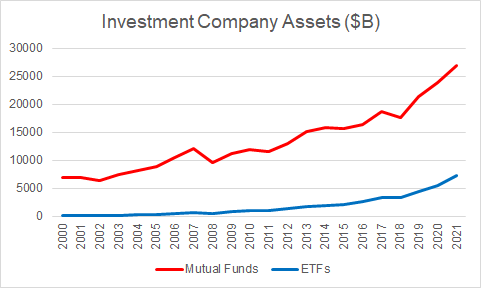

When we talk about big big trends in the asset management space the ETF vs mutual fund battle has to be one of the absolute biggest. I remember back in the early 2000s I was at Merrill Lynch and we only used mutual funds. This was when ETFs were just becoming a thing and I would constantly compare the mutual funds we used to similar ETFs. I’d compare the relative performance, fees, tax efficiency and the ETFs just about always came out on top. And I remember asking someone in the ML training program why we don’t just use ETFs. The answer was always “we don’t get paid to sell low cost index funds”. I never understood this and I’ve continued to be amazed at how sticky the mutual fund product wrapper is when it’s so much worse in so many ways (liquidity, costs, tax efficiency, etc).

So it’s still kind of amazing to see the relative size of the ETF vs mutual fund space, 20 years later, and note that the ETF space is still dwarfed by mutual funds.

I am basically the anti-Bogle when it comes to this topic. While he said ETFs were terrible I think they’re perhaps the best innovation in the investment world in the last 30 years. But the problem is that a lot of people still don’t understand them. And the thing that’s most misunderstood is their inherent tax efficiency and the way ETFs can help you defer taxes. This is especially true inside, ahem, the multi-asset fund of funds structure where you can rebalance to a certain risk profile INSIDE a single ETF using stock AND bond funds without necessarily incurring capital gains taxes along the way. As Meb Faber notes in this Tweet, the difference isn’t small. ETFs can add as much as 0.7% per year in tax efficiency alone.

The annoying thing is that this secret sauce isn’t really a secret. It’s a delicious recipe out there in broad public for everyone to consume and yet it’s a recipe that doesn’t seem to really catch on….

3) Don’t Worry About the Interest on the National Debt

We published a new 3 Minute Macro video in which we discuss the risk of interest on the national debt. This is a question I’ve gotten a million times over the years and the conspiracy theorists just love it because it seems so intuitive.

The basic thinking is that a surge in the national debt combined with rising interest rates creates the risk of a feedback loop where the government has to pay so much interest that it creates high inflation which feeds on itself. Sounds scary, but it’s not really that scary in reality.

As I explain in the video, the size of the interest payments really isn’t that big compared to historical payments and there are other much more important factors at play here. Please check it out and I hope you learn something new from the video.

1-Maybe an airplane landing isn’t the best metaphor for economic performance considering the fact that no one can even agree on what these terms mean!