Franchise Group (FRG) is one of my largest positions, naturally I feel obligated to post something on the headline grabbing news that FRG is the apparent winner of the auction for struggling retailer Kohl’s (KSS). Kohl’s would be a transformative acquisition, FRG is currently a $2.7B enterprise value company and press reports have them paying $8B for KSS ($60/share). FRG is currently guiding to $450MM in 2022 EBITDA, TIKR has the consensus KSS estimate at $2.1B. The combination of FRG being smaller than the target, little known outside of certain value/event-driven circles and fears of credit markets tightening seem to have the market doubting this deal gets done (KSS last traded for $45.75). But I have faith in CEO Brian Kahn, FRG entered my portfolio as a special situation when it was then called Liberty Tax, which went about a complicated merger and tender offer transaction that looked novel and interesting from an outsider perspective. Here is FRG’s most recent investor presentation for what the company looks like today, a lot has changed, including FRG selling the original Liberty Tax to a SPAC (sponsored by NexPoint). My thesis in the last two years has mostly revolved around “in Kahn we trust”, given the news leaks around credit providers being lined up, it appears this deal is getting done. I’ve added some KSS as a small speculative merger arbitrage position alongside FRG.

Taking a few steps back, in April, news broke from Reuters that FRG was joining the bidding for struggling retailer Kohl’s (KSS), I was a bit surprised but not entirely, Kahn is a creative deal maker and likely looks at many acquisition opportunities that don’t fit Franchise Group’s stated strategy of “owning and operating franchised and franchisable businesses”. My guess is the “franchise” part is more aspirational than truth, it is a generic name and strategy, they just look for attractive deals. Kohl’s certainly doesn’t seem to fit the franchise mold, hard to imagine someone operating a department store as a franchise, but the deal does resemble other recent FRG acquisitions as the non-core assets could be used to finance the transaction.

Last November, FRG entered into a transaction to buy southeastern furniture retailer W.S. Babcock for $580MM. Subsequently, FRG went on to sell Babcock’s credit accounts receivables to B Riley (RILY) for $400MM, the retail real estate for $94MM, and the distribution centers and corporate headquarters to Oak Street Real Estate Capital for $173.5MM. More than paying for the acquisition with asset sales and still expecting to receive $60MM in proforma LTM EBITDA. A similar transaction seems to be in store for Kohl’s, the department store chain owns their corporate headquarters, almost all of their distribution and e-fulfillment centers, and own 410 of their retail stores outright and another 238 of them owned but on ground leases.

Reports have FRG re-teaming up with Oak Street Real Estate Capital (part of Blue Owl’s platform) to provide $6B in financing based on the corporate headquarters and distribution facilities real estate (might also include the retail real estate, so my 6% cap number below might be too low), and $2B (fuzzy, Seeking Alpha number) from Apollo in non-recourse Kohl’s level term loan financing, with FRG kicking in the additional $1B via an upsized term loan. Apollo isn’t the ideal lender, but since they’re a direct lender and aren’t relying on syndicating the loan immediately like a large regulated bank, the financing seems more secure in the current uncertain environment. It is an interesting structure, FRG is using no equity, financing it all with debt and will fully own a levered equity stub KSS.

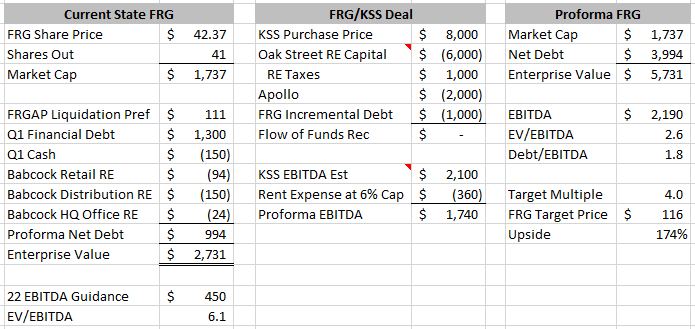

Putting together a quick back of the envelope proforma, I come up with the below:

As always, probably a few mistakes above, feel free to point them out, and obviously, this is all excluding the capitalized leases which is real leverage even if it is non-recourse, but even if you did an EBITDAR valuation, the proforma company would be extremely cheap. But I think it shows the creativity of Kahn and FRG, they’re creating a diversified series of levered bets via non-recourse sale leased back financing.

Other thoughts:

- While not a “bet the company” deal, it is pretty close and certainly risky. The market doesn’t like highly leveraged companies, FRG will likely trade cheaply for a while as they bring down the debt and eventually further diversify away from Kohl’s with future deals. Kohl’s is certainly a weak business, it is in the middle ground of not really having an identity, I can’t think of anything you must buy at Kohl’s that you couldn’t get elsewhere. There’s a lot of debt here, things could go horribly wrong.

- There is some political pressure to reject the deal, particularly in Kohl’s home state of Wisconsin, likely if FRG acquires KSS, long term this is a slow motion liquidation. FRG often partners with B Riley, the two are intertwined some, B Riley has a retail liquidation business and often invests in these distressed retailers. Selling to FRG probably cements Kohl’s as a declining business and that might face political backlash.

- FRG is heavily into home furnishings (previously mentioned Babcock, they also own American Freight which sells clearance appliances and Buddy’s, a rent-to-own retailer), based on the recent Target inventory debacle, people aren’t buying home furnishings anymore now that covid is mostly in the rear view mirror. Cynically, FRG might be doing this deal to distract from issues at the core business. However, Brian Kahn has sounded sober through the pandemic regarding inventory, supply chain, going forward expectations, he hasn’t sounded surprised by the slowdown and thus far hasn’t had to drastically change guidance.

- Macellum Capital Management has been engaging in an activist campaign against Kohl’s, they lost their proxy fight recently, but have been putting significant pressure on the company to sell themselves. Kohl’s management believed they were worth $70+, but with the recent downturn and disappointing Q1 earnings, bids have come in lower, so it might be an opportunistic time for FRG to swoop in and be the white knight. FRG also runs a decentralized management structure, so it could be seen as a preferred buyer for management as they could keep their jobs.

- FRG did recently put a $500MM buyback in place (after it was reported they were a KSS bidder), things could get pretty wild if they use the KSS cash flows to buyback shares versus paydown debt given their Debt/EBITDA ratio would likely remain within there target range immediately upon closing of the transaction.

- Brian Kahn has never been shy about buying shares in the open market (did a lot during that initial Liberty Tax/Buddy’s transaction, signed big boy letters with anyone that would sell him shares) and his private equity firm, Vintage Capital, owns 25+% of the company.

Disclosure: I own shares of FRG and KSS